Global Sushi Restaurants Market Report 2026-2033

Global Sushi Restaurants Market Forecast Snapshot: 2026–2033

| Metric | Value |

|---|---|

| 2025 Market Size | USD 12.85 Billion |

| 2033 Market Size | ~USD 17.40 Billion |

| CAGR (2026–2033) | ~3.9% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Top Segment | Full-Service Sushi Restaurants |

| Key Trend | Premium Omakase Growth & Delivery-Optimized Sushi Formats |

| Future Focus | Sustainable Seafood, AI-Based Inventory Control & Global Franchise Expansion |

Global Sushi Restaurants Market Overview

The Global Sushi Restaurants Market includes traditional sushi bars, conveyor-belt (kaiten-zushi) formats, premium omakase counters, sushi-focused casual dining chains, quick-service sushi kiosks, and delivery-only sushi cloud kitchens.

Sushi has evolved from a niche Japanese delicacy into a globally mainstream dining category. Its popularity is driven by increasing preference for seafood-based and perceived healthy meals, growing fascination with Japanese culinary culture, premium experiential dining demand, and strong compatibility with takeaway and delivery platforms.

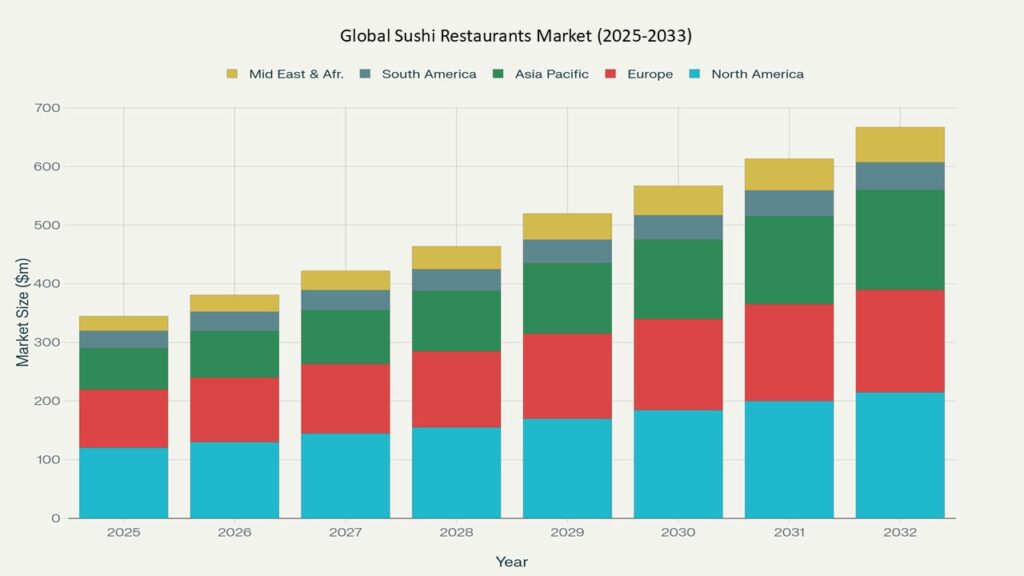

According to Phoenix Research, the Global Sushi Restaurants Market size is valued at USD 12.85 billion in 2025 and is projected to reach approximately USD 17.40 billion by 2033, reflecting a CAGR of ~3.9% during 2026–2033.

Asia-Pacific holds the largest market share, supported by strong domestic consumption in Japan and expanding sushi chain penetration across China and Southeast Asia. North America represents the fastest-growing region, driven by premium sushi adoption, fusion innovation, and high online delivery penetration.

The Post-2025 outlook indicates rising premiumization through omakase experiences, automation in sushi preparation, AI-powered seafood inventory management, and expansion of scalable franchise-led sushi formats globally.

1. Executive Summary

1.1 Market Forecast Snapshot (2026–2033)

1.2 Global Market Size & CAGR Analysis

1.3 Largest & Fastest-Growing Segments

1.4 Regional Leadership & Growth Trends

1.5 Key Market Drivers

1.6 Competitive Landscape Overview

1.7 Strategic Outlook Through 2033

2. Introduction & Market Overview

2.1 Definition of the Global Sushi Restaurants Market

2.2 Scope of the Study

2.3 Evolution of Sushi as a Global Mainstream Cuisine

2.4 Transition from Traditional Sushi Bars to Premium Omakase

2.5 Cultural Globalization & Culinary Mainstreaming

2.6 Digital Ordering, Automation & AI Integration

2.7 Sustainable Seafood & Traceability Trends

3. Research Methodology

3.1 Primary Research

3.2 Secondary Research

3.3 Market Size Estimation Model

3.4 Forecast Assumptions (2026–2033)

3.5 Data Validation & Triangulation

4. Market Dynamics

4.1 Drivers

4.1.1 Global Acceptance of Sushi as a Healthy Cuisine

4.1.2 Expansion of Premium Omakase Dining

4.1.3 Delivery & Takeaway Ecosystem Growth

4.1.4 Franchise Expansion of International Sushi Chains

4.1.5 Sustainable Seafood & Ethical Sourcing Demand

4.1.6 Urbanization & Experiential Dining Culture

4.1.7 AI-Based Inventory & Waste Optimization

4.2 Restraints

4.2.1 Seafood Price Volatility

4.2.2 Skilled Sushi Chef Shortage

4.2.3 High Rental & Urban Operating Costs

4.2.4 Supply Chain Sensitivity

4.3 Opportunities

4.3.1 Vegan & Plant-Based Sushi Expansion

4.3.2 Subscription-Based Sushi Models

4.3.3 Expansion into Emerging Markets

4.3.4 Retail-Ready & Supermarket Sushi Growth

4.4 Challenges

4.4.1 Cold-Chain Logistics Complexity

4.4.2 Delivery Commission Margin Pressure

4.4.3 Consumer Price Sensitivity

4.4.4 Competitive Market Fragmentation

5. Global Sushi Restaurants Market Analysis (USD Billion), 2026–2033

5.1 Market Size Overview

5.2 CAGR Analysis

5.3 Regional Revenue Distribution

5.4 Format-Wise Revenue Contribution

5.5 Margin & Pricing Trend Analysis

6. Market Segmentation by Restaurant Format (USD Billion), 2026–2033

6.1 Full-Service Sushi Restaurants

6.1.1 Traditional Sushi Bars

6.1.1.1 Counter-Style Chef Interaction

6.1.1.2 Table-Service Sushi Dining

6.1.1.3 Family-Owned Independent Sushi Bars

6.1.1.4 Urban High-Street Sushi Restaurants

6.1.2 Premium Omakase Restaurants

6.1.2.1 Michelin-Star Omakase

6.1.2.2 Reservation-Only Boutique Concepts

6.1.2.3 Seasonal Tasting Menu Sushi

6.1.2.4 Luxury Seafood-Focused Omakase

6.1.3 Sushi Lounges

6.1.3.1 Fusion Sushi Concepts

6.1.3.2 Bar-Integrated Sushi Dining

6.1.3.3 Nightlife-Oriented Sushi Venues

6.1.3.4 Hotel-Integrated Sushi Lounges

6.1.4 Casual Dining Sushi Chains

6.1.4.1 Mid-Scale National Chains

6.1.4.2 Regional Franchise Sushi Brands

6.1.4.3 Family-Oriented Sushi Dining

6.1.4.4 Mall-Based Casual Sushi Restaurants

6.2 Conveyor Belt Sushi (Kaiten-Zushi)

6.2.1 Standard Conveyor Formats

6.2.1.1 Manual Plate Pricing Systems

6.2.1.2 Color-Coded Pricing Models

6.2.1.3 Volume-Based Discount Models

6.2.2 Technology-Integrated Conveyor Formats

6.2.2.1 Automated Plate Tracking (RFID)

6.2.2.2 Tablet-Based Ordering Systems

6.2.2.3 Smart Table & Digital Menu Integration

6.2.3 Premium Conveyor Concepts

6.2.3.1 High-Quality Ingredient Conveyor Sushi

6.2.3.2 Express Urban Conveyor Units

6.2.3.3 Airport & Transit Hub Conveyor Sushi

6.3 Quick-Service Sushi

6.3.1 Mall & Retail-Based Sushi Kiosks

6.3.1.1 Food Court Sushi Counters

6.3.1.2 Supermarket In-Store Sushi Counters

6.3.1.3 Hypermarket Sushi Outlets

6.3.2 Transit & High-Footfall Locations

6.3.2.1 Airport Sushi Counters

6.3.2.2 Railway & Metro Station Units

6.3.2.3 Business District Grab-and-Go Outlets

6.3.3 Express Sushi Chains

6.3.3.1 Value-Priced Sushi Chains

6.3.3.2 Bento + Sushi Combo Formats

6.3.3.3 Franchise-Led Quick Sushi Brands

6.4 Cloud Kitchen & Delivery-Only Sushi

6.4.1 Single-Brand Sushi Cloud Kitchens

6.4.1.1 App-Exclusive Sushi Brands

6.4.1.2 Subscription Sushi Delivery Models

6.4.1.3 Premium Delivery-Only Omakase

6.4.2 Multi-Brand Asian Cloud Kitchens

6.4.2.1 Japanese + Korean Hybrid Kitchens

6.4.2.2 Pan-Asian Sushi Aggregator Models

6.4.2.3 Shared Infrastructure Cloud Kitchens

6.4.3 Platform-Owned Virtual Sushi Brands

6.4.3.1 Aggregator-Launched Sushi Concepts

6.4.3.2 Influencer-Led Virtual Sushi Brands

6.4.3.3 Data-Driven Micro-Market Sushi Brands

7. Market Segmentation by Product Type (USD Billion), 2026–2033

7.1 Nigiri Sushi

7.1.1 Tuna Varieties

7.1.2 Salmon Varieties

7.1.3 Shellfish & Shrimp

7.1.4 Premium Seasonal Seafood

7.1.5 Plant-Based Nigiri

7.2 Maki Rolls

7.2.1 Traditional Rolls

7.2.2 Westernized / Fusion Rolls

7.2.3 Premium Specialty Rolls

7.3 Sashimi

7.4 Sushi Platters & Combos

7.5 Specialty & Emerging Sushi Categories

8. Market Segmentation by Distribution Channel (USD Billion), 2026–2033

8.1 Dine-In

8.1.1 Casual Dining

8.1.1.1 Family-Oriented Sushi Restaurants

8.1.1.2 Urban High-Street Casual Sushi

8.1.1.3 Mall-Based Casual Dining Units

8.1.1.4 Mid-Scale Franchise Sushi Chains

8.1.2 Premium Omakase

8.1.2.1 Reservation-Only Omakase Counters

8.1.2.2 Michelin-Star Omakase Concepts

8.1.2.3 Chef-Owned Boutique Sushi Bars

8.1.2.4 Seasonal Tasting Menu Experiences

8.1.3 Hotel & Resort Dining

8.1.3.1 Five-Star Hotel Sushi Restaurants

8.1.3.2 Luxury Resort Japanese Dining

8.1.3.3 Business Hotel Sushi Concepts

8.1.3.4 Cruise & Premium Hospitality Sushi

8.1.4 Entertainment District Dining

8.1.4.1 Nightlife-Integrated Sushi Lounges

8.1.4.2 Bar & Sushi Hybrid Concepts

8.1.4.3 Event-Centric Sushi Venues

8.1.4.4 Tourist Hub Sushi Restaurants

8.2 Takeaway

8.2.1 Counter Pickup

8.2.1.1 In-Store Order & Pickup

8.2.1.2 Express Sushi Counters

8.2.1.3 Bento & Combo Pickup Units

8.2.1.4 Pre-Packed Sushi Displays

8.2.2 Pre-Order App Pickup

8.2.2.1 Mobile App Scheduled Pickup

8.2.2.2 Click-and-Collect Models

8.2.2.3 Loyalty-App Integrated Pickup

8.2.2.4 QR-Code Based Pickup Systems

8.2.3 Drive-Thru Sushi Units

8.2.3.1 Standalone Drive-Thru Outlets

8.2.3.2 Hybrid Dine-In + Drive-Thru Units

8.2.3.3 Highway & Transit Drive-Thru Sushi

8.2.3.4 Automated Pickup Lockers

8.2.4 Grab-and-Go Refrigerated Displays

8.2.4.1 Supermarket Refrigerated Sushi

8.2.4.2 Convenience Store Sushi Racks

8.2.4.3 Corporate Office Grab-and-Go Units

8.2.4.4 Airport Grab-and-Go Sushi Displays

8.3 Online Delivery

8.3.1 Third-Party Aggregator Platforms

8.3.1.1 App-Based Food Delivery Platforms

8.3.1.2 Marketplace Commission Models

8.3.1.3 Data-Integrated Delivery Partnerships

8.3.1.4 Cross-Border Delivery Networks

8.3.2 Brand-Owned Apps

8.3.2.1 Direct-to-Consumer Sushi Apps

8.3.2.2 Integrated Loyalty & Rewards Apps

8.3.2.3 Geo-Targeted Promotions

8.3.2.4 AI-Based Personalized Menu Suggestions

8.3.3 Subscription-Based Sushi Delivery

8.3.3.1 Weekly Sushi Box Subscriptions

8.3.3.2 Premium Omakase-at-Home Programs

8.3.3.3 Corporate Lunch Subscription Plans

8.3.3.4 Family Meal Subscription Packages

8.3.4 Corporate Bulk Delivery

8.3.4.1 Executive Meeting Catering

8.3.4.2 Event & Conference Bulk Orders

8.3.4.3 Office Meal Programs

8.3.4.4 Institutional Catering Contracts

8.4 Retail Ready-to-Eat

8.4.1 Supermarket Sushi Packs

8.4.1.1 Private Label Sushi

8.4.1.2 Premium Fresh Sushi Counters

8.4.1.3 Value Combo Packs

8.4.1.4 Organic & Sustainable Seafood Packs

8.4.2 Convenience Store Sushi

8.4.2.1 Single-Serve Sushi Packs

8.4.2.2 Budget-Friendly Sushi Options

8.4.2.3 Fresh Daily Replenishment Models

8.4.2.4 24/7 Retail Sushi Availability

8.4.3 Airport Retail Sushi

8.4.3.1 Duty-Free Sushi Counters

8.4.3.2 Premium Travel Sushi Boxes

8.4.3.3 Lounge-Specific Sushi Catering

8.4.3.4 Transit Grab-and-Go Packs

8.4.4 Meal Kit & DIY Sushi Boxes

8.4.4.1 Home Sushi-Making Kits

8.4.4.2 Premium Ingredient Sushi Kits

8.4.4.3 Family DIY Sushi Boxes

8.4.4.4 Subscription-Based Meal Kits

9. Market Segmentation by End-User (USD Billion), 2026–2033

9.1 Individual Consumers

9.1.1 Millennials

9.1.1.1 Premium Sushi & Omakase Demand

9.1.1.2 Health-Conscious Preferences

9.1.1.3 Delivery-First Behavior

9.1.1.4 Loyalty Program Adoption

9.1.2 Gen Z

9.1.2.1 Anime & Pop-Culture Influence

9.1.2.2 Social Media-Driven Dining

9.1.2.3 Value & Combo Meal Preference

9.1.2.4 Digital Payment Adoption

9.1.3 Working Professionals

9.1.3.1 Corporate Lunch Demand

9.1.3.2 Subscription-Based Meals

9.1.3.3 Late-Night Izakaya Dining

9.1.3.4 High AOV Premium Dining

9.1.4 Families

9.1.4.1 All-You-Can-Eat Sushi

9.1.4.2 Teppanyaki Group Dining

9.1.4.3 Suburban Japanese BBQ

9.1.4.4 Kids’ Menu Adaptation

9.1.5 Health-Conscious Consumers

9.1.5.1 Low-Calorie Sushi

9.1.5.2 Gluten-Free Options

9.1.5.3 Plant-Based Japanese

9.1.5.4 Sustainable Seafood Preference

9.1.6 Spending Behavior Analysis

9.1.6.1 Frequency of Visit

9.1.6.2 Average Spend Per Visit

9.1.6.3 Delivery vs Dine-In Ratio

9.1.6.4 Brand Loyalty Index

9.2 Corporate Customers

9.2.1 Catering

9.2.1.1 Corporate Events

9.2.1.2 Boardroom Meetings

9.2.1.3 Office Lunch Catering

9.2.1.4 Executive Omakase Events

9.2.2 Corporate Meal Programs

9.2.2.1 Subsidized Employee Meals

9.2.2.2 Daily Meal Contracts

9.2.2.3 Hybrid Work Meal Support

9.2.2.4 Tech Campus Foodservice

9.2.3 Event Orders

9.2.3.1 Trade Shows

9.2.3.2 Product Launch Events

9.2.3.3 Corporate Celebrations

9.2.3.4 Holiday Party Contracts

9.2.4 Subscription-Based Corporate Meals

9.2.4.1 Weekly Meal Plans

9.2.4.2 Bento Subscription Services

9.2.4.3 AI-Based Meal Customization

9.2.4.4 Volume-Based Pricing Models

9.2.5 Corporate Revenue Model Analysis

9.2.5.1 Contract Duration

9.2.5.2 Margin Structure

9.2.5.3 Bulk Order Discounting

9.2.5.4 Retention Rate

9.3 Institutional Clients

9.3.1 Universities

9.3.1.1 Campus Dining Contracts

9.3.1.2 Student Meal Programs

9.3.1.3 Food Court Japanese Units

9.3.1.4 Pop-Up Sushi Counters

9.3.1.5 Health-Oriented Campus Meals

9.3.2 Hospitals

9.3.2.1 Patient Meal Services

9.3.2.2 Staff Cafeterias

9.3.2.3 Low-Sodium & Special Diet Meals

9.3.2.4 On-Call Night Shift Dining

9.3.3 Office Complexes

9.3.3.1 Business Park Foodservice

9.3.3.2 Co-Working Space Partnerships

9.3.3.3 On-Site Japanese Kiosks

9.3.3.4 Shared Cafeteria Contracts

9.3.4 Government & Public Institutions

9.3.4.1 Public Sector Cafeterias

9.3.4.2 Event Catering Contracts

9.3.4.3 Military Base Foodservice

9.3.4.4 Long-Term Procurement Agreements

9.3.5 Institutional Revenue & Contract Benchmarking

9.3.5.1 Contract Value Analysis

9.3.5.2 Multi-Year Deal Structures

9.3.5.3 Compliance & Nutrition Standards

9.3.5.4 Procurement Pricing Models

10. Market Segmentation by Region

10.1 Asia-Pacific

10.2 North America

10.3 Europe

10.4 Middle East

10.5 Latin America

11. Competitive Landscape – Global

11.1 Market Share Analysis

11.2 Brand Positioning Matrix

11.3 Format-Wise Competitive Benchmarking

11.4 Franchise Expansion Strategies

11.5 AI & Digital Capability Comparison

11.6 Competitive Intensity Mapping

12. Company Profiles

12.1 Sushiro

12.2 Kura Sushi

12.3 Genki Sushi

12.4 Nobu Hospitality

12.5 Zuma Restaurants

12.6 Benihana

12.7 Sushi Zanmai

12.8 Regional Sushi Chains

13. Regional Insights

13.1 Asia-Pacific – Largest Market

13.2 North America – Fastest Growing

13.3 Europe – Premium Authenticity Market

13.4 Middle East – Luxury Growth Hub

13.5 Latin America – Emerging Metro Expansion

14. Strategic Intelligence & Phoenix AI-Backed Insights

14.1 Phoenix Demand Forecast Engine

14.2 AI-Based Seafood Inventory Optimization Model

14.3 Consumer Behavior Analyzer

14.4 Automation & Smart Table Innovation Tracker

14.5 Automated Porter’s Five Forces Analysis

15. Future Outlook & Strategic Recommendations

15.1 Premiumization & Omakase Expansion

15.2 Sustainable Seafood Strategy

15.3 Delivery Margin Optimization

15.4 Franchise-Led Global Expansion

15.5 Long-Term Market Outlook (2033+)