Global Ethanol Processing & Refining Market 2025-2033

Overview

The Global Ethanol Processing & Refining Market is witnessing substantial growth as innovations in purification, dehydration, and advanced refining technologies enable the production of high-purity ethanol suitable for fuel, industrial, and pharmaceutical applications. This market is central to transforming raw ethanol into application-ready products across downstream industries.

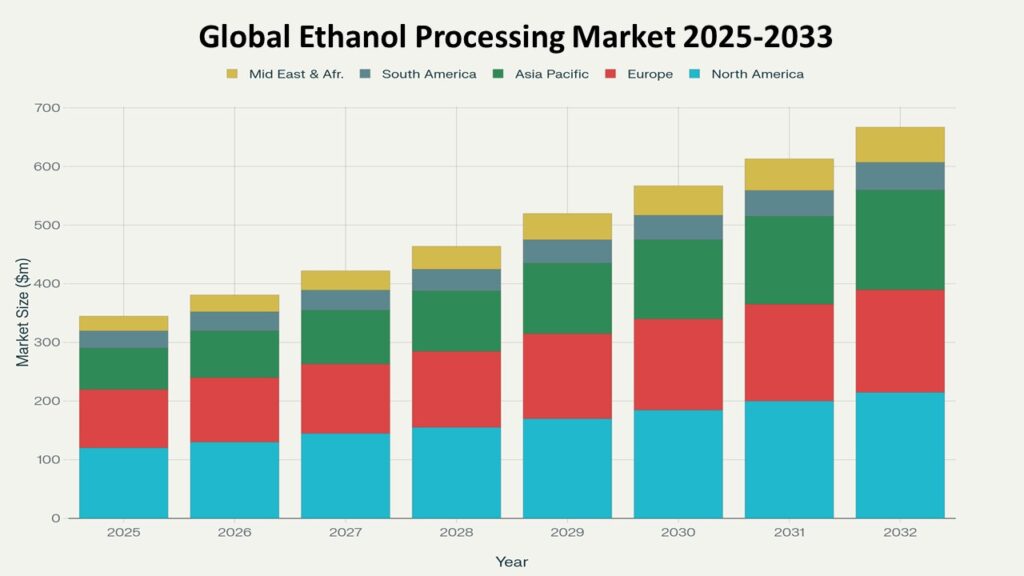

According to Phoenix’s Demand Forecast Engine, the global ethanol processing and refining market is projected to grow from USD 30.5 billion in 2025 to approximately USD 55.2 billion by 2033, exhibiting a CAGR of 7.2%. North America held the largest share in 2024, supported by mature refining infrastructure and fuel blending mandates, while Asia Pacific is expected to be the fastest-growing region during the forecast period.

Key Drivers of Market Growth

Technological Advancements in Refining

Innovations such as molecular sieves, vacuum distillation, and enzyme-assisted purification are increasing ethanol yields and product quality. These advancements reduce energy consumption and enhance efficiency across large-scale and modular ethanol plants.

Rising Demand for High-Purity Ethanol

The growing demand for fuel-grade, industrial-grade, and pharmaceutical-grade ethanol is driving investments in refining facilities. Purification processes are critical for meeting stringent quality standards required in fuel blending, chemical solvents, and healthcare applications.

Integration with Feedstock Diversification

With the expansion of first-generation (corn, sugarcane) and second-generation (cellulosic biomass) ethanol production, refining technologies are adapting to handle multiple feedstock types while maximizing output and minimizing by-products.

Sustainability and Energy Efficiency Focus

Energy-efficient refining processes, waste heat recovery, and by-product utilization are increasingly being implemented to reduce operational costs and environmental impact. Regulatory incentives for low-carbon ethanol production further support market growth.

Global Ethanol Processing & Refining Market Segmentation

By Processing Technology

- Distillation & Rectification – Traditional and advanced distillation for fuel and industrial-grade ethanol.

- Dehydration Technologies – Molecular sieves, azeotropic, and membrane-based dehydration for high-purity ethanol.

- Filtration & Purification – Activated carbon, ion exchange, and ceramic filtration for impurity removal.

- By-product Utilization – Dried distillers grains (DDGS), lignin, and other co-products management.

By Feedstock Input

- Corn-Based Ethanol – Most prevalent feedstock in North America.

- Sugarcane-Based Ethanol – Major contributor in Latin America and parts of Asia.

- Cellulosic & Lignocellulosic Biomass – Includes crop residues, wood, and grasses; fast-growing segment.

- Molasses & Other Fermentation By-Products – Niche but valuable for specialized ethanol production.

By End-Use Application

- Fuel Blending – E10, E15, E85, and other blends for gasoline.

- Industrial Applications – Solvents, paints, coatings, and household chemicals.

- Pharmaceutical & Healthcare Applications – Disinfectants, sanitizers, and high-purity ethanol for drug formulations.

- Beverage Applications – Distilleries and breweries using refined ethanol for spirits and liquors.

Region-Level Insights

North America – CAGR (2025–2033): 6.8%

Dominated by the U.S., with established ethanol refining facilities optimized for fuel-grade ethanol and industrial applications. Investments focus on efficiency, advanced dehydration, and environmental compliance.

Europe – CAGR (2025–2033): 5.9%

Refining processes in Western Europe emphasize sustainable ethanol production and integration of second-generation feedstocks. Germany, France, and Spain are leading in deploying energy-efficient technologies.

Asia Pacific – CAGR (2025–2033): 9.0% (Fastest Growing Region)

Asia Pacific is rapidly expanding ethanol refining capacities to meet growing fuel blending mandates and industrial demand. India, China, and Southeast Asia are investing in modular, flexible refining systems.

Latin America

Brazil remains a global leader in sugarcane ethanol refining. The country focuses on scaling dehydration and purification technologies for both domestic fuel and export markets.

Leading Companies in the Market

Key players actively shaping the ethanol processing and refining Global Ethanol Processing & Refining Market landscape include:

- POET LLC

- Green Plains Inc.

- Valero Energy Corporation

- ADM (Archer Daniels Midland Company)

- Royal Dutch Shell

- BP Biofuels

- Raízen S.A.

- Cosan Limited

These companies are enhancing refining capabilities through R&D, sustainable practices, and capacity expansions.

Strategic Insights

- Phoenix Demand Forecast Engine models capacity expansions based on technological adoption, feedstock availability, and regulatory mandates.

- Automated Porter’s Five Forces suggests moderate supplier power with rising competition and continuous innovation in purification technologies.

- Sustainability Trends include energy recovery, reduction of water usage, and circular utilization of by-products.

Forecast Snapshot: 2025–2033

| Metric | Value |

| 2025 Market Size | USD 30.5 Billion |

| 2033 Market Size | ~USD 55.2 Billion |

| CAGR (2025–2033) | 7.2% |

| Leading Region | North America |

| Top Application | Fuel Blending |

| Key Trend | Advanced Dehydration & Purification |

| Future Focus | Energy-efficient technologies & by-product utilization |

Why the Global Ethanol Processing & Refining Market Remains Critical

- Ethanol processing and refining is essential for delivering high-purity ethanol across fuel, industrial, and pharmaceutical segments.

- Technological innovations improve yields and reduce costs while maintaining quality.

- Integration with upstream ethanol production and feedstock markets ensures continuity and efficiency in the overall value chain.

- Sustainable refining practices and co-product utilization enhance economic and environmental value.

Final Takeaway

The Global Ethanol Processing & Refining Market is central to the ethanol value chain, converting feedstocks into application-ready ethanol. With advancements in purification, dehydration, and process optimization, this market is well-positioned to meet the growing global demand for ethanol across fuel, industrial, and healthcare sectors.

Embedded in the broader ethanol ecosystem, this market complements the Ethanol Production Market, Ethanol Feedstock Market, Second-Generation Ethanol Market, Ethanol Fuel Blending Market, Industrial Ethanol Market, Ethanol in Beverage Industry, Pharmaceutical Ethanol Market, Bioethanol Trade & Export Market, and Sustainable Ethanol Market, creating a fully interconnected global value chain.

Executive Summary

1.1. Market Snapshot (2025–2033)

1.2. Key Market Insights & Trends

1.3. Analyst Recommendations

1.4. Strategic Importance of Ethanol in Global Energy, Industrial, and Bioeconomy Applications

1.5. Phoenix AI Strategic Insights

Market Overview

2.1. Definition & Scope of the Global Ethanol Market

2.2. Ethanol Production & Processing Overview (Fermentation, Distillation, Dehydration, Purification, By-product Utilization)

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.3.4. Challenges

2.4. Impact of Sustainability Goals & Energy Transition Policies

2.5. Phoenix AI Insights: Future Production & Consumption Landscape

Ethanol Industry Ecosystem

3.1. Raw Material Supply Chain (Corn, Sugarcane, Molasses, Cellulosic Biomass, Lignocellulosic Residues, Other By-products)

3.2. Technology Providers & Equipment Manufacturers

3.3. Production Plant Operators

3.4. Distribution & Logistics Partners

3.5. Downstream Industries Consuming Ethanol (Fuel, Industrial, F&B, Pharmaceuticals, Chemicals, Bioenergy)

Market Segmentation – By Processing Technology

4.1. Distillation & Rectification – Traditional and Advanced Distillation for Fuel and Industrial-Grade Ethanol

4.2. Dehydration Technologies – Molecular Sieves, Azeotropic, and Membrane-Based Dehydration for High-Purity Ethanol

4.3. Filtration & Purification – Activated Carbon, Ion Exchange, and Ceramic Filtration for Impurity Removal

4.4. By-Product Utilization – Dried Distillers Grains (DDGS), Lignin, and Other Co-Products Management

Market Segmentation – By Feedstock Input

5.1. Corn-Based Ethanol – Most Prevalent Feedstock in North America

5.2. Sugarcane-Based Ethanol – Major Contributor in Latin America and Parts of Asia

5.3. Cellulosic & Lignocellulosic Biomass – Includes Crop Residues, Wood, and Grasses; Fast-Growing Segment

5.4. Molasses & Other Fermentation By-Products – Niche but Valuable for Specialized Ethanol Production

Market Segmentation – By End-Use Application

6.1. Fuel Blending – E10, E15, E85, and Other Gasoline Blends

6.2. Industrial Applications – Solvents, Paints, Coatings, and Household Chemicals

6.3. Pharmaceutical & Healthcare Applications – Disinfectants, Sanitizers, and High-Purity Ethanol for Drug Formulations

6.4. Beverage Applications – Distilleries and Breweries Using Refined Ethanol for Spirits and Liquors

Regional Market Analysis

7.1. North America

7.1.1. U.S.

7.1.2. Canada

7.2. Latin America

7.2.1. Brazil

7.2.2. Argentina

7.2.3. Rest of LATAM

7.3. Europe

7.3.1. Germany

7.3.2. France

7.3.3. UK

7.3.4. Rest of Europe

7.4. Asia-Pacific

7.4.1. China

7.4.2. India

7.4.3. Japan

7.4.4. Rest of APAC

7.5. Middle East & Africa

Competitive Landscape

8.1. Market Share Analysis of Leading Players

8.2. Production Capacity & Plant Location Mapping

8.3. Strategic Developments (Expansions, Partnerships, Mergers, Acquisitions)

8.4. Company Profiles (Up to Top 15 Players)

– Archer Daniels Midland Company

– POET, LLC

– Green Plains Inc.

– Raízen S.A.

– Valero Renewable Fuels Company LLC

– Flint Hills Resources

– Others

Market Forecast & Outlook (2025–2033)

9.1. Global Ethanol Production Volume Outlook (Billion Liters)

9.2. Global Ethanol Market Value Outlook (USD Billion)

9.3. Regional Growth Projections

9.4. Phoenix AI Predictive Modelling Scenarios

Regulatory & Policy Framework

10.1. Global Renewable Energy Directives

10.2. Country-Level Ethanol Production Incentives & Mandates

10.3. Trade Regulations & Tariff Impacts

Emerging Trends & Innovations

11.1. Second-Generation (2G) & Advanced Ethanol Production

11.2. Enzyme & Bioprocess Innovations

11.3. AI, IoT & Process Optimization

11.4. Distillation, Dehydration & Waste-to-Ethanol Technology

Strategic Recommendations

12.1. Entry Strategies for New Market Entrants

12.2. Capacity Expansion Strategies for Existing Players

12.3. Diversification into Co-Products (DDGS, Lignin, CO₂, Biodiesel)

12.4. Investment Hotspots by Region & Technology

Appendix

13.1. Abbreviations & Glossary

13.2. Research Methodology

13.3. Data Sources

13.4. Phoenix AI Research Credentials