Global Petrochemicals Market Size and Share Analysis 2025-2033

Global Petrochemicals Market Overview

The Global Petrochemicals Market is vibrantly transforming as energy, manufacturing, and materials industries seek proven feedstocks and advanced polymers to boost product performance and enable circular-economy transitions. Petrochemicals — including ethylene, propylene, aromatics (benzene, toluene, xylene), methanol, and downstream polymers (polyethylene, polypropylene, PVC, PS) — remain core building blocks for plastics, synthetic fibers, solvents, and specialty chemicals used across automotive, packaging, construction, and consumer goods.

This market is being energized by integrated refining-and-chemical investments, shifting feedstock mixes (naphtha, ethane, LPG, and increasing bio-based and recycled inputs), and digitalized plant operations that instantly improve yield, safety, and energy efficiency. Companies are discovering worthwhile opportunities in ethylene and propylene production capacity expansion, advanced polymer grades, and chemical recycling that empower manufacturers to overcome feedstock volatility and succeed in delivering higher-value, reliable materials to supply chains worldwide.

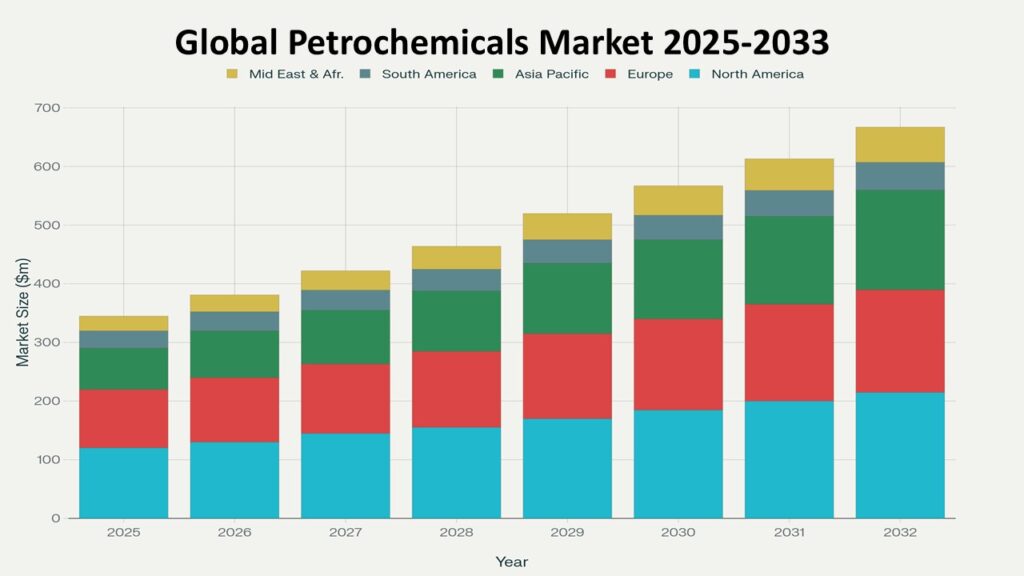

According to Phoenix’s Demand Forecast Engine, the Global Petrochemicals Market size is estimated at USD 620.0 billion in 2025 and is projected to reach approximately USD 922.0 billion by 2033, reflecting a proven CAGR of 5.2% (2025–2033). Asia-Pacific leads in both Global Petrochemicals Market size and growth momentum—driven by large-scale cracker additions, downstream capacity, and robust demand in China, India, and Southeast Asia—while North America and Middle East remain critical hubs due to feedstock advantage and integrated complexes.

The Global Petrochemicals Market continues to empower refiners, chemical producers, converters, and recyclers to learn, adapt, and create resilient value chains that balance cost-efficiency, sustainability, and product innovation in a rapidly evolving global landscape.

Key Drivers of Global Petrochemicals Market Growth

1. Industrial and Packaging Demand Recovery

Steady growth in the packaging, consumer goods, and industrial sectors continues to drive demand for commodity polymers and specialty resins, supporting long-term market stability and expansion.

2. Integrated Refinery-to-Petrochemical Investments

The development of new steam crackers, propane/ethane splitters, and large-scale refining-chemical complexes is enhancing supply chain efficiency, reducing lead times, and strengthening regional production ecosystems.

3. Feedstock Flexibility and Cost Competitiveness

Access to low-cost ethane, LPG, and naphtha feedstocks—combined with growing adoption of bio-based and recycled inputs—provides producers with a competitive edge and resilience against crude oil price volatility.

4. Advancing Circular Economy and Chemical Recycling

Innovations in pyrolysis, depolymerization, and solvent-based recycling technologies are enabling manufacturers to produce certified recycled materials, helping global brands meet sustainability goals and circular economy targets.

5. Rising Demand for Specialty and High-Performance Polymers

Increased adoption of engineering plastics, medical-grade polymers, and materials

Global Petrochemicals Market Segmentation

By Product

-

Olefins (Ethylene, Propylene)

-

Aromatics (BTX: Benzene, Toluene, Xylene)

-

Methanol & Derivatives

-

Polymers (Polyethylene, Polypropylene, PVC, Polystyrene, PET)

-

Synthetic Rubbers & Elastomers

-

Specialty & Performance Chemicals

By Feedstock

-

Naphtha (Refinery-derived)

-

Natural Gas Liquids (Ethane, Propane, Butane)

-

Coal-to-Chemicals (select regions)

-

Bio-based Feedstocks & Renewable Methanol

-

Recycled / Feedstock-from-Waste

By End-Use Industry

-

Packaging & Consumer Goods

-

Automotive & Mobility

-

Construction & Infrastructure

-

Electrical & Electronics

-

Healthcare & Medical Devices

-

Agriculture (films, coatings)

-

Textiles & Fibers

By Region

-

Asia-Pacific

-

North America

-

Europe

-

Middle East & Africa

-

Latin America

Regional Insights of Global Petrochemicals Market

Asia-Pacific – Largest & Fastest Growing Region

APAC dominates due to continuous cracker capacity additions, strong converter networks, and rapidly rising domestic demand for packaging, textiles, and automotive parts. Asia -Pacific leads the largest share of the Global market.

Middle East – Feedstock & Export Hub

The Middle East benefits from advantaged hydrocarbon feedstocks and large-scale petrochemical complexes that export monomers and polymers globally.

North America

Competitive ethane feedstock and petrochemical investments (cracker restarts, polymer plants) support growth in both domestic supply and exports to Latin America and Asia.

Europe

Focus on chemical recycling, regulations (REACH), and specialty-grade polymers drives premium product development and circular solutions.

Latin America & Africa

Gradual capacity expansion, import-substitution opportunities, and infrastructure projects provide local growth corridors over the forecast horizon.

Leading Companies in the Global Petrochemicals Market

Prominent players include:

-

Sinopec (China Petroleum & Chemical Corporation) — largest by capacity and integrated footprint

-

BASF SE

-

LyondellBasell Industries N.V.

-

Dow Inc.

-

INEOS Group

-

Reliance Industries Limited

-

Formosa Plastics Group

-

Chevron Phillips Chemical Company LLC

These companies are discovering synergies in feedstock integration, investing in chemical recycling, and developing specialty polymer portfolios to ensure proven reliability, regulatory compliance, and long-term competitiveness.Sinopec is the la

Strategic Intelligence and AI-Backed Insights

-

Phoenix Demand Forecast Engine models regional cracker builds, polymer demand intensity, and trade flows to identify capacity gaps and arbitrage opportunities.

-

Feedstock Advantage Index ranks regions by naphtha vs NGL economics and highlights export corridors.

-

Circularity & Sustainability Tracker monitors chemical-recycling projects, bio-based feedstock pilots, and certified recycled content adoption by brand owners.

-

Technology & Innovation Radar identifies advances in catalyst efficiency, electrified steam cracking, and process electrification that reduce carbon intensity.

-

Porter’s Five Forces Analysis shows moderate supplier power for catalysts and specialty inputs, strong buyer influence from large converters and brand owners, and high innovation-driven differentiation.

Global Petrochemicals Market Forecast Snapshot: 2025–2033

| Metric | Value |

|---|---|

| 2025 Market Size | USD 620.0 Billion |

| 2033 Market Size | ~USD 922.0 Billion |

| CAGR (2025–2033) | 5.2% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Top Product Segment | Olefins (Ethylene & Propylene) |

| Key Trend | Feedstock diversification & chemical recycling |

| Future Focus | Low-carbon production, specialty polymers, and circular plastics |

Why the Global Petrochemicals Market Remains Critical

-

Petrochemicals are the foundational feedstocks for modern manufacturing—powering packaging, mobility, healthcare, electronics, and construction.

-

Feedstock flexibility and regional cracker investments ensure supply resilience and cost competitiveness.

-

Chemical recycling and bio-feedstock adoption enable circular materials and help brands meet sustainability commitments.

-

Innovation in specialty polymers supports electrification, lightweighting, and high-performance applications across sectors.

-

Digitalized operations and energy efficiency improvements reduce emissions and operating costs, aligning the industry with net-zero ambitions.

Final Takeaway of Global Petrochemicals Market

The Global Petrochemicals Market is energizing the materials backbone of the global economy while rapidly adapting to sustainability and circularity imperatives. Companies that discover feedstock flexibility, invest in recycling and low-carbon technologies, boost specialty product portfolios, and ensure proven operational reliability will be best positioned to succeed in a competitive, trade-driven landscape.

At Phoenix Research, our AI-powered forecasting and strategic intelligence tools help petrochemical producers, converters, and investors learn quickly, identify profitable capacity and product niches, and act confidently—transforming short-term opportunities into long-term, humanly responsible growth.

Table of Contents

1. Global Petrochemicals Market Overview

-

Market Definition and Scope

-

Market Dynamics and Evolution

-

Market Size and Growth Forecast (2025–2033)

-

Key Highlights and Strategic Importance

2. Key Market Drivers

-

Industrial and Packaging Demand Recovery

-

Integrated Refinery-to-Petrochemical Investments

-

Feedstock Flexibility and Cost Competitiveness

-

Advancing Circular Economy and Chemical Recycling

-

Rising Demand for Specialty and High-Performance Polymers

3. Market Segmentation

By Product

-

Olefins (Ethylene, Propylene)

-

Aromatics (BTX: Benzene, Toluene, Xylene)

-

Methanol & Derivatives

-

Polymers (Polyethylene, Polypropylene, PVC, Polystyrene, PET)

-

Synthetic Rubbers & Elastomers

-

Specialty & Performance Chemicals

By Feedstock

-

Naphtha (Refinery-Derived)

-

Natural Gas Liquids (Ethane, Propane, Butane)

-

Coal-to-Chemicals (Select Regions)

-

Bio-Based Feedstocks & Renewable Methanol

-

Recycled / Feedstock-from-Waste

By End-Use Industry

-

Packaging & Consumer Goods

-

Automotive & Mobility

-

Construction & Infrastructure

-

Electrical & Electronics

-

Healthcare & Medical Devices

-

Agriculture (Films, Coatings)

-

Textiles & Fibers

By Region

-

Asia-Pacific

-

North America

-

Europe

-

Middle East & Africa

-

Latin America

4. Regional Insights of Global Petrochemicals Market

-

Asia-Pacific – Largest & Fastest Growing Region

-

Middle East – Feedstock & Export Hub

-

North America – Competitive Feedstock Advantage

-

Europe – Specialty & Circular Polymer Focus

-

Latin America & Africa – Emerging Capacity & Infrastructure Growth

5. Leading Companies in the Global Petrochemicals Market

-

Sinopec (China Petroleum & Chemical Corporation) – Largest by Capacity

-

SABIC (Saudi Basic Industries Corporation)

-

ExxonMobil Chemical

-

BASF SE

-

LyondellBasell Industries N.V.

-

Dow Inc.

-

INEOS Group

-

Reliance Industries Limited

-

Formosa Plastics Group

-

Chevron Phillips Chemical Company LLC

Leading Player: Sinopec

6. Strategic Intelligence and AI-Backed Insights

-

Phoenix Demand Forecast Engine

-

Feedstock Advantage Index

-

Circularity & Sustainability Tracker

-

Technology & Innovation Radar

-

Porter’s Five Forces Analysis

7. Global Petrochemicals Market Forecast Snapshot (2025–2033)

-

Market Size (2025)

-

Market Size (2033)

-

CAGR (2025–2033)

-

Largest Region

-

Fastest Growing Region

-

Top Product Segment

-

Key Trend

-

Future Focus

8. Why the Global Petrochemicals Market Remains Critical

-

Core Feedstock for Global Manufacturing

-

Supply Chain Resilience through Feedstock Flexibility

-

Advancement of Chemical Recycling & Circular Economy

-

Innovation in Specialty & High-Performance Polymers

-

Contribution to Low-Carbon and Energy-Efficient Production

9. Final Takeaway of Global Petrochemicals Market

-

Summary of Market Outlook

-

Strategic Opportunities for Stakeholders

-

Long-Term Growth and Circular Innovation Pathways