Global Citric Acid Market Size and Share Analysis 2025-2033

Global Citric Acid Market Overview

The Global Citric Acid Market is vibrantly evolving as food, beverage, pharmaceutical, personal care, and cleaning industries increasingly prefer natural, clean-label, and multifunctional ingredients. Citric acid — used as an acidulant, flavor enhancer, preservative, chelating agent, and pH regulator — is emerging as a proven, reliable, and humanly responsible ingredient that helps manufacturers boost product stability, extend shelf life, and ensure sensory clarity.

This market is being energized by rising demand for bio-fermented citric acid, greener production processes, and innovations in low-impurity grades for high-value applications (pharmaceuticals, specialty cleaners). Producers are discovering worthwhile opportunities in chemical recycling feedstocks, circular fermentation models, and strain-optimized bioprocesses that instantly increase yield and lower carbon intensity—helping companies overcome supply volatility and succeed with sustainable ingredient strategies.

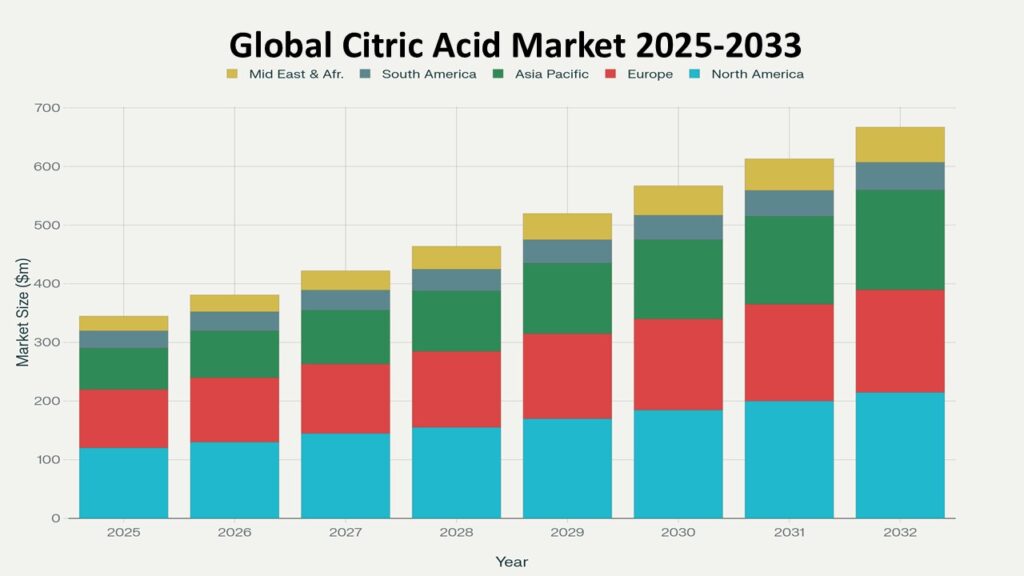

According to Phoenix’s Demand Forecast Engine, the Global Citric Acid Market size is estimated at USD 4.6 billion in 2025 and is projected to reach approximately USD 6.9 billion by 2033, reflecting a proven CAGR of 5.1% (2025–2033). Asia-Pacific currently leads in Global Citric Acid Market because of large manufacturing capacity and broad industrial use, while North America and Europe are focused on high-purity, non-GMO, and organic citric acid variants for premium food, pharma, and eco-cleaning applications.

The Global Citric Acid Market remains critical for food safety, formulation reliability, and sustainable ingredient sourcing—enabling brands and manufacturers to create effective, trusted, and consumer-friendly products worldwide.

Key Drivers of Global Citric Acid Market Growth

-

Food & Beverage Demand Recovery and Premiumization

Continued consumption of processed foods, ready-to-drink beverages, and premium functional beverages increases need for citric acid as an acidulant and natural preservative. -

Shift to Clean-Label and Bio-Fermented Ingredients

Growing consumer preference for non-GMO, plant-based, and transparent ingredient sourcing is energizing demand for bio-fermented and certified citric acid. -

Pharmaceutical & Personal Care Applications

Use in effervescent vitamins, oral care, topical formulations, and pH control in cosmetics creates reliable demand for high-purity grades. -

Eco-Friendly Cleaning & Industrial Uses

Citric acid’s chelating and descaling properties make it a preferred, biodegradable alternative in detergents, surface cleaners, and industrial water treatment. -

Technological Advances in Fermentation & Processing

AI-assisted fermentation optimization, robust microbial strains, and circular feedstock use (sugarcane molasses, corn syrup residues) increase yields and improve sustainability metrics. -

Regulatory & Sustainability Pressures

Tightening regulations on synthetic chelators and increased corporate ESG commitments push formulators toward citric acid and recycled content strategies.

Global Citric Acid Market Segmentation

By Form

-

Anhydrous Citric Acid

-

Liquid Citric Acid

By Application

-

Food & Beverages (acidulant, flavoring, preservative)

-

Pharmaceuticals (effervescents, stabilizers)

-

Personal Care & Cosmetics (pH control, chelation)

-

Detergents & Cleaners (descaling, chelating)

-

Industrial (textiles, metal finishing, water treatment)

-

Others

By Production Process

-

Fermentation (Microbial) — dominant, bio-based

-

Chemical Synthesis (limited, specialty niches)

By Region

-

Asia-Pacific

-

North America

-

Europe

-

Latin America

-

Middle East & Africa

Regional Insights of Global Citric Acid Market

Asia-Pacific – Largest Market

APAC leads in capacity and consumption, with China and India as major production hubs supplying global food processors, detergent manufacturers, and pharma formulators. Asia -Pacific leads the largest share of the Global Citric Acid Market.

North America

Focuses on specialty, non-GMO, and organic certified citric acid for premium food & beverage and pharmaceutical markets; also investing in localized production and supply redundancy.

Europe

Strong emphasis on green manufacturing, traceability, and circular feedstocks; brands demand certified and low-impurity citric acid aligned with EU regulations.

Latin America, Middle East & Africa

Emerging demand driven by rising processed food consumption, cleaning product adoption, and industrialization; opportunity for regional production and import substitution.

Leading Companies in the Global Citric Acid Market

Prominent players include:

-

Tate & Lyle PLC

-

Weifang Ensign Industry Co., Ltd.

-

RZBC Group Co., Ltd.

-

Citrique Belge NV

-

COFCO Biochemical (Anhui) Co., Ltd.

-

Gadot Biochemical Industries Ltd.

-

Shandong TTCA Co., Ltd.

These companies are investing in sustainable feedstocks, process digitization, and premium-grade production lines to ensure proven quality, traceability, and supply resilience.Cargill, Incorporated. is the most leading company in the Global Citric Acid Market

Strategic Intelligence and AI-Backed Insights

-

Phoenix Demand Forecast Engine models application-level demand, feedstock economics, and trade flows to identify supply gaps and premium opportunity pockets.

-

Sustainability Tracker highlights increasing adoption of bio-fermentation using agricultural by-products and the business case for carbon reduction.

-

Innovation Radar monitors developments in high-purity processing, continuous fermentation, and downstream concentration/evaporation efficiencies.

-

Porter’s Five Forces Analysis indicates moderate supplier concentration for specialized raw inputs, rising buyer power among global food brands, and high differentiation potential via certified / organic product lines.

Global Citric Acid Market Forecast Snapshot: 2025–2033

| Metric | Value |

|---|---|

| 2025 Market Size | USD 4.6 Billion |

| 2033 Market Size | ~USD 6.9 Billion |

| CAGR (2025–2033) | 5.1% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Top Application | Food & Beverages |

| Key Trend | Bio-fermented, non-GMO & high-purity citric acid |

| Future Focus | Circular feedstocks, localized production, and premium pharma grades |

Why the Global Citric Acid Market Remains Critical

-

Acts as a multi-functional, safe ingredient across food, pharma, and cleaning categories—critical for product stability and consumer trust.

-

Clean-label and sustainability imperatives are shifting formulators toward bio-based citric acid and traceable sourcing.

-

Technological improvements in fermentation and strain engineering ensure cost-effective scale-up and lower emissions.

-

Demand resilience from both consumer packaged goods and industrial sectors offers reliable long-term market fundamentals.

-

Regulatory and brand pressure to replace persistent chelators/harsh acids with biodegradable options increases citric acid’s strategic value.

Final Takeaway of Global Citric Acid Market

The Global Citric Acid Market is transforming into a sustainable, high-value ingredient sector where bio-fermentation, certified sourcing, and product purity define competitive advantage. Companies that invest in greener feedstocks, adopt AI-driven process optimization, and supply premium-grade citric acid will be well positioned to capture rising demand across food, pharma, and eco-cleaning segments.

At Phoenix Research, our AI-powered demand models and strategic intelligence equip stakeholders to discover market inflection points, plan resilient supply chains, and succeed responsibly in this evolving Global Citric Acid Market.

Table of Contents

1. Global Citric Acid Market Overview

2. Key Drivers of Global Citric Acid Market Growth

-

Food & Beverage Demand Recovery and Premiumization

-

Shift to Clean-Label and Bio-Fermented Ingredients

-

Pharmaceutical & Personal Care Applications

-

Eco-Friendly Cleaning & Industrial Uses

-

Technological Advances in Fermentation & Processing

-

Regulatory & Sustainability Pressures

3. Global Citric Acid Market Segmentation

-

By Form

-

Anhydrous Citric Acid

-

Liquid Citric Acid

-

-

By Application

-

Food & Beverages

-

Pharmaceuticals

-

Personal Care & Cosmetics

-

Detergents & Cleaners

-

Industrial Uses

-

Others

-

-

By Production Process

-

Fermentation (Microbial)

-

Chemical Synthesis

-

-

By Region

-

Asia-Pacific

-

North America

-

Europe

-

Latin America

-

Middle East & Africa

-

4. Regional Insights of Global Citric Acid Market

-

Asia-Pacific – Largest Market

-

North America – High-Purity and Organic Focus

-

Europe – Green Manufacturing & Traceability

-

Latin America, Middle East & Africa – Emerging Demand

5. Leading Companies in the Global Citric Acid Market

-

Cargill, Incorporated

-

Archer Daniels Midland Company (ADM)

-

Jungbunzlauer Suisse AG

-

Tate & Lyle PLC

-

Weifang Ensign Industry Co., Ltd.

-

RZBC Group Co., Ltd.

-

Citrique Belge NV

-

COFCO Biochemical (Anhui) Co., Ltd.

-

Gadot Biochemical Industries Ltd.

-

Shandong TTCA Co., Ltd.

6. Strategic Intelligence and Technology Trends

-

AI-Driven Demand Forecasting & Fermentation Optimization

-

Bio-Fermentation Using Agricultural By-Products

-

High-Purity Processing & Continuous Fermentation

-

Circular Feedstocks & Sustainability Tracking

-

Porter’s Five Forces and Competitive Landscape

7. Global Citric Acid Market Forecast Snapshot (2025–2033)

-

2025 Market Size: USD 4.6 Billion

-

2033 Market Size: ~USD 6.9 Billion

-

CAGR (2025–2033): 5.1%

-

Largest Region: Asia-Pacific

-

Fastest Growing Region: North America

-

Top Application: Food & Beverages

-

Key Trend: Bio-Fermented, Non-GMO & High-Purity Citric Acid

-

Future Focus: Circular Feedstocks & Premium Pharma Grades

8. Why the Global Citric Acid Market Remains Critical

-

Multifunctional Role Across Industries

-

Shift Toward Clean-Label, Sustainable Ingredients

-

Technological Improvements in Fermentation

-

Resilient Multi-Sector Demand

-

Rising Substitution of Harsh Chemicals