Electronics Repair and Remanufacturing Market 2025-2033

The Electronics Repair & Remanufacturing Market is experiencing robust growth, fueled by rising concerns over electronic waste and growing preferences for sustainability and cost-effective device longevity. The global market size is expected to nearly double from USD 148.6 billion in 2025 to USD 262 billion by 2035, reflecting a strong CAGR of 6.8%.

Advances in repair technologies—including remote diagnostics, AI-powered maintenance, and modular repair kits—are transforming service models and reducing downtime. Regulatory initiatives promoting repairability and eco-design, alongside increasing access to spare parts, are further supporting expansion. Key industry trends also include the integration of IoT and AR tools into repair workflows, as well as growing remanufacturing practices that extend product life cycles.

Electronics Repair & Remanufacturing Market 2025-2033The market is evolving as a strategic enabler of productivity, sustainability, and customer trust, underscoring its pivotal role in the circular economy.

Key Drivers of Market Growth

- Rapid technological advancements have increased the complexity and volume of consumer and industrial electronics, boosting demand for professional repair and remanufacturing services.

- Cost savings and sustainability are motivating consumers and businesses to prefer repair and remanufactured solutions over replacement, aligning with environmental awareness and regulatory pressures.

- Integration of AI, IoT, and smart devices has heightened the need for specialized maintenance to ensure continued performance.

- Shorter device lifespans and higher breakdown frequency are pushing up demand for efficient repair and remanufacturing, especially as the average lifecycle of popular electronics declines. urging OEMs and end-users to pursue remanufacturing as a readily available alternative.

- Expanded service provider networks and improved technician training, driven by partnerships between OEMs and independents, are enhancing market access and quality.

- Consumer preference for repair over replacement is accelerating circular economy adoption and market growth.

Market Segmentation

The market is segmented by service type, device category, end-user, and region:

- Service Type: Repair, maintenance, remanufacturing

- Device Category: Consumer electronics (smartphones, laptops, home appliances), industrial electronics, automotive electronics

- End Users: Individual consumers, commercial clients, industrial clients

- Region: Asia Pacific, Europe, North America, Latin America, Middle East & Africa

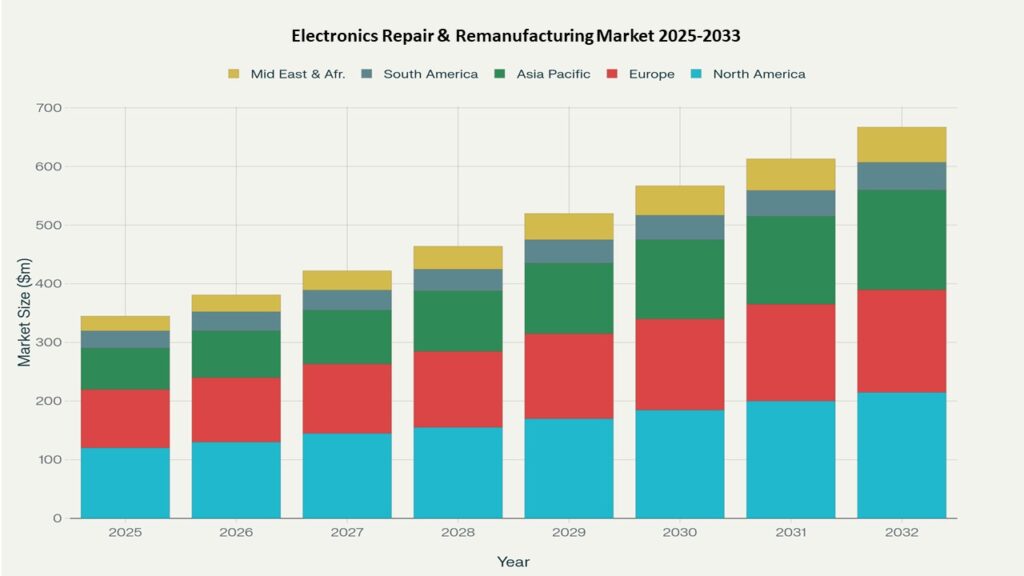

Asia Pacific dominates the market due to high electronic device ownership, cost-sensitive consumers, and strong local manufacturing, followed by Europe, where regulations around e-waste and consumer sustainability preferences drive growth.

Region-Level Insights

- Asia Pacific: Accounts for 36% of revenue in 2024, supported by growing device penetration and cost-conscious consumer behavior.

- Europe: Over 30% market share in 2023, underpinned by strong environmental regulations and consumer focus on sustainability.

- North America: Growing steadily due to advanced electronics adoption and well-established service infrastructure.

- Emerging markets (Latin America, Middle East & Africa): Demand is rising with increasing disposable incomes, improved access to repair services, and rapid digitalization.

Leading Companies in the Market

The market features a mix of global contract manufacturers, regional specialists, and niche service providers:

- Flex and Jabil: Global leaders in scalable manufacturing and repair lifecycle solutions across industries.

- Foxconn: Dominant in high-volume smartphone and smart device repair and remanufacturing.

- AER Technologies: Key player in automotive electronics remanufacturing, trusted by OEMs like Ford.

- Elmgrove Technologies and Surmotech: Specialists in PCB and system-level repair and rem

Overview

1.1 Market Context: Electronics Repair & Remanufacturing Landscape

1.2 Why Repair & Remanufacturing, Why Now: Circular Economy & Sustainability Imperative

1.3 Market Snapshot: USD 148.6B (2025) to USD 262.5B (2033) | CAGR 6.8%

1.4 AI, Modular Design, and Predictive Maintenance as Market Accelerators

1.5 Phoenix Methodology: Data Stack, Global Parts Availability, and AI-Driven Trend ForecastingKey Drivers of Market Growth

2.1 Rising Complexity and Volume of Consumer and Industrial Electronics

2.2 Cost Savings and Sustainability Driving Repair Over Replacement

2.3 Shorter Device Lifecycles Increasing Repair & Remanufacturing Demand

2.4 AI, IoT, and Remote Diagnostics Enhancing Maintenance Efficiency

2.5 Supply Chain Constraints and Rising New Product Costs Boosting Remanufacturing

2.6 Expanding Global Service Provider Networks and Skilled Workforce TrainingMarket Segmentation

3.1 By Service Type

• 3.1.1 Repair (Largest Segment – ~50% Share)

• 3.1.2 Maintenance

• 3.1.3 Remanufacturing (Fastest-Growing – ~8% CAGR)3.2 By Device Category

• 3.2.1 Consumer Electronics (Smartphones, Laptops, Appliances – ~60% Share)

• 3.2.2 Industrial Electronics

• 3.2.3 Automotive Electronics3.3 By End User

• 3.3.1 Individual Consumers

• 3.3.2 Commercial Clients

• 3.3.3 Industrial Clients3.4 By Geography

• 3.4.1 Asia Pacific

• 3.4.2 Europe

• 3.4.3 North America

• 3.4.4 Latin America

• 3.4.5 Middle East & AfricaRegion-Level Insights

4.1 Asia Pacific – Market Leader (36% Share in 2025)

• 4.1.1 Strong Local Manufacturing and Cost-Sensitive Consumer Base

• 4.1.2 High Device Penetration Driving Service Demand4.2 Europe – Second Largest Market (~30% Share in 2025)

• 4.2.1 E-Waste Regulations and Consumer Sustainability Preferences

• 4.2.2 OEM Partnerships with Regional Service Providers4.3 North America – Steady Growth

• 4.3.1 Advanced Electronics Adoption and Established Service Infrastructure

• 4.3.2 Modular Device Design and Extended Product Lifecycle Initiatives4.4 Latin America & MENA – Emerging Opportunity Zones

• 4.4.1 Rising Disposable Incomes and Access to Repair Networks

• 4.4.2 Digitalization Driving Consumer and Industrial Electronics UsageLeading Companies in the Market

5.1 Market Leaders: Scalable Solutions and Advanced Capabilities

• Flex – End-to-End Manufacturing and Repair Lifecycle Solutions

• Jabil – Global Repair and Remanufacturing Services Across Industries

• Foxconn – High-Volume Smartphone and Device Repair Services

• Pegatron – Electronics Repair and Assembly Specialist

• AER Technologies – Automotive Electronics Remanufacturing Partner for OEMs

• Elmgrove Technologies & Surmotech – PCB and System-Level Repair Leaders5.2 Competitive Intelligence Grid: Service Reach vs. Specialization Depth

5.3 OEM–Independent Service Provider Partnerships Expanding Market Access

5.4 Sustainability and Circular Economy Integration as DifferentiatorsStrategic Intelligence and AI-Backed Insights

6.1 AI-Driven Diagnostics and Predictive Maintenance Minimizing Downtime

• 6.1.1 Real-Time Fault Detection and Remote Service Models

• 6.1.2 AR and VR Tools Enhancing Technician Training6.2 Phoenix Predictive Dashboard

• 6.2.1 Tracking Global Spare Parts Shortages and Price Volatility

• 6.2.2 Mapping Consumer Sentiment Toward Repair vs. Replacement6.3 AI-Backed Regulatory Compliance and Sustainability Benchmarking

6.4 Remanufacturing as a Value Driver for OEMs and Circular Economy StakeholdersForecast Snapshot: 2025–2033

7.1 Total Market Size: USD 148.6B → USD 262.5B

7.2 Largest Region (2025): Asia Pacific (36% Share)

7.3 Second Largest Region (2025): Europe (30% Share)

7.4 Leading Service Type: Repair (~50% Share)

7.5 Fastest-Growing Service Type: Remanufacturing (~8% CAGR)

7.6 Leading Device Category: Consumer Electronics (~60% Share)

7.7 Key Growth Drivers: AI-Powered Diagnostics and Modular Repair KitsWhy the Global Market Remains Critical

8.1 Reducing Global E-Waste and Extending Device Lifespans

8.2 Economies of Scale Driving Down Repair & Remanufacturing Costs

8.3 Standardization of Repairability and Sustainability Benchmarks

8.4 Global Access to Spare Parts and Knowledge Networks

8.5 Enabling Circular Economy Objectives for OEMs and ConsumersPhoenix Analyst Insights and Final Takeaway

9.1 Final Outlook: Market to Nearly Double in Size by 2033 at 6.8% CAGR

9.2 Key Recommendations:

• For OEMs: Invest in Modular Design and Authorized Service Partnerships

• For Service Providers: Expand Remanufacturing Capabilities and Technician Training

• For Policymakers: Incentivize Circular Economy Practices and Right-to-Repair Initiatives9.3 Watchlist:

• AI-Powered Repair Workflow Adoption Rates

• Emerging Regulations Around Product Repairability

• Remanufacturing Growth in Emerging Markets9.4 Investment Horizon: AR-Enabled Training, Predictive Service Platforms, and Sustainable Component Sourcing

9.5 Vision 2033: Electronics Repair & Remanufacturing as a Mainstream Pillar of the Circular EconomyAppendices

10.1 Phoenix Research Methodology

10.2 Data Sources and Definitions

10.3 Glossary (e.g., Remanufacturing, Right-to-Repair, Modular Design)

10.4 Market Map: By Service Type and Device Category

10.5 Contact Phoenix for Custom Market Briefings and Strategic Advisoryanufacturing, serving aerospace, defense, and medical sectors.

These players ensure high-quality standards, innovation, and reduced electronic waste through advanced repair and remanufacturing capabilities.

Strategic Intelligence and AI-Backed Insights

AI and predictive analytics are playing a crucial role in the market's transformation:

- AI-powered diagnostics and predictive maintenance reduce downtime and improve efficiency.

- Real-time data analysis enables stakeholders to track global repair trends, parts shortages, and consumer sentiment.

- Augmented reality (AR) and remote diagnostics are enhancing technician training and enabling scalable service models.

- AI-backed intelligence supports faster innovation and compliance with changing global regulations, helping companies adapt to sustainability mandates.

These technologies are essential for risk mitigation, cost reduction, and customer satisfaction in a competitive market.

Forecast Snapshot: 2025–2033

| Metric | Value |

| 2025 Market Size | USD 148.6 billion |

| 2033 Market Size (Projected) | USD 262.5 billion |

| CAGR (2025–2033) | 6.8% |

| Largest Region (2025) | Asia Pacific (36% share) |

| Second Largest Region (2025) | Europe (30% share) |

| Leading Service Type | Repair (approx. 50% share) |

| Fastest-Growing Service Type | Remanufacturing (CAGR ~8%) |

| Top Device Category | Consumer Electronics (approx. 60% share) |

| Key Trend | AI-driven diagnostics & modular repair kits |

Why the Global Market Remains Critical

The electronics repair & remanufacturing market is pivotal to reducing global e-waste, extending device lifespans, and enabling circular economy practices. Global connectivity ensures:

- Widespread access to critical spare parts and technologies

- Standardization of best practices and sustainability benchmarks

- Economies of scale that drive down repair and remanufacturing costs

As device penetration grows globally, repair and remanufacturing become essential to balancing environmental stewardship with economic efficiency.

Final Takeaway

The market is poised for sustained expansion, nearly doubling in size by 2033 at a CAGR of 6.8%, driven by environmental regulations, consumer demand for cost-effective solutions, and rapid digital transformation.

Asia Pacific and Europe will remain key growth hubs, while remanufacturing is expected to outpace traditional repair services. Companies that leverage AI-driven diagnostics, modular designs, and sustainable practices will be best positioned to capture long-term value in this critical circular economy sector.

Table of Contents

Overview

1.1 Market Context: Electronics Repair & Remanufacturing Landscape

1.2 Why Repair & Remanufacturing, Why Now: Circular Economy & Sustainability Imperative

1.3 Market Snapshot: USD 148.6B (2025) to USD 262.5B (2033) | CAGR 6.8%

1.4 AI, Modular Design, and Predictive Maintenance as Market Accelerators

1.5 Phoenix Methodology: Data Stack, Global Parts Availability, and AI-Driven Trend Forecasting

Key Drivers of Market Growth

2.1 Rising Complexity and Volume of Consumer and Industrial Electronics

2.2 Cost Savings and Sustainability Driving Repair Over Replacement

2.3 Shorter Device Lifecycles Increasing Repair & Remanufacturing Demand

2.4 AI, IoT, and Remote Diagnostics Enhancing Maintenance Efficiency

2.5 Supply Chain Constraints and Rising New Product Costs Boosting Remanufacturing

2.6 Expanding Global Service Provider Networks and Skilled Workforce Training

Market Segmentation

3.1 By Service Type

• 3.1.1 Repair (Largest Segment – ~50% Share)

• 3.1.2 Maintenance

• 3.1.3 Remanufacturing (Fastest-Growing – ~8% CAGR)

3.2 By Device Category

• 3.2.1 Consumer Electronics (Smartphones, Laptops, Appliances – ~60% Share)

• 3.2.2 Industrial Electronics

• 3.2.3 Automotive Electronics

3.3 By End User

• 3.3.1 Individual Consumers

• 3.3.2 Commercial Clients

• 3.3.3 Industrial Clients

3.4 By Geography

• 3.4.1 Asia Pacific

• 3.4.2 Europe

• 3.4.3 North America

• 3.4.4 Latin America

• 3.4.5 Middle East & Africa

Region-Level Insights

4.1 Asia Pacific – Market Leader (36% Share in 2025)

• 4.1.1 Strong Local Manufacturing and Cost-Sensitive Consumer Base

• 4.1.2 High Device Penetration Driving Service Demand

4.2 Europe – Second Largest Market (~30% Share in 2025)

• 4.2.1 E-Waste Regulations and Consumer Sustainability Preferences

• 4.2.2 OEM Partnerships with Regional Service Providers

4.3 North America – Steady Growth

• 4.3.1 Advanced Electronics Adoption and Established Service Infrastructure

• 4.3.2 Modular Device Design and Extended Product Lifecycle Initiatives

4.4 Latin America & MENA – Emerging Opportunity Zones

• 4.4.1 Rising Disposable Incomes and Access to Repair Networks

• 4.4.2 Digitalization Driving Consumer and Industrial Electronics Usage

Leading Companies in the Market

5.1 Market Leaders: Scalable Solutions and Advanced Capabilities

• Flex – End-to-End Manufacturing and Repair Lifecycle Solutions

• Jabil – Global Repair and Remanufacturing Services Across Industries

• Foxconn – High-Volume Smartphone and Device Repair Services

• Pegatron – Electronics Repair and Assembly Specialist

• AER Technologies – Automotive Electronics Remanufacturing Partner for OEMs

• Elmgrove Technologies & Surmotech – PCB and System-Level Repair Leaders

5.2 Competitive Intelligence Grid: Service Reach vs. Specialization Depth

5.3 OEM–Independent Service Provider Partnerships Expanding Market Access

5.4 Sustainability and Circular Economy Integration as Differentiators

Strategic Intelligence and AI-Backed Insights

6.1 AI-Driven Diagnostics and Predictive Maintenance Minimizing Downtime

• 6.1.1 Real-Time Fault Detection and Remote Service Models

• 6.1.2 AR and VR Tools Enhancing Technician Training

6.2 Phoenix Predictive Dashboard

• 6.2.1 Tracking Global Spare Parts Shortages and Price Volatility

• 6.2.2 Mapping Consumer Sentiment Toward Repair vs. Replacement

6.3 AI-Backed Regulatory Compliance and Sustainability Benchmarking

6.4 Remanufacturing as a Value Driver for OEMs and Circular Economy Stakeholders

Forecast Snapshot: 2025–2033

7.1 Total Market Size: USD 148.6B → USD 262.5B

7.2 Largest Region (2025): Asia Pacific (36% Share)

7.3 Second Largest Region (2025): Europe (30% Share)

7.4 Leading Service Type: Repair (~50% Share)

7.5 Fastest-Growing Service Type: Remanufacturing (~8% CAGR)

7.6 Leading Device Category: Consumer Electronics (~60% Share)

7.7 Key Growth Drivers: AI-Powered Diagnostics and Modular Repair Kits

Why the Global Market Remains Critical

8.1 Reducing Global E-Waste and Extending Device Lifespans

8.2 Economies of Scale Driving Down Repair & Remanufacturing Costs

8.3 Standardization of Repairability and Sustainability Benchmarks

8.4 Global Access to Spare Parts and Knowledge Networks

8.5 Enabling Circular Economy Objectives for OEMs and Consumers

Phoenix Analyst Insights and Final Takeaway

9.1 Final Outlook: Market to Nearly Double in Size by 2033 at 6.8% CAGR

9.2 Key Recommendations:

• For OEMs: Invest in Modular Design and Authorized Service Partnerships

• For Service Providers: Expand Remanufacturing Capabilities and Technician Training

• For Policymakers: Incentivize Circular Economy Practices and Right-to-Repair Initiatives

9.3 Watchlist:

• AI-Powered Repair Workflow Adoption Rates

• Emerging Regulations Around Product Repairability

• Remanufacturing Growth in Emerging Markets

9.4 Investment Horizon: AR-Enabled Training, Predictive Service Platforms, and Sustainable Component Sourcing

9.5 Vision 2033: Electronics Repair & Remanufacturing as a Mainstream Pillar of the Circular Economy

Appendices

10.1 Phoenix Research Methodology

10.2 Data Sources and Definitions

10.3 Glossary (e.g., Remanufacturing, Right-to-Repair, Modular Design)

10.4 Market Map: By Service Type and Device Category

10.5 Contact Phoenix for Custom Market Briefings and Strategic Advisory