Global Eco-Friendly Medical Device Packaging Market 2025-2033

The Global Eco-Friendly Medical Device Packaging Market is experiencing strong growth as regulatory mandates, environmental consciousness, and sustainable procurement policies reshape packaging priorities in healthcare. Manufacturers are replacing conventional plastic-heavy packaging with recyclable monomaterials, biodegradable polymers, and post-consumer recycled materials. This transformation is driven by the dual need to maintain sterility and minimize environmental footprint—both now seen as essential to compliance and competitive advantage.

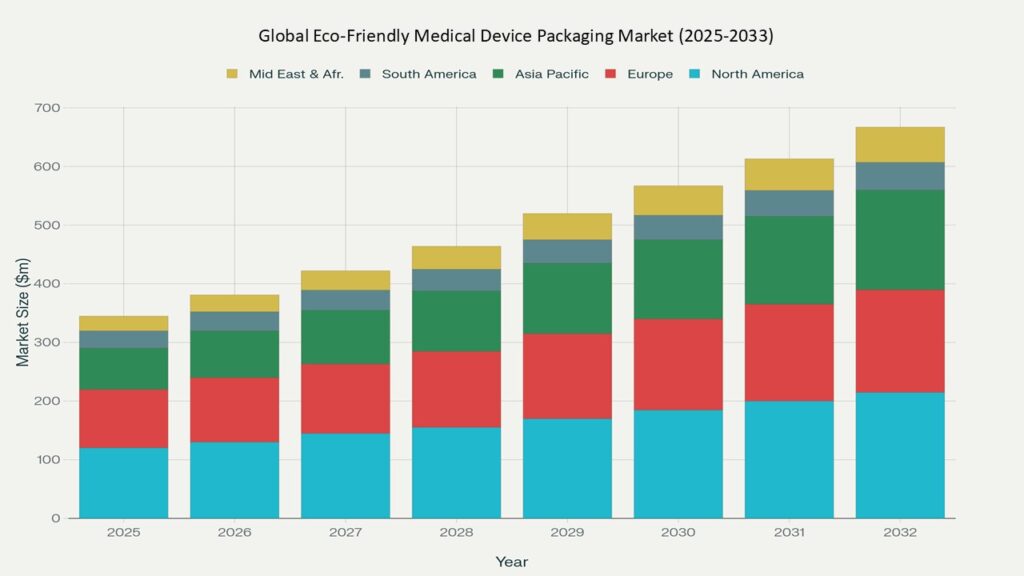

According to Phoenix’s Demand Forecast Engine, the global market is projected to grow from USD 8,765.9 million in 2025 to approximately USD 19,260.4 million by 2033, registering a CAGR of 10.3%. In 2024, North America held the largest market share (39.1%), while Asia Pacific is poised to be the fastest-growing region, with a CAGR of 12.7% during the forecast period.

Global Eco-Friendly Medical Device Packaging Market

Global Eco-Friendly Medical Device Packaging Market

Key Drivers of Market Growth

- Regulatory Mandates and Global Packaging Standards

Regulatory bodies such as the FDA, EU MDR, and ISO are enforcing stricter guidelines that prioritize sustainable packaging in medical device production. Phoenix’s Sentiment Analyzer Tool reflects a 38% year-over-year increase in institutional policies targeting packaging waste reduction. - Surge in Green Procurement Across Hospitals and OEMs

Hospitals and procurement teams are actively seeking eco-certified packaging suppliers, pushing manufacturers to shift toward low-impact and recyclable solutions. - Technology-Enabled Material Innovation

New barrier technologies, biodegradable polymers, and recyclable high-performance films are meeting sterility requirements while enabling lower carbon footprints. - Boom in Wearable and Home-Care Medical Devices

Demand for compact, lightweight, and durable packaging for home and wearable devices is encouraging innovation in form factors and protective features. - Growth in E-Commerce and Last-Mile Distribution

As direct-to-consumer (D2C) delivery of medical devices increases, packaging must meet both sustainability and transit durability standards. - Expansion in Emerging Markets

Governments and private manufacturers in Asia Pacific and Latin America are investing in green healthcare infrastructure and local packaging capabilities, fostering region-specific eco-packaging growth.

Market Segmentation

By Material Type

• Plastics (recyclable, bio-based, biodegradable)

• Paper & Paperboard (fastest-growing)

• Glass

• Metal

By Process

• Recyclable Packaging (largest segment)

• Biodegradable Packaging (fastest-growing)

• Reusable Packaging

By Packaging Type

• Primary Packaging (largest share due to sterility needs)

• Secondary Packaging (growing due to branding and compliance focus)

By End-User

• Medical Equipment

• Diagnostic Devices (e.g., IVD kits)

• Surgical Instruments & Medical Tools

By Geography

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East & Africa

Region-Level Insights

North America – CAGR (2025–2033): 9.8%

• The region leads in adoption, driven by robust regulatory oversight and strong OEM commitment to sustainability. Major companies are retrofitting existing lines to accommodate recyclable and low-emission materials.

Europe

• A pioneer in packaging circularity, Europe is home to multiple zero-waste hospital initiatives. Countries like Germany, France, and the UK are leading EU-aligned eco-packaging policy implementation.

Asia Pacific – CAGR (2025–2033): 12.7% (Fastest Growing Region)

• Rapid expansion of medical device manufacturing in China, India, and Southeast Asia, combined with government mandates for green packaging and growing export compliance needs, is fueling demand.

Latin America & Middle East/Africa

• Emerging adoption is visible in urban centers and public healthcare networks, with Brazil and UAE spearheading regulatory adoption and pilot programs for sustainable procurement.

Leading Companies in the Market

Phoenix’s Event Detection Engine highlights key market players investing in innovation and ESG-integrated packaging:

- Amcor plc – Leader in recyclable sterile barrier systems and bio-based film development

• DuPont – Offers Tyvek® sustainable packaging platforms balancing sterility and environmental safety

• Steripack – Focuses on custom-designed, sustainable medical packaging with ISO 11607 compliance

• Wipak Walothen GmbH – Specializes in recyclable high-barrier films tailored for diagnostics and instruments

• Berry Global – Innovator in PCR-based and industrial compostable packaging for healthcare applications

• Ecovative – Emerging provider of mycelium-based and biodegradable packaging for lab diagnostics

OEMs like Philips, Siemens Healthineers, and Medtronic are actively incorporating sustainable materials into their packaging lines and supply chain policies.

Strategic Intelligence and AI-Backed Insights

- Phoenix Demand Forecast Engine utilizes real-time procurement and regulatory datasets to model future eco-packaging requirements across product types.

• AI-enhanced Design Optimization Tools identify right-size packaging configurations that reduce material use without compromising integrity.

• Construction Activity Mapping System shows increasing green packaging adoption in medical device clusters across Malaysia, Poland, and Costa Rica.

• Sentiment Analyzer Tool reveals rising patient and hospital administrator preference for visible sustainability labeling in healthcare packaging.

Forecast Snapshot: 2025–2033

| Metric | Value |

| 2025 Market Size | USD 8,765.9 Million |

| 2033 Market Size | ~USD 19,260.4 Million |

| CAGR (2025–2033) | 10.3% |

| Largest Region (2024) | North America (39.1%) |

| Fastest Growing Region | Asia Pacific (12.7% CAGR) |

| Top Segment | Recyclable Packaging |

| Key Trend | Bio-based Monomaterial Films |

| Future Growth Focus | Low-footprint eCommerce-ready formats |

Why the Global Market Remains Critical

- A sustainable future for healthcare is impossible without reducing packaging waste—eco-friendly solutions are now a strategic imperative.

• Global medical device logistics networks demand harmonized, durable, and compliant packaging systems.

• Circular economy goals in the EU, U.S., and APAC are directly linked to packaging reform.

• Brand reputation, investor ESG mandates, and consumer awareness are reshaping procurement criteria across public and private sectors.

Final Takeaway

The Eco-Friendly Medical Device Packaging Market is evolving into a cornerstone of sustainable healthcare logistics. As recyclability, biodegradability, and design optimization become non-negotiable, stakeholders must adopt smarter, AI-informed, and regulation-compliant solutions. Investment in innovation, strategic materials partnerships, and predictive compliance tools will determine long-term leadership in this high-impact market. Global adoption—especially in Asia-Pacific and Latin America—is driving the next wave of opportunity for packaging players aligned with both performance and planet.

Table of Contents

Overview

1.1 Introduction to Eco-Friendly Medical Device Packaging

1.2 Evolution of Packaging in Healthcare Logistics

1.3 Market Snapshot: Size, CAGR, and Global Share (2025–2033)

1.4 Key Trends Reshaping the Market

1.5 AI-Enabled Packaging Innovation: Designing for the Future

1.6 Phoenix Research Methodology & Tool Integration Summary

Key Drivers of Market Growth

2.1 Regulatory Mandates and Global Packaging Standards

2.2 Surge in Green Procurement Across Hospitals and OEMs

2.3 Technology-Enabled Material Innovation

2.4 Boom in Wearable and Home-Care Medical Devices

2.5 Growth in E-Commerce and Last-Mile Distribution

2.6 Expansion in Emerging Markets

Market Segmentation

3.1 By Material Type

• 3.1.1 Plastics (Recyclable, Bio-Based, Biodegradable)

• 3.1.2 Paper & Paperboard

• 3.1.3 Glass

• 3.1.4 Metal

3.2 By Process

• 3.2.1 Recyclable Packaging

• 3.2.2 Biodegradable Packaging

• 3.2.3 Reusable Packaging

3.3 By Packaging Type

• 3.3.1 Primary Packaging

• 3.3.2 Secondary Packaging

3.4 By End User

• 3.4.1 Medical Equipment

• 3.4.2 Diagnostic Devices

• 3.4.3 Surgical Instruments & Medical Tools

Region-Level Insights

4.1 North America

• 4.1.1 Market Share and Growth Trends

• 4.1.2 Regulatory Landscape and OEM Sustainability Strategies

4.2 Europe

• 4.2.1 Circular Economy and Zero-Waste Hospital Initiatives

• 4.2.2 Country-Level Policy Implementation (Germany, France, UK)

4.3 Asia Pacific

• 4.3.1 Fastest Growing Region

• 4.3.2 Regional Manufacturing Growth and Green Mandates

4.4 Latin America

• 4.4.1 Urban Adoption and Government-Led Procurement

• 4.4.2 Brazil’s Role in Regulatory Piloting

4.5 Middle East & Africa (MEA)

• 4.5.1 UAE’s Early Adoption Patterns

• 4.5.2 Infrastructure Readiness and Funding Landscape

Leading Companies in the Market

5.1 Competitive Landscape Overview

5.2 Key Player Profiles

• Amcor plc

• DuPont (Tyvek®)

• Steripack

• Wipak Walothen GmbH

• Berry Global

• Ecovative

• (OEM Examples: Philips, Siemens Healthineers, Medtronic)

5.3 Innovation Mapping: Patent Activity, Product Launches, Localization

5.4 Strategic Collaborations and Sustainability Initiatives

5.5 Market Positioning and Revenue Share (Indicative)

Strategic Intelligence and AI-Backed Insights

6.1 Phoenix Sentiment Analyzer Tool: Regulatory Sentiment Trends

6.2 Phoenix Demand Forecast Engine: Predictive Material Demand Modeling

6.3 Construction Activity Mapping System: Green Packaging Buildouts

6.4 Automated Porter’s Five Forces Analysis

• 6.4.1 Competitive Rivalry

• 6.4.2 Supplier Power

• 6.4.3 Buyer Power

• 6.4.4 Threat of New Entrants

• 6.4.5 Threat of Substitutes

6.5 AI-Enhanced Design Optimization Tools

6.6 Cross-Market Correlations with E-Commerce and Digital Health

Forecast Snapshot: 2025–2033

7.1 Global Market Size Projections

7.2 CAGR and Growth Benchmarks by Segment

7.3 Regional Growth Comparison

7.4 Dominant Process & Material Type Trends

7.5 Market Inflection Points: Regulatory, Economic, Technological

7.6 Short-Term vs Long-Term Investment Outlook

Why the Global Market Remains Critical

8.1 Eco-Packaging as a Strategic Pillar of Sustainable Healthcare

8.2 Alignment with Circular Economy Goals and ESG Mandates

8.3 Integration into National Procurement and Green Infrastructure

8.4 Supply Chain Transformation and Stakeholder Value

8.5 Sustained Global Momentum Across Developed & Emerging Regions

Phoenix Researcher Insights and Key Takeaways

9.1 Strategic Summary of Findings

9.2 Early Signals from AI Models

9.3 Hidden Opportunities in Mid-Tier OEMs and Green Startups

9.4 Recommendations for Investors and Industry Stakeholders

9.5 Future-Proofing Packaging Strategy: Design + Regulation + AI

Appendices

10.1 Research Methodology

10.2 List of Data Sources

10.3 Glossary of Key Terms

10.4 About Phoenix’s AI Intelligence Suite

10.5 Contact Information & Custom Request Support