Global Quick Service Restaurants (QSR) and Fast Food Market Size, Share Analysis 2026-2033

Global Quick Service Restaurants (QSR) and Fast Food Market Forecast Snapshot: 2026–2033

| Metric | Value |

|---|---|

| 2025 Market Size | USD 875.6 Billion |

| 2033 Market Size | USD 1,298.2 Billion |

| CAGR (2025–2033) | 5.1% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Top Segment | Quick Service Restaurants (QSR) |

| Key Trend | AI-Driven Ordering & Sustainable Fast Food Innovation |

| Future Focus | Personalized Dining, Digital Delivery, and Sustainable Packaging |

Global Quick Service Restaurants (QSR) and Fast Food Market Overview

The Global Quick Service Restaurants (QSR) and Fast Food Market is undergoing structural transformation, supported by accelerating urbanization, shifting consumer lifestyles, and rising demand for convenient, affordable, and instantly accessible food options. As part of the broader foodservice and fast casual industry size 2026 landscape, QSR formats such as burgers, pizzas, sandwiches, fried chicken, and ethnic street-style offerings continue to evolve into digitally integrated, high-efficiency food ecosystems tailored to fast-paced urban living.

According to Pheonix Research, the Global Quick Service Restaurants (QSR) and Fast Food Market size is valued at USD 875.6 billion in 2025 and is projected to reach USD 1,298.2 billion by 2033, registering a CAGR of 5.1% during 2026–2033. This Quick Service Restaurants (QSR) and Fast Food revenue forecast reflects steady demand expansion, digital transformation, and franchise scalability across both mature and emerging markets.

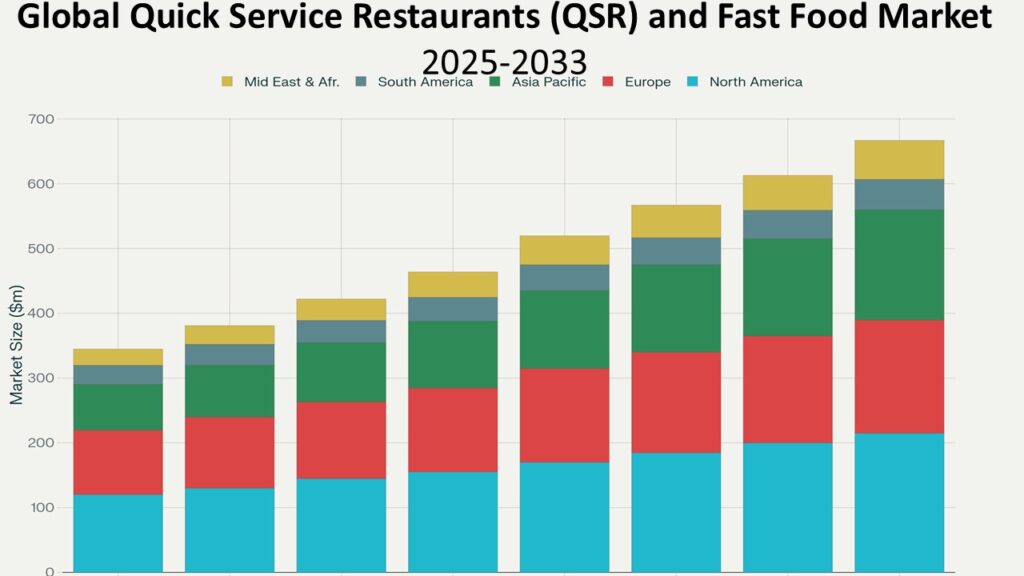

North America holds the largest share of the Global Quick Service Restaurants (QSR) and Fast Food Market, supported by strong brand penetration, established franchise ecosystems, and advanced digital ordering infrastructure. Meanwhile, Asia-Pacific is emerging as the fastest-growing region, driven by urban expansion, rising disposable income, and shifting food consumption patterns among younger populations.

The Post-2025 outlook for Quick Service Restaurants (QSR) and Fast Food indicates increasing integration of automation, AI-driven analytics, sustainability initiatives, and localized menu innovation, enabling brands to enhance profitability while adapting to evolving consumer expectations.

Key Drivers of Global Quick Service Restaurants (QSR) and Fast Food Market Growth

1. Rising Urbanization and Fast-Paced Lifestyles

Growing urban populations and expanding working demographics are reinforcing demand for ready-to-eat meals that offer speed, consistency, and affordability. Time-constrained consumers increasingly prioritize convenience without compromising taste or quality.

2. Expansion of Online Food Delivery and Digital Ordering

The Impact of AI on Quick Service Restaurants (QSR) and Fast Food is particularly visible in digital ordering systems and delivery integration. AI-enabled mobile apps and aggregator platforms such as Uber Eats and DoorDash are enhancing accessibility, improving demand forecasting, and driving digital-led revenue growth.

3. Menu Diversification and Health-Conscious Offerings

QSR operators are expanding portfolios to include plant-based, low-calorie, and allergen-sensitive menu options. This shift aligns with rising health awareness and supports Sustainability trends in Quick Service Restaurants (QSR) and Fast Food by reducing environmental impact through alternative ingredients and responsible sourcing.

4. Technological Innovations and Automation

Smart kitchens, robotic food preparation, AI-powered inventory systems, and data-driven demand planning are improving operational efficiency. Automation enhances speed, reduces waste, and strengthens profitability while enabling scalable growth across franchises.

5. Global Franchise Expansion and Localization Strategies

International QSR brands continue expanding into high-growth emerging economies while adapting menus to local preferences. Localization strategies combined with scalable franchise models strengthen regional market share and diversify revenue streams.

Global Quick Service Restaurants (QSR) and Fast Food Market Segmentation

-

By Service Type

1.1 Quick Service Restaurants (QSR)

1.1.1 Franchise-Based QSR Chains

1.1.1.1 Global Franchise Networks

1.1.1.2 Regional Franchise Operators

1.1.1.3 Master Franchise Models

1.1.1.4 Company-Owned Stores

1.1.1.5 Hybrid Franchise-Owned Models

1.1.2 Independent QSR Outlets

1.1.2.1 Single-Location Operators

1.1.2.2 Local Chain Operators

1.1.2.3 Cloud-Integrated Independent QSRs

1.1.2.4 Street-Format Quick Service Units

1.1.3 Technology-Enabled QSR Formats

1.1.3.1 AI-Powered Ordering Systems

1.1.3.2 Self-Service Kiosks

1.1.3.3 Contactless & Cashless QSR

1.1.3.4 Smart Kitchen QSR

1.1.3.5 Automated / Robotic QSR

1.2 Fast Casual Restaurants

1.2.1 Premium Fast Casual

1.2.1.1 Organic & Clean Label Concepts

1.2.1.2 Farm-to-Table Fast Casual

1.2.1.3 Gourmet Burger & Pizza Formats

1.2.1.4 Health-Focused Fast Casual

1.2.2 Themed Fast Casual

1.2.2.1 Ethnic Cuisine-Focused

1.2.2.2 Fusion Concepts

1.2.2.3 Lifestyle & Experience-Based Concepts

1.2.3 Digital-Integrated Fast Casual

1.2.3.1 App-Driven Ordering

1.2.3.2 Delivery-Optimized Models

1.2.3.3 Subscription Meal Models

1.3 Cafés & Bakeries

1.3.1 Coffee-Led Chains

1.3.1.1 Specialty Coffee Outlets

1.3.1.2 Premium Café Chains

1.3.1.3 Drive-Thru Coffee Units

1.3.2 Bakery-Focused Outlets

1.3.2.1 Artisan Bakeries

1.3.2.2 Packaged Bakery Chains

1.3.2.3 Dessert-Centric QSR

1.3.3 Hybrid Café-Bistro Models

1.3.3.1 Breakfast & Brunch Cafés

1.3.3.2 Co-Working Café Spaces

1.3.3.3 Digital Nomad-Oriented Cafés

1.4 Drive-Thru & Takeaway Chains

1.4.1 Standalone Drive-Thru Units

1.4.1.1 Highway Drive-Thru

1.4.1.2 Urban Drive-Thru

1.4.1.3 Multi-Lane Digital Drive-Thru

1.4.2 Express Takeaway Counters

1.4.2.1 Mall-Based Takeaway

1.4.2.2 Transit Hub Outlets

1.4.2.3 Food Court Counters

1.4.3 Dark Kitchens / Cloud Kitchens

1.4.3.1 Single-Brand Cloud Kitchens

1.4.3.2 Multi-Brand Cloud Kitchens

1.4.3.3 Delivery-Only Aggregator Kitchens

- By Cuisine Type

2.1 Burgers & Sandwiches

2.1.1 Beef-Based Burgers

2.1.1.1 Classic Beef Burger

2.1.1.2 Premium Angus Burger

2.1.1.3 Value Menu Burgers

2.1.2 Chicken Burgers & Sandwiches

2.1.2.1 Grilled Chicken

2.1.2.2 Crispy / Fried Chicken

2.1.2.3 Spicy & Regional Variants

2.1.3 Plant-Based & Vegan Burgers

2.1.3.1 Soy-Based Patties

2.1.3.2 Pea-Protein Patties

2.1.3.3 Lab-Grown Alternatives

2.2 Pizza & Pasta

2.2.1 Quick Service Pizza Chains

2.2.1.1 Delivery-Focused

2.2.1.2 Dine-In + Delivery Hybrid

2.2.1.3 Express Slice Concepts

2.2.2 Pasta-Based Fast Casual

2.2.2.1 Ready-to-Serve Pasta Bowls

2.2.2.2 Customizable Pasta Stations

2.2.2.3 Baked Pasta Variants

2.2.3 Specialty & Regional Variants

2.2.3.1 Thin Crust

2.2.3.2 Deep Dish

2.2.3.3 Gluten-Free & Health-Focused

2.3 Chicken & Seafood

2.3.1 Fried Chicken Chains

2.3.1.1 Bucket Format

2.3.1.2 Boneless / Nuggets

2.3.1.3 Spicy & Regional Recipes

2.3.2 Grilled & Healthy Chicken

2.3.2.1 Low-Calorie Options

2.3.2.2 Protein-Rich Meal Combos

2.3.3 Seafood QSR

2.3.3.1 Fish & Chips

2.3.3.2 Shrimp & Prawn Formats

2.3.3.3 Regional Seafood Specialties

2.4 Asian & Ethnic Fast Food

2.4.1 Chinese Fast Casual

2.4.2 Japanese Quick Service

2.4.3 Indian & South Asian QSR

2.4.4 Mexican & Latin Fusion

2.4.5 Middle Eastern Quick Service

2.5 Desserts & Beverages

2.5.1 Ice Cream & Frozen Desserts

2.5.2 Milkshakes & Smoothies

2.5.3 Specialty Coffee & Tea

2.5.4 Carbonated & Soft Drinks

2.5.5 Functional & Energy Beverages

- By Distribution Channel

3.1 Dine-In

3.1.1 Casual Seating

3.1.2 Premium Fast Casual Seating

3.1.3 Family-Oriented Dining

3.1.4 Mall & Food Court Dining

3.1.5 Experiential & Themed Dining

3.2 Takeaway

3.2.1 Counter Pickup

3.2.2 Pre-Order Pickup

3.2.3 Smart Locker Pickup

3.2.4 Curbside Pickup

3.3 Online Delivery

3.3.1 Third-Party Aggregators

3.3.1.1 App-Based Delivery

3.3.1.2 Subscription Delivery Models

3.3.2 Brand-Owned Delivery

3.3.2.1 In-House Fleet

3.3.2.2 Hybrid Fleet + Aggregator

3.3.3 Cloud Kitchen Delivery

3.3.3.1 Single Brand

3.3.3.2 Multi-Brand

3.4 Drive-Thru

3.4.1 Traditional Drive-Thru

3.4.2 Dual-Lane Digital Drive-Thru

3.4.3 AI-Enabled Voice Ordering Drive-Thru

3.4.4 Contactless Drive-Thru Systems

- By End-User

4.1 Individual Consumers

4.1.1 Millennials

4.1.2 Gen Z Consumers

4.1.3 Working Professionals

4.1.4 Families

4.1.5 Health-Conscious Consumers

4.2 Corporate Customers

4.2.1 Office Catering

4.2.2 Corporate Meal Contracts

4.2.3 Bulk Event Orders

4.2.4 Subscription-Based Corporate Meals

4.3 Institutional Clients (Schools, Hospitals, Offices)

4.3.1 Educational Institutions

4.3.1.1 Schools

4.3.1.2 Colleges & Universities

4.3.2 Healthcare Institutions

4.3.2.1 Hospitals

4.3.2.2 Long-Term Care Facilities

4.3.3 Government & Public Offices

4.3.3.1 Administrative Buildings

4.3.3.2 Defense & Public Sector Units

Regional Insights of Global Quick Service Restaurants (QSR) and Fast Food Market

North America – Largest Global Quick Service Restaurants (QSR) and Fast Food Market

North America continues to account for the largest share of the Global Quick Service Restaurants (QSR) and Fast Food Market, supported by strong brand concentration, mature franchise networks, and high digital integration. The United States remains the primary revenue contributor due to well-established global chains, widespread adoption of AI-enabled ordering systems, and sustained consumer demand for convenient, standardized dining experiences. Advanced drive-thru infrastructure, loyalty programs, and delivery partnerships further reinforce the region’s leadership position.

Asia-Pacific – Fastest Growing Market

Asia-Pacific is witnessing the fastest growth, fueled by expanding urban populations, increasing disposable income, and strong digital adoption. Rapid franchise penetration across India, China, and Southeast Asia, combined with a growing youth demographic and rising online food delivery usage, continues to accelerate market expansion. Localization strategies and affordable menu pricing further strengthen regional performance.

Europe

The European market is evolving through premium fast-casual formats, sustainability-focused operations, and heightened demand for healthier menu alternatives. Regulatory emphasis on eco-friendly packaging and responsible sourcing is reinforcing sustainability trends in Quick Service Restaurants (QSR) and Fast Food across major economies.

Middle East & Africa

Growth in the Middle East & Africa is supported by rising tourism, expansion of shopping mall dining ecosystems, and increasing entry of international QSR brands. Franchise-led development and modernization of foodservice infrastructure are generating new revenue opportunities across urban centers.

South America

South America is emerging as a steadily expanding market, driven by demand for affordable fast food options, growing middle-class consumption, and increased adoption of digital ordering platforms. Fusion cuisine innovation, regional flavor customization, and expanding delivery networks are strengthening market penetration across key economies, supporting long-term development within the broader Global Quick Service Restaurants (QSR) and Fast Food Market.

Leading Companies in the Global Quick Service Restaurants (QSR) and Fast Food Market

Prominent players include:

-

Subway IP LLC

-

Starbucks Corporation

-

Domino’s Pizza, Inc.

-

Chipotle Mexican Grill, Inc.

-

Inspire Brands (Arby’s, Dunkin’, Sonic)

-

Papa John’s International, Inc.

-

Wendy’s Company

Among these, McDonald’s Corporation is the largest company in the Global Quick Service Restaurants (QSR) and Fast Food Market. Leading companies are strengthening competitive positioning through AI-based customer engagement tools, automated kitchen systems, localized menu strategies, and enhanced sustainability frameworks.

Strategic Intelligence and AI-Backed Insights

-

Phoenix Demand Forecast Engine highlights sustained growth supported by franchise expansion, digital ordering integration, and third-party delivery partnerships.

-

The Consumer Behavior Analyzer identifies growing preference for value-based offerings, healthier alternatives, and personalized dining experiences.

-

The Innovation Tracker underscores automation in food preparation, contactless service models, and AI-driven personalization as core competitive differentiators.

-

Porter’s Five Forces Analysis reveals intense competitive rivalry, moderate supplier power, and significant opportunities for technologically advanced operators capable of differentiation.

Why the Global Quick Service Restaurants (QSR) and Fast Food Market Remains Critical

-

Increasing demand for convenient and affordable dining among urban working populations.

-

AI integration enhances operational efficiency and improves customer engagement.

-

Expanding franchise ecosystems support scalable global growth.

-

Sustainable packaging and responsible sourcing align with environmental commitments.

-

Digital personalization strengthens long-term brand loyalty and repeat consumption

Final Takeaway of Global Quick Service Restaurants (QSR) and Fast Food Market

1. Executive Summary

1.1 Market Snapshot (2026–2033)

1.2 Key Growth Highlights

1.3 Largest & Fastest Growing Regions

1.4 Top Segment Analysis

1.5 Key Trends & Future Focus

2. Market Overview

2.1 Industry Definition & Scope

2.2 Market Evolution & Structural Transformation

2.3 Digitalization & AI Integration Landscape

2.4 Post-2025 Industry Outlook

3. Market Forecast Snapshot (2026–2033)

3.1 Market Size & Revenue Forecast

3.2 CAGR Analysis

3.3 Regional Growth Outlook

3.4 Segment Growth Outlook

4. Key Drivers of Market Growth

4.1 Rising Urbanization & Lifestyle Shifts

4.2 Online Delivery & Digital Ordering Expansion

4.3 Menu Diversification & Health-Conscious Offerings

4.4 Technological Innovations & Automation

4.5 Franchise Expansion & Localization Strategies

5. Market Challenges & Restraints

5.1 Rising Raw Material Costs

5.2 Regulatory & Sustainability Pressures

5.3 Intense Competitive Rivalry

5.4 Labor & Operational Cost Pressures

6. Global Market Segmentation – By Service Type

6.1 Quick Service Restaurants (QSR)

6.1.1 Franchise-Based QSR Chains

6.1.1.1 Global Franchise Networks

6.1.1.2 Regional Franchise Operators

6.1.1.3 Master Franchise Models 6.1.1.4 Company-Owned Stores 6.1.1.5 Hybrid Franchise-Owned Models

6.1.2 Independent QSR Outlets 6.1.2.1 Single-Location Operators

6.1.2.2 Local Chain Operators

6.1.2.3 Cloud-Integrated Independent QSRs

6.1.2.4 Street-Format Quick Service Units

6.1.3 Technology-Enabled QSR Formats

6.1.3.1 AI-Powered Ordering Systems

6.1.3.2 Self-Service Kiosks

6.1.3.3 Contactless & Cashless QSR

6.1.3.4 Smart Kitchen QSR

6.1.3.5 Automated / Robotic QSR

6.2 Fast Casual Restaurants

6.2.1 Premium Fast Casual

6.2.2 Themed Fast Casual

6.2.3 Digital-Integrated Fast Casual

6.3 Cafés & Bakeries

6.3.1 Coffee-Led Chains

6.3.2 Bakery-Focused Outlets

6.3.3 Hybrid Café-Bistro Models

6.4 Drive-Thru & Takeaway Chains

6.4.1 Standalone Drive-Thru Units

6.4.2 Express Takeaway Counters

6.4.3 Dark Kitchens / Cloud Kitchens

7. Global Market Segmentation – By Cuisine Type

7.1 Burgers & Sandwiches

7.2 Pizza & Pasta

7.3 Chicken & Seafood

7.4 Asian & Ethnic Fast Food

7.5 Desserts & Beverages

8. Global Market Segmentation – By Distribution Channel

8.1 Dine-In

8.2 Takeaway

8.3 Online Delivery

8.4 Drive-Thru

9. Global Market Segmentation – By End-User

9.1 Individual Consumers

9.2 Corporate Customers

9.3 Institutional Clients

10. Regional Insights

10.1 North America

10.2 Asia-Pacific

10.3 Europe

10.4 Middle East & Africa

10.5 South America

11. Competitive Landscape

11.1 Market Share Analysis

11.2 Competitive Positioning

11.3 Technology & Innovation Benchmarking

11.4 Recent Developments & Expansion Strategies

12. Leading Companies Profiled

12.1 McDonald’s Corporation

12.2 Yum! Brands, Inc.

12.3 Restaurant Brands International

12.4 Subway IP LLC

12.5 Starbucks Corporation

12.6 Domino’s Pizza, Inc.

12.7 Chipotle Mexican Grill, Inc.

12.8 Inspire Brands

12.9 Papa John’s International, Inc.

12.10 Wendy’s Company

14. Strategic Intelligence & AI-Backed Insights

13.1 Phoenix Demand Forecast Engine

13.2 Consumer Behavior Analyzer

13.3 Innovation Tracker

13.4 Porter’s Five Forces Analysis

14.Market Opportunities & Future Outlook

14.1 AI-Driven Personalization

14.2 Sustainable Packaging Innovation

14.3 Digital Delivery Expansion

14.4 Franchise Scalability in Emerging Markets

15. Why This Market Remains Critical

16. Final Takeaway & Strategic Recommendations