Global Biotech Intellectual Property Tokenization Market 2025-2033

The Global Biotech Intellectual Property (IP) Tokenization Market is undergoing transformative growth as biotech firms adopt blockchain-enabled platforms to manage, monetize, and commercialize IP assets with greater transparency and liquidity. Tokenization—converting patents, copyrights, and proprietary biotech innovations into digital assets—empowers fractional ownership, global trading, and automated royalty distribution via smart contracts.

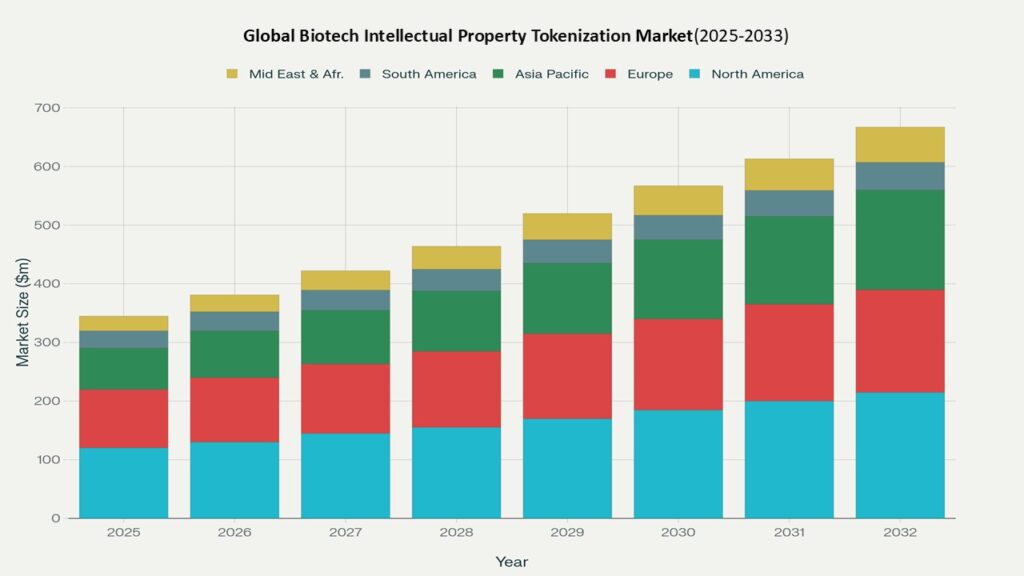

According to Phoenix’s Demand Forecast Engine, the global market is forecast to grow from USD 678.25 million in 2025 to approximately USD 2,913.9 million by 2033, exhibiting a CAGR of 20.1%. In 2024, North America accounted for the largest share (43.6%), while Asia Pacific is projected to be the fastest-growing region with a CAGR of 24.5% during the forecast period.

Key Drivers of Market Growth

- Demand for Transparent and Efficient IP Management

Tokenization enhances traceability and transactional efficiency in biotech IP markets, enabling seamless licensing and investment through secure blockchain frameworks. - Increased Liquidity via Fractional Ownership

By unlocking access to fractionalized IP assets, tokenization attracts diversified capital pools—accelerating funding for biotech R&D and early-stage innovations. - Automated Royalty Flows via Smart Contracts

Smart contracts streamline royalty payments and licensing revenues in real time, enhancing fairness and operational simplicity for IP holders and investors alike. - Strategic IP Portfolio Monetization

Tokenized biotech IP adds tangible value to startup balance sheets, bolstering investor confidence and enabling more robust commercialization strategies. - Regulatory Momentum and Institutional Onboarding

The rise of compliant tokenization platforms and clear legal frameworks—especially in APAC and Europe—is removing entry barriers and boosting institutional confidence. - Globalization of Biotech R&D and Innovation

With biotech innovation occurring across jurisdictions, tokenization facilitates international IP trading, collaboration, and risk diversification.

Market Segmentation

By Asset Type

• Patents

• Copyrights

• Trademarks

• Proprietary Biotechnology Data

By Tokenization Platform

• Permissioned (Private) Blockchains

• Permissionless (Public) Blockchains

• Hybrid Models

By Monetization Strategy

• Licensing

• Direct Sales

• Royalty Monetization

• Litigation Funding

By End-User

• Institutional Investors

• Biotech Firms

• Research Organizations

• Individual Investors

By Geography

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East & Africa

Region-Level Insights

North America – CAGR (2025–2033): 19.2%

• North America dominates the market, fueled by strong IP laws, early blockchain adoption, and institutional investment in biotech innovation. U.S.-based startups are leading the shift to IP-based digital securities.

Europe

• Regulatory harmonization under MiCA is driving compliant tokenization platforms in Germany, Switzerland, and the Netherlands. Cross-border biotech IP exchanges are gaining momentum among EU-based IP holders.

Asia Pacific – CAGR (2025–2033): 24.5% (Fastest Growing Region)

• The region is witnessing surging demand due to its fast-paced biotech ecosystem, government support for digital asset regulation, and expanding IP portfolios in China, India, and Singapore.

Latin America & Middle East

• Gradual adoption of tokenized IP platforms is underway, with growing government-backed biotech incubators and academic institutions exploring digital monetization avenues.

Leading Companies in the Market

Phoenix’s Event Detection Engine identifies top innovators driving the IP tokenization landscape:

- IntelliP – Facilitated over 5,000 biotech patent token trades in 2025, showing 200% YoY growth

• InvestaX – Regulated STO platform offering biotech IP token offerings

• IX Swap – Specializes in decentralized liquidity solutions for tokenized IP

• Securitize – A pioneer in regulatory-compliant digital securities and IP-backed asset issuance

• BlockchainX – Delivers customizable blockchain tokenization stacks for IP-driven startups

These players are investing in smart contract automation, regulatory integrations, and AI-driven valuation engines to reshape biotech IP markets.

Strategic Intelligence and AI-Backed Insights

- Phoenix Demand Forecast Engine models IP tokenization growth using proprietary data from biotech filings, IP transactions, and blockchain platform deployments.

• AI-powered Valuation Models enable real-time IP scoring, risk prediction, and monetization optimization.

• Sentiment Analyzer Tool reveals rising policy support for tokenization in Singapore, UAE, Switzerland, and key EU member states.

• Automated Porter’s Five Forces Modeling suggests increasing buyer power and reduced friction in IP licensing as secondary markets expand.

Forecast Snapshot: 2025–2033

| Metric | Value |

| 2025 Market Size | USD 678.25 Million |

| 2033 Market Size | ~USD 2,913.9 Million |

| CAGR (2025–2033) | 20.1% |

| Largest Region (2024) | North America (43.6%) |

| Fastest Growing Region | Asia Pacific (24.5% CAGR) |

| Top Segment | Patents (by Asset Type) |

| Key Trend | Smart Contracts for Royalties |

| Future Growth Focus | IP Tokenization for Startups |

Why the Global Market Remains Critical

- Biotech tokenization addresses long-standing liquidity barriers in early-stage innovation financing

• Global R&D demands interoperable IP monetization models, which blockchain-enabled platforms uniquely fulfill

• As tokenized IP becomes more standardized, investor trust is rising across both institutional and retail segments

• International frameworks support cross-border biotech partnerships—critical for tackling global health challenges and rare disease R&D

Final Takeaway

The Global Biotech Intellectual Property Tokenization Market is revolutionizing how biotech assets are owned, valued, and monetized. By enabling fractional trading, global access, and automated royalties, tokenization is breaking down legacy barriers in IP markets. Regulatory clarity, AI-backed due diligence, and platform innovation are paving the way for broader adoption and deeper liquidity.

At Phoenix Research, our AI-enabled market intelligence tools track patent flows, digital asset legislation, and tokenized asset exchanges—delivering insights that empower biotech stakeholders to lead confidently in this new digital IP economy.

Table of Contents

Global Biotech Intellectual Property (IP) Tokenization Market – Table of Contents

- Executive Summary & Market Overview

- 1.1 Introduction to Biotech IP Tokenization

- 1.2 Tokenization’s Role in Biotech Innovation Financing

- 1.3 Market Snapshot: Size, Growth Rate, and Forecast (2025–2033)

- 1.4 Key Drivers and Disruptive Trends

- 1.5 Phoenix Research Methodology & Toolset Overview (Forecast Engine, Event Detection, AI Valuation)

- Key Drivers of Market Growth

- 2.1 Demand for Transparent and Efficient IP Management

- 2.2 Increased Liquidity via Fractional Ownership

- 2.3 Automated Royalty Flows via Smart Contracts

- 2.4 Strategic IP Portfolio Monetization for Startups

- 2.5 Regulatory Momentum and Institutional Onboarding

- 2.6 Globalization of Biotech R&D and Innovation

- Market Segmentation

- 3.1 By Asset Type

- 3.1.1 Patents

- 3.1.2 Copyrights

- 3.1.3 Trademarks

- 3.1.4 Proprietary Biotechnology Data

- 3.2 By Tokenization Platform

- 3.2.1 Permissioned (Private) Blockchains

- 3.2.2 Permissionless (Public) Blockchains

- 3.2.3 Hybrid Models

- 3.3 By Monetization Strategy

- 3.3.1 Licensing

- 3.3.2 Direct Sales

- 3.3.3 Royalty Monetization

- 3.3.4 Litigation Funding

- 3.4 By End User

- 3.4.1 Institutional Investors

- 3.4.2 Biotech Firms

- 3.4.3 Research Organizations

- 3.4.4 Individual Investors

- 3.5 By Geography

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- Region-Level Insights

- 4.1 North America

- 4.1.1 Early Adoption by U.S. Startups

- 4.1.2 IP Law Strength and Blockchain Maturity

- 4.2 Europe

- 4.2.1 Impact of MiCA Regulation and IP Harmonization

- 4.2.2 Growth in Tokenized Patent Exchanges

- 4.3 Asia Pacific

- 4.3.1 Fastest Growing Region – CAGR 24.5%

- 4.3.2 IP Digitization in China, India, and Singapore

- 4.4 Latin America & Middle East

- 4.4.1 Incubator-Led Adoption and Academic Partnerships

- 4.4.2 Infrastructure Gaps and Policy Evolution

- Leading Companies in the Market

- 5.1 Competitive Landscape Overview

- 5.2 Innovation Profiles of Key Players

- 5.2.1 IntelliP

- 5.2.2 InvestaX

- 5.2.3 IX Swap

- 5.2.4 Securitize

- 5.2.5 BlockchainX

- 5.3 Smart Contract Capabilities and Compliance Readiness

- 5.4 Product Development, Patent Trades, and Ecosystem Expansion

- Strategic Intelligence and AI-Backed Insights

- 6.1 Phoenix Demand Forecast Engine: Market Growth Model

- 6.2 AI-Based IP Valuation and Risk Assessment Tools

- 6.3 Sentiment Analyzer Tool: Regulatory Support Mapping

- 6.4 Automated Porter’s Five Forces Analysis

- 6.4.1 Competitive Rivalry

- 6.4.2 Supplier Power

- 6.4.3 Buyer Power

- 6.4.4 Threat of New Entrants

- 6.4.5 Threat of Substitutes

- Forecast Snapshot: 2025–2033

| Metric | Value |

| 7.1 2025 Market Size | USD 678.25 Million |

| 7.2 2033 Market Size | USD 2,913.9 Million |

| 7.3 CAGR (2025–2033) | 20.1% |

| 7.4 Largest Region (2024) | North America (43.6%) |

| 7.5 Fastest Growing Region | Asia Pacific (24.5% CAGR) |

| 7.6 Top Segment | Patents (By Asset Type) |

| 7.7 Key Trend | Smart Contracts for Royalty Management |

| 7.8 Future Growth Focus | IP Tokenization for Startups |

- Why the Global Market Remains Critical

- 8.1 Solving Liquidity Challenges in Biotech Innovation

- 8.2 Enabling Interoperable and Scalable IP Commercialization

- 8.3 Rising Investor Confidence through Standardized Tokens

- 8.4 Driving Global R&D Collaboration for Rare Diseases and Public Health

- 8.5 Resilience Through Cross-Border and Multi-Jurisdictional Adoption

- Final Takeaway

- 9.1 Tokenization is Reshaping IP Value Chains

- 9.2 AI and Blockchain Unlock New Monetization Models

- 9.3 Compliance-Driven Growth to Attract Institutional Capital

- 9.4 Biotech Firms Must Adapt to the Digital IP Economy

- 9.5 Phoenix Tools Enable Strategic Foresight and Competitive Edge

- Appendices

- 10.1 Research Methodology

- 10.2 List of Data Sources and Models

- 10.3 Glossary of Key Terms

- 10.4 About Phoenix AI Intelligence Tools

10.5 Contact Information and Customization Support