Global Functional Gummies and Jellies Market, 2025-2033

The Global Functional Gummies & Jellies Market is accelerating as consumers shift from pills to palatable, on-the-go formats for vitamins, minerals, botanicals, collagen and probiotics. Confectionery-like delivery, better compliance, clean-label formulations (pectin/vegan), and social-commerce education are redefining nutraceutical adoption across age groups and use-cases (immunity, sleep, gut, beauty-from-within).

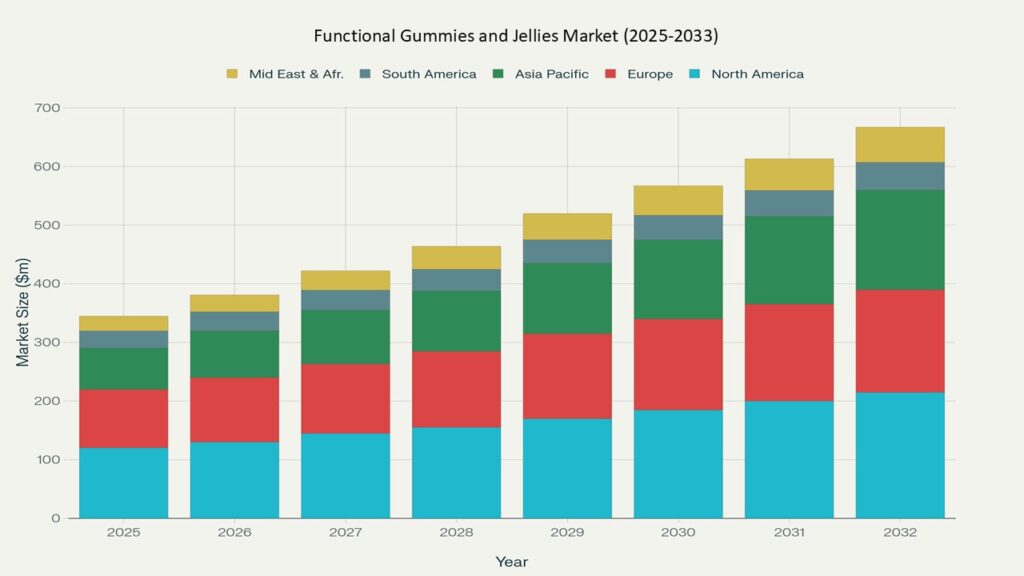

According to Phoenix’s Demand Forecast Engine, the market is projected to grow from ~USD 5.2 billion in 2025 to ~USD 10.9 billion by 2033, reflecting a CAGR of ~10.1% (2025–2033). In 2024, North America led with ~44% share, while Asia Pacific is set to grow the fastest on the back of rising wellness spend, e-commerce penetration, and K-beauty/J-beauty influence. These trajectories align with external benchmarks indicating rapid growth in functional gummies and strong baselines in broader gummy supplements and jellies & gummies categories.

Key Drivers of Market Growth

- Pill fatigue → compliance boost: Chewable formats improve adherence vs. tablets/caps, expanding lifetime value in VMS (vitamins, minerals, supplements). External trackers show gummy-format outperformance within supplements.

- Beauty-from-within & collagen boom: Collagen/HA and biotin gummies fuel the “ingestible beauty” wave alongside sleep and de-stress SKUs.

- Clean-label, low-sugar engineering: Shift to pectin/vegan, sugar-reduced and natural flavors supports broader adoption and premium pricing—mirrored in jellies & gummies category upgrades.

- Omnichannel scale & creator education: DTC, marketplaces, and pharmacy chains amplify launches; creator content compresses trial cycles and builds trust.

- Wider user cohorts: Kids’ multi-vitamins, women’s health, active/sports, and healthy-aging SKUs expand the addressable base; retailers widen sets accordingly.

Market Segmentation

By Offering

- Functional Gummies (vitamins/minerals, probiotics, collagen/beauty, sleep/stress, fiber/omega)

- Functional Jellies (energy/electrolyte, fiber, herbal, collagen/beauty)

By Ingredient System

- Vitamins & Minerals • Probiotics/Prebiotics • Collagen/Beauty Actives • Botanicals/Adaptogens • Omega/Fiber

By Consumer Group

- Children & Teens • Adults (General Wellness) • Women’s Health • Active/Sports • Healthy Aging

By Claim/Format

- Vegan/Pectin • Sugar-Reduced/No Added Sugar • Gelatin-based • Non-GMO/Clean-Label

By Distribution Channel

- Pharmacies/Drugstores • Supermarkets & Convenience • Specialty Nutrition/Beauty • Online (Brand DTC & Marketplaces)

Region-Level Insights

North America – CAGR (2025–2033): ~8–9%

• Largest revenue pool; strong retail planograms for gummy supplements; ~44% share in 2024. Heightened scrutiny on claims favors reputable brands.

Europe

• Clean-label and sugar-reduction regulations shape formulations; pharmacy and para-pharmacy dominant alongside fast-growing online.

Asia Pacific – CAGR (2025–2033): ~12–14% (Fastest Growing Region)

• Rising middle class, beauty-from-within popularity (Japan/Korea/China), and rapid cross-border e-commerce adoption propel uptake; convenience stores and marketplaces expand shelf space.

Latin America

• Pharmacy-led education and localized flavors; Brazil and Mexico scale gummy vitamins and collagen lines via marketplaces.

Middle East & Africa

• High per-capita spend pockets (GCC); emerging specialty retail and beauty-from-within sets in modern trade and e-commerce.

Leading Companies in the Market

Based on Phoenix’s Event Detection Engine and Innovation Tracker, leading players include: Bayer (One A Day), Church & Dwight (Vitafusion), Pharmavite (Nature Made), Haleon (Centrum in select markets), Unilever (OLLY), Nestlé Health Science (Vital Proteins / Garden of Life), The Bountiful Company brands, plus challengers Goli Nutrition, SmartyPants, Herbaland, HUM Nutrition, Ritual and regional specialists. Traditional confectioners increasingly launch functional lines adjacent to core jellies & gummies.

Strategic Intelligence and AI-Backed Insights

- Phoenix Demand Forecast Engine fuses retailer POS, search-and-social velocity, and promo calendars to model SKU-level repeat and trade-up.

- Construction Activity Mapping System flags new pharmacy/specialty doors and co-packing capacity expansions supporting private-label functional gummies.

- Sentiment Analyzer Tool tracks rising intent for vegan/pectin, low-sugar, and collagen-plus claims across creator content.

- Automated Porter’s Five Forces: High rivalry (fast copy cycles, private label), moderate buyer power (promo-sensitive), low switching costs online, rising regulatory/QA barriers (claims, sugar levels).

Forecast Snapshot: 2025–2033

| Metric | Value |

| 2025 Market Size | ~USD 5.2 Billion |

| 2033 Market Size | ~USD 10.9 Billion |

| CAGR (2025–2033) | ~10.1% |

| Largest Region (2024) | North America (~44% share) |

| Fastest Growing Region | Asia Pacific (~12–14% CAGR) |

| Top Segments | Collagen/Beauty; Probiotics; Sleep/Stress |

| Key Trend | Vegan/pectin, sugar-reduced formulations |

| Future Growth Focus | Pharmacy + online bundles; women’s health; kids; beauty-from-within |

Why the Global Market Remains Critical

- Compliance wins: Better taste/texture drives higher adherence than pills, improving real-world outcomes.

- Premiumization runway: Beauty/gut/sleep SKUs support higher ASPs with science-backed claims.

- Omnichannel resilience: Strong performance across pharmacies, mass retail, and online.

- Manufacturing leverage: Flexible co-packing and private-label unlock retailer margin plays.

Final Takeaway

Functional gummies & jellies are moving from indulgent novelty to mainstream wellness delivery systems. Brands that combine clean-label, low-sugar engineering with credible actives and creator-led education will outgrow the category. Phoenix Research’s AI-backed platforms pinpoint claim architectures, price-pack strategies, and door expansion hotspots—positioning stakeholders for durable, above-market growth in this high-compliance format.

- Executive Summary & Market Overview

• 1.1 Introduction to Functional Gummies & Jellies

• 1.2 Evolution from Confectionery to Nutraceutical-Infused Formats

• 1.3 Market Snapshot: Size, CAGR, Share (2023–2032)

• 1.4 Key Consumer Trends: Convenience Nutrition, Clean Label, Plant-Based Formulations

• 1.5 Post-Pandemic Surge in Immunity & Wellness-Focused Products

• 1.6 Phoenix Research Methodology & Tool Integration (Demand Forecast Engine, Consumer Sentiment Analyzer, Nutraceutical Tracker) - Key Drivers of Market Growth

• 2.1 Rising Demand for On-the-Go Nutrition and Fortified Foods

• 2.2 Growing Preference for Gummies Over Pills & Capsules

• 2.3 Expansion of Functional Ingredients: Vitamins, Collagen, Probiotics, Omega-3s

• 2.4 Increasing Vegan, Gelatin-Free, and Plant-Based Alternatives

• 2.5 E-Commerce & D2C Brands Driving Accessibility

• 2.6 Influence of Millennials & Gen Z Health-Conscious Lifestyles - Market Segmentation

• 3.1 By Product Type

o 3.1.1 Functional Gummies

o 3.1.2 Functional Jellies

• 3.2 By Functionality

o 3.2.1 Immunity Boosting

o 3.2.2 Digestive Health (Probiotics, Fiber)

o 3.2.3 Skin, Hair & Nail Health (Collagen, Biotin)

o 3.2.4 Energy & Focus (Caffeine, Adaptogens, Nootropics)

o 3.2.5 Bone & Joint Health (Calcium, Vitamin D)

o 3.2.6 Others (Sleep Support, Heart Health, Stress Relief)

• 3.3 By Ingredient Type

o 3.3.1 Gelatin-Based

o 3.3.2 Pectin-Based (Vegan-Friendly)

o 3.3.3 Others (Agar, Starch Blends)

• 3.4 By Consumer Demographic

o 3.4.1 Adults

o 3.4.2 Kids

o 3.4.3 Seniors

• 3.5 By Distribution Channel

o 3.5.1 Offline (Pharmacies, Health Stores, Hypermarkets)

o 3.5.2 Online (E-Retailers, Brand Websites, Subscription Models) - Region-Level Insights

• 4.1 North America

o 4.1.1 U.S. as the Largest Nutraceutical Gummies Market

o 4.1.2 Strong D2C Brand Ecosystem and Functional Food Innovation

• 4.2 Europe

o 4.2.1 Germany, UK, and France Leading Functional Nutrition Trends

o 4.2.2 Growing Regulatory Oversight on Health Claims

• 4.3 Asia Pacific

o 4.3.1 Fastest Growth Region – Rising Middle-Class & Preventive Health Focus

o 4.3.2 China, India & Japan Driving Nutraceutical Gummies Demand

• 4.4 Latin America

o 4.4.1 Brazil & Mexico as Emerging Growth Hubs

o 4.4.2 Increasing Role of Pharmacies & Health Chains

• 4.5 Middle East & Africa

o 4.5.1 Rising Awareness of Preventive Health & Immunity

o 4.5.2 Growth of Modern Retail Driving Functional Product Availability - Leading Companies in the Market

• 5.1 Competitive Landscape Overview

• 5.2 Company Profiles & Key Offerings

o 5.2.1 Church & Dwight (Vitafusion)

o 5.2.2 Nature’s Bounty

o 5.2.3 SmartyPants Vitamins

o 5.2.4 Hero Nutritionals (Yummi Bears)

o 5.2.5 Olly Nutrition

o 5.2.6 Nestlé Health Science (Solgar, Garden of Life)

o 5.2.7 Amway

o 5.2.8 Goli Nutrition

o 5.2.9 Nature Made

o 5.2.10 Regional & Niche Functional Gummy Startups

• 5.3 Innovation Tracking: Sugar-Free, Functional Blends, CBD/Adaptogen Gummies

• 5.4 Strategic Partnerships, M&A, and Market Expansion Initiatives - Strategic Intelligence and Phoenix-Backed Insights

• 6.1 Phoenix Demand Forecast Engine: Functional Gummies & Jellies Projections

• 6.2 Consumer Sentiment Analyzer: Social Media & Wellness Trends

• 6.3 Nutraceutical Ingredient Tracker: Emerging Demand Patterns

• 6.4 Automated Porter’s Five Forces

o 6.4.1 Competitive Rivalry

o 6.4.2 Supplier Power

o 6.4.3 Buyer Power

o 6.4.4 Threat of New Entrants

o 6.4.5 Threat of Substitutes

• 6.5 Regulatory Landscape: Health Claims, Labeling & Food Safety

• 6.6 Cross-Market Trends: Gummies in Sports Nutrition, Functional Beverages, and Kids’ Nutrition - Forecast Snapshot: 2023–2032

• 7.1 Global Market Size and Revenue Projections

• 7.2 CAGR by Functionality & Ingredient Base

• 7.3 Regional Growth Benchmarking

• 7.4 Top Performing Segments (Immunity, Skin Health)

• 7.5 Market Inflection Points (Health Awareness, Tech-Enabled Nutrition, Regulation)

• 7.6 Short-Term vs. Long-Term Investment Outlook - Why the Global Functional Gummies & Jellies Market Remains Critical

• 8.1 Shift from Pill Fatigue to Chewable Functional Nutrition

• 8.2 Asia Pacific & Latin America: High-Growth, Underpenetrated Markets

• 8.3 Sugar-Free & Plant-Based Gummies Addressing Consumer Health Needs

• 8.4 Preventive Healthcare and Wellness as Long-Term Growth Drivers

• 8.5 Expanding Role of E-Commerce & Subscription-Based Wellness Products - Phoenix Researcher Insights & Final Takeaways

• 9.1 Strategic Summary of Findings

• 9.2 Early Signals from Consumer Health Behavior Models

• 9.3 Emerging Growth Pockets: Vegan Gummies, Seniors’ Nutrition, Functional Kids’ Jellies

• 9.4 Actionable Recommendations for OEMs, Nutraceutical Brands & Policymakers

• 9.5 The Path Forward: Functional Confectionery as Everyday Nutrition

10. Appendices

• 10.1 Research Methodology

• 10.2 Data Sources and Assumptions

• 10.3 Glossary of Terms

• 10.4 Phoenix’s Market Intelligence Suite Overview

• 10.5 Contact & Custom Research Support