AI-Driven Personalized Elderly Care Market 2025-2033

AI-Driven Personalized Elderly Care Market OVERVIEW

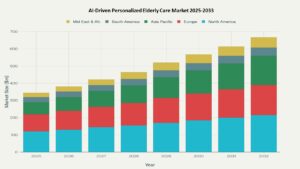

The AI-Driven Personalized Elderly Care Market is expanding rapidly, driven by global aging demographics and demand for individualized, tech-enabled care. The market is projected to grow from USD 1.41 billion in 2025 to approximately USD 3.07 billion by 2033, registering a CAGR of 10.2%. Innovations in predictive analytics, virtual assistants, robotics, and remote monitoring are transforming care environments—enabling safer, smarter, and more responsive support for seniors. Adoption is accelerating across independent living, home care, and institutional settings, with momentum fueled by rising chronic disease burden, smart home integration, and government-backed digital health reforms.

Key Drivers of Market Growth

- Global Aging Acceleration

By 2030, over 4 billion people will be aged 60+, creating urgent demand for scalable elderly care solutions, particularly in regions facing caregiver shortages. - Advancements in AI & Predictive Analytics

Machine learning, NLP, and sensor fusion technologies enable personalized risk prediction, care recommendations, and behavioral insights—elevating both clinical and daily support. - IoT-Enabled Real-Time Monitoring

Connected devices and smart home systems provide proactive care through fall detection, medication adherence, and ambient health tracking—improving independence and safety. - Rising Chronic Disease Prevalence

The growing incidence of diabetes, dementia, and cardiovascular conditions is increasing reliance on AI-enabled early detection, remote diagnostics, and continuous care planning. - Government Initiatives & Funding

National programs in North America, Europe, and Asia-Pacific are backing AI integration in senior care through incentives, regulatory pathways, and digital health mandates. - Consumer Shift Toward ‘Aging in Place’

Preference for home-based aging is pushing demand for virtual caregivers, robotic aids, and telehealth tools that support aging with dignity and autonomy.

Market Segmentation

By Type

- Predictive Analytics Platforms

- AI-Powered Virtual Assistants

- Remote Monitoring Systems

- Smart Home & Robotic Companions

By Application

- Chronic Disease Management

- Daily Living Support

- Medication Reminders

- Companionship & Fall Detection

By End User

- Independent Seniors

- Home Care Agencies

- Assisted Living Facilities

- Nursing Homes

By Technology

- AI Software (ML, NLP)

- Wearable Sensors

- IoT Devices

- Cloud-Based Telehealth Platforms

Region-Level Insights

North America – CAGR (2025–2033): 10.4%

- Dominates market share with early AI adoption, high aging population, and mature reimbursement infrastructure.

- Major deployments in senior housing, telemonitoring programs, and smart home pilots.

Asia Pacific – CAGR (2025–2033): 12.1% (Fastest Growing Region)

- Rapidly aging nations such as Japan, China, and South Korea are accelerating smart elderly care investments.

- National digital health initiatives and caregiver shortages are driving AI adoption at scale.

Europe

- Strong uptake in Western Europe driven by smart aging programs in the UK, Germany, and the Netherlands.

- Eastern Europe shows moderate growth due to economic and policy constraints.

Latin America & Middle East

- Gradual adoption in urban hubs, especially in Brazil, UAE, and Saudi Arabia, where elderly care is gaining policy traction.

- Market characterized by growing partnerships and rising digital literacy among aging populations.

Leading Companies in the Market

Phoenix’s Competitive Movement Tracker identifies key companies leading innovation:

- CarePredict – Behavioral wearables and analytics for fall prevention and wellness monitoring.

- Intuition Robotics – Social robots (e.g., ElliQ) for cognitive engagement and loneliness reduction.

- Aiva Health – Voice-enabled virtual assistants for in-home and institutional caregiving.

- Catalia Health – Conversational AI agents focused on chronic condition management.

- AliveCor – Remote ECG and cardiac monitoring for seniors with cardiovascular risks.

- Active Protective – AI-driven smart garments for fall impact reduction.

- HCA Healthcare & Enlivant – Integrating AI tools within elder care operations.

These players are prioritizing AI personalization, robotic automation, and multi-sensor platforms to deliver next-gen care.

Strategic Intelligence and AI-Backed Insights

- Phoenix Demand Forecast Engine projects 2.2x growth in AI-driven elderly care tools by 2033, fueled by smart device proliferation and insurance-linked adoption models.

- Sentiment Analyzer Tool shows a policy-level shift across APAC and Europe favoring tech-enabled aging-in-place strategies since 2022.

- AI-enabled predictive tools are reducing readmissions and hospital visits by up to 30% in pilot programs.

- Automated Porter’s Five Forces modeling shows moderate-to-high supplier power due to proprietary algorithms and platform dependencies.

Forecast Snapshot: 2025–2033

| Metric | Value |

| 2025 Market Size | USD 1.41 Billion |

| 2033 Market Size | ~USD 3.07 Billion |

| CAGR (2025–2033) | 10.2% |

| Largest Region (2024) | North America |

| Fastest Growing Region | Asia Pacific (12.1% CAGR) |

| Top Segment | Remote Monitoring Systems |

| Key Trend | AI-based predictive care models |

| Future Growth Focus | Home care, Smart Living, Robotics Integration |

Why the Global Market Remains Critical

- Aging is a global megatrend—AI offers scalable, adaptive support for fragile healthcare systems.

- Chronic disease burden and staffing shortages make automation and personalization essential.

- Global health systems are increasingly tying elder care reimbursements to tech adoption.

- AI is enabling proactive care, improving outcomes while reducing total cost of care.

Final Takeaway

The AI-driven personalized elderly care market is undergoing a transformative shift—positioning AI as the backbone of intelligent, human-centered elder support. With rising global demand, declining caregiver availability, and maturing digital infrastructure, this sector is poised for sustained growth. The convergence of predictive intelligence, robotic caregiving, and smart monitoring ecosystems is redefining elderly well-being. As the market approaches USD 3.07 billion by 2033, opportunities abound for healthtech leaders, insurers, and infrastructure planners to embed AI into every facet of senior care—making aging not only safer but smarter.

Table of Contents

Overview

1.1 Introduction to AI-Driven Personalized Elderly Care

1.2 Market Evolution: From Reactive to Predictive Elder Support

1.3 Market Snapshot: Global Size, CAGR, and Growth (2025–2033)

1.4 Role of AI, Robotics, and IoT in Care Innovation

1.5 Phoenix Methodology: Forecast Engine, Sentiment Analyzer, and Forces Model

Key Drivers of Market Growth

2.1 Global Aging Acceleration and Caregiver Shortage

2.2 AI, Machine Learning, and Predictive Analytics Advancements

2.3 Real-Time Monitoring via IoT and Sensor Integration

2.4 Managing the Chronic Disease Burden through Smart Tools

2.5 Government Reforms and Elderly Tech Incentives

2.6 Rising Preference for Aging in Place and Virtual Care Models

Market Segmentation

3.1 By Type

• 3.1.1 Predictive Analytics Platforms

• 3.1.2 AI-Powered Virtual Assistants

• 3.1.3 Remote Monitoring Systems

• 3.1.4 Smart Home & Robotic Companions

3.2 By Application

• 3.2.1 Chronic Disease Management

• 3.2.2 Daily Living Support

• 3.2.3 Medication Reminders

• 3.2.4 Companionship & Fall Detection

3.3 By End User

• 3.3.1 Independent Seniors

• 3.3.2 Home Care Agencies

• 3.3.3 Assisted Living Facilities

• 3.3.4 Nursing Homes

3.4 By Technology

• 3.4.1 AI Software (ML, NLP)

• 3.4.2 Wearable Sensors

• 3.4.3 IoT Devices

• 3.4.4 Cloud-Based Telehealth Platforms

Region-Level Insights

4.1 North America – Market Leader

• 4.1.1 Early Adoption and Telemonitoring Integration

• 4.1.2 Insurance-Linked AI Deployment and Smart Housing Models

4.2 Asia Pacific – Fastest Growing Region

• 4.2.1 National Strategies for Elder Tech and Digital Aging

• 4.2.2 Scaling AI Solutions for Rapidly Aging Populations

4.3 Europe

• 4.3.1 Smart Aging Programs and Cross-Border Collaborations

• 4.3.2 Western vs Eastern Market Disparities

4.4 Latin America & Middle East

• 4.4.1 Urbanization, Digital Literacy, and Policy Reform

• 4.4.2 Smart Clinics and Elder Tech Pilots in UAE and Brazil

Leading Companies in the Market

5.1 Market Positioning and Innovation Strategies

5.2 Key Players & AI Integration Models

• CarePredict

• Intuition Robotics

• Aiva Health

• Catalia Health

• AliveCor

• Active Protective

• HCA Healthcare & Enlivant

5.3 Partnerships with Insurers, Health Systems, and Tech Providers

5.4 R&D Focus Areas: Fall Prevention, Social AI, Cognitive Monitoring

5.5 Go-to-Market Models: D2C, B2B, and Institutional Sales

Strategic Intelligence and AI-Backed Insights

6.1 Phoenix Forecast Engine: Growth Trajectory to 2033

6.2 Sentiment Analyzer: Aging-in-Place Policy Signals & Public Adoption

6.3 Predictive AI: Hospital Avoidance and Chronic Risk Modeling

6.4 Porter’s Five Forces (Automated):

• 6.4.1 Competitive Intensity

• 6.4.2 Buyer Power (Caregivers, Facilities, Seniors)

• 6.4.3 Supplier Power (AI Software, IoT Device Vendors)

• 6.4.4 Threat of Substitutes

• 6.4.5 Barriers to Entry (Regulations, IP, Data Security)

Forecast Snapshot: 2025–2033

7.1 Market Growth Curve: Absolute Dollar Opportunity

7.2 Segment-Level Forecasts: Monitoring, Robotics, Predictive Tools

7.3 Regional Momentum: Penetration Rates and Investment Hotspots

7.4 Market Shifts: From Clinical Care to Preventive Smart Support

7.5 Disruption Scenarios and Ecosystem Sensitivity Models

Why the Global Market Remains Critical

8.1 Demographic Urgency and Systemic Healthcare Strain

8.2 AI as an Enabler of Proactive, Personalized Care

8.3 Reimbursement Models and Value-Based AI Adoption

8.4 Tech-Enabled Autonomy: Reducing Institutional Dependence

8.5 Ethical, Inclusive, and Secure AI for Elder Populations

Phoenix Analyst Insights and Final Takeaway

9.1 Market Outlook: From Assistive Tech to Autonomous Wellness

9.2 Strategic Recommendations for Stakeholders

• Startups & Robotics Firms

• Senior Housing Operators

• Digital Health Platforms

• Policymakers & Reimbursement Boards

9.3 Future Themes: Ambient AI, Emotion-Aware Systems, Smart Wearables

9.4 Investment Opportunity Radar: Infrastructure, APIs, Localized AI

9.5 The Aging of AI: Next Decade Implications in Global Elder Care

Appendices

10.1 Research Methodology

10.2 Data Sources and AI Modeling Assumptions

10.3 Glossary of Terms (Predictive Health, FallTech, Companion AI)

10.4 About Phoenix Strategic Intelligence Platforms

10.5 Contact Information for Custom Reports & Strategy Briefings