Global Sensors Market, 2025-2033

Global Sensors Market to Reach USD 452.27 Billion by 2033

The Global Sensors Market is experiencing robust expansion, propelled by accelerating IoT deployment, industrial automation, smart infrastructure, and automotive electrification. Sensors are now critical infrastructure for real-time data collection and decision-making across industries—from consumer electronics and healthcare to smart cities and autonomous systems.

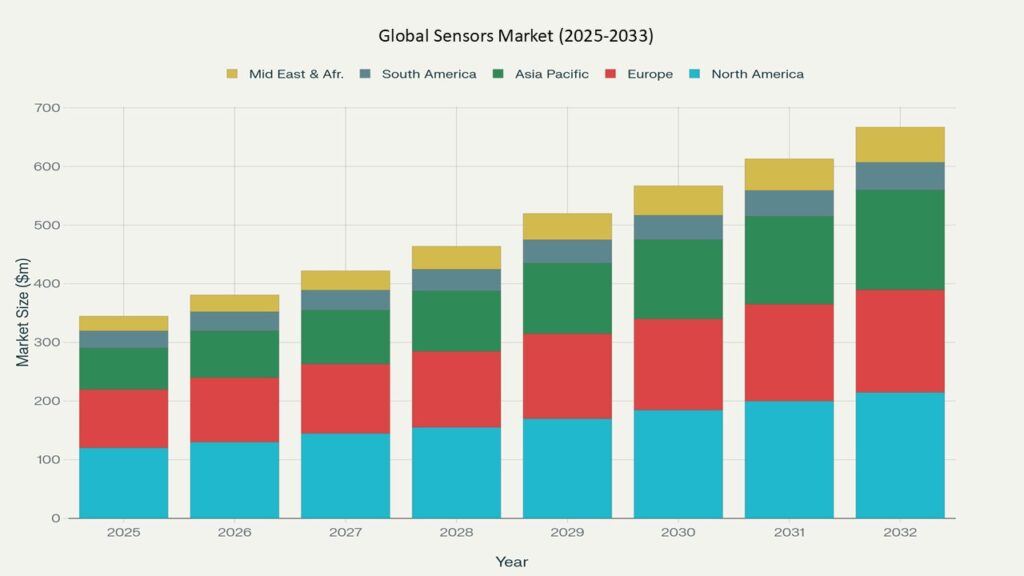

According to Phoenix’s Demand Forecast Engine, market will expand from USD 236.75 billion in 2025 to approximately USD 452.27 billion by 2033, recording a CAGR of 10.4% over the forecast period.

Key Drivers of Market Growth

- IoT & Smart Infrastructure Adoption

Growing demand for sensors in smart cities, connected devices, and enterprise automation is a major growth lever. - Industrial Automation & Predictive Maintenance

Sensors are pivotal in reducing downtime and enhancing key manufacturing KPIs across smart factories. - Electrification & Autonomous Mobility

Automotive sensors—especially in electric and autonomous vehicles—are expanding rapidly, particularly in Asia. - Miniaturization & Edge AI Integration

MEMS, CMOS, and smart sensors are increasingly integrated with AI to enable local data processing. - Healthcare Wearables & Environmental Monitoring

The rise of wearable devices and environmental sensing applications is fueling demand in healthcare and smart building sectors.

Market Segmentation

By Type / Technology

- Smart Sensors (IoT-enabled, MEMS, CMOS, etc.)

- Industrial Sensors (Temperature, Pressure, Flow, Position, Force, etc.)

By Application

- Automotive & Mobility (ADAS, EVs)

- Industrial Automation & Manufacturing

- Consumer Electronics & Wearables

- Built Environment & Smart Infrastructure (Smart Cities, Buildings)

- Healthcare & Environmental Monitoring

By End User

- OEMs (Automotive, Electronics, Machinery)

- Process & Discrete Manufacturers

- Smart Infrastructure Providers

- Healthcare & Wearable Device Manufacturers

Region-Level Insights

Asia Pacific – Largest Market (~40% share)

Fueled by massive electronics and automotive production, smart manufacturing initiatives in China, India, and Southeast Asia continue to drive growth.

North America – Advanced Adoption

Strong in industrial, automotive, and smart infrastructure sensors, especially with IoT and edge deployment in manufacturing and healthcare.

Europe – Sustainability & Smart Industry Lead

Focus on high-precision sensors for automation, EVs, and green infrastructure projects.

Latin America & MEA

Emerging demand for process sensors, environmental monitoring, and smart building systems, especially in urbanizing regions.

Leading Companies in the Market

- Honeywell

- STMicroelectronics

- NXP Semiconductors

- Analog Devices / ADI

- Siemens

- Robert Bosch

- Infineon

- Omron

- Sensirion

- Texas Instruments

These firms are advancing sensor technology through innovations in MEMS, imaging, smart packaging, and ecosystem integration.

Strategic Intelligence and AI-Backed Insights

- Phoenix Demand Forecast Engine shows strong growth in industrial and automotive segments, led by Asia-Pacific scaling.

- Construction Activity Mapping System tracks expansion of smart factory and smart city sensor deployments.

- Sentiment Analyzer Tool indicates rising interest in wearables and environmental sensors for health.

- Porter’s Five Forces (Automated) highlights moderate supplier power, high buyer bargaining in commoditized markets, and increased differentiation among smart sensor providers.

Forecast Snapshot: 2025–2033

| Metric | Value |

| 2025 Market Size | ~USD 236 Billion |

| 2033 Market Size | ~USD 452 Billion |

| CAGR (2025–2033) | 10.4% |

| Largest Region (2024) | Asia Pacific (~40%) |

| Fastest Growing Region | Asia Pacific (est. 8–10% CAGR) |

| Top Segment | Smart Sensors & IoT Devices |

| Key Trend | Edge Integration + MEMS |

| Future Growth Focus | Industrial Automation & EV Sensors |

Why the Global Market Remains Critical

- Sensors are the nervous system of digital transformation across all industries.

- They power Industry 4.0, autonomous systems, and smart infrastructure, enabling data-driven insights at scale.

- Demand is underpinned by IoT proliferation, automation, and regulatory investments in safety and efficiency.

- Technological convergence (MEMS, AI, Edge) creates new value propositions and defensible market positioning.

Final Takeaway

The Global Sensors Market is on a trajectory to double within the next decade, evolving into a pivotal enabler of smart technology ecosystems. Companies that invest in smart sensor platforms, edge analytics, and industrial partnership models will lead the charge in future global adoption.

- Executive Summary & Market Overview

- 1.1 Introduction to the Global Sensors Market

- 1.2 Evolution of Sensor Technologies: From Analog to Smart & IoT-Enabled Sensors

- 1.3 Market Snapshot: Size, Share, and CAGR (2023–2032)

- 1.4 Key Market Trends: Miniaturization, Wireless Connectivity, AI-Integrated Sensing, Low-Power Sensors

- 1.5 Role of Sensors in IoT, Smart Cities, Autonomous Systems, and Industry 4.0

- 1.6 Phoenix Research Methodology & Analytical Tools

- Key Drivers of Market Growth

- 2.1 Rising Demand from Automotive (ADAS, EVs, Autonomous Driving)

- 2.2 Expanding Applications in Consumer Electronics (Smartphones, Wearables, AR/VR)

- 2.3 Industrial Automation & Smart Manufacturing Adoption

- 2.4 Healthcare Expansion: Remote Monitoring & Diagnostic Devices

- 2.5 Integration with AI, ML & Edge Computing for Predictive Analytics

- 2.6 Growing Smart City Initiatives & Environmental Monitoring

- Market Segmentation

- 3.1 By Sensor Type

- 3.1.1 Temperature Sensors

- 3.1.2 Pressure Sensors

- 3.1.3 Motion & Position Sensors (Accelerometers, Gyroscopes, Magnetometers)

- 3.1.4 Image Sensors

- 3.1.5 Proximity & Occupancy Sensors

- 3.1.6 Gas & Chemical Sensors

- 3.1.7 Optical & Light Sensors

- 3.1.8 Biosensors

- 3.1.9 Others (Touch, Humidity, Flow, etc.)

- 3.2 By Technology

- 3.2.1 MEMS (Microelectromechanical Systems)

- 3.2.2 CMOS Technology

- 3.2.3 NEMS (Nanoelectromechanical Systems)

- 3.2.4 Others (Infrared, Photonic, Wireless)

- 3.3 By Application

- 3.3.1 Automotive

- 3.3.2 Consumer Electronics

- 3.3.3 Industrial & Manufacturing

- 3.3.4 Healthcare & Medical Devices

- 3.3.5 Aerospace & Defense

- 3.3.6 Environmental Monitoring & Smart Cities

- 3.3.7 Others (Agriculture, Logistics, Energy)

- 3.4 By End User

- 3.4.1 OEMs

- 3.4.2 Industrial Enterprises

- 3.4.3 Consumers

- 3.4.4 Governments & Research Institutes

- Region-Level Insights

- 4.1 North America

- 4.1.1 U.S. Leadership in IoT & Smart Devices

- 4.1.2 Automotive Sensor Adoption in EVs & ADAS

- 4.2 Europe

- 4.2.1 Strong Automotive Industry in Germany & France

- 4.2.2 EU Regulations Driving Smart Environmental Monitoring

- 4.3 Asia Pacific

- 4.3.1 Largest Market Driven by China, Japan, South Korea

- 4.3.2 Growing Adoption in Consumer Electronics & Industrial Automation

- 4.4 Latin America

- 4.4.1 Brazil & Mexico’s Emerging Automotive & Industrial Sector

- 4.4.2 Increasing Smart Infrastructure Projects

- 4.5 Middle East & Africa

- 4.5.1 Smart City Investments (Dubai, Saudi Arabia NEOM)

- 4.5.2 Adoption in Oil & Gas, Defense, and Security Applications

- Leading Companies in the Market

- 5.1 Competitive Landscape Overview

- 5.2 Company Profiles & Strategic Highlights

- 5.2.1 Bosch Sensortec

- 5.2.2 Texas Instruments

- 5.2.3 STMicroelectronics

- 5.2.4 Honeywell International

- 5.2.5 TE Connectivity

- 5.2.6 Analog Devices

- 5.2.7 Infineon Technologies

- 5.2.8 Omron Corporation

- 5.2.9 Sony Semiconductor (Image Sensors)

- 5.2.10 NXP Semiconductors

- 5.3 Emerging Startups & Innovators in Niche Sensor Segments

- 5.4 Mergers & Acquisitions, Partnerships, and R&D Focus

- Strategic Intelligence and Phoenix-Backed Insights

- 6.1 Phoenix Industry Readiness Index for Sensors

- 6.2 Technology & Innovation Roadmap: MEMS, AI, Edge Computing Integration

- 6.3 Automated Porter’s Five Forces Analysis

- 6.3.1 Competitive Rivalry

- 6.3.2 Supplier Power

- 6.3.3 Buyer Power

- 6.3.4 Threat of New Entrants

- 6.3.5 Threat of Substitutes

- 6.4 Regulatory & Standards Landscape (ISO, IEC, Automotive, Medical Devices)

- 6.5 Sustainability & Green Sensors for Eco-Friendly Monitoring

- Forecast Snapshot: 2023–2032

- 7.1 Global Market Size & Growth Forecast

- 7.2 CAGR by Sensor Type & Application

- 7.3 Regional Growth Comparisons

- 7.4 Fastest Growing Segments (Healthcare Biosensors, Automotive ADAS, IoT Sensors)

- 7.5 Market Inflection Points: AI-Powered Sensing, Autonomous Systems, Sustainability

- 7.6 Investment Outlook: Venture Capital, Tech Giants, Industrial Players

- Why the Global Sensors Market Remains Critical

- 8.1 Enabler of IoT, AI, and Industry 4.0 Transformation

- 8.2 Expanding Role in Consumer Lifestyle & Digital Devices

- 8.3 Driving Safety, Automation, and Predictive Maintenance Across Industries

- 8.4 Role in Environmental Sustainability & Climate Monitoring

- 8.5 Sensors as a Backbone of Smart & Connected Ecosystems

- Phoenix Researcher Insights & Final Takeaways

- 9.1 Strategic Summary of Findings

- 9.2 Growth Pockets: MEMS Sensors, Healthcare Biosensors, Automotive ADAS, IoT

- 9.3 Recommendations for Global Leaders & Local Innovators

- 9.4 Evolving Consumer & Industrial Sensor Adoption Trends

- 9.5 Phoenix Research Positioning: Delivering Strategic Growth Intelligence

- Appendices

- 10.1 Research Methodology

- 10.2 Data Sources and Assumptions

- 10.3 Glossary of Sensor Technologies

- 10.4 Phoenix Market Intelligence Suite Overview

10.5 Contact & Custom Research Support