Global Spirits Market Report 2026–2033

Global Spirits Market Forecast Snapshot (2026–2033)

| Metric | Value |

|---|---|

| 2025 Market Size | USD 493.7 Billion |

| 2033 Market Size | ~USD 732.5 Billion |

| CAGR (2025–2033) | 5.0% |

| Largest Market | Europe |

| Fastest Growing Region | Asia-Pacific |

| Dominant Product Segment | Whiskey & Vodka |

| Key Trend | Premiumization & Craft Spirits |

| Future Focus | Sustainable Production, Digital Transformation |

Global Spirits Market Overview

The Global Spirits Market encompasses a wide range of alcoholic beverages, including whiskey, vodka, rum, gin, tequila, brandy, liqueurs, and other premium or craft spirit offerings. The market has evolved into a mainstream global segment, driven by rising disposable incomes, urban lifestyles, premiumization trends, and growing consumer preference for authentic, high-quality, and innovative spirit experiences.

Consumers are increasingly seeking craft and flavored variants, boutique distillery products, and premium aged spirits, reflecting a shift toward experimentation, heritage, and taste sophistication. Digital distribution, e-commerce platforms, and online alcohol delivery services further enhance accessibility and visibility for both established and emerging brands.

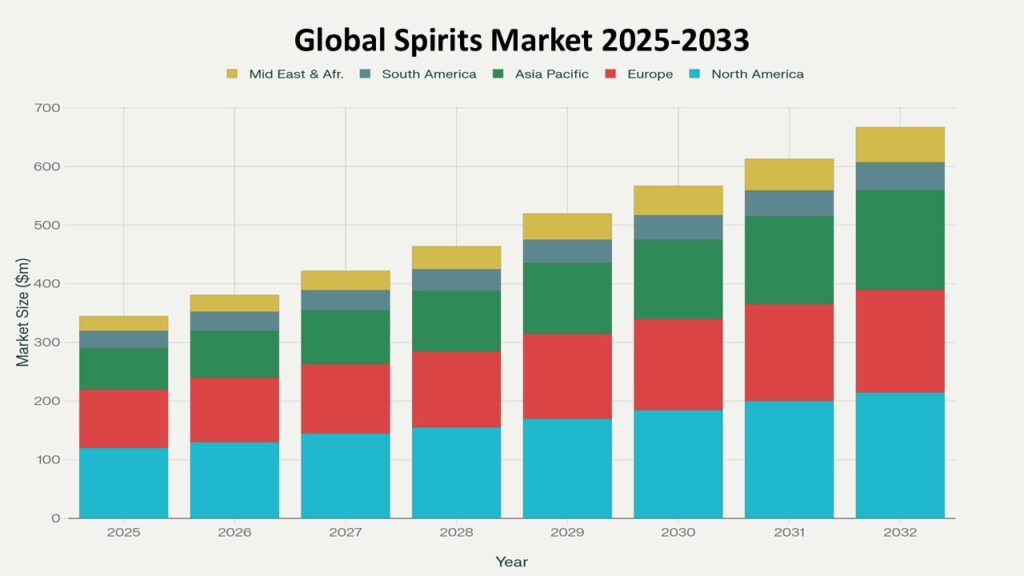

According to Phoenix Demand Forecast Engine, the Global Spirits Market is valued at USD 493.7 billion in 2025 and is projected to reach approximately USD 732.5 billion by 2033, reflecting a CAGR of ~5.0% during 2026–2033. Europe currently holds the largest market share, supported by historic distilling traditions, premium brand portfolios, and strong domestic consumption, while Asia-Pacific represents the fastest-growing region, fueled by rising disposable incomes, urban nightlife culture, and hospitality expansion.

Post-2025, growth is expected to be shaped by rising craft and premium consumption, digital marketing and e-commerce adoption, sustainable and ethical production practices, and innovation in flavored, low-calorie, and experiential spirit offerings.

Key Drivers of Global Spirits Market Growth

1. Premiumization & Product Innovation

Increasing consumer inclination toward high-quality, aged, and artisanal spirits is encouraging manufacturers to introduce small-batch releases, limited editions, and specialty craft variants that command higher margins.

2. Rising Popularity of Craft & Flavored Spirits

Demand for locally produced, distinctive, and flavored offerings—such as botanical-infused gins, fruit-forward vodkas, and experimental blends—is attracting younger and experience-driven consumers.

3. Urbanization & Evolving Lifestyle Patterns

Growth in urban populations, expanding social culture, nightlife expansion, and rising disposable incomes are fueling consumption of premium and experimental spirit categories.

4. Expansion of Distribution & Digital Commerce

The rapid development of e-commerce platforms, alcohol delivery applications, and global duty-free retail networks is improving product accessibility and strengthening international brand visibility.

5. Brand Heritage, Storytelling & Influencer Marketing

Strategic brand positioning through heritage narratives, celebrity partnerships, experiential campaigns, and digital engagement is enhancing brand loyalty among millennials and Gen Z consumers.

6. Sustainability & Responsible Production Practices

Growing emphasis on renewable energy usage, organic raw materials, carbon footprint reduction, and recyclable packaging aligns with environmentally conscious consumer expectations and strengthens long-term brand equity.

Global Spirits Market Segmentation

1. By Product Type

1.1 Whiskey

1.1.1 Single Malt Whiskey

1.1.1.1 Aged 12–15 Years

1.1.1.2 Aged 16–20 Years

1.1.1.3 Aged 20+ Years

1.1.2 Blended Whiskey

1.1.2.1 Standard Blends

1.1.2.2 Premium Blends

1.1.3 Bourbon / Rye

1.1.3.1 Bourbon

1.1.3.2 Rye Whiskey

1.2 Vodka

1.2.1 Flavored Vodka

1.2.1.1 Fruit-Flavored Vodka

1.2.1.2 Botanical / Herb-Infused Vodka

1.2.2 Premium Vodka

1.2.2.1 Ultra-Premium / Small-Batch Vodka

1.2.2.2 Organic / Clean-Label Vodka

1.3 Rum

1.3.1 Light / White Rum

1.3.1.1 Standard Light Rum

1.3.1.2 Flavored Light Rum

1.3.2 Dark / Aged Rum

1.3.2.1 Aged 3–7 Years

1.3.2.2 Aged 8–12 Years

1.3.3 Spiced Rum

1.3.3.1 Standard Spiced Rum

1.3.3.2 Premium / Craft Spiced Rum

1.4 Gin

1.4.1 London Dry Gin

1.4.1.1 Standard London Dry

1.4.1.2 Premium London Dry

1.4.2 Premium / Craft Gin

1.4.2.1 Small-Batch Craft Gin

1.4.2.2 Botanical / Flavored Craft Gin

1.5 Tequila

1.5.1 Blanco / Silver

1.5.1.1 Standard Blanco

1.5.1.2 Premium Blanco

1.5.2 Reposado

1.5.2.1 Standard Reposado

1.5.2.2 Premium Reposado

1.5.3 Añejo / Extra Añejo

1.5.3.1 Añejo (1–3 Years)

1.5.3.2 Extra Añejo (3+ Years)

1.6 Brandy

1.6.1 Cognac

1.6.1.1 VS / VSOP

1.6.1.2 XO / Premium Cognac

1.6.2 Other Brandy Variants

1.6.2.1 Fruit Brandies (Apple, Pear, etc.)

1.6.2.2 Regional Brandy Variants

1.7 Liqueurs

1.7.1 Herbal / Botanical Liqueurs

1.7.1.1 Digestive & Aperitif Liqueurs

1.7.1.2 Specialty Herbal Blends

1.7.2 Cream / Dessert Liqueurs

1.7.2.1 Chocolate / Coffee Cream Liqueurs

1.7.2.2 Vanilla / Nut-Flavored Cream Liqueurs

1.8 Others

1.8.1 Ready-to-Drink (RTD) Spirits

1.8.1.1 RTD Cocktail Mixes

1.8.1.2 RTD Highball & Spritz

1.8.2 Specialty / Regional Spirits

1.8.2.1 Local / Indigenous Spirits

1.8.2.2 Limited Edition / Seasonal Spirits

2. By Category

2.1 Premium Spirits

2.1.1 Ultra-Premium / Aged Spirits

2.1.2 Craft / Small-Batch Spirits

2.2 Standard Spirits

2.2.1 Mass-Market Bottled Spirits

2.2.2 Flavored / Value Variants

2.3 Economy Spirits

2.3.1 Budget Bottled Spirits

2.3.2 Local / Regional Economy Brands

3. By Distribution Channel

3.1 On-Trade (Bars, Restaurants, Hotels)

3.1.1 Premium & Boutique Bars

3.1.1.1 Cocktail Bars

3.1.1.2 Hotel Lounges

3.1.2 Hotel & Resort Beverage Services

3.1.2.1 Luxury Resorts

3.1.2.2 Mid-Tier Hotels

3.2 Off-Trade (Supermarkets, Retail Stores)

3.2.1 Large Retail Chains

3.2.1.1 Global Chains (e.g., Walmart, Tesco)

3.2.1.2 Regional / National Chains

3.2.2 Specialty Liquor Stores

3.2.2.1 Premium / Craft Stores

3.2.2.2 Standard Retail Liquor Stores

3.3 Online Channels

3.3.1 E-Commerce Marketplaces

3.3.1.1 Global Platforms (Amazon, Alibaba)

3.3.1.2 Regional / Local Online Retailers

3.3.2 Direct-to-Consumer Subscription / Delivery

3.3.2.1 Subscription-Based Spirit Boxes

3.3.2.2 Personalized Spirit Bundles

4. By End User

4.1 Individual Consumers

4.1.1 Daily / Casual Drinkers

4.1.1.1 Standard Spirits for Everyday Use

4.1.1.2 Flavored & Light Spirits

4.1.2 Social & Leisure Drinkers

4.1.2.1 Party & Event Consumption

4.1.2.2 Premium Spirits for Occasions

4.1.3 Premium / Collectors

4.1.3.1 Limited Edition / Rare Bottles

4.1.3.2 Vintage & Aged Collections

4.2 Commercial (Hospitality & Entertainment)

4.2.1 Hotels & Resorts

4.2.1.1 Luxury / Premium Hotels

4.2.1.2 Mid-Tier Hotels

4.2.2 Restaurants & Bars

4.2.2.1 Fine Dining Restaurants

4.2.2.2 Casual Dining / Bar Chains

4.2.3 Clubs, Lounges & Event Venues

4.2.3.1 Nightclubs / High-End Lounges

4.2.3.2 Event Catering & Banquet Services

5. By Region

5.1 North America

5.2 Europe

5.3 Asia-Pacific

5.4 Latin America

5.5 Middle East & Africa

Regional Insights of the Global Spirits Market

Europe

Europe maintains the largest market share, driven by its established distilling heritage, presence of iconic premium brands, and strong domestic consumption. The region shows sustained growth in craft, small-batch, and aged spirits, with consumers increasingly seeking authenticity, heritage, and innovative flavor profiles. Regulatory frameworks supporting quality labeling and responsible drinking further reinforce market stability.

North America

North America is experiencing rapid expansion in flavored, craft, and premium spirits, fueled by a vibrant cocktail culture, growing number of local micro-distilleries, and urban lifestyle trends. Consumer interest in low-calorie, organic, and sustainably produced products is shaping product innovation. E-commerce platforms and direct-to-consumer subscriptions are accelerating market reach and brand engagement.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, and Japan, driven by rapid urbanization, rising disposable incomes, and the expansion of modern retail and hospitality sectors. Westernization of consumption habits, growing nightlife culture, and rising interest in premium and imported spirits are further fueling market adoption. Localized flavors and limited-edition releases are increasingly popular among urban consumers.

Latin America

Growth in Latin America is supported by both traditional and emerging spirit categories. Regional beverages like cachaça, mezcal, and rum are gaining international recognition, while exports and cross-border collaborations with global brands are boosting market expansion. Increasing tourism, rising disposable incomes, and growing social occasions also contribute to higher per-capita consumption.

Middle East & Africa

While cultural norms and strict regulations limit alcohol consumption, markets in the UAE, South Africa, and select tourism hubs are witnessing moderate but steady growth. Tourism-driven hospitality, international events, and luxury hotels are key drivers. Additionally, interest in premium and imported spirits among affluent urban populations is gradually expanding the overall market footprint.

Leading Companies in the Global Spirits Market

-

Bacardi Limited

-

Brown-Forman Corporation

-

Beam Suntory Inc.

-

Rémy Cointreau SA

-

Campari Group

-

William Grant & Sons Ltd.

-

Constellation Brands, Inc.

-

E. & J. Gallo Winery

Competition Focus: Premium product portfolios, heritage-based marketing, flavor innovation, craft spirits, sustainable production, and digital distribution. Diageo plc is the largest company in the Global spirits Market market.

Strategic Intelligence & AI-Backed Insights

Market modeling: Phoenix Demand Forecast Engine analyzed consumer preferences, premium vs. standard adoption, regional consumption patterns, and seasonal/occasion-driven demand.

Why the Global Spirits Market Remains Critical

-

Reflects cultural, social, and lifestyle evolution worldwide.

-

Drives employment and tourism in hospitality sectors.

-

Encourages sustainable innovation and ethical production.

-

Contributes significantly to government revenue via taxation and exports.

-

Represents a major segment of the global alcoholic beverage industry with recurring revenue potential.

Final Takeaway of Global Spirits Market

The Global Spirits Market continues to evolve as consumer preferences shift toward premium, authentic, and responsibly produced beverages. The projected CAGR of ~5.0% during 2025–2033 reflects steady growth, fueled by increasing disposable incomes, urban lifestyle adoption, and rising demand for craft, flavored, and aged spirits.

Future growth will follow a dual-structure model, with high-margin premium and craft spirits targeting affluent urban consumers, alongside scalable standard and economy spirits addressing mass-market demand. Innovation in flavor, packaging, and digital distribution, coupled with sustainable and ethical production practices, will define market leadership.

Companies investing in brand storytelling, AI-driven marketing insights, e-commerce expansion, experiential distillery tours, and sustainable production are positioned to gain long-term competitive advantage.

At Phoenix Research, our AI-driven market intelligence and forecasting frameworks provide detailed revenue projections, consumer trend analysis, and strategic insights, enabling manufacturers, investors, and stakeholders to capitalize on the evolving Post-2025 global spirits landscape with data-backed, scalable strategies.

📢 Social Mentions & Publication Channels

Explore deeper insights and follow our cross-platform updates on LinkedIn, and X for continuous intelligence and market coverage.

LinkedIn: https://www.linkedin.com/feed/update/urn:li:activity:7430144829751214081

X : https://x.com/Pheonix_Insight/status/2024380158447407382?s=20

Table of Contents

1. Market Forecast Snapshot (2026–2033)

1.1 2025 Market Size – USD 493.7 Billion

1.2 2033 Market Size – ~USD 732.5 Billion

1.3 CAGR (2025–2033) – ~5.0%

1.4 Largest Market – Europe

1.5 Fastest Growing Region – Asia-Pacific

1.6 Dominant Product Segment – Whiskey & Vodka

1.7 Key Trend – Premiumization & Craft Spirits

1.8 Future Focus – Sustainable Production, Digital Transformation

2. Global Spirits Market Overview

2.1 Market Definition & Scope

2.2 Evolution of the Global Spirits Industry

2.3 Premiumization & Craft Movement

2.4 Digital Transformation & E-Commerce Expansion

2.5 Regulatory & Taxation Landscape

2.6 Post-2025 Market Outlook

3. Key Drivers of Global Spirits Market Growth

3.1 Premiumization & Product Innovation

3.2 Popularity of Craft & Flavored Spirits

3.3 Urbanization & Lifestyle Changes

3.4 Expansion of Distribution & E-Commerce

3.5 Brand Heritage & Experiential Marketing

3.6 Sustainability & Ethical Production Practices

4. Market Segmentation by Product Type

4.1 Whiskey

4.1.1 Single Malt Whiskey

4.1.1.1 Aged 12–15 Years

4.1.1.2 Aged 16–20 Years

4.1.1.3 Aged 20+ Years

4.1.2 Blended Whiskey

4.1.2.1 Standard Blends

4.1.2.2 Premium Blends

4.1.3 Bourbon / Rye

4.1.3.1 Bourbon

4.1.3.2 Rye Whiskey

4.2 Vodka

4.2.1 Flavored Vodka

4.2.1.1 Fruit-Flavored Vodka

4.2.1.2 Botanical / Herb-Infused Vodka

4.2.2 Premium Vodka

4.2.2.1 Ultra-Premium / Small-Batch Vodka

4.2.2.2 Organic / Clean-Label Vodka

4.3 Rum

4.3.1 Light / White Rum

4.3.1.1 Standard Light Rum

4.3.1.2 Flavored Light Rum

4.3.2 Dark / Aged Rum

4.3.2.1 Aged 3–7 Years

4.3.2.2 Aged 8–12 Years

4.3.3 Spiced Rum

4.3.3.1 Standard Spiced Rum

4.3.3.2 Premium / Craft Spiced Rum

4.4 Gin

4.4.1 London Dry Gin

4.4.1.1 Standard London Dry

4.4.1.2 Premium London Dry

4.4.2 Premium / Craft Gin

4.4.2.1 Small-Batch Craft Gin

4.4.2.2 Botanical / Flavored Craft Gin

4.5 Tequila

4.5.1 Blanco / Silver

4.5.1.1 Standard Blanco

4.5.1.2 Premium Blanco

4.5.2 Reposado

4.5.2.1 Standard Reposado

4.5.2.2 Premium Reposado

4.5.3 Añejo / Extra Añejo

4.5.3.1 Añejo (1–3 Years)

4.5.3.2 Extra Añejo (3+ Years)

4.6 Brandy

4.6.1 Cognac

4.6.1.1 VS / VSOP

4.6.1.2 XO / Premium Cognac

4.6.2 Other Brandy Variants

4.6.2.1 Fruit Brandies

4.6.2.2 Regional Brandy Variants

4.7 Liqueurs

4.7.1 Herbal / Botanical Liqueurs

4.7.1.1 Digestive & Aperitif Liqueurs

4.7.1.2 Specialty Herbal Blends

4.7.2 Cream / Dessert Liqueurs

4.7.2.1 Chocolate / Coffee Cream Liqueurs

4.7.2.2 Vanilla / Nut-Flavored Cream Liqueurs

4.8 Others

4.8.1 Ready-to-Drink (RTD) Spirits

4.8.1.1 RTD Cocktail Mixes

4.8.1.2 RTD Highball & Spritz

4.8.2 Specialty / Regional Spirits

4.8.2.1 Local / Indigenous Spirits

4.8.2.2 Limited Edition / Seasonal Spirits

5. Market Segmentation by Category

5.1 Premium Spirits

5.1.1 Ultra-Premium / Aged Spirits

5.1.2 Craft / Small-Batch Spirits

5.2 Standard Spirits

5.2.1 Mass-Market Bottled Spirits

5.2.2 Flavored / Value Variants

5.3 Economy Spirits

5.3.1 Budget Bottled Spirits

5.3.2 Local / Regional Economy Brands

6. Market Segmentation by Distribution Channel

6.1 On-Trade (Bars, Restaurants, Hotels)

6.1.1 Premium & Boutique Bars

6.1.1.1 Cocktail Bars

6.1.1.2 Hotel Lounges

6.1.2 Hotel & Resort Beverage Services

6.1.2.1 Luxury Resorts

6.1.2.2 Mid-Tier Hotels

6.2 Off-Trade (Supermarkets, Retail Stores)

6.2.1 Large Retail Chains

6.2.1.1 Global Chains (Walmart, Tesco)

6.2.1.2 Regional / National Chains

6.2.2 Specialty Liquor Stores

6.2.2.1 Premium / Craft Stores

6.2.2.2 Standard Retail Liquor Stores

6.3 Online Channels

6.3.1 E-Commerce Marketplaces

6.3.1.1 Global Platforms (Amazon, Alibaba)

6.3.1.2 Regional / Local Online Retailers

6.3.2 Direct-to-Consumer Subscription / Delivery

6.3.2.1 Subscription-Based Spirit Boxes

6.3.2.2 Personalized Spirit Bundles

7. Market Segmentation by End User

7.1 Individual Consumers

7.1.1 Daily / Casual Drinkers

7.1.1.1 Standard Spirits for Everyday Use

7.1.1.2 Flavored & Light Spirits

7.1.2 Social & Leisure Drinkers

7.1.2.1 Party & Event Consumption

7.1.2.2 Premium Spirits for Occasions

7.1.3 Premium / Collectors

7.1.3.1 Limited Edition / Rare Bottles

7.1.3.2 Vintage & Aged Collections

7.2 Commercial (Hospitality & Entertainment)

7.2.1 Hotels & Resorts

7.2.1.1 Luxury / Premium Hotels

7.2.1.2 Mid-Tier Hotels

7.2.2 Restaurants & Bars

7.2.2.1 Fine Dining Restaurants

7.2.2.2 Casual Dining / Bar Chains

7.2.3 Clubs, Lounges & Event Venues

7.2.3.1 Nightclubs / High-End Lounges

7.2.3.2 Event Catering & Banquet Services

8. Market Segmentation by Region

8.1 North America

8.2 Europe

8.3 Asia-Pacific

8.4 Latin America

8.5 Middle East & Africa

9. Regional Insights

9.1 Europe – Market Leader

9.2 North America – Premium & Craft Expansion

9.3 Asia-Pacific – Fastest Growing Region

9.4 Latin America – Export & Heritage Growth

9.5 Middle East & Africa – Tourism-Driven Expansion

10. Competitive Landscape

10.1 Market Share Analysis

10.2 Competitive Positioning Matrix

10.3 Mergers & Acquisitions

10.4 Craft Distillery Expansion Trends

10.5 Pricing & Premiumization Strategies

11. Leading Companies

11.1 Diageo plc (Largest Player)

11.2 Pernod Ricard SA

11.3 Bacardi Limited

11.4 Brown-Forman Corporation

11.5 Beam Suntory Inc.

11.6 Rémy Cointreau SA

11.7 Campari Group

11.8 William Grant & Sons Ltd.

11.9 Constellation Brands, Inc.

11.10 E. & J. Gallo Winery

12. Strategic Intelligence & AI-Backed Insights

12.1 Phoenix Demand Forecast Modeling

12.2 Production & Distillery Investment Mapping

12.3 Consumer Sentiment & Trend Analytics

12.4 Porter’s Five Forces Analysis

13. Sustainability & Regulatory Landscape

13.1 Environmental & Ethical Production

13.2 Packaging & Carbon Footprint Reduction

13.3 Alcohol Regulations & Taxation Policies

13.4 Responsible Drinking Initiatives

14. Market Significance

14.1 Cultural & Lifestyle Influence

14.2 Contribution to Tourism & Hospitality

14.3 Government Revenue & Taxation Impact

14.4 Employment & Supply Chain Ecosystem

14.5 Recurring Revenue & Brand Loyalty

15. Final Takeaway

15.1 Growth Outlook (2026–2033)

15.2 Dual-Structure Growth Model

15.3 Premium vs. Mass-Market Strategy

15.4 Digital & Experiential Expansion

15.5 Strategic Recommendations

16. Appendix

17. About Us

18. Disclaimer

t