Blockchain Clinical Trial Transparency Market 2025-2033

The Blockchain Clinical Trial Transparency Market is witnessing robust growth as pharmaceutical and life sciences industries seek improved data security, transparency, and compliance in clinical research. Blockchain technology provides an immutable, decentralized ledger system that addresses longstanding challenges in clinical trials, including data integrity, patient privacy, and regulatory transparency.

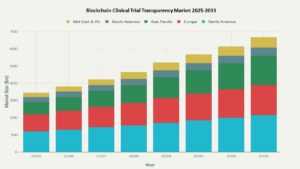

The market is valued at approximately USD 1.0 billion in 2025 and is expected to reach USD 6.0 billion by 2033, growing at a compound annual growth rate (CAGR) of 25.0% over the forecast period.

By 2025, the clinical trials segment is projected to comprise nearly 46% of the broader blockchain healthcare market, underpinned by heightened demand for tamper-proof data management and automation of processes. Adoption is further propelled by the need to prevent data manipulation, enable real-time tracking, and reduce administrative costs.

North America is poised to lead this market due to strong infrastructure, regulatory support, and investments in digital healthcare innovation. Hesitancy among some stakeholders and integration with legacy systems remain barriers, but continued technological advancements and policy development are expected to accelerate market expansion.

Key Drivers of Market Growth

- Escalating demand for data integrity and transparency in clinical trials is a primary driver, as blockchain ensures data immutability and traceability, mitigating risks of data manipulation and supporting regulatory compliance.

- Surging cybersecurity concerns—including the rise of ransomware attacks—are compelling adoption of blockchain for secure and tamper-proof management of sensitive healthcare and trial data.

- Increased focus on efficiency and cost reduction: Blockchain-based automation streamlines administrative processes, reduces manual errors, and accelerates approval timelines, lowering operational costs for sponsors and CROs. Estimated cost savings range between 15–20% per trial.

- Improved patient recruitment and engagement: Blockchain facilitates secure, privacy-preserving participant identification and allows patients to monitor their own data usage, fostering trust and higher retention rates. Some pilot projects report 20–30% improvement in retention.

- Regulatory and industry initiatives prioritizing transparency and traceability in informed consent processes are expanding blockchain’s relevance in clinical trial workflows.

- Expansion of outsourcing and commercialization of pharmaceutical R&D amplifies the need for reliable, interoperable platforms to manage multi-center trials, further stimulating market growth. Global outsourcing of trials is growing at a CAGR of ~8%, reinforcing blockchain’s utility in distributed models.

Market Segmentation

The Blockchain Clinical Trial Transparency Market is segmented by application, blockchain type, and geography.

- By Application:

The clinical trials segment is projected to dominate, driven by the need for improved data integrity, secure document management, and enhanced transparency throughout trial processes. - By Blockchain Type:

The market is divided into public and private blockchains.- Public blockchain networks currently hold the larger share (approx. 60%) due to their open, decentralized nature that ensures data immutability and fosters trust among stakeholders.

- Private (permissioned) blockchains are gaining ground for internal clinical governance, access control, and compliance tracking.

- By Geography:

North America is expected to lead, attributed to heavy investment in healthcare infrastructure and strict data privacy regulations.

This segmentation reflects blockchain’s role in addressing challenges such as data manipulation, costly manual processes, and inefficient regulatory compliance, thereby attracting diverse stakeholders in global clinical research.

Region-Level Insights

- North America

Anticipated to lead the blockchain clinical trial transparency market, backed by substantial investments in healthcare infrastructure, robust regulatory frameworks for patient data privacy, and proactive initiatives to combat healthcare fraud. In 2025, North America is expected to account for approximately 53% of total market share. - Europe

Closely follows, propelled by stricter transparency mandates for clinical research, strong government support, and early adoption of advanced blockchain solutions among pharmaceutical companies. - Asia Pacific

Witnessing rapid growth due to increasing digitalization in healthcare, expanding clinical trial activity in emerging economies like China and India, and efforts to improve trial transparency. Region expected to grow at CAGR above 30% through 2033. - Latin America and Middle East & Africa

These are emerging markets, experiencing gradual adoption as regulatory bodies and healthcare institutions recognize the benefits of blockchain for data integrity and patient consent traceability. - Across all regions, integration with AI and IoT is accelerating adoption, streamlining clinical trial processes, and ensuring real-time, immutable records for auditability and compliance.

- Regional uptake and market share are shaped by local data regulations, the maturity of digital health ecosystems, and varying levels of stakeholder collaboration in clinical research.

Leading Companies in the Market

The Blockchain Clinical Trial Transparency Market is driven by leading firms known for their innovative applications of blockchain to ensure data integrity, transparency, and security in clinical research.

Prominent companies include:

- Akiri

- BurstIQ

- PokitDok

- Guardtime

- Medicalchain

- Patientory

Notably, Triall has partnered with prestigious organizations like the Mayo Clinic to implement blockchain-powered solutions for real-time data capture and document management in multicenter clinical trials, setting new industry standards for transparency and regulatory compliance.

These key players are expanding their offerings, leveraging smart contracts to streamline site payments and automate protocol amendments, and driving blockchain adoption across global pharmaceutical and healthcare institutions.

Strategic Intelligence and AI-Backed Insights

The blockchain clinical trial transparency market is rapidly evolving, driven by increased regulatory scrutiny and the demand for secure, tamper-proof, and auditable clinical trial data.

Blockchain’s immutability and interoperability directly address longstanding issues of data integrity and traceability in clinical research, enabling unprecedented transparency and auditability throughout the trial lifecycle.

Advanced AI-powered analytics complement blockchain’s foundation by delivering:

- Real-time anomaly detection

- Predictive monitoring of recruitment bottlenecks

- Automated protocol compliance checks

This results in faster decision-making cycles, fewer protocol deviations, and improved trial reliability.

Leading pharmaceutical sponsors and CROs are increasingly prioritizing AI-blockchain integration to accelerate trial approvals and build trust with regulators. Strategic investments are targeting scalable private blockchain infrastructures capable of operating across multi-jurisdictional research ecosystems, ensuring alignment with global data privacy standards.

This evolution is reshaping competitive dynamics, creating new trial governance models, and pushing the industry toward elevated standards for clinical transparency and operational efficiency.

Forecast Snapshot: 2025–2033

| Metric | Value |

| Market Size (2025) | USD 1.0 Billion |

| Market Size (2033) | USD 6.0 Billion |

| CAGR (2025–2033) | 25.0% |

| Clinical Trials Share (2025) | 46% of blockchain in healthcare |

| North America Share (2025) | ~53% |

| Asia Pacific CAGR | >30% |

Note: Metrics are derived from broader blockchain-in-healthcare data, narrowed to transparency-related clinical trial applications. Estimates reflect averaged projections from 2024–2034 trends.

Why the Global Market Remains Critical

The global market remains critical for the Blockchain Clinical Trial Transparency sector due to its vital role in standardizing data integrity, fostering regulatory compliance, and combating fraud across international borders.

Adoption is driven by:

- Globalization of clinical trials

- Rising instances of protocol deviations and consent mismanagement

- Mounting concerns over counterfeit data in drug development

Multinational trials demand interoperable, compliant infrastructure, and blockchain provides the cross-border transparency needed for harmonized collaboration. North America and Europe are shaping the benchmarks, but uptake in Asia and LATAM is closing the gap rapidly.

Active global participation ensures that trial sponsors and CROs benefit from the latest in privacy tech, consent analytics, and stakeholder trust frameworks.

Final Takeaway

The Blockchain Clinical Trial Transparency Market is scaling fast, underpinned by the need for secure, transparent, and immutable trial infrastructure. As pharma sponsors, CROs, and regulators raise the bar on data integrity and auditability, blockchain emerges as a foundational pillar.

With clinical trials expected to represent nearly half of all blockchain healthcare activity by 2025, the market outlook is highly positive. North America and Europe are paving the path, but Asia Pacific is the growth hotspot to watch.

Challenges around data interoperability and provider hesitancy remain, but integration with AI and IoT, coupled with strong policy momentum, will continue to accelerate transformation.

Table of Contents

Overview

1.1 Market Context: Blockchain in Clinical Trials

1.2 Why Transparency, Why Now: The Integrity Imperative

1.3 Market Snapshot: USD 1.0B (2025) to USD 6.0B (2033) | CAGR 25.0%

1.4 Blockchain as a Catalyst for Trust, Efficiency & Compliance

1.5 Phoenix Methodology: Data Stack, Predictive Modeling, Sentiment Mapping

Key Drivers of Market Growth

2.1 Rising Demand for Data Integrity & Auditability

2.2 Cybersecurity Pressures: Ransomware and IP Protection

2.3 Trial Cost Reduction Through Smart Contracts & Automation

2.4 Blockchain-Enabled Patient Engagement & Consent Trust

2.5 Regulatory Shifts Favoring Transparent Trial Ecosystems

2.6 Outsourced, Multi-Center Trial Expansion (Global R&D Shifts)

Market Segmentation

3.1 By Application

• 3.1.1 Clinical Trials (Dominant Segment – 46% Share in 2025)

• 3.1.2 Patient Recruitment & Retention

• 3.1.3 Informed Consent Verification

• 3.1.4 Real-Time Audit Trail Management

3.2 By Blockchain Type

• 3.2.1 Public Blockchain Networks (60% Share)

• 3.2.2 Private (Permissioned) Blockchains

• 3.2.3 Hybrid Models for Multi-Stakeholder Governance

3.3 By Geography

• 3.3.1 North America

• 3.3.2 Europe

• 3.3.3 Asia Pacific

• 3.3.4 Latin America

• 3.3.5 Middle East & Africa

Region-Level Insights

4.1 North America – Market Leader (53% Share in 2025)

• 4.1.1 Early Regulatory Adoption (e.g., FDA Digital Health Framework)

• 4.1.2 Blockchain Integration in Multisite Trials and Fraud Prevention

4.2 Europe – Regulatory-Driven Growth

• 4.2.1 Strong Transparency Mandates and Compliance Infrastructure

• 4.2.2 Pharma-Led Pilots and Consortium Efforts

4.3 Asia Pacific – Fastest Growing Region (>30% CAGR)

• 4.3.1 Rapid Clinical Outsourcing in India, China, South Korea

• 4.3.2 Digital Health Convergence with Blockchain

4.4 LATAM & MENA – Emerging Opportunity Zones

• 4.4.1 Nascent Regulatory Adoption

• 4.4.2 Gradual Institutional Buy-in, Public Health Trials Driving Momentum

Leading Companies in the Market

5.1 Market Leaders: Product Portfolio and Differentiators

• Akiri – Secure Data Liquidity Networks

• BurstIQ – Blockchain-Based Precision Data Exchange

• PokitDok – Legacy Integration for Pharma Workflows

• Guardtime – Military-Grade Integrity Verification

• Medicalchain – Clinical Records & Consent on Chain

• Patientory – Blockchain-Powered Patient Identity Management

• Triall – Flagship Deployment with Mayo Clinic: Document Immutability & Compliance

5.2 Competitive Intelligence Grid: Use Case Depth vs. Scale

5.3 Smart Contracts: Automating Site Payments, Protocol Versioning

5.4 Strategic Partnerships: Pharma Alliances, CRO Integrations, RegTech Collaborations

Strategic Intelligence and AI-Backed Insights

6.1 Blockchain + AI: Synergistic Potential in Clinical Operations

• 6.1.1 Real-Time Protocol Deviation Flagging

• 6.1.2 Predictive Bottleneck Analysis in Patient Recruitment

• 6.1.3 Automated Trial Governance Engines

6.2 Phoenix Predictive Dashboard

• 6.2.1 Growth Forecast: Public vs. Private Blockchain Adoption

• 6.2.2 Consent Fraud Reduction Metrics

• 6.2.3 Trial Retention Boosts via Trust Infrastructure

6.3 Sentiment Analyzer Trends (2022–2025):

• Positive Regulatory Movement in APAC, EU

• CRO Executive Confidence in Smart Protocol Tools

6.4 AI-Backed Porter’s Five Forces

• 6.4.1 Supplier Power: Blockchain Dev Firms vs. Open Source

• 6.4.2 Buyer Power: Large Sponsors Driving Platform Standardization

• 6.4.3 Threat of Substitution: Centralized Clinical SaaS

• 6.4.4 Barriers to Entry: Regulatory Certs, Legacy Integration Costs

• 6.4.5 Competitive Rivalry: High Innovation, Low Standardization

Forecast Snapshot: 2025–2033

7.1 Total Market Size: USD 1.0B → USD 6.0B

7.2 Clinical Trials Segment Share: 46% (2025)

7.3 CAGR by Region:

• North America – 22–24%

• Asia Pacific – >30%

7.4 Top Growth Enablers:

• Smart Protocol Automation

• Global Consent Auditability

• Patient-Facing Trust Features

Why the Global Market Remains Critical

8.1 Cross-Border Trial Governance Requires Immutable Records

8.2 Protocol Deviations, Consent Fraud & Data Tampering on the Rise

8.3 Globalization of R&D and Regulatory Harmonization Needs

8.4 Stakeholder Trust, Consent Analytics, and IP Protection as Strategic Mandates

8.5 Multinational Trials Relying on AI-Blockchain Infrastructure

Phoenix Analyst Insights and Final Takeaway

9.1 Final Outlook: From Data Vault to Dynamic Trial OS

9.2 Key Recommendations:

• For CROs: Invest in Hybrid Blockchain Protocols

• For Sponsors: Standardize Consent & Site Payment Smart Contracts

• For Regulators: Codify Interoperable Ledger Standards

9.3 Watchlist:

• Blockchain–AI–IoT Triad Integration

• Privacy-Preserving Computation for Consent & Identity

• Blockchain in Decentralized Clinical Trials (DCTs)