Global Dairy Market share and size analysis 2025-2033

Global Dairy Market Overview

The Global Dairy Market is vibrantly transforming as consumer demand shifts toward functional dairy, value-added dairy ingredients, and sustainable dairy production models. Traditional fluid milk and commodity dairy remain foundational, but the market is being energized by dairy protein isolates, lactose-reduced products, fortified milk drinks, probiotic yogurts, and premium cheese and butter varieties that empower health, convenience, and culinary innovation.

This market is being energized by supply-chain modernization, precision herd management, and plant-forward hybrid formulations that help producers increase yield, reduce emissions, and meet consumer expectations for traceability and animal welfare. Companies are discovering worthwhile opportunities in cold-chain expansion, dairy ingredient exports, and dairy-based nutritional solutions for infants, athletes, and aging populations—helping manufacturers overcome price volatility and succeed with resilient, diversified product portfolios.

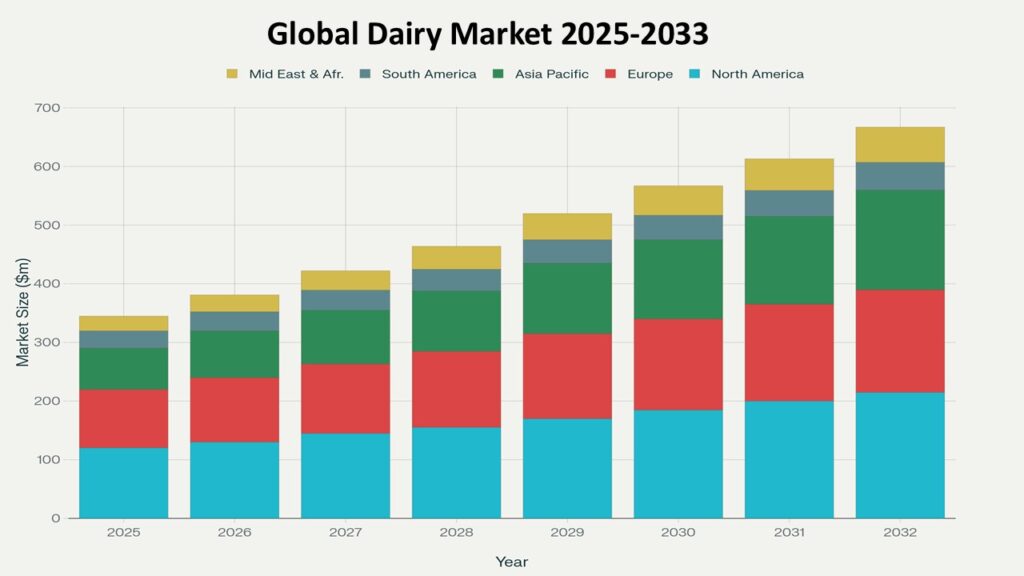

According to Phoenix’s Demand Forecast Engine, the Global Dairy Market size is estimated at USD 600.0 billion in 2025 and is projected to reach approximately USD 820.0 billion by 2033, reflecting a CAGR of ~4.0% (2025–2033). Asia-Pacific currently leads the Global Dairy Market due to rising per-capita consumption, expanding cold-chain infrastructure, and growing dairy processing capacity, while North America and Europe focus on premiumization, high-protein dairy, and sustainability certainties.

The Global Dairy Market remains central to global nutrition, food security, and rural livelihoods—enabling food manufacturers, retailers, and ingredient suppliers to create effective, trusted, and consumer-oriented dairy solutions worldwide.

Key Drivers of Global Dairy Market Growth

-

Rising Demand for Protein & Functional Foods

Consumers seeking muscle health, weight management, and immune support are boosting demand for whey protein isolates, caseinates, and fortified milk beverages. -

Premiumization & Flavor Innovation

Growth in artisanal cheeses, specialty butters, lactose-free milks, and flavored dairy beverages is energizing higher-margin segments. -

Cold-Chain & E-commerce Expansion

Improved refrigerated logistics and online grocery platforms instantly increase accessibility for fresh and chilled dairy products. -

Sustainability & Responsible Sourcing

Investment in methane mitigation, regenerative grazing, and low-carbon dairy processing ensures market trust and regulatory alignment. -

Technological Advances in Dairy Processing

Membrane filtration, enzyme technologies, and automation improve yield, reduce waste, and increase ingredient quality. -

Population Growth & Urbanization in Emerging Economies

Urban consumers in Asia-Pacific and Africa are discovering higher dairy intake patterns—driving volume growth and new product launches.

Global Dairy Market Segmentation

By Product

-

Fluid Milk (UHT, Pasteurized, Flavored)

-

Cheese (Cheddar, Mozzarella, Specialty Cheeses)

-

Yogurt & Fermented Dairy (Greek, Probiotic, Drinkable)

-

Butter & Spreads

-

Milk Powder (Whole & Skimmed)

-

Dairy Ingredients (Whey Protein, Casein, Lactose)

-

Ice Cream & Frozen Desserts

By Formulation / Value-Add

-

Conventional Dairy

-

Fortified/Functional Dairy (Protein-enriched, Vitamin-fortified)

-

Lactose-Free / Reduced-Lactose Products

-

Organic & Grass-Fed Dairy

-

Plant-Hybrid Dairy (dairy + plant blends)

By Distribution Channel

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Foodservice & HORECA

-

E-commerce & Direct-to-Consumer

-

Institutional Supply

By Region

-

Asia-Pacific

-

North America

-

Europe

-

Latin America

-

Middle East & Africa

Regional Insights

Asia-Pacific — Largest & Rapidly Modernizing Market

Asia-Pacific leads consumption and production growth driven by China, India, and ASEAN nations. Rising middle classes, better refrigeration, and expanding dairy processing create both volume and premium opportunities.

North America — Premiumization & Ingredient Demand

U.S. and Canada focus on high-protein dairy, lactose-free trends, and dairy ingredients for sports nutrition. Efficiency gains and consolidation among processors are notable.

Europe — Sustainability & Specialty Cheese Leadership

Europe emphasizes PDO cheeses, sustainable dairy farming practices, and premium fermented dairy backed by strong regulatory frameworks.

Latin America — Growing Processing & Export Potential

Brazil, Argentina, and Chile expand milk powder and cheese exports while domestic consumption rises with urbanization.

Middle East & Africa — Import Reliant but Fast-Growing

Many markets rely on imports of milk powder and dairy ingredients, but local processing capacity and chilled retail growth are accelerating.

Leading Companies in the Global Dairy Market

-

Fonterra Co-operative Group

-

Arla Foods

-

Dairy Farmers of America (DFA)

-

Yili Group

-

Mengniu Dairy

-

Amul (Gujarat Co-operative Milk Marketing Federation)

-

Saputo Inc.

These players are investing in sustainable sourcing, dairy ingredient innovation, and cold-chain expansion to create resilient supply chains and differentiated product portfolios. Nestlé S.A. leads with broad nutrition and dairy portfolios across global markets.

Strategic Intelligence and AI-Backed Insights

-

Phoenix Demand Forecast Engine models demand by urbanization, per-capita dairy consumption, and protein trend indices to identify growth corridors.

-

Innovation Tracker highlights rising R&D in microfiltration, precision fermentation (dairy proteins), and zero-waste processing.

-

Sustainability & Carbon Analyzer flags cost-effective methane reduction, feed optimization, and renewable energy integration as high impact.

-

Porter’s Five Forces indicates moderate supplier power (milk collection variability), rising buyer influence (retail consolidation), and strong potential for product innovation to reduce price sensitivity.

Global Dairy Market Forecast Snapshot: 2025–2033

| Metric | Value |

|---|---|

| 2025 Market Size | USD 600.0 Billion |

| 2033 Market Size | ~USD 820.0 Billion |

| CAGR (2025–2033) | ~4.0% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Top Segment | Dairy Ingredients & Cheese |

| Key Trend | Protein Fortification & Sustainable Dairy Farming |

| Future Focus | Cold-Chain, Ingredient Exports, and Regenerative Dairy Systems |

Why the Global Dairy Market Remains Critical

-

Primary source of animal-based nutrition globally—essential for childhood growth, maternal nutrition, and clinical feeding.

-

Dairy ingredients (whey, casein) underpin sports nutrition, infant formula, and processed foods, creating high-value trade flows.

-

Rural livelihoods and millions of smallholder farmers depend on dairy value chains for income and food security.

-

Innovation in low-carbon dairy and regenerative grazing is key to meeting climate goals while maintaining supply.

-

Cold-chain and distribution resilience are vital to reduce waste, ensure safety, and support expanding urban demand.

Final Takeaway Of Global Dairy Market

The Global Dairy Market is a resilient, evolving industry balancing tradition with rapid innovation. Companies that boost sustainability, invest in dairy ingredient innovation, and expand cold-chain capabilities will succeed in capturing both mass value and premium segments. With nutrition, rural livelihoods, and industrial uses intertwined, dairy remains a strategic food sector for economic stability and public health.

At Phoenix Research, our AI-powered forecasting and market intelligence help stakeholders learn quickly, identify profitable niches (e.g., high-protein ingredients, lactose-free, organic dairy), and act confidently to grow in this essential global market.

Overview

Key Drivers of Market Growth

Rising Demand for Protein & Functional Foods

Premiumization & Flavor Innovation

Cold-Chain & E-commerce Expansion

Sustainability & Responsible Sourcing

Technological Advancements in Dairy Processing

Population Growth & Urbanization in Emerging Economies

Market Segmentation

By Product

• Fluid Milk (UHT, Pasteurized, Flavored)

• Cheese (Cheddar, Mozzarella, Specialty Cheeses)

• Yogurt & Fermented Dairy (Greek, Probiotic, Drinkable)

• Butter & Spreads

• Milk Powder (Whole & Skimmed)

• Dairy Ingredients (Whey Protein, Casein, Lactose)

• Ice Cream & Frozen Desserts

By Formulation / Value-Add

• Conventional Dairy

• Fortified/Functional Dairy (Protein-enriched, Vitamin-fortified)

• Lactose-Free / Reduced-Lactose Products

• Organic & Grass-Fed Dairy

• Plant-Hybrid Dairy (Dairy + Plant Blends)

By Distribution Channel

• Supermarkets & Hypermarkets

• Convenience Stores

• Foodservice & HORECA

• E-commerce & Direct-to-Consumer

• Institutional Supply

By Region

• Asia-Pacific

• North America

• Europe

• Latin America

• Middle East & Africa

Region-Level Insights

Asia-Pacific – Largest & Fastest Growing

North America – Premium & Functional Dairy Focus

Europe – Sustainable & Specialty Cheese Leadership

Latin America – Processing & Export Expansion

Middle East & Africa – Import-Reliant but Developing

Leading Companies in the Market

Nestlé S.A.

Danone S.A.

Lactalis Group

Fonterra Co-operative Group

Arla Foods

Dairy Farmers of America (DFA)

Yili Group

Mengniu Dairy

Amul (GCMMF)

Saputo Inc.

Strategic Intelligence and AI-Backed Insights

Phoenix Demand Forecast Engine

Innovation Tracker

Sustainability & Carbon Analyzer

Porter’s Five Forces Analysis

Forecast Snapshot: 2025–2033

2025 Market Size: USD 600.0 Billion

2033 Market Size: ~USD 820.0 Billion

CAGR (2025–2033): ~4.0%

Largest Region: Asia-Pacific

Fastest Growing Region: Asia-Pacific

Top Segment: Dairy Ingredients & Cheese

Key Trend: Protein Fortification & Sustainable Dairy Farming

Future Focus: Cold-Chain Expansion & Regenerative Dairy Systems

Why the Market Remains Critical

Essential Source of Global Nutrition

Supports Rural Livelihoods & Food Security

Drives Innovation in Low-Carbon & Regenerative Dairy

Enables High-Protein, Functional, and Sustainable Diets

Cold-Chain Resilience Strengthens Global Supply

Final Takeaway