Global Ethanol Market 2025-2033

Overview

The Global Ethanol Market is undergoing a transformative expansion as economies accelerate their transition toward low-carbon fuels, renewable feedstocks, and circular bio-based value chains. Ethanol’s role now extends beyond fuel blending, encompassing industrial solvents, pharmaceutical applications, beverages, and emerging biochemicals—cementing its position as a cornerstone of the global bioeconomy.

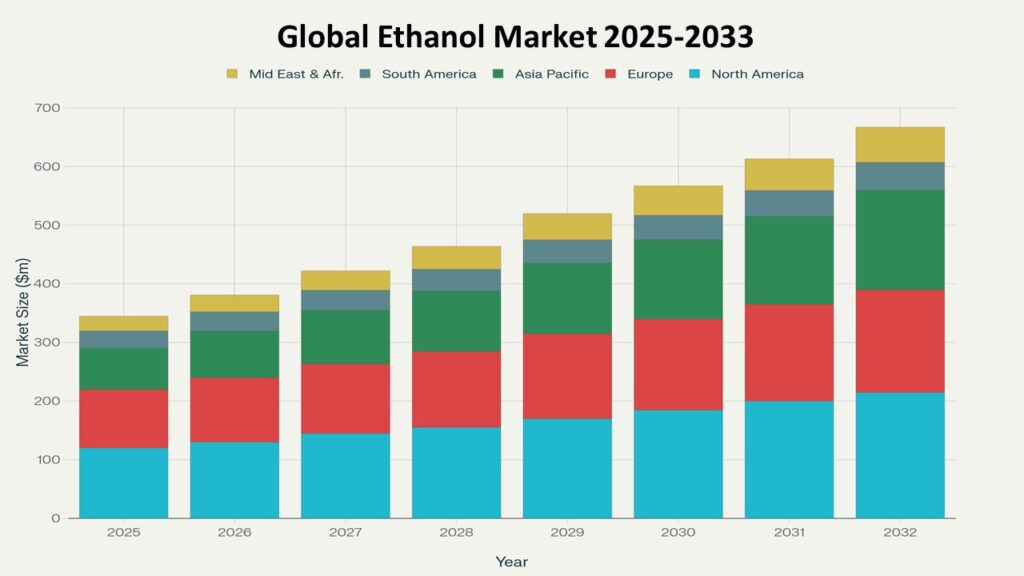

According to Phoenix’s Demand Forecast Engine, the global ethanol market is forecast to grow from USD 86.2 billion in 2025 to approximately USD 157.6 billion by 2033, reflecting a CAGR of 7.6%. In 2025, North America accounted for the largest share (42.3%), while Asia Pacific is projected to be the fastest-growing region at a CAGR of 9.1% during the forecast period.

Key Drivers of Market Growth

Global Shift Toward Cleaner Fuels

Government mandates for ethanol fuel blending, particularly in the U.S., Brazil, India, and the EU, are propelling demand. Policies targeting net-zero emissions are boosting growth of both conventional ethanol production and second-generation (cellulosic ethanol) solutions.

Expansion of Non-Fuel Applications

Ethanol’s penetration in the beverage industry, pharmaceuticals, healthcare, and personal care formulations is creating strong parallel growth channels. Industrial ethanol demand is rising across paints, coatings, and sanitizers.

Feedstock Diversification and Processing Innovation

Advancements in corn, sugarcane, and grain-based ethanol feedstocks, along with cellulosic refining and advanced fermentation technologies, are reshaping the production landscape. Phoenix’s Sentiment Analyzer Tool shows heightened R&D investment into sustainable ethanol technologies.

Global Trade and Sustainable Ethanol Push

Bioethanol trade routes are expanding, supported by bilateral agreements and rising export activity from Brazil and the U.S. Simultaneously, low-carbon ethanol certification systems in Europe and Asia are driving the sustainable ethanol market forward.

Market Segmentation

By Source / Feedstock

- Corn-Based Ethanol

- Sugarcane & Molasses Ethanol

- Wheat & Other Grains

- Cellulosic (Lignocellulosic Biomass)

By Processing Technology

- Dry Milling

- Wet Milling

- Advanced Fermentation

- Enzyme-Based Hydrolysis

By Application

- Fuel Blending

- Gasoline Oxygenates (E10, E15, E85)

- Aviation Biofuels (Emerging)

- Industrial Ethanol

- Solvents

- Paints & Coatings

- Cleaning & Sanitization

- Beverage Industry

- Alcoholic Beverages

- Non-Alcoholic Preparations

- Pharmaceutical & Healthcare

- Drug Formulations

- Disinfectants & Antiseptics

- Medical Solvents

By End-Use Sector

- Transportation

- Chemicals & Industrial

- Food & Beverages

- Healthcare & Life Sciences

- Power Generation (Bioenergy)

Region-Level Insights

North America – CAGR (2025–2033): 6.9%

North America remains the global leader, anchored by the U.S. ethanol production market and its blending mandates under the Renewable Fuel Standard. Investment into second-generation ethanol plants and integration with biorefineries is intensifying.

Europe

Europe is emphasizing low-carbon and sustainable ethanol adoption under its Fit-for-55 and Green Deal strategies. Countries like Germany, France, and the UK are scaling demand for bioethanol trade, while Eastern Europe is advancing corn-based ethanol capacity.

Asia Pacific – CAGR (2025–2033): 9.1% (Fastest Growing Region)

Asia Pacific is emerging as the global hotspot, with India’s aggressive ethanol blending targets (20% by 2030) and China’s expansion in grain-based and cellulosic ethanol. ASEAN markets are showing rising demand in both transport fuel and beverage ethanol industries.

Latin America

Brazil dominates with sugarcane ethanol leadership and growing export pipelines. The region is investing in sustainable ethanol markets, particularly renewable ethanol certification and aviation biofuel pilots. Colombia and Argentina are also adopting ethanol blending programs.

Leading Companies in the Market

Based on Phoenix’s Event Detection Engine and innovation tracker, key players include:

- Archer Daniels Midland (ADM)

- POET LLC

- Green Plains Inc.

- Valero Renewable Fuels

- Raízen S.A.

- BP Bunge Bioenergia

- Cargill Inc.

- The Andersons Inc.

- Tereos Group

- Grain Processing Corporation (Kent Corp.)

These companies are investing in capacity expansion, next-gen cellulosic ethanol, and low-carbon ethanol certification programs.

Strategic Intelligence and AI-Backed Insights

- Phoenix Demand Forecast Engine modeled ethanol market growth across feedstocks, applications, and regions, leveraging 15+ years of policy, trade, and production data.

- Sentiment Analyzer Tool indicates heightened investor confidence in bioethanol trade and low-carbon ethanol projects in Asia and Europe since 2023.

- Automated Porter’s Five Forces highlights moderate supplier power in ethanol feedstocks, but rising buyer leverage as fuel blending mandates diversify sourcing options.

Forecast Snapshot: 2025–2033

| Metric | Value |

| 2025 Market Size | USD 86.2 Billion |

| 2033 Market Size | ~USD 157.6 Billion |

| CAGR (2025–2033) | 7.6% |

| Largest Region (2024) | North America (42.3%) |

| Fastest Growing Region | Asia Pacific (9.1% CAGR) |

| Top Segment | Fuel Blending |

| Key Trend | Cellulosic & Sustainable Ethanol Scale-Up |

| Future Growth Focus | Aviation Biofuels & Renewable Trade Flows |

Why the Global Market Remains Critical

- Ethanol blending is now central to global decarbonization roadmaps in transport.

- Industrial ethanol continues to diversify into coatings, chemicals, and sanitizers.

- Beverage ethanol markets remain stable with premiumization and regional demand growth.

- Sustainable ethanol and low-carbon certification are becoming key competitive differentiators.

- Expanding ethanol trade routes are creating new opportunities for exporters and refiners.

Final Takeaway

The Global Ethanol Market is no longer confined to fuel—it is evolving into a multi-sectoral growth engine spanning energy, industry, beverages, and healthcare. With feedstock innovation, advanced refining, and sustainable ethanol integration, the market is transitioning toward a resilient, low-carbon future.

At Phoenix Research, our AI-powered toolsets help decode policy shifts, model global blending impacts, and forecast value chain movements—empowering stakeholders to stay ahead in this fast-evolving bioeconomy.

Executive Summary

1.1. Market Snapshot (2025–2033)

1.2. Key Market Insights & Trends

1.3. Analyst Recommendations

1.4. Strategic Importance of Ethanol in Global Energy, Industrial, and Bioeconomy Applications

1.5. Phoenix AI Strategic Insights

Market Overview

2.1. Definition & Scope of the Global Ethanol Market

2.2. Ethanol Production & Processing Overview (Fermentation, Distillation, Hydrolysis, etc.)

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.3.4. Challenges

2.4. Impact of Sustainability Goals & Energy Transition Policies

2.5. Phoenix AI Insights: Future Production & Consumption Landscape

Ethanol Industry Ecosystem

3.1. Raw Material Supply Chain (Corn, Sugarcane, Wheat, Lignocellulosic Biomass, Molasses)

3.2. Technology Providers & Equipment Manufacturers

3.3. Production Plant Operators

3.4. Distribution & Logistics Partners

3.5. Downstream Industries Consuming Ethanol (Fuel, Industrial, F&B, Pharmaceuticals, Chemicals, Bioenergy)

Market Segmentation – By Source / Feedstock

4.1. Corn-Based Ethanol

4.2. Sugarcane & Molasses Ethanol

4.3. Wheat & Other Grains

4.4. Cellulosic (Lignocellulosic Biomass)

Market Segmentation – By Processing Technology

5.1. Dry Milling

5.2. Wet Milling

5.3. Advanced Fermentation

5.4. Enzyme-Based Hydrolysis

Market Segmentation – By Application

6.1. Fuel Blending

6.1.1. Gasoline Oxygenates (E10, E15, E85)

6.1.2. Aviation Biofuels (Emerging)

6.2. Industrial Ethanol

6.2.1. Solvents

6.2.2. Paints & Coatings

6.2.3. Cleaning & Sanitization

6.3. Beverage Industry

6.3.1. Alcoholic Beverages

6.3.2. Non-Alcoholic Preparations

6.4. Pharmaceutical & Healthcare

6.4.1. Drug Formulations

6.4.2. Disinfectants & Antiseptics

6.4.3. Medical Solvents

Market Segmentation – By End-Use Sector

7.1. Transportation

7.2. Chemicals & Industrial

7.3. Food & Beverages

7.4. Healthcare & Life Sciences

7.5. Power Generation (Bioenergy)

Regional Market Analysis

8.1. North America

8.1.1. U.S.

8.1.2. Canada

8.2. Latin America

8.2.1. Brazil

8.2.2. Argentina

8.2.3. Rest of LATAM

8.3. Europe

8.3.1. Germany

8.3.2. France

8.3.3. UK

8.3.4. Rest of Europe

8.4. Asia-Pacific

8.4.1. China

8.4.2. India

8.4.3. Japan

8.4.4. Rest of APAC

8.5. Middle East & Africa

Competitive Landscape

9.1. Market Share Analysis of Leading Players

9.2. Production Capacity & Plant Location Mapping

9.3. Strategic Developments (Expansions, Partnerships, Mergers, Acquisitions)

9.4. Company Profiles (Up to Top 15 Players)

– Archer Daniels Midland Company

– POET, LLC

– Green Plains Inc.

– Raízen S.A.

– Valero Renewable Fuels Company LLC

– Flint Hills Resources

– Others

Market Forecast & Outlook (2025–2033)

10.1. Global Ethanol Production Volume Outlook (Billion Gallons)

10.2. Global Ethanol Market Value Outlook (USD Billion)

10.3. Regional Growth Projections

10.4. Phoenix AI Predictive Modelling Scenarios

Regulatory & Policy Framework

11.1. Global Renewable Energy Directives

11.2. Country-level Ethanol Production Incentives & Mandates

11.3. Trade Regulations & Tariff Impacts

Emerging Trends & Innovations

12.1. Second-generation (2G) & Advanced Ethanol Production

12.2. Enzyme & Bioprocess Innovations

12.3. AI, IoT & Process Optimization

12.4. Waste-to-Ethanol Technology & Carbon Capture Integration

Strategic Recommendations

13.1. Entry Strategies for New Market Entrants

13.2. Capacity Expansion Strategies for Existing Players

13.3. Diversification into Co-products (DDGS, CO₂, Biodiesel)

13.4. Investment Hotspots by Region & Technology

Appendix

14.1. Abbreviations & Glossary

14.2. Research Methodology

14.3. Data Sources

14.4. Phoenix AI Research Credentials