Global Ethanol in Pharmaceutical & Healthcare Market

Overview

The Global Ethanol in Pharmaceutical & Healthcare Market is witnessing robust expansion as ethanol continues to play a critical role as a solvent, disinfectant, and formulation component across medical, clinical, and therapeutic applications. Its widespread use in drug manufacturing, laboratory preparations, hand sanitizers, disinfectants, and as a carrier in pharmaceutical solutions underpins its strategic importance within the global healthcare ecosystem. Rising focus on hygiene, pandemic-driven preparedness, and the growing pharmaceutical pipeline are propelling market demand.

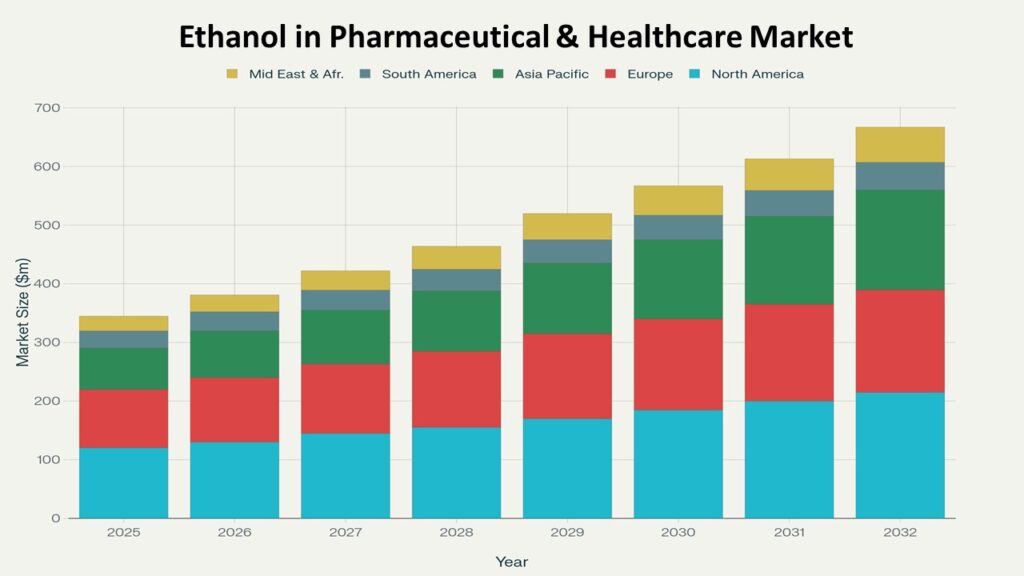

According to Phoenix’s Demand Forecast Engine, the global Ethanol in Pharmaceutical & Healthcare Market is expected to grow from USD 21.8 billion in 2025 to approximately USD 42.6 billion by 2033, reflecting a CAGR of 8.7%. In 2024, North America accounted for the largest share, while Asia Pacific is forecast to emerge as the fastest-growing region during the outlook period.

2025-2033

Key Drivers of Market Growth

Rising Demand for Medical-Grade Disinfectants

Post-COVID, stringent infection prevention protocols and hospital hygiene standards are fueling demand for ethanol-based sanitizers, hand rubs, and disinfectants.

Ethanol as a Critical Pharmaceutical Excipient

The Ethanol in Pharmaceutical & Healthcare Market benefits from ethanol’s essential role in drug formulations as a solvent, preservative, and stabilizer in cough syrups, oral solutions, topical gels, and injectables.

Expanding Biopharma & R&D Pipeline

The global boom in biotechnology, vaccine development, and clinical research continues to push ethanol utilization in laboratories, compounding pharmacies, and drug discovery applications.

Interconnected Ethanol Ecosystem

The Ethanol in Pharmaceutical & Healthcare Market is interdependent with Ethanol Production, Feedstock, Processing & Refining, and Second-Generation Ethanol, while also overlapping with Industrial Ethanol, Ethanol Fuel Blending, Beverage Ethanol, Sustainable Ethanol, and Bioethanol Trade. These upstream and downstream linkages ensure consistency in supply, compliance with purity standards, and resilience in global distribution.

Market Segmentation

By Application

- Pharmaceutical Formulations – Syrups, elixirs, tinctures, capsules, injectables.

- Antiseptics & Disinfectants – Hand sanitizers, surface disinfectants, wound cleaning solutions.

- Laboratory & Clinical Use – Reagents, sample preparation, molecular biology processes.

- Vaccines & Biologics – Ethanol in stabilization and production of biologic therapies.

By Purity Level

- Medical Grade (95%–96%) – Widely used across healthcare settings.

- Absolute Ethanol (99.9%) – Critical for sensitive pharmaceutical applications.

- Denatured Ethanol – Utilized in disinfectants and cleaning agents.

By End User

- Pharmaceutical Companies – Large- and mid-scale drug manufacturers.

- Hospitals & Clinics – Onsite use for disinfection and clinical preparations.

- Research & Academic Institutes – Biotech, genomics, and chemical labs.

- Contract Manufacturing Organizations (CMOs) – Outsourced production and formulation partners.

By Distribution Channel

- Direct Supply (Pharma Contracts)

- Medical Distributors

- Laboratory Suppliers

- Online/Pharma Retail Chains

Region-Level Insights

North America – CAGR (2025–2033): 7.9%

Dominates the Ethanol in Pharmaceutical & Healthcare Market, driven by strong regulatory oversight, high demand for sanitizers and disinfectants, and robust pharma manufacturing in the U.S.

Europe – CAGR (2025–2033): 8.2%

Supported by well-established pharmaceutical hubs in Germany, Switzerland, and the UK. EU’s stringent drug safety regulations reinforce high standards for ethanol purity.

Asia Pacific – CAGR (2025–2033): 10.1% (Fastest Growing Region)

Rising investments in pharma manufacturing in India and China, combined with healthcare expansion, position Asia Pacific as the most dynamic region.

Latin America

Ethanol-rich countries like Brazil are not only leading in bioethanol production but also increasingly channeling ethanol toward healthcare use, especially in urban hospitals and research labs.

Leading Companies in the Market

Key players shaping the Ethanol in Pharmaceutical & Healthcare Market include:

- Pfizer Inc.

- Johnson & Johnson

- Merck KGaA

- Novartis AG

- GlaxoSmithKline (GSK)

- Thermo Fisher Scientific

- CordenPharma International

- Lonza Group

These companies rely on pharmaceutical-grade ethanol sourcing strategies, strict GMP compliance, and partnerships with ethanol producers.

Strategic Insights

- The Ethanol in Pharmaceutical & Healthcare Market is increasingly influenced by sustainability mandates, creating demand for second-generation and low-carbon ethanol in formulations.

- Pandemic-driven investments in sanitizer and disinfectant manufacturing have permanently expanded the ethanol footprint in healthcare.

- Integration with Industrial Ethanol and Sustainable Ethanol supply ensures flexibility in pricing and availability for pharma end users.

- Phoenix’s Sentiment Analyzer shows a strong policy tilt across APAC and LATAM toward ethanol-based disinfectants in public health infrastructure.

Forecast Snapshot: 2025–2033

| Metric | Value |

| 2025 Market Size | USD 21.8 Billion |

| 2033 Market Size | ~USD 42.6 Billion |

| CAGR (2025–2033) | 8.7% |

| Largest Region (2024) | North America |

| Fastest Growing Region | Asia Pacific (10.1%) |

| Key Segment | Pharmaceutical Formulations |

| Future Focus | Sustainable, High-Purity Ethanol |

Why the Market Remains Critical

- The Ethanol in Pharmaceutical & Healthcare Market underpins critical healthcare products, from life-saving drugs to frontline disinfectants.

- It is a cornerstone of pandemic preparedness and everyday hospital operations.

- Its upstream and downstream integration with the wider ethanol ecosystem strengthens global health security.

Final Takeaway

The Global Ethanol in Pharmaceutical & Healthcare Market is not just a subset of industrial ethanol—it is a strategic enabler of global health resilience. From hospitals and clinics to pharma labs and vaccine development, ethanol is deeply embedded in medical innovation and patient safety.

By linking upstream sources (production, feedstock, refining, second-gen ethanol) with downstream usage (industrial, sustainable ethanol, beverage, fuel blending, and bioethanol trade), the Ethanol in Pharmaceutical & Healthcare Market solidifies ethanol’s status as a critical bridge between energy, industry, and healthcare.

Executive Summary

1.1. Market Snapshot (2025–2033)

1.2. Key Market Insights & Trends

1.3. Analyst Recommendations

1.4. Strategic Importance of Ethanol in the Global Pharmaceutical & Healthcare Sector

1.5. Phoenix AI Strategic Insights

Market Overview

2.1. Definition & Scope of the Ethanol in Pharmaceutical & Healthcare Market

2.2. Ethanol Role in Drug Manufacturing, Disinfection & Clinical Applications

2.3. Market Dynamics

-

2.3.1. Drivers

-

2.3.2. Restraints

-

2.3.3. Opportunities

-

2.3.4. Challenges

2.4. Impact of Pandemic Preparedness, Biopharma Growth & Hygiene Demand

2.5. Phoenix AI Insights: Healthcare Demand Trends & R&D Pipelines

Industry Ecosystem

3.1. Ethanol Supply Chain for Pharma & Healthcare (Producers, Refiners, Traders)

3.2. Linkages with Feedstock & Production Technology Markets

3.3. Pharmaceutical Manufacturers, Hospitals, Research Labs, and CMOs

3.4. Distribution Networks (Direct Supply, Medical Distributors, Online/Pharma Retail)

3.5. Integration with Adjacent Markets (Industrial Ethanol, Beverage, Fuel Blending, Sustainable Ethanol)

Market Segmentation

4. By Application

-

4.1. Pharmaceutical Formulations (Syrups, Elixirs, Tinctures, Injectables)

-

4.2. Antiseptics & Disinfectants (Hand Sanitizers, Surface Cleaners, Wound Care)

-

4.3. Laboratory & Clinical Use (Reagents, Sample Prep, Molecular Biology)

-

4.4. Vaccines & Biologics (Stabilizers & Biotech Processes)

5. By Purity Level

-

5.1. Medical Grade (95%–96%)

-

5.2. Absolute Ethanol (99.9%)

-

5.3. Denatured Ethanol

6. By End User

-

6.1. Pharmaceutical Companies

-

6.2. Hospitals & Clinics

-

6.3. Research & Academic Institutes

-

6.4. Contract Manufacturing Organizations (CMOs)

7. By Distribution Channel

-

7.1. Direct Supply (Pharma Contracts)

-

7.2. Medical Distributors

-

7.3. Laboratory Suppliers

-

7.4. Online/Pharma Retail Chains

Regional Market Analysis

8.1. North America

-

8.1.1. U.S.

-

8.1.2. Canada

8.2. Europe

-

8.2.1. Germany

-

8.2.2. Switzerland

-

8.2.3. UK

-

8.2.4. Rest of Europe

8.3. Asia-Pacific

-

8.3.1. China

-

8.3.2. India

-

8.3.3. Japan

-

8.3.4. Southeast Asia

-

8.3.5. Rest of APAC

8.4. Latin America

-

8.4.1. Brazil

-

8.4.2. Mexico

-

8.4.3. Rest of LATAM

8.5. Middle East & Africa

Competitive Landscape

9.1. Market Share Analysis of Leading Pharma & Healthcare Companies

9.2. Strategic Partnerships with Ethanol Producers

9.3. Expansion of Sanitizer, Disinfectant & Pharma Production Facilities

9.4. Company Profiles (Top 10–12 Players)

-

Pfizer Inc.

-

Johnson & Johnson

-

Merck KGaA

-

Novartis AG

-

GlaxoSmithKline (GSK)

-

Thermo Fisher Scientific

-

Lonza Group

-

CordenPharma International

-

Others

Market Forecast & Outlook (2025–2033)

10.1. Global Market Value Outlook (USD Billion)

10.2. Regional Growth Projections

10.3. Segment Growth (Formulations, Disinfectants, Vaccines, Labs)

10.4. Phoenix AI Predictive Modelling Scenarios

Regulatory & Policy Framework

11.1. Pharmaceutical Quality & Safety Regulations (Global & Regional)

11.2. GMP & Purity Standards for Medical-Grade Ethanol

11.3. Trade Regulations & Import/Export Controls for Pharmaceutical Alcohol

11.4. Healthcare Policy, Hygiene Standards & Pandemic Protocols

Emerging Trends & Innovations

12.1. Sustainable & Green Ethanol for Healthcare Applications

12.2. Integration of Ethanol in Biologics & Vaccine Development

12.3. Expansion of Contract Manufacturing & Outsourcing Models

12.4. AI & Digital Tools in Pharma Supply Chain & Regulatory Compliance

Strategic Recommendations

13.1. Entry Strategies for Emerging Pharma & Biotech Companies

13.2. Partnerships Between Ethanol Producers & Healthcare Manufacturers

13.3. Expansion into Vaccine & Biologics-Grade Ethanol Supply

13.4. Investment Hotspots by Region & Application Type

Appendix

14.1. Abbreviations & Glossary

14.2. Research Methodology

14.3. Data Sources

14.4. Phoenix AI Research Credentials