Phoenix Research Forecasts Global Biotech IP Tokenization Market to Surpass USD 2.91 Billion by 2033, Unlocking Liquidity and Global Access Through Smart Contracts and Fractional Ownership

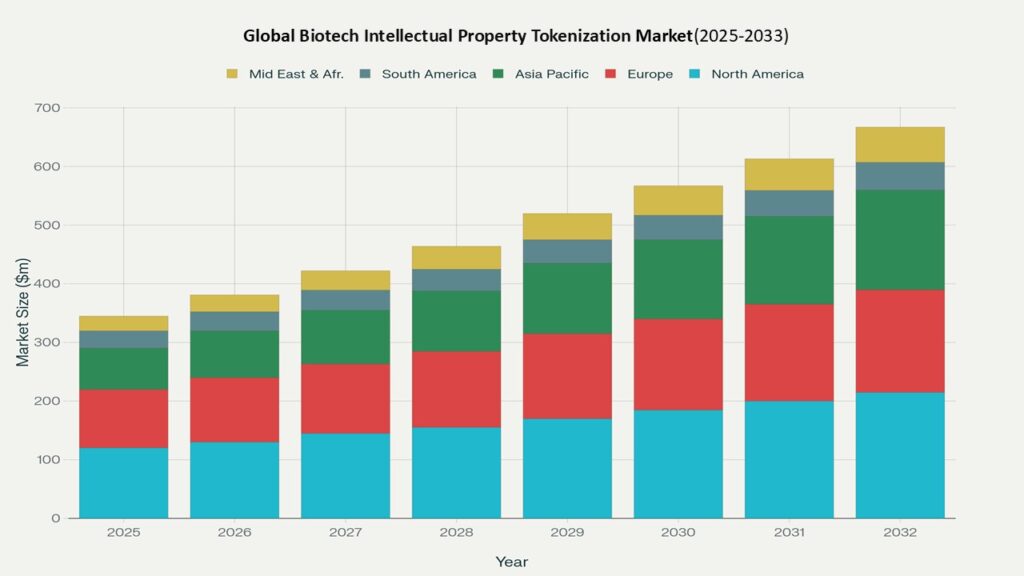

– July 29, 2025 – Phoenix Research, a leader in AI-driven life sciences intelligence, has released its latest report: “Global Biotech Intellectual Property Tokenization Market: Redefining Ownership, Liquidity, and Monetization of Innovation Assets (2025–2033).” According to the report, the market is projected to grow from USD 678.25 million in 2025 to approximately USD 2,913.9 million by 2033, registering a CAGR of 20.1% over the forecast period.

The report highlights how blockchain-based tokenization is fundamentally transforming IP management and biotech funding. By converting patents, copyrights, and proprietary biotech data into tradable digital assets, tokenization platforms are enabling fractional ownership, real-time royalty flows, and global investor access.

“Tokenized biotech IP is changing the calculus of innovation finance,” said Meera Bansal, Senior Analyst at Phoenix Research. “Smart contracts are automating royalty payments while fractionalization brings previously inaccessible R&D assets to capital markets, reshaping biotech deal-making.”

Key Insights from the Report:

Fractionalized IP for Accelerated Liquidity:

Tokenization allows biotech firms to unlock working capital from illiquid IP assets. Phoenix’s Demand Forecast Engine shows strong momentum for IP-backed financing in early-stage biotech across North America, Asia, and the EU.

Smart Contracts and Royalty Automation:

AI-powered smart contracts are reducing overhead and ensuring tamper-proof royalty payments, enabling fairer, real-time monetization for IP holders and licensees.

Compliant Platforms Fuel Institutional Entry:

Rising legal clarity in Singapore, Switzerland, and the UAE is attracting institutional investors to regulated IP token marketplaces. Phoenix’s Sentiment Analyzer Tool flags consistent policy support across 12 key jurisdictions.

Strategic IP Commercialization Models:

Biotech startups are increasingly using tokenization to diversify financing, boost valuation, and expand licensing reach. Tokenized IP portfolios are becoming tangible financial assets on balance sheets.

Regional Dynamics:

- North America remains the largest market, accounting for 43.6% in 2024. U.S.-based startups are pioneering the shift toward IP-based digital securities backed by strong IP law and early blockchain adoption. CAGR (2025–2033): 19.2%.

- Asia Pacific is the fastest-growing region with a projected CAGR of 24.5%. Biotech parks in India, China, and Singapore are embedding tokenization into R&D ecosystems. Phoenix’s Construction Activity Mapping System tracks over 120 facilities adopting digital IP solutions.

- Europe is advancing harmonized token regulation through MiCA, enabling cross-border IP trading, particularly in Germany, Switzerland, and the Netherlands.

- Latin America & Middle East are early-stage adopters. Government-backed biotech incubators in Brazil and the UAE are piloting tokenization for academic and publicly funded IP assets.

Segment Trends:

- By Asset Type: Patents account for the dominant share, as high-value innovations in gene editing, diagnostics, and biologics become prime candidates for tokenization.

- By Platform: Hybrid and permissioned blockchains are preferred due to institutional-grade security and regulatory compatibility.

- By Monetization Strategy: Royalty monetization and direct licensing are the most adopted use cases, while litigation funding via tokenized assets is emerging.

- By End User: Biotech firms, institutional investors, and research institutes are leading adopters. Individual investor participation is rising via fractional offerings.

Competitive Intelligence:

Phoenix’s Event Detection Engine and Innovation Tracker spotlight leading innovators:

- IntelliP tokenized over 5,000 biotech patents in 2025, demonstrating 200% YoY growth in transaction volume.

- InvestaX and IX Swap are spearheading security token offerings (STOs) for biotech IP, integrating decentralized liquidity pools.

- Securitize is focusing on compliant digital security issuance tied to IP royalties.

- BlockchainX delivers modular blockchain stacks for biotech IP marketplaces.

These firms are investing heavily in AI valuation engines, regulatory integration, and cross-chain interoperability to future-proof digital IP ecosystems.

Phoenix’s AI Toolkit in Action:

- Demand Forecast Engine uses IP transaction data, biotech patent filings, and token activity logs to model demand signals.

- AI-Powered IP Valuation Models calculate real-time token worth, licensing potential, and investment risk based on innovation lifecycle stages.

- Sentiment Analyzer Tool tracks global policy sentiment, confirming regulatory green lights in 9 of the top 15 biotech hubs.

- Automated Porter’s Five Forces Analysis shows growing buyer power and increasing IP tradability, although entry barriers persist in platform compliance and valuation accuracy.

Forecast Snapshot (2025–2033):

| Metric | Value |

| 2025 Market Size | USD 678.25 Million |

| 2033 Market Size | USD 2,913.9 Million (est.) |

| CAGR (2025–2033) | 20.1% |

| Largest Region (2024) | North America (43.6% share) |

| Fastest Growing Region | Asia Pacific (24.5% CAGR) |

| Top Segment | Patents |

| Key Trend | Smart Contracts for Royalties |

| Future Growth Focus | Tokenization for Startups |

Why the Global Market Remains Critical:

- Tokenized biotech IP removes longstanding liquidity barriers in early-stage R&D financing.

- Interoperable blockchain platforms support cross-border biotech innovation partnerships.

- Investors benefit from transparent, auditable royalty streams and diversified exposure.

- As regulatory clarity improves, tokenized IP is set to become a standardized asset class for biotech commercialization.

Final Takeaway:

The Global Biotech Intellectual Property Tokenization Market is reshaping how biotech innovation is owned, financed, and traded. By merging blockchain and AI, tokenization enables fractional ownership, global access, and automated royalties—opening new capital pathways for IP-rich biotech firms. As compliant platforms scale and digital infrastructure matures, tokenized IP is poised to become a core component of biotech dealmaking and R&D monetization.

To access the full report and explore Phoenix Research’s AI-enabled token economy models, visit:

🔗 https://www.pheonixresearch.com/market-report/global-biotech-intellectual-property-tokenization-market-2025-2033/