Global Ethanol Fuel Blending Market 2025-2033

Overview

The Global Ethanol Fuel Blending Market is expanding rapidly as governments and automotive industries increasingly adopt ethanol-blended fuels to reduce greenhouse gas emissions and enhance energy security. Rising fuel mandates, technological advancements in flexible-fuel vehicles, and growing awareness of sustainable transportation are driving widespread adoption of E10, E15, E85, and other biofuel blends.

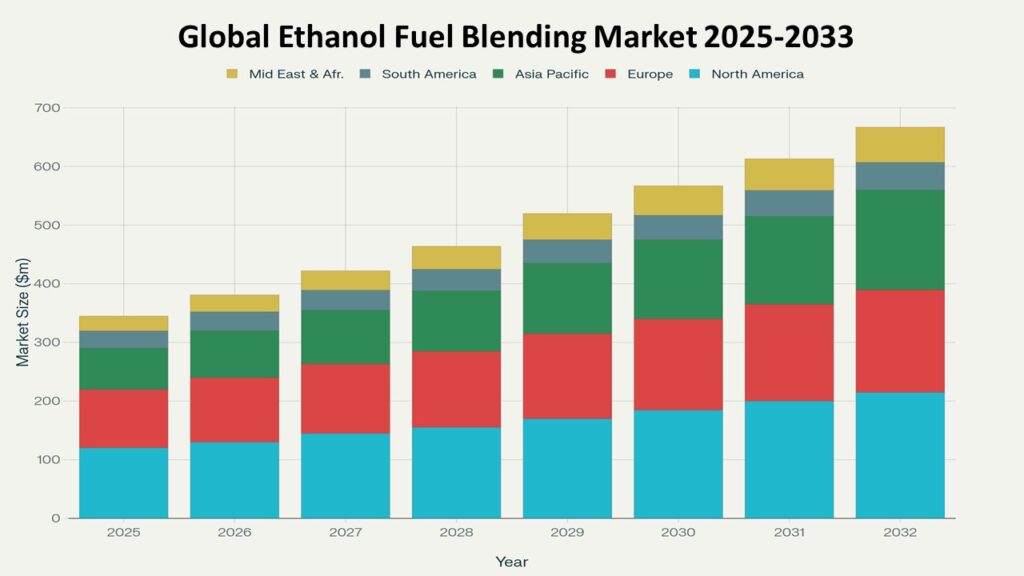

According to Phoenix’s Demand Forecast Engine, the global Ethanol Fuel Blending Market is projected to grow from USD 45.2 billion in 2025 to approximately USD 98.5 billion by 2033, exhibiting a CAGR of 10.2%. North America is dominating the market in 2025, supported by strong regulatory frameworks, while Asia Pacific is expected to be the fastest-growing region during the forecast period.

Key Drivers of Market Growth

Government Mandates and Regulatory Support

Government policies and Renewable Fuel Standards (RFS) are major drivers for the Ethanol Fuel Blending Market. Low-carbon fuel policies and biofuel blending targets are encouraging the adoption of E10, E15, and E85 across passenger and commercial vehicles. Incentives for ethanol-compatible vehicles and infrastructure further strengthen market growth.

Automotive Industry Adoption

The expansion of flexible-fuel vehicles (FFVs) globally is accelerating the Ethanol Fuel Blending Market, with vehicles capable of running on high ethanol blends like E85 seeing rapid adoption in North America and Brazil.

Sustainability and Environmental Goals

The Ethanol Fuel Blending Market is strongly linked to sustainability initiatives, as ethanol-blended fuels reduce carbon emissions and support ESG targets across transportation sectors. Increasing awareness of climate change and decarbonization policies is driving higher blend ratios and wider adoption.

Integration with Ethanol Value Chain

The Ethanol Fuel Blending Market connects upstream and downstream segments of the ethanol ecosystem, complementing Ethanol Production, Ethanol Processing & Refining, Second-Generation Ethanol, Sustainable Ethanol, and supporting trade flows in Bioethanol Export Markets.

Market Segmentation

By Blend Type

- E10 (10% ethanol, 90% gasoline) – Widely used for standard vehicles in North America, Europe, and Asia.

- E15 (15% ethanol, 85% gasoline) – Increasing adoption in countries with higher renewable fuel mandates.

- E85 (Flexible-fuel vehicles) – Growing penetration in North America and Brazil for high-ethanol compatible engines.

- Other Blends (E20, E25, etc.) – Emerging markets exploring higher ethanol ratios for industrial and fleet applications.

By Vehicle Type

- Passenger Vehicles – Compact cars, sedans, SUVs compatible with E10 and E15 blends.

- Commercial Vehicles – Light-duty trucks, buses, and delivery fleets using higher ethanol blends.

- Flexible-Fuel Vehicles (FFVs) – Vehicles engineered to operate on E85 or intermediate blends.

- Two/Three-Wheelers – Low-carbon solutions for emerging economies in Asia and LATAM.

By Distribution Channel

- Fuel Stations & Retail Networks – Blended gasoline available through conventional service stations.

- Direct Industrial & Fleet Supply – Bulk blending for corporate fleets, public transport, and industrial operations.

- Infrastructure & Storage – Ethanol-compatible pipelines, storage tanks, and terminal facilities.

Region-Level Insights

North America – CAGR (2025–2033): 9.5%

North America remains the largest market for the Ethanol Fuel Blending Market, led by the U.S. Renewable Fuel Standard and strong FFV adoption. Brazil continues to lead in high-ethanol blends through sugarcane-based ethanol and robust infrastructure.

Europe – CAGR (2025–2033): 7.8%

Europe’s Ethanol Fuel Blending Market growth is driven by EU renewable energy directives, emission reduction targets, and policies promoting biofuel-compatible vehicles.

Asia Pacific – CAGR (2025–2033): 12.1% (Fastest Growing Region)

Emerging countries in India, China, and Southeast Asia are scaling their ethanol blending mandates, driving the Ethanol Fuel Blending Market with government support for production, FFV rollout, and infrastructure expansion.

Latin America

Brazil remains the global leader in high-ethanol fuel adoption. Other LATAM countries are piloting ethanol blending programs, contributing to the overall Ethanol Fuel Blending Market growth.

Leading Companies in the Market

Key players shaping the Ethanol Fuel Blending Market include:

- POET LLC

- Green Plains Inc.

- Raízen S.A.

- Cargill Inc.

- Valero Energy Corporation

- Louis Dreyfus Company

These companies are investing in ethanol production, blending infrastructure, and partnerships with automotive OEMs to expand fuel availability and adoption.

Strategic Insights

- The Ethanol Fuel Blending Market supports global decarbonization, renewable energy mandates, and fuel security.

- The market is interlinked with Ethanol Production, Ethanol Feedstock, Ethanol Processing & Refining, Second-Generation Ethanol, Sustainable Ethanol, Industrial Ethanol, Beverage Ethanol, Pharmaceutical Ethanol, and Bioethanol Trade & Export Markets, forming a cohesive global ecosystem.

- Forecasting and scenario analysis indicate rising adoption in emerging regions and higher blend ratios over the next decade.

Forecast Snapshot: 2025–2033

| Metric | Value |

| 2025 Market Size | USD 45.2 Billion |

| 2033 Market Size | ~USD 98.5 Billion |

| CAGR (2025–2033) | 10.2% |

| Leading Region | North America |

| Top Blend | E10 |

| Key Trend | Flexible-Fuel Vehicles & Higher Ethanol Blends |

| Future Focus | Asia Pacific & Modular Fuel Infrastructure |

Why the Market Remains Critical

- The Ethanol Fuel Blending Market enhances fuel security, reduces oil import dependency, and supports low-carbon transportation initiatives.

- Serves as a downstream bridge connecting ethanol production, refining, and sustainable ethanol initiatives.

- Offers scalable solutions for passenger, commercial, and fleet operations across multiple regions.

Final Takeaway

The Global Ethanol Fuel Blending Market is a vital component of the ethanol ecosystem, enabling widespread adoption of low-carbon transportation fuels. Government mandates, flexible-fuel vehicle adoption, and advances in blending infrastructure position the market for robust growth from 2025 through 2033.

This market is intrinsically linked with Ethanol Production Market, Ethanol Feedstock Market, Ethanol Processing & Refining Market, Second-Generation Ethanol Market, Industrial Ethanol Market, Ethanol in Beverage Industry, Pharmaceutical Ethanol Market, Bioethanol Trade & Export Market, and Sustainable Ethanol Market, forming a cohesive global ecosystem.

Executive Summary

1.1. Market Snapshot (2025–2033)

1.2. Key Market Insights & Trends

1.3. Analyst Recommendations

1.4. Strategic Importance of Ethanol in Global Energy, Industrial, and Bioeconomy Applications

1.5. Phoenix AI Strategic Insights

Market Overview

2.1. Definition & Scope of the Global Ethanol Market

2.2. Ethanol Production & Processing Overview (Fermentation, Distillation, Dehydration, Purification, By-product Utilization)

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.3.4. Challenges

2.4. Impact of Sustainability Goals & Energy Transition Policies

2.5. Phoenix AI Insights: Future Production & Consumption Landscape

Ethanol Industry Ecosystem

3.1. Raw Material Supply Chain (Corn, Sugarcane, Molasses, Wheat, Cellulosic Biomass, Lignocellulosic Residues, Other By-products)

3.2. Technology Providers & Equipment Manufacturers

3.3. Production Plant Operators

3.4. Distribution & Logistics Partners

3.5. Downstream Industries Consuming Ethanol (Fuel, Industrial, F&B, Pharmaceuticals, Chemicals, Bioenergy)

Market Segmentation – By Processing Technology

4.1. Distillation & Rectification – Traditional and Advanced Distillation for Fuel and Industrial-Grade Ethanol

4.2. Dehydration Technologies – Molecular Sieves, Azeotropic, and Membrane-Based Dehydration for High-Purity Ethanol

4.3. Filtration & Purification – Activated Carbon, Ion Exchange, and Ceramic Filtration for Impurity Removal

4.4. By-Product Utilization – Dried Distillers Grains (DDGS), Lignin, and Other Co-Products Management

Market Segmentation – By Feedstock Input

5.1. Corn-Based Ethanol – Most Prevalent Feedstock in North America

5.2. Sugarcane-Based Ethanol – Major Contributor in Latin America and Parts of Asia

5.3. Cellulosic & Lignocellulosic Biomass – Includes Crop Residues, Wood, and Grasses; Fast-Growing Segment

5.4. Molasses & Other Fermentation By-Products – Niche but Valuable for Specialized Ethanol Production

Market Segmentation – By End-Use Application

6.1. Fuel Blending

6.1.1. Blend Type

-

E10 (10% ethanol, 90% gasoline) – Standard vehicles in North America, Europe, Asia

-

E15 (15% ethanol, 85% gasoline) – Higher renewable fuel mandates

-

E85 (Flexible-Fuel Vehicles) – North America and Brazil

-

Other Blends (E20, E25, etc.) – Emerging markets and industrial/fleet applications

6.1.2. Vehicle Type -

Passenger Vehicles – Compact cars, sedans, SUVs (E10/E15)

-

Commercial Vehicles – Light-duty trucks, buses, delivery fleets (higher blends)

-

Flexible-Fuel Vehicles (FFVs) – Operate on E85/intermediate blends

-

Two/Three-Wheelers – Low-carbon solutions in Asia/LATAM

6.1.3. Distribution Channel -

Fuel Stations & Retail Networks – Blended gasoline via service stations

-

Direct Industrial & Fleet Supply – Bulk blending for corporate fleets, public transport, industrial operations

-

Infrastructure & Storage – Ethanol-compatible pipelines, storage tanks, terminals

6.2. Industrial Applications – Solvents, Paints, Coatings, Household Chemicals

6.3. Pharmaceutical & Healthcare Applications – Disinfectants, Sanitizers, High-Purity Ethanol for Drug Formulations

6.4. Beverage Applications – Distilleries and Breweries Using Refined Ethanol for Spirits and Liquors

Regional Market Analysis

7.1. North America

7.1.1. U.S.

7.1.2. Canada

7.2. Latin America

7.2.1. Brazil

7.2.2. Argentina

7.2.3. Rest of LATAM

7.3. Europe

7.3.1. Germany

7.3.2. France

7.3.3. UK

7.3.4. Rest of Europe

7.4. Asia-Pacific

7.4.1. China

7.4.2. India

7.4.3. Japan

7.4.4. Rest of APAC

7.5. Middle East & Africa

Competitive Landscape

8.1. Market Share Analysis of Leading Players

8.2. Production Capacity & Plant Location Mapping

8.3. Strategic Developments (Expansions, Partnerships, Mergers, Acquisitions)

8.4. Company Profiles (Up to Top 15 Players)

– Archer Daniels Midland Company

– POET, LLC

– Green Plains Inc.

– Raízen S.A.

– Valero Renewable Fuels Company LLC

– Flint Hills Resources

– Others

Market Forecast & Outlook (2025–2033)

9.1. Global Ethanol Production Volume Outlook (Billion Liters)

9.2. Global Ethanol Market Value Outlook (USD Billion)

9.3. Regional Growth Projections

9.4. Phoenix AI Predictive Modelling Scenarios

Regulatory & Policy Framework

10.1. Global Renewable Energy Directives

10.2. Country-Level Ethanol Production Incentives & Mandates

10.3. Trade Regulations & Tariff Impacts

Emerging Trends & Innovations

11.1. Second-Generation (2G) & Advanced Ethanol Production

11.2. Enzyme & Bioprocess Innovations

11.3. AI, IoT & Process Optimization

11.4. Distillation, Dehydration & Waste-to-Ethanol Technology

Strategic Recommendations

12.1. Entry Strategies for New Market Entrants

12.2. Capacity Expansion Strategies for Existing Players

12.3. Diversification into Co-Products (DDGS, Lignin, CO₂, Biodiesel)

12.4. Investment Hotspots by Region & Technology

Appendix

13.1. Abbreviations & Glossary

13.2. Research Methodology

13.3. Data Sources

13.4. Phoenix AI Research Credentials