Global Ethanol in Beverage Industry Market

Overview

The Global Ethanol in Beverage Industry Market is expanding steadily, supported by the rising demand for alcoholic beverages such as beer, wine, spirits, and premium liquor. Ethanol serves as the essential ingredient in brewing and distilling processes, enabling the production of a wide variety of beverage types. Shifting consumer preferences toward premium spirits, craft breweries, and ready-to-drink (RTD) beverages, coupled with strong cultural and economic drivers, are fueling growth across global markets.

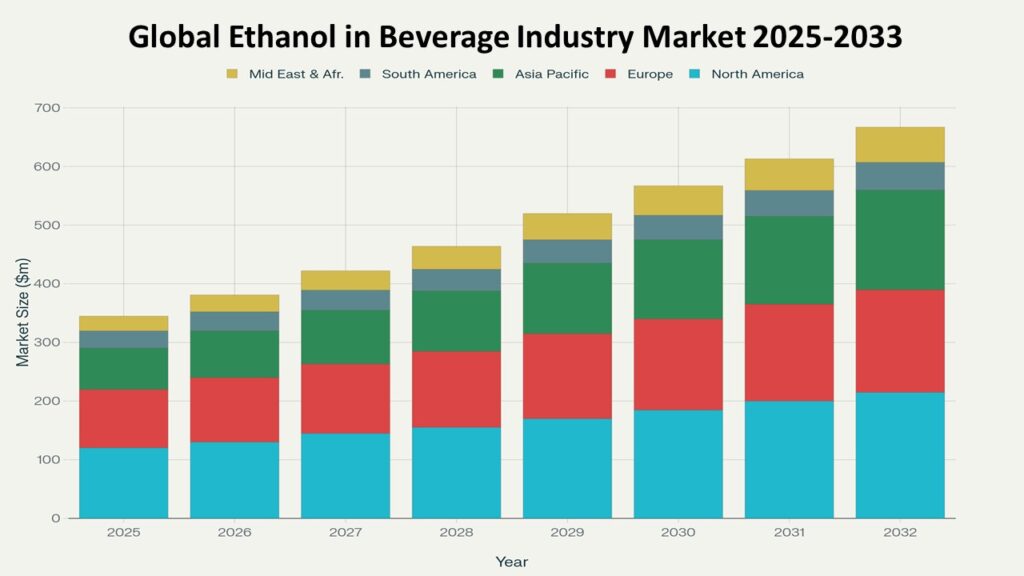

According to Phoenix’s Demand Forecast Engine, the global Ethanol in Beverage Industry Market is expected to grow from USD 35.1 billion in 2025 to around USD 62.4 billion by 2033, at a CAGR of 7.1%. North America currently leads the market, while Asia Pacific is projected to be the fastest-growing region during the forecast period.

Key Drivers of Market Growth

Rising Alcohol Consumption and Premiumization

Growing global alcohol consumption, particularly in emerging markets, is a primary driver of the Ethanol in Beverage Industry Market. Consumers are also trading up to premium categories, including high-quality spirits and craft beverages, further boosting ethanol demand.

Expansion of Breweries and Distilleries

The rise of microbreweries, distilleries, and craft beer culture has significantly contributed to the Ethanol in Beverage Industry Market. Small and medium players are increasing ethanol procurement, strengthening ties with ethanol production and refining industries.

Changing Consumer Preferences

Younger demographics and urban consumers are gravitating toward flavored alcoholic beverages, RTDs, and low-alcohol variants. This diversification of product portfolios continues to shape ethanol utilization in the beverage sector.

Interconnected Ethanol Value Chain

The Ethanol in Beverage Industry Market does not operate in isolation—it is strongly linked to upstream segments such as Ethanol Production, Feedstock, Processing & Refining, and Second-Generation Ethanol, as well as downstream markets including Industrial Ethanol, Ethanol Fuel Blending, Pharmaceutical Ethanol, Sustainable Ethanol, and international Bioethanol Trade. This interconnected ecosystem ensures stable supply, price stability, and long-term growth.

Market Segmentation

By Beverage Type

- Beer & Lager – Large-scale ethanol use in brewing and fermentation processes.

- Wine – Ethanol derived naturally during fermentation, with growing demand for premium and organic wines.

- Spirits – Vodka, whiskey, rum, gin, tequila, and other distilled beverages requiring high-purity ethanol.

- Ready-to-Drink (RTD) Beverages – Increasing ethanol usage in canned cocktails and flavored alcoholic beverages.

- Others – Traditional beverages and regional specialties.

By Purity Level

- Potable Ethanol (96%–99%) – Beverage-grade ethanol specifically designed for brewing and distilling.

- Absolute Ethanol (99.9%) – Specialty ethanol used in high-purity distillation processes for premium beverages.

By Distribution Channel

- Breweries – Industrial-scale production units with high ethanol consumption.

- Distilleries – Ethanol as a direct feedstock for spirit manufacturing.

- Microbreweries & Craft Units – Smaller producers focusing on artisanal beverages.

- RTD Manufacturers – Expanding market segment, particularly among young consumers.

Region-Level Insights

North America – CAGR (2025–2033): 6.3%

North America dominates the Ethanol in Beverage Industry Market, supported by established distilleries, large-scale breweries, and a mature alcoholic beverage industry.

Europe – CAGR (2025–2033): 6.7%

Europe remains a traditional hub for wine and spirits, with countries such as France, Italy, and the UK fueling ethanol demand through premium beverage production.

Asia Pacific – CAGR (2025–2033): 9.2% (Fastest Growing Region)

Rapid urbanization, rising disposable incomes, and growing youth population are fueling demand for beer, spirits, and RTDs in China, India, and Southeast Asia.

Latin America

Strong cultural demand for alcoholic beverages in Brazil and Mexico contributes significantly to the Ethanol in Beverage Industry Market, while integration with local ethanol production boosts supply availability.

Leading Companies in the Market

Key players driving the Ethanol in Beverage Industry Market include:

- Diageo Plc

- Anheuser-Busch InBev

- Heineken N.V.

- Constellation Brands

- Pernod Ricard S.A.

- Bacardi Limited

These companies rely heavily on stable ethanol supply chains and are increasingly aligning with sustainable ethanol sourcing strategies.

Strategic Insights

- The Ethanol in Beverage Industry Market is deeply tied to consumer culture, social trends, and regional traditions, making it resilient despite economic fluctuations.

- Premiumization and RTDs are reshaping ethanol consumption patterns within the beverage segment.

- Integration with upstream markets such as Ethanol Production, Feedstock, Processing & Refining, and Second-Generation Ethanol ensures consistent supply and supports sustainability goals.

- Growing alignment with Sustainable Ethanol initiatives reflects consumer and regulatory pressures for greener, low-carbon alcoholic beverages.

Forecast Snapshot: 2025–2033

| Metric | Value |

| 2025 Market Size | USD 35.1 Billion |

| 2033 Market Size | ~USD 62.4 Billion |

| CAGR (2025–2033) | 7.1% |

| Largest Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Segment | Spirits & Premium Beverages |

| Future Focus | Sustainable Sourcing & Craft Expansion |

Why the Market Remains Critical

- The Ethanol in Beverage Industry Market ensures ethanol demand across one of the largest and most culturally significant sectors globally.

- It provides stable revenue streams for ethanol producers and processors, strengthening the overall ethanol ecosystem.

- By connecting with adjacent segments like Industrial Ethanol, Pharmaceutical Ethanol, Sustainable Ethanol, and Fuel Blending, the market reinforces the importance of ethanol as a multi-industry commodity.

Final Takeaway

The Global Ethanol in Beverage Industry Market is a cornerstone of the global ethanol value chain, with strong cultural, economic, and consumer-driven demand. From breweries and wineries to distilleries and RTD manufacturers, ethanol remains indispensable in the production of alcoholic beverages.

By linking upstream supply (production, feedstock, refining, second-generation ethanol) with downstream demand (industrial, pharmaceutical, sustainable ethanol, and bioethanol trade), the Ethanol in Beverage Industry Market highlights the central role of ethanol in shaping consumer experiences and industrial growth worldwide.

Executive Summary

1.1. Market Snapshot (2025–2033)

1.2. Key Market Insights & Trends

1.3. Analyst Recommendations

1.4. Strategic Importance of Ethanol in the Global Beverage Industry

1.5. Phoenix AI Strategic Insights

Market Overview

2.1. Definition & Scope of the Ethanol in Beverage Industry Market

2.2. Ethanol Role in Brewing, Distilling & RTD Manufacturing

2.3. Market Dynamics

-

2.3.1. Drivers

-

2.3.2. Restraints

-

2.3.3. Opportunities

-

2.3.4. Challenges

2.4. Impact of Premiumization, Craft Expansion & RTD Growth

2.5. Phoenix AI Insights: Future Consumer Demand Trends

Industry Ecosystem

3.1. Ethanol Supply Chain for Beverages (Producers, Refiners, Traders)

3.2. Linkages with Feedstock & Production Technology Markets

3.3. Breweries, Distilleries, Wineries, and RTD Manufacturers

3.4. Distribution Networks (Regional & Global)

3.5. Integration with Adjacent Markets (Industrial Ethanol, Pharma, Fuel Blending)

Market Segmentation

4. By Beverage Type

4.1. Beer & Lager

4.2. Wine

4.3. Spirits (Vodka, Whiskey, Rum, Gin, Tequila, Others)

4.4. Ready-to-Drink (RTD) Beverages

4.5. Others (Traditional & Regional Beverages)

5. By Purity Level

5.1. Potable Ethanol (96%–99%)

5.2. Absolute Ethanol (99.9%)

6. By Distribution Channel

6.1. Breweries

6.2. Distilleries

6.3. Microbreweries & Craft Units

6.4. RTD Manufacturers

Regional Market Analysis

7.1. North America

-

7.1.1. U.S.

-

7.1.2. Canada

7.2. Europe -

7.2.1. France

-

7.2.2. Italy

-

7.2.3. UK

-

7.2.4. Rest of Europe

7.3. Asia-Pacific

-

7.3.1. China

-

7.3.2. India

-

7.3.3. Japan

-

7.3.4. Southeast Asia

-

7.3.5. Rest of APAC

7.4. Latin America

-

7.4.1. Brazil

-

7.4.2. Mexico

-

7.4.3. Rest of LATAM

7.5. Middle East & Africa

Competitive Landscape

8.1. Market Share Analysis of Leading Beverage Companies

8.2. Strategic Partnerships with Ethanol Producers

8.3. Expansion of Breweries, Distilleries & RTD Production Facilities

8.4. Company Profiles (Top 10–12 Players)

-

Diageo Plc

-

Anheuser-Busch InBev

-

Heineken N.V.

-

Constellation Brands

-

Pernod Ricard S.A.

-

Bacardi Limited

-

Others

Market Forecast & Outlook (2025–2033)

9.1. Global Market Value Outlook (USD Billion)

9.2. Regional Growth Projections

9.3. Segment Growth (Beer, Wine, Spirits, RTD)

9.4. Phoenix AI Predictive Modelling Scenarios

Regulatory & Policy Framework

10.1. Alcohol & Beverage Regulations (Global & Regional)

10.2. Quality Standards for Potable Ethanol

10.3. Trade Regulations & Import/Export Controls

10.4. Taxation & Excise Duties on Alcoholic Beverages

Emerging Trends & Innovations

11.1. Premiumization & Growth of Craft Beverages

11.2. Expansion of Ready-to-Drink (RTD) Segment

11.3. Sustainable & Green Ethanol Sourcing for Beverages

11.4. AI & Digital Tools in Consumer Behavior Analysis

Strategic Recommendations

12.1. Entry Strategies for Emerging Beverage Companies

12.2. Partnerships Between Ethanol Producers & Distilleries

12.3. Expansion into Premium Spirits & RTD Categories

12.4. Investment Hotspots by Region & Beverage Type

Appendix

13.1. Abbreviations & Glossary

13.2. Research Methodology

13.3. Data Sources

13.4. Phoenix AI Research Credentials