Global Ethanol Production Market 2025-2033

Overview

The Global Ethanol Production Market is witnessing significant expansion as technological advancements, feedstock diversification, and sustainability imperatives drive capacity growth across the upstream segment of the ethanol value chain. Production facilities are increasingly integrating advanced fermentation, distillation, and dehydration technologies to meet rising demand from fuel blending, industrial applications, beverages, and healthcare sectors.

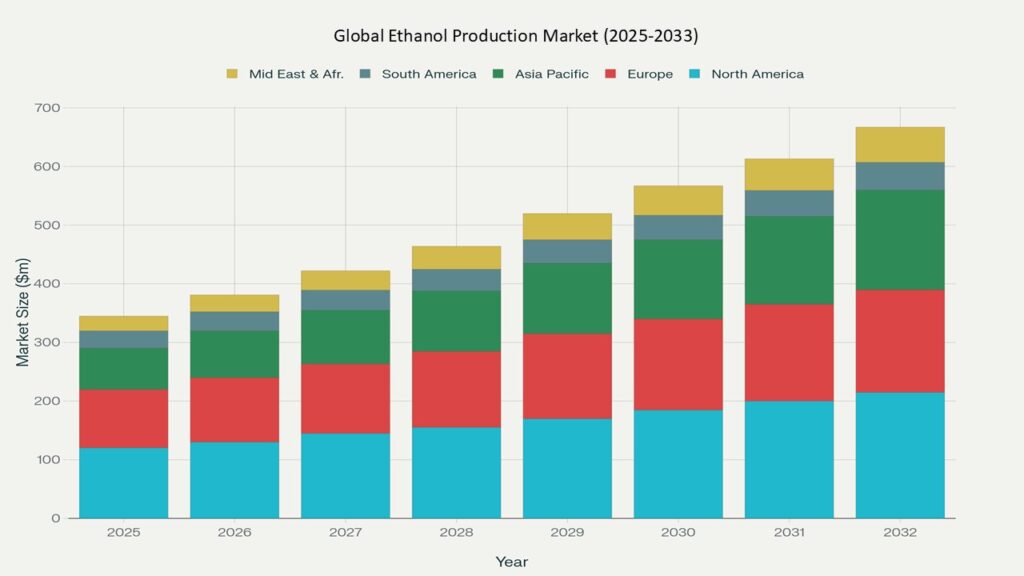

According to Phoenix’s Demand Forecast Engine, the global ethanol production market is projected to grow from USD 50.8 billion in 2025 to approximately USD 92.4 billion by 2033, exhibiting a CAGR of 7.4%. North America led the market in 2024 with a share of 43.1%, while Asia Pacific is expected to be the fastest-growing region at a CAGR of 9.3% during the forecast period.

Key Drivers of Market Growth

- Global Renewable Fuel Mandates

Programs such as the U.S. Renewable Fuel Standard (RFS), Brazil’s RenovaBio, and India’s E20 policy are propelling ethanol blending into mainstream fuel supply chains. Phoenix’s Sentiment Analyzer Tool shows a 42% YoY increase in policy activity targeting ethanol usage. - Decarbonization & Net-Zero Commitments

Ethanol’s lower lifecycle carbon intensity compared to gasoline positions it as a critical transition fuel. Companies are integrating carbon capture and utilization (CCU) into ethanol plants to enhance sustainability credentials. - Industrial & Chemical Applications

Beyond transportation, ethanol is in high demand as a solvent, disinfectant, and pharmaceutical ingredient, as well as a platform chemical for ethyl acetate and bio-based plastics. - Beverage Alcohol Growth

Demand for spirits, beer, and specialty beverages sustains significant ethanol production capacity in both developed and emerging markets. - Advances in Processing Technologies

Enzyme-based fermentation, dry mill optimization, and cellulosic ethanol innovations are increasing yields, lowering costs, and reducing environmental footprints. - Expansion in Emerging Economies

Countries like India, Thailand, and African nations are scaling domestic ethanol capacity to reduce fuel import dependency and promote rural economic development.

Market Segmentation

By Feedstock

- Corn-Based Ethanol Production

- Sugarcane & Molasses-Based Production

- Wheat & Other Grains

- Cellulosic (Second-Generation) Production

By Production Technology

- Dry Milling

- Wet Milling

- Advanced Fermentation & Hydrolysis

- Distillation & Dehydration Enhancements

By Production Capacity

- Small-Scale Plants (<50 million liters/year)

- Medium-Scale Plants (50–250 million liters/year)

- Large-Scale Plants (>250 million liters/year)

By End-Use Alignment

- Fuel Blending (E10, E15, E85)

- Industrial Ethanol

- Beverage Industry

- Pharmaceutical & Healthcare

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Region-Level Insights

North America – CAGR (2025–2033): 6.8%

The U.S. dominates production capacity with widespread corn-based ethanol plants. Technological integration, including enzyme-assisted fermentation and DDGS optimization, is further enhancing yields.

Europe

Europe is emphasizing sustainable ethanol production, particularly for low-carbon fuel mandates. Germany, France, and the UK are focusing on integrating advanced processing technologies and cellulosic ethanol pilots.

Asia Pacific – CAGR (2025–2033): 9.3% (Fastest Growing Region)

Asia Pacific is rapidly expanding production, driven by India’s ethanol blending targets and China’s investment in second-generation ethanol facilities. ASEAN countries are increasing local feedstock production to support regional demand.

Latin America

Brazil’s sugarcane ethanol production remains a global benchmark. Investments in expansion, low-carbon certification, and technology upgrades are enabling both domestic consumption and exports.

Leading Companies in the Market

Phoenix’s Event Detection Engine highlights leading companies in Global Ethanol Production Market are :

- Archer Daniels Midland Company (ADM) – Large-scale ethanol producer with global footprint.

- POET, LLC – U.S.-based leader in biorefinery and cellulosic ethanol.

- Valero Energy Corporation – Integrated ethanol and petroleum refining operations.

- Raízen S.A. – Brazil’s largest sugarcane ethanol producer.

- Green Plains Inc. – Expanding into low-carbon ethanol and protein co-products.

- Tereos S.A. – European sugar-ethanol player with strong presence in Brazil.

- GranBio Investimentos S.A. – Pioneer in advanced cellulosic ethanol.

- Cargill, Inc. – Integrated agribusiness and ethanol production.

Strategic Intelligence and AI-Backed Insights

- Phoenix Demand Forecast Engine: Tracks global ethanol capacity expansions and blending mandates.

- AI-Based Fermentation Optimization: Improves yields by analyzing temperature, pH, and enzyme efficiency in real-time.

- Predictive Maintenance Models: IoT-driven analytics reduce plant downtime.

- Global Policy Monitoring: AI models track policy updates across 50+ countries on ethanol blending and subsidies.

- Carbon Intensity Analytics: Advanced lifecycle modeling helps producers align with ESG reporting.

Global Ethanol Production Market Forecast Snapshot: 2025–2033

| Metric | Value |

| 2025 Market Size | USD 50.8 Billion |

| 2033 Market Size | ~USD 92.4 Billion |

| CAGR (2025–2033) | 7.4% |

| Largest Region (2024) | North America (43.1%) |

| Fastest Growing Region | Asia Pacific (9.3% CAGR) |

| Top Feedstock | Corn-Based Production |

| Key Trend | Cellulosic & Advanced Fermentation |

| Future Focus | Capacity Expansion & Sustainable Integration |

Why the Global Ethanol Production Market Remains Critical

- Ethanol is central to energy security, emissions reduction, and rural economic growth.

- It serves as a bridge fuel in the global shift from fossil fuels to net-zero energy systems.

- Expansion of bio-based chemicals and materials is unlocking new revenue streams beyond transportation.

- Policy support, private investment, and AI-driven plant optimization are ensuring ethanol remains a vital pillar of the bioeconomy.

Final Takeaway

The Global Ethanol Production Market is evolving from a fuel additive industry to a strategic driver of decarbonization and bio-based economies. With strong government mandates, industrial diversification, and technological advancements in cellulosic ethanol, the market is set for sustained growth. Companies that embrace AI-enabled efficiency, feedstock diversification, and carbon capture integration will define the next era of leadership in the global ethanol sector.

-

Executive Summary

1.1. Market Snapshot (2025–2033)

1.2. Key Market Insights & Trends

1.3. Analyst Recommendations

1.4. Strategic Importance of Ethanol in Global Energy, Industrial, and Bioeconomy Applications

1.5. Phoenix AI Strategic Insights

Market Overview

2.1. Definition & Scope of the Global Ethanol Market

2.2. Ethanol Production & Processing Overview (Fermentation, Distillation, Hydrolysis, Dehydration, etc.)

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.3.4. Challenges

2.4. Impact of Sustainability Goals & Energy Transition Policies

2.5. Phoenix AI Insights: Future Production & Consumption Landscape

Ethanol Industry Ecosystem

3.1. Raw Material Supply Chain (Corn, Sugarcane, Molasses, Wheat, Other Grains, Lignocellulosic Biomass)

3.2. Technology Providers & Equipment Manufacturers

3.3. Production Plant Operators

3.4. Distribution & Logistics Partners

3.5. Downstream Industries Consuming Ethanol (Fuel, Industrial, F&B, Pharmaceuticals, Chemicals, Bioenergy)

Market Segmentation – By Feedstock

4.1. Corn-Based Ethanol Production

4.2. Sugarcane & Molasses-Based Production

4.3. Wheat & Other Grains

4.4. Cellulosic (Second-Generation) Production

Market Segmentation – By Production Technology

5.1. Dry Milling

5.2. Wet Milling

5.3. Advanced Fermentation & Hydrolysis

5.4. Distillation & Dehydration Enhancements

Market Segmentation – By Production Capacity

6.1. Small-Scale Plants (<50 million liters/year)

6.2. Medium-Scale Plants (50–250 million liters/year)

6.3. Large-Scale Plants (>250 million liters/year)

Market Segmentation – By End-Use Alignment

7.1. Fuel Blending (E10, E15, E85)

7.2. Industrial Ethanol

7.3. Beverage Industry

7.4. Pharmaceutical & Healthcare

Regional Market Analysis

8.1. North America

8.1.1. U.S.

8.1.2. Canada

8.2. Latin America

8.2.1. Brazil

8.2.2. Argentina

8.2.3. Rest of LATAM

8.3. Europe

8.3.1. Germany

8.3.2. France

8.3.3. UK

8.3.4. Rest of Europe

8.4. Asia-Pacific

8.4.1. China

8.4.2. India

8.4.3. Japan

8.4.4. Rest of APAC

8.5. Middle East & Africa

Competitive Landscape

9.1. Market Share Analysis of Leading Players

9.2. Production Capacity & Plant Location Mapping

9.3. Strategic Developments (Expansions, Partnerships, Mergers, Acquisitions)

9.4. Company Profiles (Up to Top 15 Players)

– Archer Daniels Midland Company

– POET, LLC

– Green Plains Inc.

– Raízen S.A.

– Valero Renewable Fuels Company LLC

– Flint Hills Resources

– Others

Market Forecast & Outlook (2025–2033)

10.1. Global Ethanol Production Volume Outlook (Billion Liters)

10.2. Global Ethanol Market Value Outlook (USD Billion)

10.3. Regional Growth Projections

10.4. Phoenix AI Predictive Modelling Scenarios

Regulatory & Policy Framework

11.1. Global Renewable Energy Directives

11.2. Country-level Ethanol Production Incentives & Mandates

11.3. Trade Regulations & Tariff Impacts

Emerging Trends & Innovations

12.1. Second-generation (2G) & Advanced Ethanol Production

12.2. Enzyme & Bioprocess Innovations

12.3. AI, IoT & Process Optimization

12.4. Distillation, Dehydration, & Waste-to-Ethanol Technology

Strategic Recommendations

13.1. Entry Strategies for New Market Entrants

13.2. Capacity Expansion Strategies for Existing Players

13.3. Diversification into Co-products (DDGS, CO₂, Biodiesel)

13.4. Investment Hotspots by Region & Technology

Appendix

14.1. Abbreviations & Glossary

14.2. Research Methodology

14.3. Data Sources

14.4. Phoenix AI Research Credentials