Global eSIM Market Size and Share Analysis 2025-2033

Global eSIM Market Overview

The Global eSIM Market is rapidly transforming the global connectivity landscape, driven by the explosive rise in smart devices, IoT integration, and next-generation mobile communication technologies. As industries shift toward digital-first connectivity and embedded intelligence, the embedded SIM (eSIM) — also known as an embedded Universal Integrated Circuit Card (eUICC) — has become a cornerstone of smart connectivity, remote provisioning, and seamless network management.

Unlike traditional SIM cards, eSIMs allow users to switch carriers, activate profiles remotely, and manage multiple devices without physical replacement, fueling adoption across smartphones, connected cars, industrial IoT systems, wearables, and consumer electronics.

According to Phoenix’s Demand Forecast Engine, the Global eSIM Market size is valued at USD 10.8 billion in 2025 and is projected to reach approximately USD 32.4 billion by 2033, expanding at a CAGR of 14.7% (2025–2033).

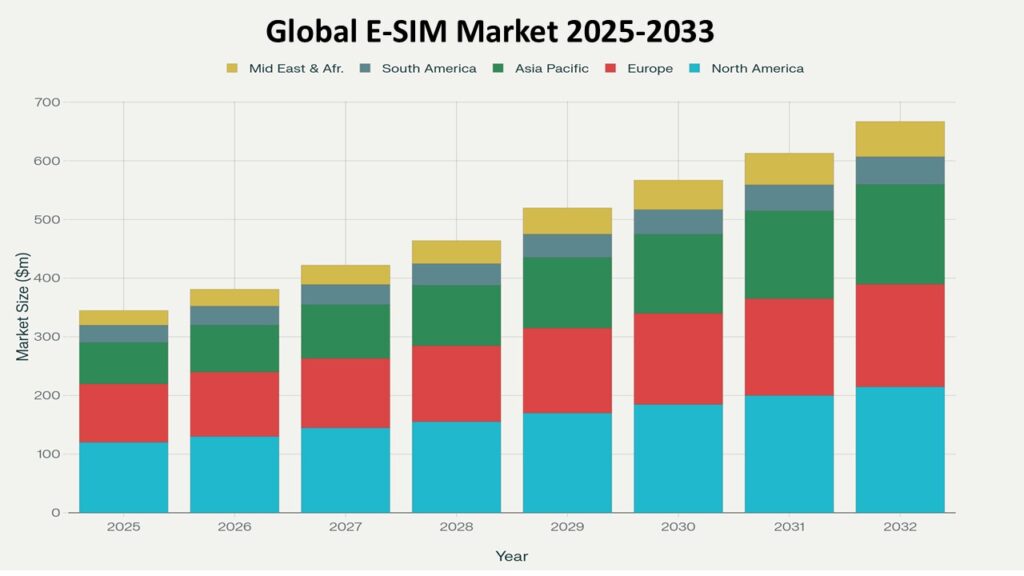

North America and Europe currently lead global Global eSIM Market size and adoption, supported by regulatory backing and strong telecom infrastructure, while Asia-Pacific is emerging as the fastest-growing region, driven by 5G integration, IoT device expansion, and smart manufacturing ecosystems.

The Global eSIM Market plays a pivotal role in enabling digital transformation, sustainable IoT connectivity, and global interoperability, unlocking the next wave of intelligent communication and borderless network access.

Key Drivers of Global eSIM Market Growth

1. Rising Penetration of IoT and Smart Connected Devices

The surge in smartphones, smartwatches, wearables, connected vehicles, and industrial IoT sensors is fueling large-scale adoption of eSIM technology, offering reliable connectivity and simplified global roaming.

2. Growing Demand for Flexible and Remote SIM Provisioning

Consumers and enterprises increasingly prefer over-the-air (OTA) provisioning, which allows for instant carrier switching, simplified device activation, and enhanced user experience without physical SIM cards.

3. Expansion of 5G Networks and Smart Infrastructure

The rollout of 5G and LTE-M networks is accelerating eSIM integration, ensuring faster data speeds, low latency, and consistent connectivity across smart devices and industrial systems.

4. Increasing Adoption in Automotive and Transportation Industries

eSIMs are becoming standard in connected vehicles, fleet management, and telematics systems, enabling real-time data transmission, navigation, and over-the-air updates for enhanced vehicle intelligence.

5. Regulatory Push and Ecosystem Standardization

Supportive policies by organizations like the GSMA, along with global telecom carrier interoperability standards, are promoting large-scale commercial deployment of eSIM-enabled devices.

6. Sustainability and Reduced E-Waste Generation

By eliminating physical SIM cards and packaging waste, eSIM technology aligns with sustainable manufacturing goals and eco-friendly telecom operations, appealing to environmentally conscious consumers.

Global eSIM Market Segmentation

By Solution Type

-

Hardware (Embedded eUICC)

-

Connectivity Management Platform (CMP)

-

Subscription Management Services

By Application

-

Smartphones & Tablets

-

Connected Vehicles (Automotive)

-

Wearables & Smart Devices

-

Laptops & Consumer Electronics

-

Industrial IoT & M2M Devices

-

Smart Energy and Utilities

By End User

-

Consumer

-

Enterprise

-

Machine-to-Machine (M2M)

-

Telecom Operators

By Industry Vertical

-

Automotive & Transportation

-

Consumer Electronics

-

Energy & Utilities

-

Healthcare

-

Manufacturing & Industrial

-

Retail & Logistics

By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

Regional Insights of the Global eSIM Market

North America – Early Adopter and Global eSIM Market Leader

The U.S. and Canada dominate the global eSIM landscape, supported by robust telecom infrastructure, early 5G deployment, and widespread smartphone integration. Major OEMs like Apple, Google, and Samsung have accelerated adoption through native eSIM compatibility.North America leads a largest share of the Global eSIM Market.

Europe – Standardization and Automotive Innovation

Europe remains a key hub for automotive eSIM integration and regulatory support, led by Germany, the U.K., and France. The region’s focus on connected mobility and industrial IoT further strengthens eSIM penetration.

Asia-Pacific – Fastest-Growing Region

The Asia-Pacific eSIM market is expanding rapidly due to the rise in smart manufacturing, telecom digitization, and affordable IoT ecosystems in China, Japan, South Korea, and India. Local carriers are actively collaborating with global chipset manufacturers to enable scalable eSIM adoption.

Latin America – Growing Telecom Digitalization

Countries like Brazil and Mexico are witnessing accelerated eSIM adoption, driven by mobile digital identity initiatives and increasing smartphone penetration.

Middle East & Africa – Emerging Opportunities in Smart Cities

With nations like the UAE and Saudi Arabia investing in smart city infrastructure, IoT-driven public services, and autonomous mobility, the region is poised for strong eSIM growth in the coming decade.

Leading Companies in the Global eSIM Market

-

Infineon Technologies AG

-

NXP Semiconductors

-

Qualcomm Technologies, Inc.

-

Deutsche Telekom AG

-

Gemalto N.V.

-

Sierra Wireless

-

ARM Holdings

These global leaders are reshaping connectivity through secure embedded hardware, cloud-based subscription management platforms, and AI-driven connectivity optimization.

Thales Group is the largest market share, leveraging its end-to-end digital security and eSIM management ecosystem.

Strategic Intelligence and AI-Powered Insights

-

Phoenix Demand Forecast Engine identifies consistent market acceleration due to 5G rollout and IoT device interconnectivity.

-

AI-Driven Analytics show rising enterprise adoption for M2M and industrial automation networks.

-

Innovation Tracker highlights advancements in secure remote provisioning, multi-profile management, and carrier-agnostic connectivity platforms.

-

Porter’s Five Forces Analysis indicates increasing competition with growing collaboration between chipset manufacturers, telecom operators, and OEMs.

Global eSIM Market Forecast Snapshot: 2025–2033

| Metric | Value |

|---|---|

| 2025 Market Size | USD 10.8 Billion |

| 2033 Market Size | ~USD 32.4 Billion |

| CAGR (2025–2033) | 14.7% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Top Application Segment | Smartphones & Connected Vehicles |

| Key Trend | 5G Integration & Multi-Profile Connectivity |

| Future Focus | IoT, Cloud-Driven Subscription Management & Green Connectivity |

Why the Global eSIM Market Remains Critical

-

Surge in IoT and connected device ecosystems across industries.

-

Increased preference for remote SIM activation and flexible network switching.

-

Integration of 5G, AI, and cloud computing in smart connectivity systems.

-

Expansion of connected mobility and autonomous vehicles.

-

Growing emphasis on eco-friendly, sustainable connectivity solutions.

Final Takeaway of the Global eSIM Market

The Global eSIM Market represents a paradigm shift in digital connectivity and mobile identity, paving the way for a future of frictionless, global communication. With rising adoption across automotive, telecom, IoT, and enterprise ecosystems, eSIMs are set to become the universal enabler of secure, adaptive, and intelligent network access.

Manufacturers, telecom operators, and IoT solution providers that embrace open standards, AI-enabled subscription management, and sustainable digital infrastructure will lead the evolution of smart, borderless, and future-ready connectivity ecosystems.

At Phoenix Research, our AI-powered analytics and forecasting systems deliver data-driven insights and strategic intelligence to help businesses, investors, and policymakers capitalize on the next wave of embedded connectivity transformation.

Table of Contents

1. Global eSIM Market Overview

2. Key Drivers of Global eSIM Market Growth

-

Rising Penetration of IoT and Smart Connected Devices

-

Growing Demand for Flexible and Remote SIM Provisioning

-

Expansion of 5G Networks and Smart Infrastructure

-

Increasing Adoption in Automotive and Transportation Industries

-

Regulatory Push and Ecosystem Standardization

-

Sustainability and Reduced E-Waste Generation

3. Global eSIM Market Segmentation

By Solution Type

-

Hardware (Embedded eUICC)

-

Connectivity Management Platform (CMP)

-

Subscription Management Services

By Application

-

Smartphones & Tablets

-

Connected Vehicles (Automotive)

-

Wearables & Smart Devices

-

Laptops & Consumer Electronics

-

Industrial IoT & M2M Devices

-

Smart Energy and Utilities

By End User

-

Consumer

-

Enterprise

-

Machine-to-Machine (M2M)

-

Telecom Operators

By Industry Vertical

-

Automotive & Transportation

-

Consumer Electronics

-

Energy & Utilities

-

Healthcare

-

Manufacturing & Industrial

-

Retail & Logistics

By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

4. Regional Insights of the Global eSIM Market

-

North America – Early Adopter and Market Leader

-

Europe – Standardization and Automotive Innovation

-

Asia-Pacific – Fastest-Growing Region

-

Latin America – Growing Telecom Digitalization

-

Middle East & Africa – Emerging Opportunities in Smart Cities

5. Leading Companies in the Global eSIM Market

-

Thales Group

-

Giesecke+Devrient (G+D)

-

STMicroelectronics

-

Infineon Technologies AG

-

NXP Semiconductors

-

Qualcomm Technologies, Inc.

-

Deutsche Telekom AG

-

Gemalto N.V.

-

Sierra Wireless

-

ARM Holdings

Leading Player: Thales Group

6. Strategic Intelligence and AI-Powered Insights

-

Phoenix Demand Forecast Engine

-

AI-Driven Analytics for Enterprise and M2M Adoption

-

Innovation Tracker for Secure Remote Provisioning

-

Porter’s Five Forces Analysis

7. Global eSIM Market Forecast Snapshot: 2025–2033

-

2025 Market Size: USD 10.8 Billion

-

2033 Market Size: ~USD 32.4 Billion

-

CAGR (2025–2033): 14.7%

-

Largest Region: North America

-

Fastest Growing Region: Asia-Pacific

-

Top Application Segment: Smartphones & Connected Vehicles

-

Key Trend: 5G Integration & Multi-Profile Connectivity

-

Future Focus: IoT, Cloud-Driven Subscription Management & Green Connectivity

8. Why the Global eSIM Market Remains Critical

-

Surge in IoT and Connected Device Ecosystems

-

Increased Preference for Remote SIM Activation

-

Integration of 5G, AI, and Cloud Computing

-

Expansion of Connected Mobility and Autonomous Vehicles

-

Growing Emphasis on Eco-Friendly, Sustainable Connectivity