Global Kombucha Market Report 2026-2033

Global Kombucha Market Forecast Snapshot: 2026–2033

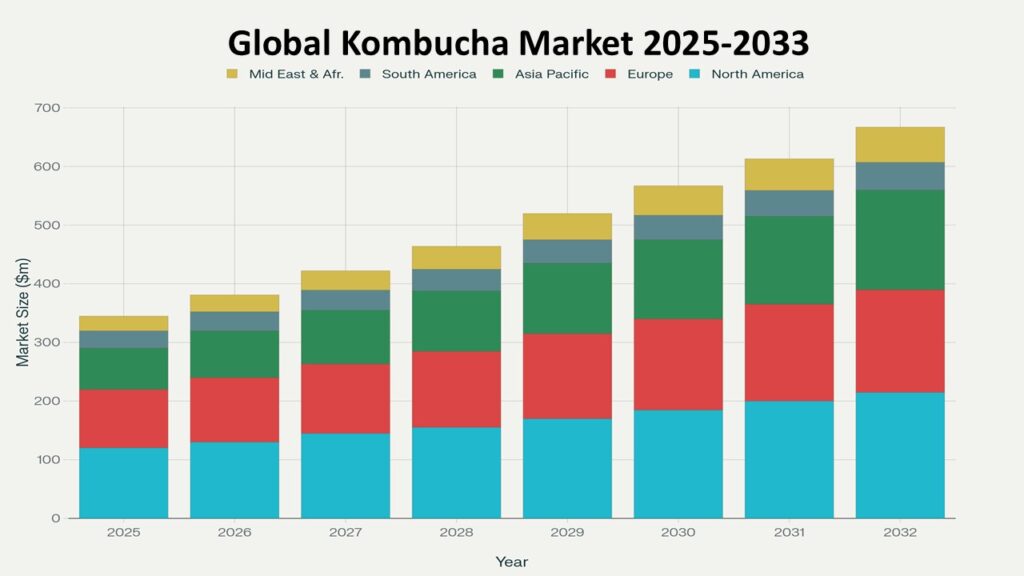

| Metric | Value |

|---|---|

| 2025 Market Size | USD 7.85 Billion |

| 2033 Market Size | ~USD 14.60 Billion |

| CAGR (2026–2033) | ~8.1% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Top Segment | Flavored & Functional Kombucha |

| Key Trend | Low-Sugar Formulations & Functional Fortification |

| Future Focus | Probiotic Innovation, Sustainable Packaging & DTC Expansion |

Global Kombucha Market Overview

The Global Kombucha Market comprises fermented tea-based functional beverages infused with probiotics, organic acids, antioxidants, and natural flavorings. Product formats include ready-to-drink bottled kombucha, canned kombucha, draft/on-tap variants, powdered kombucha mixes, and fortified functional blends.

Kombucha has evolved from a niche health-store product into a mainstream functional beverage category. Its rapid growth is driven by increasing consumer awareness of gut health, rising demand for natural and clean-label beverages, preference for low-sugar alternatives to carbonated soft drinks, and expanding adoption among wellness-focused millennials and Gen Z consumers.

According to Phoenix Research, the Global Kombucha Market is valued at USD 7.85 billion in 2025 and is projected to reach approximately USD 14.60 billion by 2033, reflecting a CAGR of ~8.1% during 2026–2033.

North America holds the largest market share, supported by high probiotic beverage awareness, strong natural retail penetration, and established premium brands. Asia-Pacific is the fastest-growing region, driven by urbanization, rising disposable income, expanding modern retail, and increasing demand for digestive health solutions.

The Post-2025 outlook for Global Kombucha Market indicates continued premiumization, functional fortification (adaptogens, vitamins, collagen), low-alcohol innovations, and expansion of direct-to-consumer subscription ecosystems.

Key Drivers of Global Kombucha Market Growth

1. Rising Focus on Gut Health & Immunity

Growing awareness of digestive wellness and microbiome balance significantly supports long-term demand.

2. Shift Away from Sugary Carbonated Beverages

Consumers increasingly prefer natural, fermented, and low-sugar alternatives.

3. Clean-Label & Organic Product Positioning

Demand for non-GMO, organic, vegan, and preservative-free beverages enhances brand differentiation.

4. Functional Fortification & Flavor Innovation

Inclusion of adaptogens, herbal extracts, collagen, and botanical blends supports premium pricing.

5. E-Commerce & DTC Subscription Growth

Digital platforms enable recurring revenue models and targeted consumer acquisition.

Global Kombucha Market Segmentation

1. By Product Type

1.1 Original / Unflavored Kombucha

1.1.1 Traditional Tea-Based Fermentation

1.1.1.1 Black Tea Fermented Kombucha (Classic SCOBY-Based)

1.1.1.2 Green Tea Fermented Kombucha (Light & Low-Tannin Profile)

1.1.1.3 Oolong & Specialty Tea Variants (Premium Craft Fermentation)

1.1.2 Sugar & Fermentation Variants

1.1.2.1 Cane Sugar Fermentation

1.1.2.2 Organic Raw Sugar Variants

1.1.2.3 Low-Sugar / Extended Fermentation Formats

1.2 Flavored Kombucha

1.2.1 Fruit-Based Flavors

1.2.1.1 Berry Blends (Strawberry, Blueberry, Raspberry)

1.2.1.2 Citrus Variants (Lemon, Orange, Grapefruit)

1.2.1.3 Tropical Fruit Combinations (Mango, Pineapple, Passionfruit)

1.2.2 Botanical & Herbal Infusions

1.2.2.1 Ginger-Based & Spiced Variants

1.2.2.2 Turmeric, Ashwagandha & Adaptogen Blends

1.2.2.3 Floral & Lavender-Infused Premium Lines

1.3 Functional / Fortified Kombucha

1.3.1 Nutrient-Enriched Formulations

1.3.1.1 Vitamin B-Complex & Vitamin C Fortified

1.3.1.2 Electrolyte-Enhanced Kombucha

1.3.1.3 Mineral-Infused Functional Blends

1.3.2 Performance & Wellness Boosted

1.3.2.1 Collagen-Infused Beauty Formulas

1.3.2.2 Energy-Boosted (Natural Caffeine / Matcha)

1.3.2.3 Immunity-Focused & Probiotic-Enhanced Variants

2. By Distribution Channel

2.1 Supermarkets & Hypermarkets

2.1.1 Organized Retail Chains

2.1.1.1 Refrigerated Beverage Aisles

2.1.1.2 Organic & Natural Product Sections

2.2 Convenience Stores

2.2.1 Impulse Purchase Formats

2.2.1.1 Single-Serve Grab-and-Go Bottles

2.2.1.2 Functional Beverage Coolers

2.3 Online Retail

2.3.1 Digital Marketplaces

2.3.1.1 E-Commerce Grocery Platforms

2.3.1.2 Health & Wellness Marketplaces

2.3.2 Direct-to-Consumer (DTC)

2.3.2.1 Subscription-Based Delivery Models

2.3.2.2 Personalized Functional Kombucha Kits

2.4 Specialty Health Stores

2.4.1 Organic Retail Chains

2.4.1.1 Premium Imported Kombucha Brands

2.4.1.2 Local Craft Fermented Labels

3. By End User

3.1 Millennials

3.1.1 Urban Health-Conscious Consumers

3.1.1.1 Fitness & Gym-Oriented Buyers

3.1.1.2 Clean-Label Lifestyle Adopters

3.2 Gen Z

3.2.1 Trend-Driven Functional Beverage Consumers

3.2.1.1 Social Media Influenced Buyers

3.2.1.2 Experimental Flavor Seekers

3.3 Wellness & Lifestyle Consumers

3.3.1 Probiotic & Digestive Health Focused

3.3.1.1 Daily Gut-Health Routine Users

3.3.1.2 Preventive Health-Oriented Consumers

4. By Region

4.1 North America

4.2 Europe

4.3 Asia-Pacific

4.4 Latin America

4.5 Middle East & Africa

Leading Companies in the Global Kombucha Market

GT’s Living Foods

KeVita (PepsiCo)

Health-Ade Kombucha

Brew Dr. Kombucha

Remedy Drinks

Humm Kombucha

The Hain Celestial Group

The market remains moderately fragmented, with premium craft brands competing alongside multinational beverage companies expanding through acquisitions and product line extensions.

Strategic Intelligence & AI-Backed Insights

The Impact of AI on Global Kombucha Market is increasingly visible across demand forecasting, flavor innovation analytics, fermentation process optimization, and supply chain planning.

Phoenix Demand Forecast Engine identifies sustained double-digit growth in premium fortified variants and subscription-based models.

AI-powered consumer analytics highlight rising preference for low-sugar, functional, and clean-label formulations.

Sustainability trends in Global Kombucha Market emphasize recyclable aluminum cans, reduced sugar fermentation optimization, local sourcing of tea leaves, and carbon-neutral bottling initiatives.

Porter’s Five Forces Analysis indicates moderate supplier power (tea & probiotic cultures), increasing buyer power due to product variety, and high competitive rivalry driven by rapid brand proliferation.

Why the Global Kombucha Market Remains Critical

• Rising global demand for functional and probiotic beverages

• Strong alignment with wellness, immunity, and digestive health trends

• Expanding omnichannel distribution ecosystems

• High premiumization potential through functional fortification

• Scalable DTC subscription and recurring revenue models

Final Takeaway of Global Kombucha Market

The Global Kombucha Market is evolving into a premium-driven, innovation-led, and health-centric functional beverage segment. The Global Kombucha Market Revenue Forecast indicates sustained expansion at a CAGR of ~8.1% through 2033, supported by increasing consumer demand for probiotic, low-sugar, and clean-label beverages.

Future growth will follow a dual-structure model: high-margin functional and fortified kombucha targeting wellness-focused urban consumers, alongside scalable flavored RTD formats designed for mass retail and convenience distribution. This balanced ecosystem enables both premium value capture and broad accessibility.

Companies investing in AI-powered fermentation optimization, sustainable packaging innovation, DTC subscription ecosystems, and global retail partnerships will secure stronger competitive positioning in the evolving Post-2025 outlook for Global Kombucha Market.

At Phoenix Research, our advanced forecasting frameworks provide detailed Global Kombucha Market Revenue Forecast analysis, competitive intelligence, and strategic growth insights — empowering stakeholders to capitalize on the evolving functional beverage landscape with data-backed decision-making and scalable expansion strategies.

1. Executive Summary

1.1 Global Market Snapshot (2026–2033)

1.2 Key Growth Highlights & Strategic Insights

1.3 Largest and Fastest-Growing Regions

1.4 Dominant and Emerging Market Segments

1.5 High-Potential Opportunity Areas

2. Global Kombucha Market Overview

2.1 Market Definition and Scope

2.2 Evolution of the Global Kombucha Industry

2.3 Industry Value Chain & Supply Ecosystem

2.4 Business Models (RTD, Craft, DTC, Private Label)

2.5 Pricing Structure & Margin Analysis

2.6 Regulatory and Compliance Landscape

3. Market Forecast Snapshot (2026–2033)

3.1 Market Size in 2025: USD 7.85 Billion

3.2 Projected Market Size by 2033: ~USD 14.60 Billion

3.3 Compound Annual Growth Rate (CAGR): ~8.1%

3.4 Largest Regional Market: North America

3.5 Fastest-Growing Region: Asia-Pacific

3.6 Leading Segment: Flavored & Functional Kombucha

3.7 Key Industry Trend: Low-Sugar Formulations & Functional Fortification

3.8 Future Outlook: Probiotic Innovation, Sustainable Packaging & DTC Expansion

4. Market Dynamics

4.1 Primary Growth Drivers

4.2 Market Restraints & Limitations

4.3 Emerging Opportunities

4.4 Key Industry Challenges

4.5 Impact of Macroeconomic and Regulatory Factors

5. Market Segmentation by Product Type (USD Billion), 2026–2033

5.1 Original / Unflavored Kombucha

5.1.1 Traditional Tea-Based Fermentation

5.1.1.1 Black Tea Fermented Kombucha

5.1.1.2 Green Tea Fermented Kombucha

5.1.1.3 Oolong and Specialty Tea Variants

5.1.2 Sugar and Fermentation Variants

5.1.2.1 Cane Sugar Fermentation

5.1.2.2 Organic Raw Sugar Variants

5.1.2.3 Extended Fermentation Low-Sugar Formats

5.2 Flavored Kombucha

5.2.1 Fruit-Based Flavors

5.2.1.1 Berry Blends

5.2.1.2 Citrus Variants

5.2.1.3 Tropical Fruit Combinations

5.2.2 Botanical & Herbal Infusions

5.2.2.1 Ginger-Based Variants

5.2.2.2 Turmeric and Adaptogen Blends

5.2.2.3 Floral-Infused Premium Lines

5.3 Functional / Fortified Kombucha

5.3.1 Nutrient-Enriched Formulations

5.3.1.1 Vitamin-Fortified Kombucha

5.3.1.2 Electrolyte-Enhanced Variants

5.3.1.3 Mineral-Infused Blends

5.3.2 Performance & Wellness-Boosted Variants

5.3.2.1 Collagen-Infused Formulas

5.3.2.2 Energy-Boosted (Matcha / Natural Caffeine)

5.3.2.3 Immunity-Focused Probiotic Variants

6. Market Segmentation by Distribution Channel (USD Billion), 2026–2033

6.1 Supermarkets & Hypermarkets

6.1.1 Refrigerated Beverage Aisles

6.1.2 Organic & Natural Product Sections

6.2 Convenience Stores

6.2.1 Single-Serve Grab-and-Go Bottles

6.2.2 Functional Beverage Coolers

6.3 Online Retail

6.3.1 E-Commerce Grocery Platforms

6.3.2 Health & Wellness Marketplaces

6.4 Direct-to-Consumer

6.4.1 Subscription-Based Delivery Models

6.4.2 Personalized Functional Kombucha Kits

6.5 Specialty Health Stores

6.5.1 Organic Retail Chains

6.5.2 Local Craft Fermentation Brands

7. Market Segmentation by End User (USD Billion), 2026–2033

7.1 Millennials

7.1.1 Fitness-Oriented Consumers

7.1.2 Clean-Label Lifestyle Adopters

7.2 Generation Z (Gen Z)

7.2.1 Trend-Driven Functional Beverage Buyers

7.2.2 Experimental Flavor Seekers

7.3 Wellness & Lifestyle Consumers

7.3.1 Daily Gut-Health Users

7.3.2 Preventive Health-Focused Consumers

7.4 Institutional Buyers

7.4.1 Cafés & Juice Bars

7.4.2 Corporate Wellness Programs

7.4.3 Hospitality & Premium Retail Channels

8. Market Segmentation by Region (USD Billion), 2026–2033

8.1 North America

8.2 Europe

8.3 Asia-Pacific

8.4 Latin America

8.5 Middle East & Africa

9. Regional Insights

9.1 North America – Market Leadership

9.2 Asia-Pacific – Accelerated Growth Trajectory

9.3 Europe – Clean-Label & Sustainability-Driven Expansion

9.4 Latin America – Emerging Consumption Patterns

9.5 Middle East & Africa – Developing Premium Demand

10. Competitive Landscape

10.1 Market Share Analysis

10.2 Competitive Positioning Matrix

10.3 Mergers, Acquisitions & Strategic Partnerships

10.4 Product Launches & Innovation Trends

11. Company Profiles

11.1 GT’s Living Foods

11.2 KeVita (PepsiCo)

11.3 Health-Ade Kombucha

11.4 Brew Dr. Kombucha

11.5 Remedy Drinks

11.6 Humm Kombucha

11.7 The Hain Celestial Group

12. Strategic Intelligence & AI-Backed Insights

12.1 Impact of Artificial Intelligence on the Kombucha Market

12.2 Demand Forecast Modeling (Phoenix Forecast Engine)

12.3 Sustainability & Packaging Innovation Trends

12.4 Porter’s Five Forces Analysis

12.5 Investment and Expansion Strategy Outlook

13. Why the Global Kombucha Market Remains Critical

13.1 Functional Beverage Industry Transformation

13.2 Premiumization & Margin Expansion Potential

13.3 Subscription & Direct-to-Consumer Scalability

13.4 Alignment with Global Wellness Megatrends

14. Appendix

14.1 Research Methodology

14.2 Data Sources & Key Assumptions

14.3 Abbreviations

14.4 Currency Conversion Standards

15. About Us

15.1 Phoenix Research Overview

15.2 Our Forecasting & Analytical Framework

15.3 Industry Coverage Portfolio

15.4 Contact Information

16. Disclaimer

16.1 Report Usage Terms & Conditions

16.2 Limitation of Liability

16.3 Intellectual Property Rights

16.4 Forward-Looking Statements Notice