Global Prescription Drugs Market Size and Share Analysis 2025-2033

Global Prescription Drugs Market Overview

The Global Prescription Drugs Market is vibrantly transforming, driven by rising healthcare spending, aging populations, and rapid innovation in biologics, gene therapies, and precision medicines. Prescription pharmaceuticals — spanning branded specialty drugs, biologics, and generic prescription medicines — are becoming central to modern healthcare systems as they empower clinicians to treat complex chronic and rare diseases more effectively and responsibly.

This Global Prescription Drugs Market is being energized by breakthroughs in biotechnology, targeted therapies, and digital health integration (real-world evidence, AI-enabled drug discovery, and telemedicine-enabled prescribing). Payers, providers, and manufacturers are discovering ways to boost patient access while balancing cost pressures through biosimilars, value-based contracting, and improved supply-chain resilience. The shift toward personalized medicine and preventative pharmacotherapy is creating worthwhile opportunities across oncology, immunology, CNS, cardiovascular, and metabolic disease portfolios.

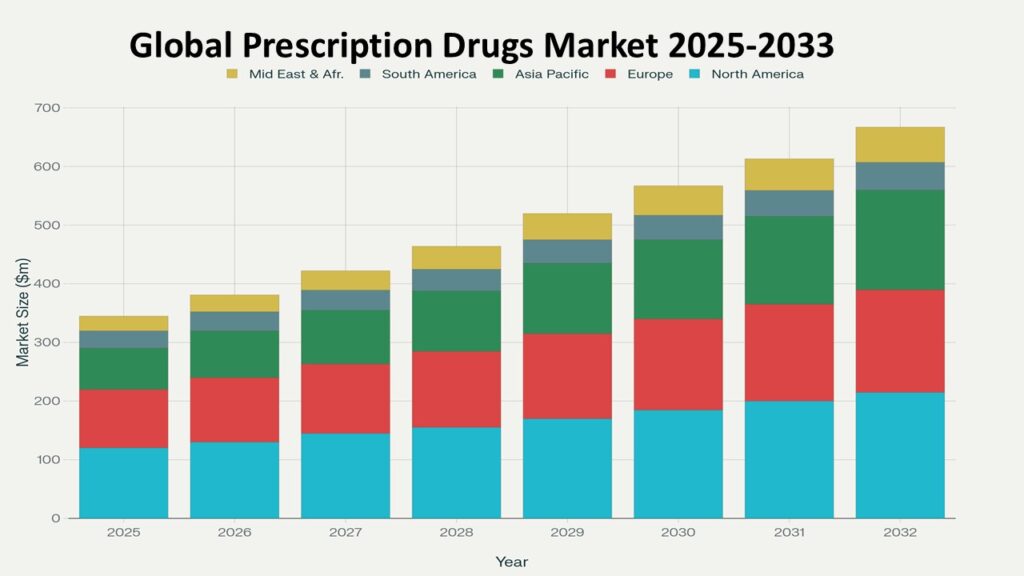

According to Phoenix’s Demand Forecast Engine, the Global Prescription Drugs Market size is estimated at USD 1,460.0 billion in 2025 and is projected to reach approximately USD 2,292.1 billion by 2033, reflecting a proven CAGR of 5.8% (2025–2033). North America remains the largest Global Prescription Drugs Market size—supported by high per-capita spending and rapid uptake of specialty medicines—while Asia-Pacific is the fastest-growing region as access expands, local manufacturing scales, and healthcare systems modernize.

The Global Prescription Drugs Market continues to empower pharmaceutical companies, healthcare providers, and payers to discover innovative therapies, overcome access challenges, and create sustainable pricing and distribution models that ensure patient outcomes, regulatory clarity, and commercial viability across global markets.

Key Drivers of Global Prescription Drugs Market Growth

-

Biologics & Specialty Drug Innovation

New monoclonal antibodies, cell & gene therapies, and precision oncology drugs are boosting sales and redefining standard of care in high-value therapeutic areas. -

Aging Population & Chronic Disease Burden

Growing prevalence of cardiovascular disease, diabetes, cancer, and neurodegenerative disorders is increasing long-term prescription demand worldwide. -

Expansion of Healthcare Access in Emerging Markets

Public insurance schemes, improved primary care, and telehealth are energizing prescription uptake in Asia-Pacific, Latin America, and parts of Africa. -

Rise of Biosimilars & Generics

Biosimilar launches and generic competition create cost-effective alternatives that help payers manage budgets and improve access. -

Digital Therapeutics & Real-World Evidence

AI-driven drug discovery, adaptive clinical trials, and real-world data enable faster approvals and proven value demonstration—accelerating adoption.

Global Prescription Drugs Market Segmentation

By Product Type

-

Branded Prescription Drugs (small molecules, biologics)

-

Generic Prescription Drugs

-

Biosimilars

-

Specialty & Orphan Drugs

By Therapeutic Area

-

Oncology

-

Immunology & Inflammation

-

Cardiovascular & Metabolic Diseases

-

Central Nervous System (CNS) Disorders

-

Infectious Diseases (including antivirals)

-

Respiratory Diseases

-

Rare Diseases & Orphan Indications

By Distribution Channel

-

Hospital Pharmacies

-

Retail Pharmacies

-

Specialty Pharmacies

-

Online/Remote Dispensing (telepharmacy)

By Pricing Model

-

Fee-for-service/Unit Price

-

Value-Based Contracts / Outcomes-Based Pricing

-

Government-procured Supply

By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

Regional Insights of Global Prescription Drugs Market

North America – Largest Market

High specialty drug penetration, strong R&D investment, and advanced reimbursement mechanisms keep North America has the largest Market Share in Global Prescription Drugs Market

Europe

Regulatory sophistication, parallel price negotiation, and growing biosimilar uptake shape a steady, sustainable market.

Asia-Pacific – Fastest Growing Region

Expanding insurance coverage, local manufacturing scale-up, and growing middle-class healthcare consumption drive rapid growth, notably in China, India, and Southeast Asia.

Latin America

Public procurement programs and domestic generics manufacturing present immediate growth corridors.

Middle East & Africa

Healthcare modernization projects and increased public health spending are gradually energizing prescription drug demand.

Leading Companies in the Global Prescription Drugs Market

-

Novartis AG

-

Merck & Co., Inc. (MSD)

-

Sanofi S.A.

-

AbbVie Inc.

-

Bristol Myers Squibb

-

AstraZeneca plc

-

GlaxoSmithKline plc (GSK)

-

Takeda Pharmaceutical Company Ltd.

-

Eli Lilly and Company

These leaders are investing in AI-enabled drug discovery, specialty manufacturing, and global distribution partnerships to ensure reliable supply, regulatory compliance, and timely patient access.Pfizer Inc. (U.S.) Leads the Market with Largest Market share.

Strategic Intelligence and AI-Backed Insights

-

Phoenix Demand Forecast Engine models revenue by therapeutic class, geography, and policy changes to identify growth pockets (e.g., oncology biologics, diabetes injectables).

-

Real-World Evidence Tracker assists in demonstrating outcomes for value-based pricing and payer negotiations.

-

Pipeline & Approval Monitor highlights expedited pathways (accelerated approvals, conditional authorizations) and the impact on time-to-market.

-

Supply Chain Resilience Analyzer measures risks from API concentration, geopolitical disruptions, and manufacturing bottlenecks.

Forecast Snapshot: 2025–2033

| Metric | Value |

|---|---|

| 2025 Market Size | USD 1,460.0 Billion |

| 2033 Market Size | ~USD 2,292.1 Billion |

| CAGR (2025–2033) | 5.8% |

| Largest Region (2024) | North America |

| Fastest Growing Region | Asia-Pacific |

| Top Therapeutic Growth Area | Oncology & Specialty Biologics |

| Key Trend | Personalized medicine, biosimilars, and outcomes-based contracting |

| Future Focus | Access expansion, affordability models, and localized manufacturing |

Why the Global Prescription Drugs Market Remains Critical

-

Addresses major public health needs—treatment of chronic, infectious, and rare diseases remains foundational to healthcare systems.

-

Drives medical innovation—prescription drugs finance upstream biopharma R&D and new modality development (RNA therapies, cell & gene).

-

Supports healthcare system sustainability—through biosimilars, generics, and smarter reimbursement models that balance access and incentives.

-

Enables economic value—pharmaceutical sector investments create high-value jobs, manufacturing capacity, and export opportunities in advanced and emerging economies.

-

Provides measurable clinical outcomes—real-world evidence and digital health tools ensure treatments deliver proven patient benefits.

Final Takeaway of Global Prescription Drugs Market

The Global Prescription Drugs Market is a vibrant, innovation-driven, and strategically critical pillar of modern healthcare. Companies that discover breakthrough therapies, create transparent value propositions for payers, and ensure reliable, affordable supply will succeed in delivering meaningful patient outcomes and sustainable commercial returns.

At Phoenix Research, our AI-powered forecasting models and strategic intelligence platforms help stakeholders learn quickly, quantify market opportunities, and implement proven commercialization strategies—ensuring confident decisions in a market where science, policy, and patient access must align for long-term success.

Table of Contents

-

1. Global Prescription Drugs Market Overview

-

2. Key Drivers of Global Prescription Drugs Market Growth

-

Biologics & Specialty Drug Innovation

-

Aging Population & Chronic Disease Burden

-

Expansion of Healthcare Access in Emerging Markets

-

Rise of Biosimilars & Generics

-

Digital Therapeutics & Real-World Evidence

-

-

3. Global Prescription Drugs Market Segmentation

-

By Product Type

-

Branded Prescription Drugs (Small Molecules & Biologics)

-

Generic Prescription Drugs

-

Biosimilars

-

Specialty & Orphan Drugs

-

-

By Therapeutic Area

-

Oncology

-

Immunology & Inflammation

-

Cardiovascular & Metabolic Diseases

-

Central Nervous System (CNS) Disorders

-

Infectious Diseases (including Antivirals)

-

Respiratory Diseases

-

Rare Diseases & Orphan Indications

-

-

By Distribution Channel

-

Hospital Pharmacies

-

Retail Pharmacies

-

Specialty Pharmacies

-

Online/Remote Dispensing (Telepharmacy)

-

-

By Pricing Model

-

Fee-for-Service / Unit Price

-

Value-Based Contracts / Outcomes-Based Pricing

-

Government-Procured Supply

-

-

By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

-

-

-

4. Regional Insights of the Global Prescription Drugs Market

-

North America – Largest Market

-

Europe – Regulatory & Biosimilar Adoption

-

Asia-Pacific – Fastest Growing Region

-

Latin America – Public Procurement & Generics

-

Middle East & Africa – Emerging Healthcare Expansion

-

-

5. Leading Companies in the Global Prescription Drugs Market

-

Pfizer Inc.

-

Roche Holding AG

-

Johnson & Johnson (Janssen)

-

Novartis AG

-

Merck & Co., Inc. (MSD)

-

Sanofi S.A.

-

AbbVie Inc.

-

Bristol Myers Squibb

-

AstraZeneca plc

-

GlaxoSmithKline plc (GSK)

-

Takeda Pharmaceutical Company Ltd.

-

Eli Lilly and Company

-

-

6. Strategic Intelligence and AI-Backed Insights

-

Phoenix Demand Forecast Engine

-

Real-World Evidence Tracker

-

Pipeline & Approval Monitor

-

Supply Chain Resilience Analyzer

-

-

7. Global Prescription Drugs Market Forecast Snapshot: 2025–2033

-

2025 Market Size

-

2033 Market Size

-

CAGR (2025–2033)

-

Largest Region

-

Fastest Growing Region

-

Top Therapeutic Growth Area

-

Key Trend

-

Future Focus

-

-

8. Why the Global Prescription Drugs Market Remains Critical

-

Addresses Major Public Health Needs

-

Drives Medical Innovation

-

Supports Healthcare System Sustainability

-

Enables Economic Value

-

Provides Measurable Clinical Outcomes

-

-

9. Final Takeaway of the Global Prescription Drugs Market