Global Lip Gloss Market, 2024-2032

Global Lip Gloss Market to Reach USD 6.2 Billion by 2032

Global Lip Gloss Market

The Global Lip Gloss Market is expanding steadily as beauty consumers prioritize shine, comfort, and skincare-infused color. Hybrid formulas (hydration + color), social media virality, and DTC distribution are reshaping launch cadence and demand. Affordable-luxury dynamics (“lipstick effect”) continue to buoy lip categories even in uneven macro cycles, lifting both prestige and masstige gloss portfolios.

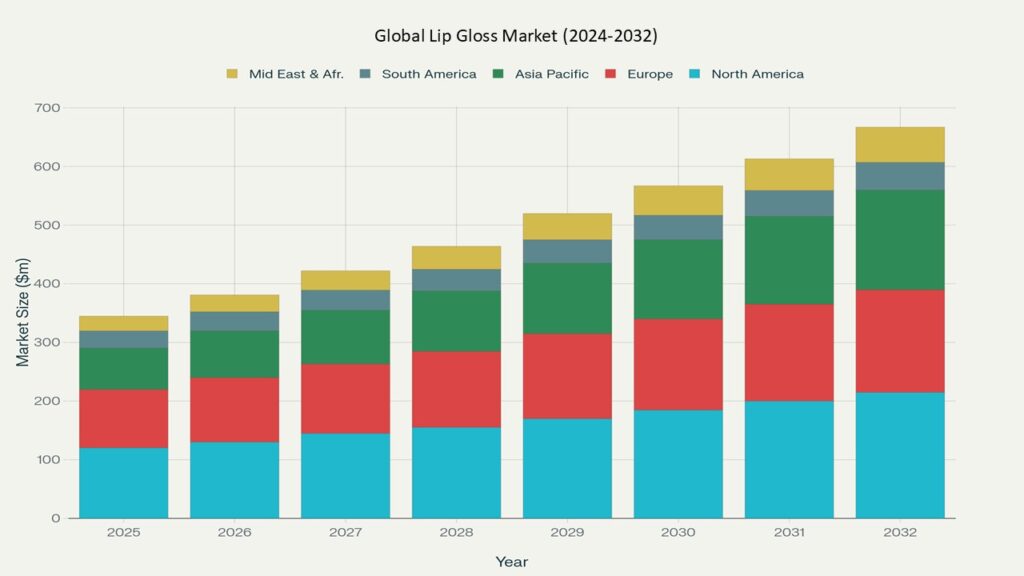

According to Phoenix’s Demand Forecast Engine, the market is projected to grow from ~USD 4.0 billion in 2025 to ~USD 6.1–6.2 billion by 2032, reflecting a ~5.4–5.6% CAGR (2025–2032). In 2024, North America held the leading share, while Asia Pacific is poised to post the fastest growth on the back of a large, digital-first consumer base and rising beauty spend. These trajectories align with recent third-party benchmarks indicating ~USD 4.0B around 2024–2025 and ~USD 6.1B by 2032–2034.

Key Drivers of Market Growth

- Influencer-led discovery & social commerce — Short-form video accelerates new-shade sell-outs and seasonal drops, boosting conversion across DTC and marketplaces.

- Skincare-meets-color — Hydrating, non-sticky, ceramide/HA-based glosses expand use-occasions and repeat purchase rates.

- Affordable indulgence — Consumers trade down across categories but still “treat” within lip; prestige lip products outpace overall makeup growth in 2025 YTD.

- E-commerce & omnichannel scale — Always-on shade drops and creator collabs compress go-to-market timelines and widen reach.

- Natural/clean preferences — Momentum for organic/clean labels and skin-friendly ingredients nudges reformulations and line extensions.

Market Segmentation

By Finish

- Glossy (high-shine) • Sheer/Shimmer • Plumping • Matte/Lacquer-gloss hybrids.

By Category

- Conventional • Natural/Organic/Clean.

By Distribution Channel

- Online (Brand DTC, Marketplaces) • Specialty Beauty Retail • Drugstore/Mass • Department Stores/Travel Retail.

By Price Tier

- Mass • Masstige • Prestige.

By End User

- Consumer (B2C) • Professional MUAs/Studios • Salons & Retail Sets (B2B).

Region-Level Insights

North America – CAGR (2025–2032): ~4.8–5.2%

• Largest current revenue pool, supported by strong prestige ecosystems, influencer marketing depth, and robust specialty retail.

Europe

• Stable premium spend; clean-beauty regulation and refillable/low-plastic formats gaining traction in key markets.

Asia Pacific – CAGR (2025–2032): ~6.5–7.2% (Fastest Growing Region)

• Expanding young, beauty-active base and high social-commerce penetration; makeup leadership in APAC underpins lip growth.

Latin America

• Rising beauty retail footprints and local influencer ecosystems—Mexico a standout growth node within wider color cosmetics expansion.

Middle East & Africa

• High spend per capita in GCC, premiumization, and tourism-driven retail; increasing openness to Asian brands and K-beauty hybrids.

Leading Companies in the Market

Based on Phoenix’s Event Detection Engine and Innovation Tracker, leading players include: L’Oréal (including Maybelline, NYX, Lancôme), Estée Lauder (MAC, Bobbi Brown), Shiseido (NARS), Coty (CoverGirl), LVMH (Fenty Beauty, Dior), Revlon, Kose, Amorepacific, Unilever (Hourglass/Youth-oriented portfolios), Glossier, Rare Beauty. These brands drive shade velocity, skincare-infused glosses, and creator collaborations—anchored by strong retail media and DTC engines.

Strategic Intelligence and AI-Backed Insights

- Phoenix Demand Forecast Engine blends retailer POS, social-engagement velocity, and promo calendars to estimate shade-level repeat rates and new-item survival.

- Launch Heatmap tracks creator-driven spikes across TikTok/IG, correlating EMV with basket attach (liners, balms).

- Sentiment Analyzer Tool flags rising intent for non-sticky, hydrating glosses and clean/organic claims.

- Automated Porter’s Five Forces: High rivalry (fast copy cycles), moderate buyer power (brand loyalty in prestige), low switching cost online, and distribution clout at specialty retailers.

Forecast Snapshot: 2025–2032

| Metric | Value |

| 2025 Market Size | ~USD 4.0 Billion |

| 2032 Market Size | ~USD 6.1–6.2 Billion |

| CAGR (2025–2032) | ~5.4–5.6% |

| Largest Region (2024) | North America |

| Fastest Growing Region | Asia Pacific |

| Top Segment | Skincare-infused, non-sticky glossy finishes |

| Key Trend | Creator collabs & social-commerce drops |

| Future Growth Focus | Masstige price tier; online-first launches; clean/organic lines |

Why the Market Remains Critical

- Entry-friendly growth: Frequent shade refreshes and collabs allow rapid brand penetration with manageable R&D risk.

- High repeat purchase: Skincare benefits and seasonality drive replenishment.

- Omnichannel resilience: Balanced performance across prestige/mass and online/offline.

- Signal for broader makeup health: Lip gloss momentum correlates with category traffic and basket expansion.

Final Takeaway

The Lip Gloss Market is shifting from simple shine to skincare-smart, creator-amplified color. Brands that deliver non-sticky, hydrating textures, leverage social-commerce cadence, and localize shade + claim architecture by region will outgrow the category. Phoenix Research’s AI-backed platforms pinpoint launch timing, channel mix, and price-pack architecture—positioning stakeholders to command outsized share in this glossy growth lane.

- Executive Summary & Market Overview

• 1.1 Introduction to the Global Lip Gloss Market

• 1.2 Evolution from Traditional Gloss to Hybrid Skincare-Infused Cosmetics

• 1.3 Market Snapshot: Size, CAGR, Share (2023–2032)

• 1.4 Key Consumer Trends: Clean Beauty, Vegan Formulations, and Online-First Brands

• 1.5 Post-Pandemic Shifts in Makeup Consumption and Beauty Routines

• 1.6 Phoenix Research Methodology & Tool Integration (Demand Forecast Engine, Sentiment Analyzer, Social Commerce Tracker) - Key Drivers of Market Growth

• 2.1 Rising Demand for Everyday Wear & Natural Look Cosmetics

• 2.2 Influence of Social Media, Beauty Influencers, and Celebrity Brands

• 2.3 Growth in E-Commerce & D2C Channels for Beauty Products

• 2.4 Expanding Demand for Vegan, Cruelty-Free, and Clean Label Formulations

• 2.5 Innovation in Textures & Finishes (Glossy, Matte, Glitter, Tinted Balms)

• 2.6 Rising Disposable Incomes & Beauty Spending in Emerging Economies - Market Segmentation

• 3.1 By Product Type

o 3.1.1 Clear Gloss

o 3.1.2 Tinted Gloss

o 3.1.3 Glitter/Shimmer Gloss

o 3.1.4 Plumping Gloss

o 3.1.5 Others (Hybrid Lip Care Glosses)

• 3.2 By Finish

o 3.2.1 Glossy

o 3.2.2 Matte

o 3.2.3 Satin/Sheer

• 3.3 By Ingredient Type

o 3.3.1 Conventional

o 3.3.2 Vegan & Natural/Organic

• 3.4 By Price Range

o 3.4.1 Mass

o 3.4.2 Premium

o 3.4.3 Luxury

• 3.5 By Distribution Channel

o 3.5.1 Offline (Supermarkets, Department Stores, Specialty Beauty Stores)

o 3.5.2 Online (E-Retailers, Brand Websites, Social Commerce)

• 3.6 By End User

o 3.6.1 Women

o 3.6.2 Men (Emerging Segment)

o 3.6.3 Unisex/Youth - Region-Level Insights

• 4.1 North America

o 4.1.1 U.S. Leading with Celebrity & Influencer-Driven Brands

o 4.1.2 Premium & Clean Beauty Surge

• 4.2 Europe

o 4.2.1 France, Italy, UK as Luxury Beauty Hubs

o 4.2.2 Rise of Vegan & Sustainable Packaging Trends

• 4.3 Asia Pacific

o 4.3.1 Largest Growth Region – K-Beauty & J-Beauty Influence

o 4.3.2 Expanding Middle-Class Beauty Consumers in India & China

• 4.4 Latin America

o 4.4.1 Brazil & Mexico Driving Mass-Market Adoption

o 4.4.2 Growing Role of Social Commerce in Beauty Sales

• 4.5 Middle East & Africa

o 4.5.1 Luxury & Prestige Lip Gloss Demand in GCC Countries

o 4.5.2 Emerging Opportunities in Africa’s Urban Centers - Leading Companies in the Market

• 5.1 Competitive Landscape Overview

• 5.2 Company Profiles & Key Offerings

o 5.2.1 L’Oréal Group

o 5.2.2 Estée Lauder Companies

o 5.2.3 Coty Inc.

o 5.2.4 Shiseido

o 5.2.5 Revlon

o 5.2.6 Fenty Beauty (Rihanna)

o 5.2.7 Kylie Cosmetics

o 5.2.8 Maybelline (L’Oréal)

o 5.2.9 NYX Professional Makeup

o 5.2.10 Glossier

• 5.3 Innovation Tracking: Skincare-Infused Glosses, Eco-Friendly Packaging, Multi-Functional Glosses

• 5.4 Strategic Partnerships, Brand Collaborations & Digital Marketing Expansion - Strategic Intelligence and Phoenix-Backed Insights

• 6.1 Phoenix Demand Forecast Engine: Lip Gloss Market Projections

• 6.2 Social Commerce Analyzer: Impact of TikTok, Instagram & Influencer Marketing

• 6.3 Consumer Sentiment Analyzer: Clean Beauty & Ingredient Transparency

• 6.4 Automated Porter’s Five Forces

o 6.4.1 Competitive Rivalry

o 6.4.2 Supplier Power

o 6.4.3 Buyer Power

o 6.4.4 Threat of New Entrants

o 6.4.5 Threat of Substitutes

• 6.5 Regulatory Framework: Cosmetic Safety & Labeling Compliance

• 6.6 Cross-Market Trends: Lip Gloss in Hybrid Skincare & Men’s Grooming - Forecast Snapshot: 2023–2032

• 7.1 Global Market Size and Revenue Projections

• 7.2 CAGR by Product Type, Finish & Price Range

• 7.3 Regional Growth Benchmarking

• 7.4 Top Performing Segments (Tinted Gloss, Vegan Formulations)

• 7.5 Market Inflection Points (Digital-First Brands, Clean Beauty, Inflation Impact)

• 7.6 Short-Term vs. Long-Term Investment Outlook - Why the Global Lip Gloss Market Remains Critical

• 8.1 Lip Gloss as an Affordable Luxury in Beauty Portfolios

• 8.2 Asia Pacific & Latin America: Untapped Growth Opportunities

• 8.3 E-Commerce & Social Media as Key Market Accelerators

• 8.4 Clean Beauty Movement Driving Long-Term Demand

• 8.5 Rising Inclusivity & Gender-Neutral Beauty Trends - Phoenix Researcher Insights & Final Takeaways

• 9.1 Strategic Summary of Findings

• 9.2 Early Signals from Consumer Beauty Behavior Models

• 9.3 Emerging Growth Pockets: Men’s Glosses, Social Commerce Channels

• 9.4 Actionable Recommendations for OEMs, Retailers & Policymakers

• 9.5 The Path Forward: Lip Gloss as a Fusion of Beauty, Care & Digital Engagement

10. Appendices

• 10.1 Research Methodology

• 10.2 Data Sources and Assumptions

• 10.3 Glossary of Terms

• 10.4 Phoenix’s Market Intelligence Suite Overview

• 10.5 Contact & Custom Research Support