Global AI-Based Radiology Solutions Market 2025-2033

The Global AI-Based Radiology Solutions Market is undergoing robust expansion as healthcare systems prioritize accuracy, speed, and decision support in diagnostic imaging. The convergence of AI algorithms with radiology platforms is redefining clinical workflows—enabling faster diagnoses, enhanced detection of complex diseases, and improved patient outcomes. Post-pandemic acceleration in digital diagnostics, coupled with workforce shortages, is driving hospitals and imaging centers to invest heavily in AI-driven radiology platforms.

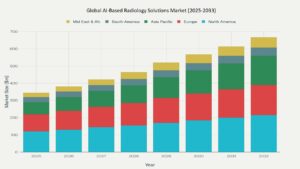

According to Phoenix’s Demand Forecast Engine, the global market is projected to grow from USD 1,842.67 million in 2025 to approximately USD 4,785.2 million by 2033, reflecting a CAGR of 12.6%. In 2024, North America led with a 41.3% market share, while Asia Pacific is expected to register the fastest growth at a CAGR of 14.9% through 2033.

Global AI-Based Radiology Solutions Market

Key Drivers of Market Growth

- Rising Imaging Volume and Diagnostic Complexity

The dramatic increase in medical imaging—especially in oncology, neurology, and cardiology—is outpacing available radiologist capacity. Phoenix’s Sentiment Analyzer Tool confirms a global shift in strategic budgets toward AI as a solution to imaging backlog and reporting accuracy. - Integration of AI with PACS, RIS, and Cloud Infrastructure

AI tools are increasingly embedded into Picture Archiving and Communication Systems (PACS) and Radiology Information Systems (RIS), streamlining clinical workflows and boosting productivity. Radiology departments are adopting cloud-native systems that support AI model deployment at scale. - Precision Diagnostics and Early Detection

AI-based image recognition models enhance early detection of diseases such as lung cancer, stroke, and diabetic retinopathy. Governments and private insurers are backing pilot projects where AI integration is linked to reimbursement incentives and screening mandates.

Market Segmentation

By Offering

• AI Software

• AI Services

• Imaging Hardware with Embedded AI

By Imaging Modality

• X-Ray

• CT

• MRI

• Ultrasound

• PET-CT

By Clinical Application

• Oncology

• Neurology

• Cardiology

• Orthopedics

• Pulmonology

• Emergency Imaging

By End User

• Hospitals

• Diagnostic Imaging Centers

• Specialty Clinics

• Academic & Research Institutes

Region-Level Insights

North America – CAGR (2025–2033): 11.8%

• Home to early adopters, North America benefits from strong reimbursement frameworks and mature radiology infrastructure. The U.S. FDA has approved over 300 AI imaging solutions, setting a global precedent for regulatory acceptance.

Europe

• Western Europe is witnessing a surge in AI integration across public health systems, especially in Germany, France, and the UK. Eastern Europe lags due to IT infrastructure limitations but is supported by EU-led AI innovation grants.

Asia Pacific – CAGR (2025–2033): 14.9% (Fastest Growing Region)

• India, China, South Korea, and Japan are becoming hotbeds for AI-radiology collaborations. According to Phoenix’s Construction Activity Mapping System, over 400 new diagnostic centers in Tier 2 cities across Asia are embedding AI in radiology suites.

Latin America

• Brazil and Mexico are leading AI diagnostic adoption in Latin America. Regional hospitals are tapping into cloud-based solutions to leapfrog on-premise limitations, and pilot projects are being rolled out in oncology and chest X-ray screening.

Leading Companies in the Market

Based on Phoenix’s Event Detection Engine and Innovation Tracker, leading players include:

Aidoc, Lunit, Zebra Medical Vision, Siemens Healthineers, GE HealthCare, Arterys, Qure.ai, RadNet Inc., IBM Watson Health (now Merative), Infervision.

These companies are investing in explainable AI models, real-time diagnostic alerts, and platform interoperability to enhance radiologist adoption and clinical trust.

Strategic Intelligence and AI-Backed Insights

- Phoenix Demand Forecast Engine incorporates historical imaging data and reimbursement trends to project AI radiology adoption curves.

• Construction Activity Mapping System identifies AI imaging deployments in oncology screening centers across Africa and Southeast Asia.

• Sentiment Analyzer Tool highlights a marked increase in clinical trial activity related to AI-enhanced MRI and CT diagnostics.

• Automated Porter’s Five Forces analysis reveals low buyer power in developed economies due to platform stickiness and regulatory compliance requirements.

Forecast Snapshot: 2025–2033

| Metric | Value |

| 2025 Market Size | USD 1,842.67 Million |

| 2033 Market Size | ~USD 4,785.2 Million |

| CAGR (2025–2033) | 12.6% |

| Largest Region (2024) | North America (41.3%) |

| Fastest Growing Region | Asia Pacific (14.9% CAGR) |

| Top Segment | AI Software for CT & MRI |

| Key Trend | Multi-modal AI platforms |

| Future Growth Focus | Diagnostic centers and community hospitals |

Why the Global Market Remains Critical

- AI is no longer a peripheral add-on—it's a core component of radiology modernization strategies

• Asia Pacific and Latin America offer attractive growth potential with less competitive saturation

• AI-based diagnostic solutions reduce reporting errors, speed up diagnosis, and increase throughput

• Regulatory agencies globally are fast-tracking AI approvals to mitigate diagnostic workforce gaps

Final Takeaway

The Global AI-Based Radiology Solutions Market is advancing from experimental to essential. AI is empowering radiologists with tools that extend accuracy, reduce fatigue, and enhance clinical value. From lung scans to neurological imaging, AI is augmenting human intelligence to drive faster, more precise healthcare.

At Phoenix Research, our AI-backed platforms offer unmatched foresight into technology convergence, regulatory trends, and regional market inflection points—positioning stakeholders for long-term leadership in this transformative healthcare frontier.

Table of Contents

- Executive Summary & Market Overview

- 1.1 Introduction to AI in Radiology

- 1.2 Evolution from Conventional Imaging to AI-Driven Diagnostics

- 1.3 Market Snapshot: Size, CAGR, Share (2025–2033)

- 1.4 Key Trends Reshaping Diagnostic Imaging Workflows

- 1.5 Post-Pandemic Surge in AI Investments

- 1.6 Phoenix Research Methodology & Tool Integration (Demand Forecast Engine, Sentiment Analyzer, etc.)

- Key Drivers of Market Growth

- 2.1 Rising Imaging Volume and Diagnostic Complexity

- 2.2 Integration of AI with PACS, RIS, and Cloud Infrastructure

- 2.3 Precision Diagnostics and Early Detection Capabilities

- 2.4 Growing Regulatory Approvals and Reimbursement Models

- 2.5 Workforce Shortages and Radiologist Burnout

- 2.6 Increasing Acceptance of Explainable AI (XAI) in Clinical Settings

- Market Segmentation

- 3.1 By Offering

- 3.1.1 AI Software

- 3.1.2 AI Services

- 3.1.3 Imaging Hardware with Embedded AI

- 3.2 By Imaging Modality

- 3.2.1 X-Ray

- 3.2.2 CT

- 3.2.3 MRI

- 3.2.4 Ultrasound

- 3.2.5 PET-CT

- 3.3 By Clinical Application

- 3.3.1 Oncology

- 3.3.2 Neurology

- 3.3.3 Cardiology

- 3.3.4 Orthopedics

- 3.3.5 Pulmonology

- 3.3.6 Emergency Imaging

- 3.4 By End User

- 3.4.1 Hospitals

- 3.4.2 Diagnostic Imaging Centers

- 3.4.3 Specialty Clinics

- 3.4.4 Academic & Research Institutes

- Region-Level Insights

- 4.1 North America

- 4.1.1 Market Leadership and FDA-Approved AI Tools

- 4.1.2 Reimbursement & Infrastructure Drivers

- 4.2 Europe

- 4.2.1 Public Health AI Integration (Germany, UK, France)

- 4.2.2 Funding Gaps in Eastern Europe

- 4.3 Asia Pacific

- 4.3.1 Fastest Growth Region – CAGR 14.9%

- 4.3.2 Tier 2 City Deployments and Government-Led Initiatives

- 4.4 Latin America

- 4.4.1 Brazil and Mexico Leading Regional Adoption

- 4.4.2 Cloud-Based AI Diagnostics

- 4.5 Middle East & Africa

- 4.5.1 Pilot Programs in UAE and South Africa

- 4.5.2 Infrastructure Expansion via Public-Private Models

- Leading Companies in the Market

- 5.1 Competitive Landscape Overview

- 5.2 Company Profiles & Key Offerings

- 5.2.1 Aidoc

- 5.2.2 Lunit

- 5.2.3 Zebra Medical Vision

- 5.2.4 Siemens Healthineers

- 5.2.5 GE HealthCare

- 5.2.6 Arterys

- 5.2.7 Qure.ai

- 5.2.8 RadNet Inc.

- 5.2.9 IBM Watson Health (Merative)

- 5.2.10 Infervision

- 5.3 Innovation Tracking: Explainable AI, Real-Time Alerts, Interoperability

- 5.4 Funding, Strategic Partnerships & Expansion Initiatives

- Strategic Intelligence and AI-Backed Insights

- 6.1 Phoenix Demand Forecast Engine: AI Imaging Projections

- 6.2 Construction Activity Mapping System: Deployment Analysis

- 6.3 Sentiment Analyzer Tool: Clinical Trial and Policy Trends

- 6.4 Automated Porter’s Five Forces

- 6.4.1 Competitive Rivalry

- 6.4.2 Supplier Power

- 6.4.3 Buyer Power

- 6.4.4 Threat of New Entrants

- 6.4.5 Threat of Substitutes

- 6.5 Regulatory Momentum Across Regions

- 6.6 Cross-Market Trends: AI in Digital Pathology, Cardiac Imaging, and Beyond

- Forecast Snapshot: 2025–2033

- 7.1 Global Market Size and Revenue Projections

- 7.2 CAGR by Segment and Modality

- 7.3 Regional Growth Benchmarking

- 7.4 Top Performing Segments (CT & MRI AI Software)

- 7.5 Market Inflection Points (Tech, Regulatory, Economics)

- 7.6 Short-Term vs. Long-Term Investment Outlook

- Why the Global Market Remains Critical

- 8.1 AI as a Core Component of Radiology Infrastructure

- 8.2 Asia Pacific & Latin America: High-Growth, Low-Saturation Zones

- 8.3 AI-Driven Improvements in Diagnostic Accuracy and Throughput

- 8.4 Global Regulatory Support & Accelerated Approval Pathways

- 8.5 Decentralized Healthcare Driving AI Demand in Community Imaging

- Phoenix Researcher Insights & Final Takeaways

- 9.1 Strategic Summary of Findings

- 9.2 Early Signals from AI Market Models

- 9.3 Mid-Sized Diagnostic Centers: Underserved Growth Nodes

- 9.4 Actionable Recommendations for OEMs, Tech Firms & Policymakers

- 9.5 The Path Forward: AI-Augmented Radiology in a Human-Centric Era

- Appendices

- 10.1 Research Methodology

- 10.2 Data Sources and Assumptions

- 10.3 Glossary of Terms

- 10.4 Phoenix’s AI Intelligence Suite Overview

- 10.5 Contact & Custom Research Support