Global Data Center Construction Market Size and Share Analysis 2025-2033

Global Data Center Construction Market Overview

The Global Data Center Construction Market is experiencing a remarkable expansion, driven by the increasing demand for digital infrastructure to support cloud computing, AI/ML workloads, high-speed connectivity, and data localization requirements. Modern data center projects now include hyperscale campuses, colocation hubs, edge facilities, and modular/prefabricated sites designed for high-density computation

"The Global Data Center Construction Market size is undergoing a major change, driven by the growing demand for AI training clusters, GPU-intensive workloads, and low-latency user experiences. This shift is leading to a new era of data center design, characterized by higher power densities, advanced cooling systems - think liquid cooling and immersion cooling, microgrid integration, and sustainability-focused designs that minimize environmental impact."

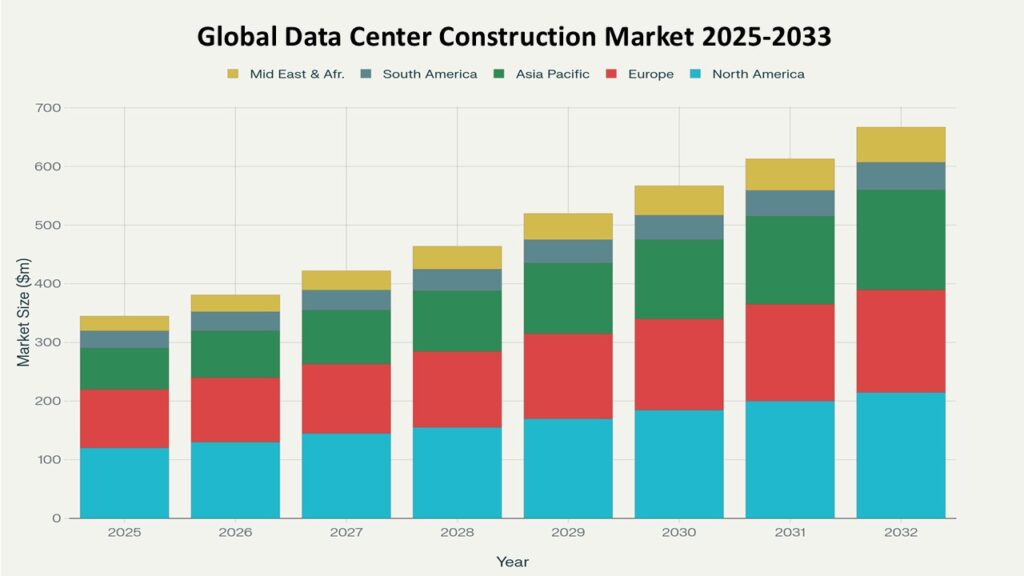

According to Phoenix Demand Forecast Engine, the Global Data Center Construction Market size is estimated at USD 118.4 billion in 2025 and is projected to reach approximately USD 212.7 billion by 2033, growing at a strong CAGR of ~7.6% (2025–2033). In 2024, North America accounted for the largest share, supported by hyperscaler capex, robust cloud adoption, and widespread availability of power and fiber networks. Meanwhile, the Asia-Pacific region remains the fastest-growing market, driven by rising cloud penetration, rapid digitalization, and large-scale data localization initiatives in India, China, Japan, and Southeast Asia.

The Global Data Center Construction Market is witnessing a surge in demand, driven by AI-driven workloads that are dominating new facility designs. As enterprises accelerate their migration to hybrid cloud and edge architectures, the market is poised for significant growth. Key factors shaping the next phase of global build-outs include power availability, sustainability mandates, and the adoption of modular construction techniques, enabling faster, more efficient, and scalable data center deployments.

Key Drivers of the Global Data Center Construction Market Growth

1. AI/ML & High-Density Workload Expansion

"The growth of AI training clusters and high-performance computing (HPC) workloads is driving a surge in demand for data center facilities equipped with higher rack densities, advanced liquid cooling systems, upgraded substations, and robust power distribution architectures, fueling significant expansion in the Global Data Center Construction Market."

2. Hyperscaler & Cloud Provider Investments

Tech giants are driving growth through the expansion of multi-region campuses, edge clusters, and sustainable hyperscale facilities, boosting massive global construction pipelines and shaping the future of digital infrastructure worldwide

3. Edge Computing & 5G Integration

The increasing adoption of IoT, autonomous systems, and low-latency applications is driving the rapid deployment of edge micro-data centers in urban and industrial areas, enabling faster data processing and improved real-time decision-making.

4. Sustainability & Energy Efficiency Mandates

Governments, ESG policies, and corporate net-zero commitments are driving the rapid growth of sustainable practices in data centers, including renewable energy sourcing, heat reuse systems, advanced cooling technologies, and low-PUE architecture, to reduce environmental impact and achieve energy efficiency.

5. Modular & Prefabricated Construction

Factory-built, standardized modules are driving the rapid growth of efficient data center deployments, reducing time-to-market, enhancing scalability, and lowering labor costs, making them ideal for edge deployments and colocation expansions.

6. Data Sovereignty, Security & Compliance Needs

Regulatory pressure is prompting the construction of regional facilities to ensure secure and compliant data storage, particularly in highly regulated sectors like finance, healthcare, government, and telecom, where data sovereignty and security are paramount.

7. Surging Power & Connectivity Requirements

To support the growing demand for data storage and processing, modern high-density data centers now require robust infrastructure, including high-capacity substations, dual-grid redundancy, fiber backbones, and energy storage systems, to ensure reliable and efficient operations.

Global Data Center Construction Market Segmentation

By Facility Type

-

Hyperscale Data Centers

-

Colocation Data Centers

-

Enterprise/On-Premises Data Centers

-

Edge & Micro Data Centers

-

Modular/Prefabricated Data Centers

By Component

-

Electrical Infrastructure (substations, UPS, switchgear)

-

Mechanical Systems (cooling, HVAC, liquid cooling)

-

IT/Network Infrastructure

-

Civil & Structural Construction

-

Security & Monitoring Systems

-

Commissioning Services

By Construction Model

-

Design-Build

-

Design-Bid-Build

-

EPC (Engineering, Procurement, Construction)

-

Modular/Prefabricated

By End User

-

Hyperscalers (AWS, Azure, Google Cloud, Meta)

-

Colocation Providers

-

Telecom Operators

-

Enterprises (BFSI, Healthcare, Retail, Government)

-

Research & HPC Institutions

By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

Regional Insights of the Global Data Center Construction Market

North America – Market Leader

North America dominates due to hyperscale expansion, strong fiber networks, power availability, and robust demand for AI infrastructure. The U.S. continues to lead in large multi-building AI-ready campuses. North America leads the largest share of the Global Data Center Construction Market.

Europe – Sustainability-Focused Expansions

Europe emphasizes energy efficiency, carbon-neutral construction, heat-reuse integration, and regulatory compliance. Nordic countries attract large-scale builds due to abundant renewable energy.

Asia-Pacific – Fastest Growing Market

APAC growth is fueled by cloud adoption, 5G networks, digital transformation initiatives, rising urbanization, and government-driven data localization laws. India and Southeast Asia are experiencing hyperscale booms.

Latin America – Colocation & Cloud Momentum

Brazil and Mexico lead new construction activity, supported by telecom expansion, rising demand for local cloud infrastructure, and improving energy access.

Middle East & Africa – Digital-Sovereign Infrastructure Push

GCC nations (Saudi Arabia, UAE, Qatar) and South Africa drive growth with investments in sovereign cloud, hyperscale campuses, and AI-aligned digital infrastructure.

Leading Companies in the Global Data Center Construction Market

-

Turner Construction

-

DPR Construction

-

Black & Veatch

-

Arup

-

Skanska

-

Schneider Electric

-

ABB

-

Eaton

-

Digital Realty

-

Equinix

-

CyrusOne / QTS

These players compete on engineering capability, time-to-delivery, sustainability expertise, modular construction capabilities, and access to electrical/mechanical equipment. Hyperscalers represent the strongest buyer segment with significant pricing and design influence.

The largest company in the Global Data Center Construction Market is NTT Global Data Centers.

Strategic Intelligence and AI-Backed Insights

Phoenix Demand Forecast Engine

Modeled construction demand using AI workload growth rates, cloud migration curves, regional power availability, substation timelines, and rack-density progression across hyperscale and colocation facilities.

Construction Activity Mapping System

Identified major hyperscale campus expansions in North America and Europe, rapid edge facility deployment across APAC and LATAM, and increased investment in modular/prefabricated manufacturing capacity.

Sentiment Analyzer Tool

Indicates rising enterprise and regulator focus on sustainability, uptime reliability, renewable energy integration, and data sovereignty—shaping design, site selection, and vendor qualification.

Automated Porter’s Five Forces Analysis

Shows moderate supplier power for electrical/mechanical contractors and specialized systems (immersion cooling, UPS, transformers), high buyer power from hyperscalers, and substantial entry barriers due to capital intensity and technical complexity.

Global Data Center Construction Market Forecast Snapshot: 2025–2033

| Metric | Value |

|---|---|

| 2025 Market Size | USD 118.4 Billion |

| 2033 Market Size | ~USD 212.7 Billion |

| CAGR (2025–2033) | 7.6% |

| Largest Market | North America |

| Fastest Growing Region | Asia-Pacific |

| Major Segment | Hyperscale & Modular Builds |

| Key Trend | Liquid cooling, sustainability, modularization |

| Future Growth Focus | AI-ready facilities, microgrids, edge expansion |

Why the Global Data Center Construction Market Remains Critical

-

Supports cloud computing, AI training, and digital services powering global economies

-

Enables low-latency, secure data storage essential for enterprise operations

-

Drives technological innovation in energy systems, cooling, and modular design

-

Strengthens national digital sovereignty through localized data infrastructure

-

Acts as a foundation for 5G/6G networks, IoT ecosystems, fintech, and smart cities

Final Takeaway of the Global Data Center Construction Market

The Global Data Center Construction Market is entering a high-growth phase driven by AI workloads, hyperscaler expansions, and the global digital economy’s rising data demands. The next decade will be defined by sustainable architecture, liquid cooling adoption, grid-integrated infrastructure, and the rise of modular and edge facilities across emerging markets.

According to Phoenix Demand Forecast Engine, growth through 2033 will be accelerated by AI-driven computational requirements, regulatory-driven data localization, and massive cloud expansion from hyperscalers and telecom providers. At Phoenix Research, our market intelligence supports developers, EPCs, technology providers, and investors in identifying optimal build locations, supply-chain risks, and growth-ready construction models across global markets.

Table of Contents

1. Global Conversational AI Market Overview

2. Key Drivers of Global Conversational AI Market Growth

-

Growing demand for automated and personalized customer interactions.

-

Breakthroughs in Generative AI, LLMs, and agentic AI systems.

-

Rising usage across enterprises for customer service, sales, and operations.

-

Increasing adoption of smart speakers, wearables, and voice-enabled devices.

-

Significant cost reduction and improved workforce productivity through automation.

3. Global Conversational AI Market Segmentation

By Component

-

Solutions: Chatbots, Voice Assistants, IVR Systems, AI Agent Platforms, Multimodal Assistants

-

Services: Consulting, Integration & Deployment, Training & Support

By Technology

-

NLP

-

Machine Learning & Deep Learning

-

Automatic Speech Recognition (ASR)

-

Text-to-Speech (TTS)

-

Speech Analytics

-

Sentiment & Emotion AI

-

Large Language Models (LLMs)

By Deployment Mode

-

Cloud

-

On-Premise

By Application

-

Customer Support & Helpdesk

-

Virtual Assistants

-

Sales & Marketing Automation

-

HR & Recruitment Bots

-

Healthcare Assistants

-

Banking & Insurance Bots

-

Smart Home & Automotive Assistants

-

Retail & E-commerce Chatbots

-

IT Service Management

-

Travel & Hospitality Automation

By End-User Industry

-

BFSI

-

Retail & E-commerce

-

Healthcare

-

Telecom

-

Automotive

-

Manufacturing

-

Government & Public Sector

-

Education

By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

4. Regional Insights of the Global Conversational AI Market

-

North America: Largest market with strong enterprise AI adoption.

-

Europe: Regulatory-driven growth with focus on responsible AI.

-

Asia-Pacific: Fastest-growing region due to digitalization and mobile-first economies.

-

Latin America: Expanding usage in BFSI, telecom, and customer support.

-

Middle East & Africa: Accelerating digital transformation across government & enterprises.

5. Leading Companies in the Global Conversational AI Market

Google LLC | Microsoft | AWS | IBM | OpenAI | Meta | NVIDIA | Oracle | SAP | SoundHound AI | Kore.ai | LivePerson | Nuance | Yellow.ai | Cognigy

Leading Company: Google LLC

6. Strategic Intelligence & AI-Backed Insights

-

Strong growth in healthcare triage, smart banking, and enterprise automation.

-

Rising adoption of multimodal assistants, voice cloning, sentiment AI, and autonomous agents.

-

Cost optimization through AI-driven CX and back-office automation.

-

Porter’s Five Forces: High market growth; competitive intensity increasing.

7. Global Conversational AI Market Forecast Snapshot: 2025–2033

-

2025: USD 17.9 Billion

-

2033: ~USD 59.3 Billion

-

CAGR: 16.5%

-

Largest Market: North America

-

Fastest Growing: Asia-Pacific

-

Top Application: Customer Support & Virtual Assistance

-

Key Trend: Generative AI, Autonomous Agents

-

Future Focus: Enterprise Automation, Multimodal AI, Secure Agentic Systems

8. Why the Global Conversational AI Market Is Critical

-

Strengthens automation for enterprises across sectors.

-

Boosts customer experience with personalized engagement.

-

Reduces operational costs at scale.

-

Enables hyper-personalized, real-time interactions.

-

Foundation for next-generation AI agent ecosystems.

9. Final Takeaway of the Global Conversational AI Market