Global Digital Banking Market Size And Share Analysis 2025-2033

Global Digital Banking Market Overview

The Global Digital Banking Market is undergoing a vibrant transformation, driven by rapid technological innovation, increasing smartphone penetration, and a global shift toward cashless, instant, and secure financial ecosystems. Banks and fintech companies are discovering new ways to boost customer experience, overcome legacy system challenges, and transform traditional banking into seamless, user-centric digital journeys.

The Global Digital Banking market is instantly benefiting from innovations such as AI-driven personalization, blockchain security, open banking frameworks, and cloud-native platforms, which enhance reliability, confidentiality, and operational efficiency. Increasing adoption of mobile wallets, digital lending platforms, and wealth management apps is quickly expanding the reach of financial services to previously underserved populations, empowering individuals and small businesses to manage finances more effectively.

According to Phoenix Research’s Demand Forecast Engine, the Global Digital Banking market size is estimated at USD 21.4 billion in 2025 and is expected to reach approximately USD 48.9 billion by 2033, growing at a CAGR of 10.9%. Banks are quickly learning to convert challenges into opportunities, creating worthwhile, excellent solutions that boost trust, transform operations, and deliver enhanced value. Meanwhile, consumers are discovering faster, safer, and more efficient ways to manage their finances, making digital banking a definitively reliable and transformative choice in today’s financial ecosystem.

Key Drivers of Global Digital Banking Market Growth

1. Rising Smartphone & Internet Penetration

Affordable smartphones and mobile data quickly increase access to digital banking platforms, enabling users to instantly manage accounts and payments.

2. Shift Toward Cashless Transactions

The move to contactless, secure payments boosts convenience, helping financial institutions overcome operational limitations and succeed effectively.

3. AI, Big Data & Blockchain Integration

AI-powered analytics, chatbots, and blockchain ensure confidentiality, efficiency, and reliability, transforming the customer experience.

4. Regulatory Support & Open Banking

APIs and open banking frameworks empower users, allowing banks to discover growth opportunities and succeed immediately.

5. Financial Inclusion

Digital platforms are overcoming infrastructure gaps, providing worthwhile access to unbanked populations through micro-loans, eKYC, and mobile wallets.

Global Digital Banking Market Segmentation

By Type

-

Retail Digital Banking

-

Corporate Digital Banking

-

Investment Digital Banking

By Service

-

Payments & Transfers

-

Loans & Savings

-

Wealth Management

-

Customer Support & Advisory

By Technology

-

AI & Machine Learning

-

Blockchain

-

Cloud Computing

-

Open Banking Platforms

By Deployment

-

On-Premise

-

Cloud-Based

By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

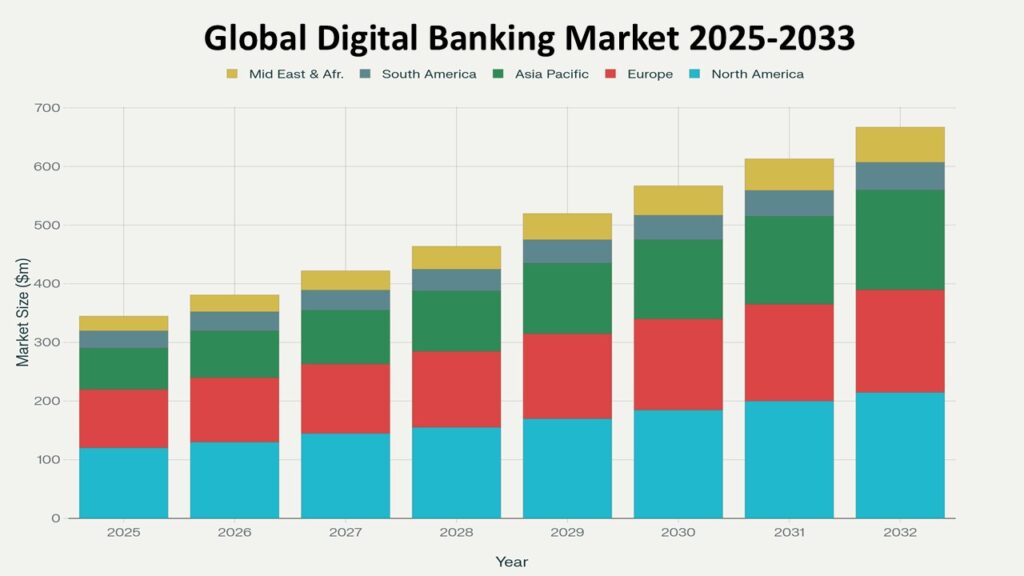

Global Digital Banking Market Regional Insights

Asia-Pacific – Fastest Growing Region (CAGR 12.4%)

The region is vibrantly expanding, with India, China, and Southeast Asia leading adoption. Emerging fintech players are quickly learning, overcoming infrastructure challenges, and boosting digital financial inclusion.

North America

Advanced technology adoption ensures effective, reliable, and secure banking, allowing institutions to succeed confidently.

Europe

Open banking and regulatory frameworks empower users, enhancing confidentiality, transparency, and excellent customer experiences.

Latin America & Middle East/Africa

Mobile-first strategies and low-cost fintech innovations instantly provide opportunities, allowing local banks to discover new growth avenues.

Leading Companies of Global Digital Banking Market

-

Banco Santander S.A.

-

BBVA

-

Barclays

-

Revolut Ltd.

-

N26 GmbH

-

PayPal Holdings Inc.

-

Monzo Bank Ltd.

These companies are investing in AI, cloud solutions, and cybersecurity to boost efficiency, reliability, and customer satisfaction, while transforming the global digital banking landscape.

Why the Global Digital Banking Market Remains Critical

Instant Access: Users can quickly manage funds, boosting financial inclusion and convenience.

Efficiency & Innovation: AI and blockchain transform operations, helping banks overcome challenges and succeed effectively.

Confidential & Secure: Cybersecurity ensures reliable, trustworthy transactions.

Regulatory Support: Open banking and digital policies empower users, helping banks discover growth opportunities.

Customer-Centric Solutions: Mobile wallets and personalized services empower users and make banking worthwhile and excellent.

Emerging Markets: Asia-Pacific, Latin America, and Africa instantly offer growth, allowing banks to transform traditional banking.

Global Digital Banking Market Forecast Snapshot (2025–2033)

| Metric | Value |

|---|---|

| 2025 Market Size | USD 21.4 Billion |

| 2033 Market Size | USD 48.9 Billion |

| CAGR (2025–2033) | 10.9% |

| Largest Region (2024) | North America (~34%) |

| Fastest Growing Region | Asia-Pacific (12.4% CAGR) |

| Top Segment | Retail Digital Banking |

| Key Trend | AI, Blockchain & Cloud Convergence |

Strategic Intelligence and AI-Backed Insights

Phoenix Research integrates artificial intelligence, predictive analytics, and data-driven modeling to deliver unmatched insights into the global digital banking landscape. Our proprietary Demand Forecast Engine analyzes macroeconomic indicators, consumer adoption trends, and fintech innovation metrics to generate reliable, forward-looking intelligence.

These AI-backed insights help banks, fintech startups, and investors identify growth opportunities, evaluate competitive positioning, and forecast financial performance with higher accuracy. From regulatory dynamics to emerging digital ecosystems, Phoenix Research provides actionable intelligence that helps organizations make confident, data-supported strategic decisions in this dynamic, evolving market.

Final Takeaway of Global Digital Banking Market

The Global Digital Banking Market is transforming financial services worldwide, driven by rapid adoption of AI, cloud computing, blockchain, and advanced analytics. Institutions that discover innovative solutions, boost operational efficiency, overcome legacy system challenges, and deliver reliable, secure, and excellent customer experiences are poised to succeed immediately.

This Global Digital Banking Market is being energized by digital-first consumer expectations, regulatory reforms, and fintech innovations, creating worthwhile opportunities for banks, payment providers, and financial technology companies to create scalable, trusted, and humanly responsible financial ecosystems. Companies that learn, adapt, and implement proven strategies can instantly enhance service delivery, reduce operational risks, and expand their competitive advantage in a rapidly evolving landscape.

At Phoenix Research, our AI-driven forecasting tools and strategic insights help stakeholders convert data into actionable decisions, identify emerging trends immediately, and succeed confidently in this dynamic, high-growth Global Digital Banking Market, ensuring long-term growth, resilience, and sustained customer satisfaction.

-

Market Overview

-

Key Drivers of Market Growth

2.1 Rising Smartphone & Internet Penetration

2.2 Shift Toward Cashless Transactions

2.3 AI, Big Data & Blockchain Integration

2.4 Regulatory Support & Open Banking

2.5 Financial Inclusion -

Market Segmentation

3.1 By Type

• Retail Digital Banking

• Corporate Digital Banking

• Investment Digital Banking3.2 By Service

• Payments & Transfers

• Loans & Savings

• Wealth Management

• Customer Support & Advisory3.3 By Technology

• AI & Machine Learning

• Blockchain

• Cloud Computing

• Open Banking Platforms3.4 By Deployment

• On-Premise

• Cloud-Based3.5 By Region

• North America

• Europe

• Asia-Pacific

• Latin America

• Middle East & Africa -

Region-Level Insights

4.1 Asia-Pacific – Fastest Growing Region (CAGR 12.4%)

4.2 North America – Mature, Technology-Driven Market

4.3 Europe – Open Banking & Regulatory Leadership

4.4 Latin America & Middle East/Africa – Mobile-First Growth Opportunities -

Leading Companies in the Global Digital Banking Market

5.1 JPMorgan Chase & Co.

5.2 HSBC Holdings Plc

5.3 Citigroup Inc.

5.4 Banco Santander S.A.

5.5 BBVA

5.6 Barclays

5.7 Revolut Ltd.

5.8 N26 GmbH

5.9 PayPal Holdings Inc.

5.10 Monzo Bank Ltd. -

Strategic Intelligence and AI-Backed Insights

6.1 Phoenix Demand Forecast Engine

6.2 Consumer & Market Sentiment Analyzer

6.3 Technology Adoption & Innovation Tracking

6.4 Porter’s Five Forces Analysis -

Forecast Snapshot (2025–2033)

7.1 Market Size (2025 & 2033)

7.2 CAGR (2025–2033)

7.3 Largest & Fastest Growing Regions

7.4 Top Segment

7.5 Key Trend -

Why the Global Digital Banking Market Remains Critical

8.1 Instant Access & Convenience

8.2 Efficiency & Innovation

8.3 Confidential & Secure Transactions

8.4 Regulatory Support & Open Banking

8.5 Customer-Centric Solutions

8.6 Emerging Market Opportunities -

Final Takeaway