Global Cocoa Powder Market Report 2026-2033

Global Cocoa Powder Market Forecast Snapshot: 2026–2033

| Metric | Value |

|---|---|

| 2025 Market Size | USD 24.6 Billion |

| 2033 Market Size | ~USD 36.8 Billion |

| CAGR (2026–2033) | ~5.2% |

| Largest Region | Europe |

| Fastest Growing Region | Asia-Pacific |

| Top Segment | Natural Cocoa Powder |

| Key Trend | Clean-Label Formulations, Premium Chocolate Applications & Functional Antioxidant Positioning |

| Future Focus | Sustainable Sourcing, Traceability Technology & High-Flavanol Cocoa Innovation |

Global Cocoa Powder Market Overview

The Global Cocoa Powder Market is witnessing steady expansion, supported by rising demand across bakery, confectionery, dairy, beverages, and functional food applications. Cocoa powder remains a foundational ingredient within the global chocolate and dessert ecosystem, while also gaining traction in health-oriented formulations due to its natural antioxidant and flavanol content.

According to Phoenix Research, the Global Cocoa Powder Market is valued at USD 24.6 billion in 2025 and is projected to reach approximately USD 36.8 billion by 2033, registering a CAGR of ~5.2% (2026–2033). Market growth is driven by premium chocolate consumption, expanding bakery production, rising demand for cocoa-based beverages, and increasing adoption of clean-label and sustainably sourced ingredients.

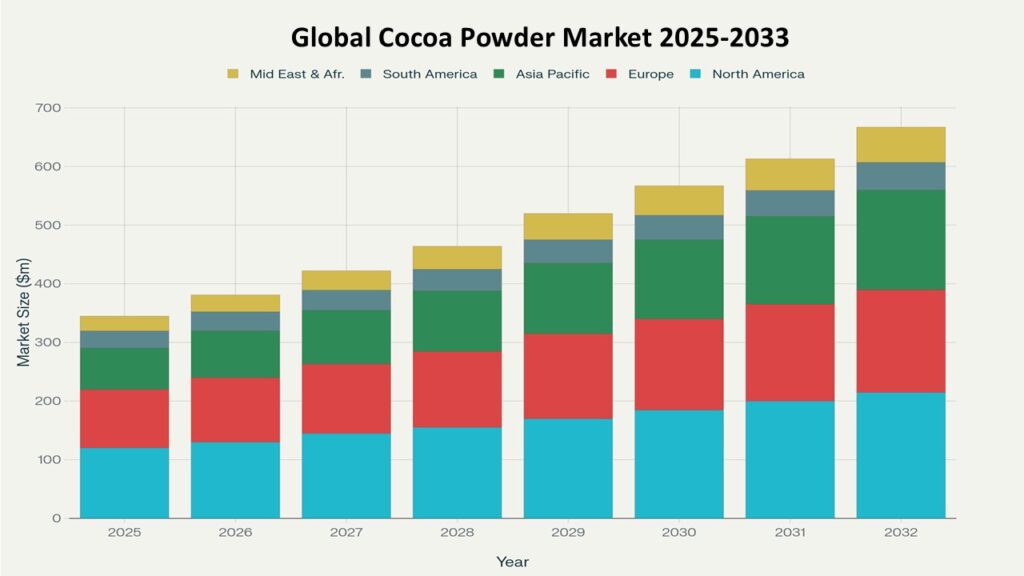

Europe leads the market due to strong chocolate manufacturing heritage and high per-capita cocoa consumption. Asia-Pacific is the fastest-growing region, fueled by urbanization, rising disposable incomes, westernized dietary trends, and expanding processed food industries.

The Post-2025 outlook emphasizes ethical cocoa sourcing, blockchain-enabled traceability, high-flavanol functional cocoa, and sustainable farming partnerships as key growth accelerators.

Key Drivers of Global Cocoa Powder Market Growth

1. Rising Demand from Chocolate & Confectionery Industry

Cocoa powder remains a core raw material in chocolate production, bakery items, desserts, and confectionery fillings. Premium and artisanal chocolate growth significantly supports value expansion.

2. Expansion of Bakery & Processed Food Sector

Global growth in packaged bakery products, cakes, biscuits, ready-to-mix desserts, and snack bars continues to strengthen industrial cocoa powder demand.

3. Increasing Popularity of Cocoa-Based Beverages

Hot cocoa, flavored milk, protein shakes, and RTD chocolate beverages are expanding globally, particularly among younger consumers and urban households.

4. Health & Functional Ingredient Positioning

Cocoa powder’s natural antioxidant and flavanol properties are gaining recognition for cardiovascular and cognitive health benefits, driving demand in functional food and nutraceutical segments.

5. Sustainable & Ethical Sourcing Initiatives

Growing consumer awareness regarding fair trade, farmer welfare, and environmental sustainability is accelerating adoption of certified cocoa (Rainforest Alliance, Fairtrade, Organic).

Global Cocoa Powder Market Segmentation

1. By Product Type

1.1 Natural Cocoa Powder

1.1.1 Regular Fat Content

1.1.1.1 10–12% Cocoa Butter Content

1.1.1.2 Standard Industrial Grade

1.1.1.3 Retail Baking Packs

1.1.1.4 Beverage-Grade Cocoa

1.1.2 Low-Fat Cocoa Powder

1.1.2.1 8–10% Cocoa Butter Content

1.1.2.2 Diet & Low-Calorie Applications

1.1.2.3 Instant Mix Formulations

1.1.2.4 Nutritional Blends

1.1.3 High-Fat Cocoa Powder

1.1.3.1 20–22% Cocoa Butter Content

1.1.3.2 Premium Confectionery Grade

1.1.3.3 Artisan Chocolate Applications

1.1.3.4 Luxury Dessert Formulations

1.1.4 High-Flavanol Cocoa Powder

1.1.4.1 Functional Beverage Grade

1.1.4.2 Nutraceutical Ingredient Grade

1.1.4.3 Cardiovascular Health Formulations

1.1.4.4 Cognitive Support Blends

1.2 Alkalized (Dutch-Processed) Cocoa Powder

1.2.1 Light Alkalized

1.2.1.1 Mild Flavor Profile

1.2.1.2 Light Brown Color Grade

1.2.1.3 Bakery Applications

1.2.1.4 Dairy Beverage Applications

1.2.2 Medium Alkalized

1.2.2.1 Balanced Flavor Grade

1.2.2.2 Standard Confectionery Use

1.2.2.3 Ice Cream Formulations

1.2.2.4 Syrup & Topping Applications

1.2.3 Heavy Alkalized

1.2.3.1 Dark Brown Cocoa

1.2.3.2 Intense Flavor Grade

1.2.3.3 Premium Chocolate Fillings

1.2.3.4 Gourmet Baking Applications

1.2.4 Black Cocoa Powder

1.2.4.1 Ultra-Dark Color Grade

1.2.4.2 Sandwich Cookie Applications

1.2.4.3 Decorative Baking Use

1.2.4.4 Specialty Dessert Products

1.3 Specialty & Organic Cocoa Powder

1.3.1 Organic Certified

1.3.1.1 USDA Organic Certified

1.3.1.2 EU Organic Certified

1.3.1.3 Clean-Label Retail Packs

1.3.1.4 Organic Beverage Mixes

1.3.2 Fairtrade Certified

1.3.2.1 Farmer Cooperative Sourced

1.3.2.2 Ethical Sourcing Programs

1.3.2.3 Premium Ethical Chocolate Use

1.3.2.4 Social Impact Brands

1.3.3 Single-Origin Cocoa

1.3.3.1 Ghana-Origin Cocoa

1.3.3.2 Ivory Coast-Origin Cocoa

1.3.3.3 Ecuador-Origin Cocoa

1.3.3.4 Peru-Origin Cocoa

1.3.4 Clean-Label Formulations

1.3.4.1 Non-GMO Certified

1.3.4.2 Preservative-Free Cocoa

1.3.4.3 Additive-Free Blends

1.3.4.4 Natural Flavor Retention Grade

2. By Application

2.1 Chocolate & Confectionery

2.1.1 Dark Chocolate

2.1.1.1 50–70% Cocoa Content

2.1.1.2 70–85% Premium Dark

2.1.1.3 High-Flavanol Functional Dark

2.1.1.4 Artisan Chocolate Bars

2.1.2 Milk Chocolate

2.1.2.1 Standard Milk Chocolate

2.1.2.2 Creamy Dairy Blends

2.1.2.3 Flavored Milk Chocolate

2.1.2.4 Compound Milk Coatings

2.1.3 Filled Chocolates

2.1.3.1 Truffles

2.1.3.2 Cream-Filled Centers

2.1.3.3 Nut-Filled Chocolates

2.1.3.4 Liqueur-Filled Variants

2.1.4 Compound Chocolate Coatings

2.1.4.1 Bakery Coatings

2.1.4.2 Ice Cream Shell Coatings

2.1.4.3 Snack Bar Coatings

2.1.4.4 Decorative Drizzles

2.2 Bakery Products

2.2.1 Cakes & Pastries

2.2.1.1 Layer Cakes

2.2.1.2 Chocolate Muffins

2.2.1.3 Swiss Rolls

2.2.1.4 Chocolate Tarts

2.2.2 Cookies & Biscuits

2.2.2.1 Chocolate Chip Cookies

2.2.2.2 Sandwich Biscuits

2.2.2.3 Chocolate Wafers

2.2.2.4 Brownie Cookies

2.2.3 Brownies

2.2.3.1 Fudge Brownies

2.2.3.2 Low-Sugar Brownies

2.2.3.3 Protein Brownies

2.2.3.4 Premium Gourmet Brownies

2.2.4 Ready-to-Mix Baking Products

2.2.4.1 Cake Mixes

2.2.4.2 Brownie Mixes

2.2.4.3 Pancake & Waffle Mixes

2.2.4.4 Instant Dessert Mixes

2.3 Beverages

2.3.1 Hot Chocolate

2.3.1.1 Classic Cocoa Mix

2.3.1.2 Premium Dark Cocoa Drink

2.3.1.3 Low-Sugar Hot Chocolate

2.3.1.4 Instant Sachet Packs

2.3.2 RTD Chocolate Drinks

2.3.2.1 Chocolate Milk

2.3.2.2 Plant-Based Chocolate Drinks

2.3.2.3 Protein-Enriched RTD

2.3.2.4 Kids’ Nutritional Drinks

2.3.3 Protein & Nutrition Shakes

2.3.3.1 Whey Protein Cocoa Blend

2.3.3.2 Vegan Protein Cocoa Blend

2.3.3.3 Sports Recovery Drinks

2.3.3.4 Meal Replacement Shakes

2.3.4 Flavored Dairy Beverages

2.3.4.1 Chocolate Yogurt Drinks

2.3.4.2 Fortified Dairy Drinks

2.3.4.3 Chocolate Smoothies

2.3.4.4 Functional Dairy Blends

3. By Distribution Channel

3.1 B2B / Industrial Supply

3.1.1 Chocolate Manufacturers

3.1.1.1 Multinational Confectionery Firms

3.1.1.2 Regional Chocolate Producers

3.1.1.3 Private Label Manufacturers

3.1.1.4 Artisan Chocolate Makers

3.1.2 Bakery Manufacturers

3.1.2.1 Industrial Bakeries

3.1.2.2 Packaged Snack Producers

3.1.2.3 Frozen Dessert Manufacturers

3.1.2.4 Ready-to-Mix Producers

3.1.3 Beverage Companies

3.1.3.1 Dairy Beverage Brands

3.1.3.2 RTD Manufacturers

3.1.3.3 Sports Nutrition Brands

3.1.3.4 Functional Drink Producers

3.1.4 Food Ingredient Suppliers

3.1.4.1 Ingredient Distributors

3.1.4.2 Bulk Cocoa Traders

3.1.4.3 Exporters

3.1.4.4 Private Label Ingredient Suppliers

3.2 Retail / Off-Trade

3.2.1 Supermarkets & Hypermarkets

3.2.1.1 Branded Retail Packs

3.2.1.2 Private Label Cocoa

3.2.1.3 Premium Baking Cocoa

3.2.1.4 Promotional Multipacks

3.2.2 Specialty Food Stores

3.2.2.1 Gourmet Ingredient Stores

3.2.2.2 Artisan Baking Shops

3.2.2.3 Imported Cocoa Retailers

3.2.2.4 Health-Focused Stores

3.2.3 Organic Retail Chains

3.2.3.1 Certified Organic Cocoa

3.2.3.2 Fairtrade Retail Packs

3.2.3.3 Clean-Label Cocoa

3.2.3.4 High-Flavanol Wellness Cocoa

3.2.4 Online Grocery Platforms

3.2.4.1 E-Commerce Marketplaces

3.2.4.2 Brand-Owned Websites

3.2.4.3 Subscription Baking Supplies

3.2.4.4 Bulk Purchase Platforms

4. By Region

4.1 Europe

4.2 North America

4.3 Asia-Pacific

4.4 Latin America

4.5 Middle East & Africa

Leading Companies in the Global Cocoa Powder Market

Barry Callebaut AG

Cargill, Incorporated

Olam Food Ingredients (OFI)

Blommer Chocolate Company

Touton S.A.

Ecom Agroindustrial Corp.

JB Foods Limited

Moner Cocoa, S.A.

Barry Callebaut AG remains one of the largest global players in the cocoa powder market due to its vertically integrated supply chain, extensive processing capabilities, and strong partnerships with global chocolate manufacturers. The company operates across premium and industrial segments, maintaining significant international market presence and sustainability leadership initiatives.

Regional Insights of the Global Cocoa Powder Market

Europe – Largest Market

Europe continues to dominate the cocoa powder market, driven by strong chocolate production capacity, premium confectionery demand, and established bakery industries. Germany, Belgium, Switzerland, and France remain key contributors.

Asia-Pacific – Fastest Growing Market

Asia-Pacific is witnessing accelerated growth due to expanding middle-class populations, westernized dietary adoption, and rising consumption of chocolate-based snacks and beverages across China, India, Japan, and Southeast Asia.

North America

North America demonstrates steady growth supported by functional beverage innovation, premium dessert demand, and rising interest in clean-label baking ingredients.

Latin America

As a major cocoa-producing region, Latin America benefits from both export-oriented processing and growing domestic chocolate consumption, particularly in Brazil and Mexico.

Middle East & Africa

Growth in this region is supported by rising urbanization, expanding retail infrastructure, and increasing demand for premium imported chocolate and dessert products.

Why the Global Cocoa Powder Market Remains Critical

-

Essential raw material within the global chocolate, bakery, and confectionery supply chain.

-

Strong integration across multiple food and beverage categories ensures diversified demand streams.

-

Rising premium chocolate consumption enhances value growth and margin expansion.

-

Functional antioxidant positioning supports entry into nutraceutical and wellness markets.

-

Sustainability and traceability initiatives reinforce long-term supply chain resilience.

-

Expanding emerging market consumption strengthens global volume stability.

Strategic Intelligence & AI-Driven Insights

Phoenix Demand Forecast Engine

Predicts sustained growth driven by premium chocolate expansion and Asia-Pacific volume acceleration through 2033.

Supply Chain & Sourcing Intelligence Tracker

Monitors cocoa bean origin risks, weather volatility, geopolitical exposure, and sustainability certification penetration.

Consumer Trend Analyzer

Identifies rising preference for dark chocolate, high-cocoa content products, and functional antioxidant positioning.

Pricing & Commodity Volatility Dashboard

AI-enabled analytics track cocoa futures, price fluctuations, and margin optimization strategies across manufacturers.

ESG & Traceability Intelligence Framework

Evaluates sustainability commitments, farmer partnership programs, and blockchain-based cocoa traceability systems.

Final Takeaway of the Global Cocoa Powder Market

The Global Cocoa Powder Market is transitioning toward a premium-driven, sustainability-focused, and functionally positioned ingredient ecosystem. The projected CAGR of ~5.2% (2026–2033) reflects stable expansion supported by chocolate industry growth, bakery innovation, and rising functional food integration.

Future competitive advantage will be secured by companies investing in ethical sourcing partnerships, high-flavanol product innovation, AI-driven supply chain optimization, and diversified regional processing capacity.

At Phoenix Research, our advanced forecasting frameworks deliver comprehensive Cocoa Powder Market revenue projections, competitive benchmarking, and AI-backed strategic intelligence — enabling stakeholders to navigate the Post-2025 global food ingredient landscape with data-driven precision and long-term value creation

1. Executive Summary

1.1 Market Snapshot (2026–2033)

1.2 Key Growth Highlights

1.3 Largest & Fastest Growing Regions

1.4 Dominant & Emerging Segments

1.5 Strategic Opportunity Areas

2. Global Cocoa Powder Market Overview

2.1 Definition & Product Scope

2.2 Evolution of the Cocoa Processing Industry

2.3 Cocoa Value Chain Analysis (Farm to Finished Ingredient)

2.4 Business Models (Industrial Supply, Ingredient Specialists, Private Label, Premium Cocoa Brands)

2.5 Pricing & Commodity Volatility Analysis

2.6 Regulatory Landscape & Certification Standards

3. Market Forecast Snapshot (2026–2033)

3.1 2025 Market Size: USD 24.6 Billion

3.2 2033 Market Size: ~USD 36.8 Billion

3.3 CAGR (2026–2033): ~5.2%

3.4 Largest Region: Europe

3.5 Fastest Growing Region: Asia-Pacific

3.6 Top Segment: Natural Cocoa Powder

3.7 Key Trend: Clean-Label Formulations & Premium Chocolate Applications

3.8 Future Focus: Sustainable Sourcing, Traceability Technology & High-Flavanol Innovation

4. Market Dynamics

4.1 Key Growth Drivers

4.2 Market Restraints

4.3 Emerging Opportunities

4.4 Industry Challenges

4.5 Impact of Macroeconomic & Commodity Price Factors

5. Market Segmentation by Product Type (USD Billion), 2026–2033

5.1 Natural Cocoa Powder

5.1.1 Regular Fat Content

5.1.1.1 10–12% Cocoa Butter Content

5.1.1.2 Industrial Processing Grade

5.1.1.3 Retail Baking Grade

5.1.1.4 Beverage-Grade Cocoa

5.1.2 Low-Fat Cocoa Powder

5.1.2.1 8–10% Cocoa Butter Content

5.1.2.2 Diet & Low-Calorie Applications

5.1.2.3 Instant Beverage Mixes

5.1.2.4 Nutritional & Protein Blends

5.1.3 High-Fat Cocoa Powder

5.1.3.1 20–22% Cocoa Butter Content

5.1.3.2 Premium Confectionery Use

5.1.3.3 Artisan Chocolate Applications

5.1.3.4 Luxury Dessert Formulations

5.1.4 High-Flavanol Cocoa Powder

5.1.4.1 Functional Beverage Grade

5.1.4.2 Nutraceutical Ingredient Grade

5.1.4.3 Cardiovascular Health Applications

5.1.4.4 Cognitive Support Formulations

5.2 Alkalized (Dutch-Processed) Cocoa Powder

5.2.1 Light Alkalized

5.2.1.1 Mild Flavor Profile

5.2.1.2 Light Brown Color Grade

5.2.1.3 Bakery Applications

5.2.1.4 Dairy Beverage Applications

5.2.2 Medium Alkalized

5.2.2.1 Balanced Flavor Grade

5.2.2.2 Confectionery Use

5.2.2.3 Ice Cream Formulations

5.2.2.4 Syrup & Topping Applications

5.2.3 Heavy Alkalized

5.2.3.1 Dark Brown Cocoa

5.2.3.2 Intense Flavor Profile

5.2.3.3 Premium Chocolate Fillings

5.2.3.4 Gourmet Baking

5.2.4 Black Cocoa Powder

5.2.4.1 Ultra-Dark Grade

5.2.4.2 Sandwich Cookies

5.2.4.3 Decorative Baking

5.2.4.4 Specialty Dessert Products

5.3 Specialty & Certified Cocoa Powder

5.3.1 Organic Certified

5.3.1.1 USDA Organic

5.3.1.2 EU Organic

5.3.1.3 Clean-Label Retail Packs

5.3.1.4 Organic Beverage Mixes

5.3.2 Fairtrade Certified

5.3.2.1 Cooperative Sourcing

5.3.2.2 Ethical Supply Programs

5.3.2.3 Premium Chocolate Use

5.3.2.4 Social Impact Brands

5.3.3 Single-Origin Cocoa

5.3.3.1 Ghana-Origin

5.3.3.2 Ivory Coast-Origin

5.3.3.3 Ecuador-Origin

5.3.3.4 Peru-Origin

5.3.4 Clean-Label & Non-GMO Formulations

5.3.4.1 Non-GMO Certified

5.3.4.2 Preservative-Free

5.3.4.3 Additive-Free Blends

5.3.4.4 Natural Flavor Retention Grade

6. Market Segmentation by Application (USD Billion), 2026–2033

6.1 Chocolate & Confectionery

6.1.1 Dark Chocolate

6.1.1.1 50–70% Cocoa

6.1.1.2 70–85% Premium Dark

6.1.1.3 High-Flavanol Functional Dark

6.1.1.4 Artisan Bars

6.1.2 Milk Chocolate

6.1.2.1 Standard Milk Chocolate

6.1.2.2 Creamy Dairy Blends

6.1.2.3 Flavored Milk Chocolate

6.1.2.4 Compound Coatings

6.1.3 Filled Chocolates

6.1.3.1 Truffles

6.1.3.2 Cream-Filled

6.1.3.3 Nut-Filled

6.1.3.4 Liqueur-Filled

6.1.4 Compound Chocolate Coatings

6.1.4.1 Bakery Coatings

6.1.4.2 Ice Cream Shells

6.1.4.3 Snack Bar Coatings

6.1.4.4 Decorative Drizzles

6.2 Bakery Products

6.2.1 Cakes & Pastries

6.2.2 Cookies & Biscuits

6.2.3 Brownies

6.2.4 Ready-to-Mix Baking Products

6.3 Beverages

6.3.1 Hot Chocolate

6.3.2 RTD Chocolate Drinks

6.3.3 Protein & Nutrition Shakes

6.3.4 Flavored Dairy Beverages

7. Market Segmentation by Distribution Channel (USD Billion), 2026–2033

7.1 B2B / Industrial Supply

7.1.1 Chocolate Manufacturers

7.1.2 Bakery Manufacturers

7.1.3 Beverage Companies

7.1.4 Food Ingredient Suppliers

7.2 Retail / Off-Trade

7.2.1 Supermarkets & Hypermarkets

7.2.2 Specialty Food Stores

7.2.3 Organic Retail Chains

7.2.4 Online Grocery Platforms

8. Market Segmentation by Region (USD Billion), 2026–2033

8.1 Europe

8.2 North America

8.3 Asia-Pacific

8.4 Latin America

8.5 Middle East & Africa

9. Regional Insights

9.1 Europe – Chocolate Manufacturing Leadership

9.2 Asia-Pacific – Rapid Consumption Growth

9.3 North America – Functional & Premium Demand

9.4 Latin America – Production & Export Strength

9.5 Middle East & Africa – Emerging Premiumization

10. Competitive Landscape

10.1 Market Share Analysis

10.2 Competitive Positioning Matrix

10.3 Mergers & Acquisitions

10.4 Product Innovation & Sustainability Initiatives

11. Company Profiles

11.1 Barry Callebaut AG

11.2 Cargill, Incorporated

11.3 Olam Food Ingredients (OFI)

11.4 Blommer Chocolate Company

11.5 Touton S.A.

11.6 Ecom Agroindustrial Corp.

11.7 JB Foods Limited

11.8 Moner Cocoa, S.A.

12. Strategic Intelligence & AI-Backed Insights

12.1 AI-Based Demand Forecast Modeling (Phoenix Engine)

12.2 Commodity Price Volatility Analytics

12.3 ESG & Sustainability Intelligence

12.4 Porter’s Five Forces Analysis

12.5 Investment & Expansion Strategy Outlook

13. Why the Global Cocoa Powder Market Remains Critical

13.1 Core Ingredient in Global Chocolate Ecosystem

13.2 Multi-Category Food & Beverage Integration

13.3 Premiumization & Margin Expansion

13.4 Functional Antioxidant Positioning

13.5 Sustainable Sourcing & Traceability Advantage

14. Appendix

15. About Us

16. Disclaimer