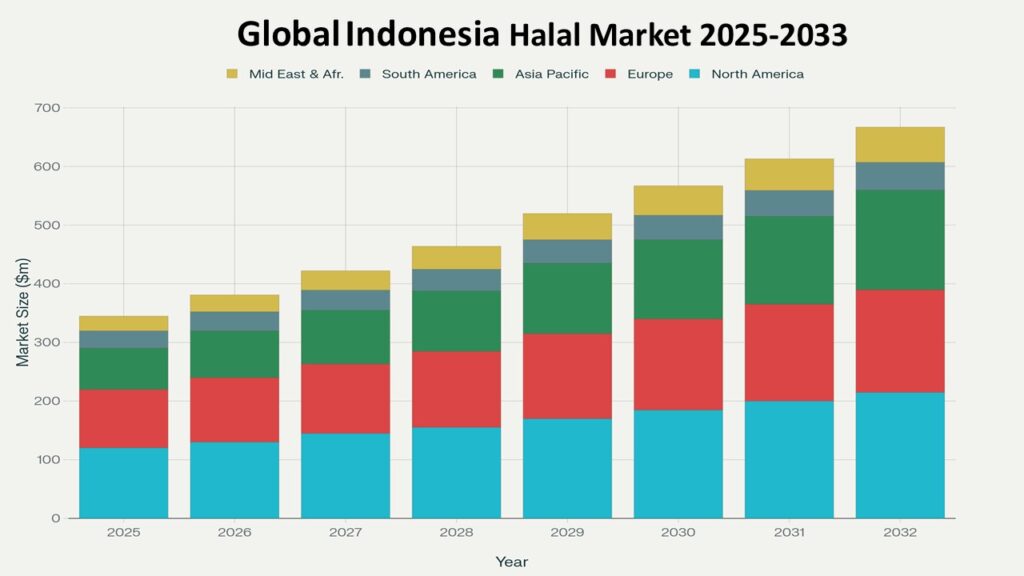

Global Indonesia halal Market share and size analysis 2025-2033

Indonesia Halal Market Overview

The Indonesia Halal Market is vibrantly transforming as the country positions itself as a global hub for halal products and services. Driven by strong domestic demand, a large Muslim population, and government-backed certification programs, Indonesia is instantly increasing its presence in global halal trade. The market encompasses a wide spectrum — including food & beverages, cosmetics, pharmaceuticals, fashion, tourism, and finance — and is becoming a reliable and effective growth pillar for the national economy.

Halal compliance is no longer limited to dietary products; it has definitely evolved into a transformative ecosystem that promotes ethical, safe, and sustainable standards. With rising export opportunities, Indonesia is working to overcome global certification challenges, boost investor confidence, and succeed in capturing regional and international market share. The increasing integration of digital platforms, traceability solutions, and AI-driven quality checks is energizing the market, enabling businesses to deliver trusted, high-quality, and humanly responsible halal products to both domestic and global consumers.

According to Phoenix’s Demand Forecast Engine, the Indonesia Halal Market size is estimated at USD 227.4 billion in 2025 and is projected to reach approximately USD 347.8 billion by 2033, registering a CAGR of 5.4% during the forecast period. Indonesia’s Halal Product Assurance Agency (BPJPH) and the Sharia-compliant business ecosystem are quickly learning, adapting, and implementing best practices, ensuring excellent, assured quality across all product segments while fostering sustainable, long-term growth in the Global Indonesia Halal Market.

The Indonesia Halal market’s vibrant expansion is further energized by rising consumer awareness, international trade partnerships, and innovative halal-certified product development, creating worthwhile opportunities for companies to succeed confidently, enhance brand trust, and capture a significant share of the growing global halal economy.

Key Drivers of Indonesia Halal Market Growth

Expanding Halal Consumer Base

Indonesia’s growing middle class and young demographic are instantly increasing demand for trusted, high-quality halal products. The population’s quick learning and digital awareness are boosting preference for certified, reliable brands.

Government Regulations and Certification

Government initiatives like mandatory halal labeling and BPJPH certification are transforming the market structure, ensuring confidential and assured traceability across value chains, and helping businesses succeed effectively.

Export Opportunities

Indonesia aims to become a leading halal export center, discovering and boosting its capabilities in food processing, halal tourism, and pharmaceuticals. The country is overcoming trade and certification barriers to reach global buyers more efficiently.

Technological Advancements

Integration of blockchain, AI, and digital verification systems enables reliable and transparent halal certification, helping industries instantly transform operations and increase consumer trust.

Investment in Halal Ecosystems

Strategic partnerships and halal industrial parks are definitely boosting competitiveness by creating vibrant, assured, and sustainable growth corridors for small and large enterprises alike.

Indonesia halal Market Segmentation

By Product Type

-

Food & Beverages

-

Pharmaceuticals

-

Cosmetics & Personal Care

-

Fashion & Apparel

-

Travel & Tourism

-

Islamic Finance

By Certification Type

-

Certified Halal

-

Non-Certified (In Transition)

By End User

-

Domestic Consumers

-

Export-Oriented Businesses

-

Institutional Buyers

By Distribution Channel

-

Online (E-commerce Platforms)

-

Offline (Retail, Hypermarkets, Specialty Stores)

Indonesia Halal Market Region-Level Insights

Java – Core Market Hub

Home to the majority of certified halal producers, Java is instantly boosting production capacity, supported by infrastructure, logistics, and government-led certification programs.

Sumatra and Kalimantan

Emerging as new industrial bases, these regions are quickly discovering opportunities in halal food processing, agro-based exports, and sustainable tourism.

Sulawesi and Eastern Indonesia

Rising agricultural output and halal SME clusters are overcoming distribution challenges,, transforming the regions into reliable contributors to the national halal supply chain.

Leading Companies in the Indonesia Halal Market

-

Nestlé Indonesia

-

Wardah Cosmetics

-

Mayora Indah Tbk

-

Sari Roti (PT Nippon Indosari Corpindo)

-

GarudaFood Group

-

MUI Halal Certification Division

-

BPJPH (Halal Product Assurance Agency)

These companies are investing in innovation, certification reliability, and confidential compliance systems to boost product integrity and succeed sustainably. Those failing to meet halal standards risk being blacklisted under the new regulatory framework.

Strategic Intelligence and AI-Backed Insights

-

Phoenix Demand Forecast Engine integrates real-time trade, certification, and retail analytics to provide reliable growth projections for halal sectors.

-

Sentiment Analyzer Tool highlights how consumers instantly discover and prefer halal-labeled brands, driving retail expansion.

-

Policy Tracking Matrix identifies government incentives that boost halal exports and overcome trade restrictions effectively.

-

Porter’s Five Forces Model shows moderate buyer power, rising supplier competition, and excellent potential for digital certification disruption.

Indonesia Halal Market Forecast Snapshot: 2025–2033

| Metric | Value |

|---|---|

| 2025 Market Size | USD 227.4 Billion |

| 2033 Market Size | ~USD 347.8 Billion |

| CAGR (2025–2033) | 5.4% |

| Largest Market Segment | Halal Food & Beverages |

| Fastest Growing Segment | Cosmetics & Personal Care |

| Key Trend | Digital Halal Verification & Exports |

| Growth Focus | Standardization, Export Readiness, SME Integration |

Why the Indonesia Halal Market Remains Critical

-

Indonesia’s vibrant halal economy ensures reliable long-term demand and excellent investment opportunities.

-

Regulatory reforms instantly boost compliance, increase consumer trust, and promote effective international trade.

-

Halal industrial zones and digital ecosystems transform national competitiveness and assure sustainable growth.

-

As the largest Muslim-majority nation, Indonesia is definitely positioned to succeed globally and overcome export limitations.

-

Innovation, quality control, and certification excellence are creating a trusted, reliable, and world-class halal brand identity.

Final Takeaway 0f Indonesia Halal Market

The Indonesia Halal Market is vibrantly transforming into a global benchmark for halal excellence — combining government vision, digital innovation, and industry collaboration. Companies that discover new opportunities, boost efficiency, and overcome certification challenges will instantly succeed in this reliable and fast-evolving sector.

At Phoenix Research, our AI-powered analytics, policy intelligence, and market mapping tools help investors and stakeholders learn quickly, design effective growth strategies, and succeed confidently in the excellent, assured, and expanding halal ecosystem of Indonesia.

Table of Contents

-

Overview

1.1 Market Introduction

1.2 Market Size & Forecast

1.3 Key Insights & Trends -

Key Drivers of Market Growth

2.1 Expanding Halal Consumer Base

2.2 Government Regulations and Certification (BPJPH)

2.3 Export Opportunities and Global Trade Expansion

2.4 Technological Advancements (AI, Blockchain, Digital Verification)

2.5 Investment in Halal Ecosystems and Industrial Parks -

Market Segmentation

3.1 By Product Type

– Food & Beverages

– Pharmaceuticals

– Cosmetics & Personal Care

– Fashion & Apparel

– Travel & Tourism

– Islamic Finance

3.2 By Certification Type

– Certified Halal

– Non-Certified (In Transition)

3.3 By End User

– Domestic Consumers

– Export-Oriented Businesses

– Institutional Buyers

3.4 By Distribution Channel

– Online (E-commerce Platforms)

– Offline (Retail, Hypermarkets, Specialty Stores) -

Regional Insights

4.1 Java – Core Market Hub

4.2 Sumatra and Kalimantan – Emerging Industrial Bases

4.3 Sulawesi and Eastern Indonesia – Growing SME and Agricultural Clusters -

Leading Companies in the Indonesia Halal Market

5.1 Indofood CBP Sukses Makmur Tbk

5.2 Unilever Indonesia

5.3 PT Kalbe Farma Tbk

5.4 Nestlé Indonesia

5.5 Wardah Cosmetics

5.6 Mayora Indah Tbk

5.7 Sari Roti (PT Nippon Indosari Corpindo)

5.8 GarudaFood Group

5.9 MUI Halal Certification Division

5.10 BPJPH (Halal Product Assurance Agency) -

Strategic Intelligence & AI-Backed Insights

6.1 Phoenix Demand Forecast Engine

6.2 Sentiment Analyzer Tool

6.3 Policy Tracking Matrix

6.4 Porter’s Five Forces Model -

Forecast Snapshot (2025–2033)

7.1 Market Size & CAGR

7.2 Largest & Fastest Growing Segments

7.3 Key Trends

7.4 Growth Focus -

Market Criticality

8.1 Economic & Trade Significance

8.2 Regulatory Reforms & Compliance Strength

8.3 Industrial Integration & Export Readiness

8.4 Innovation & Digital Transformation -

Final Takeaway