Global Sushi Restaurants Market, 2025-2033

Global Sushi Restaurants Market to Reach USD 49.3 Billion by 2033

Overview

The Global Sushi Restaurants Market is expanding as sushi transitions from a niche Japanese delicacy to a mainstream global dining trend. Rising urbanization, growing health-conscious consumer segments, and the appeal of Japanese cultural exports (anime, K-pop/J-pop crossovers, and culinary tourism) are accelerating sushi’s popularity. Sushi restaurants are diversifying offerings with fusion menus, plant-based alternatives, and premium Omakase dining, while fast-casual formats are making sushi more accessible to mass consumers.

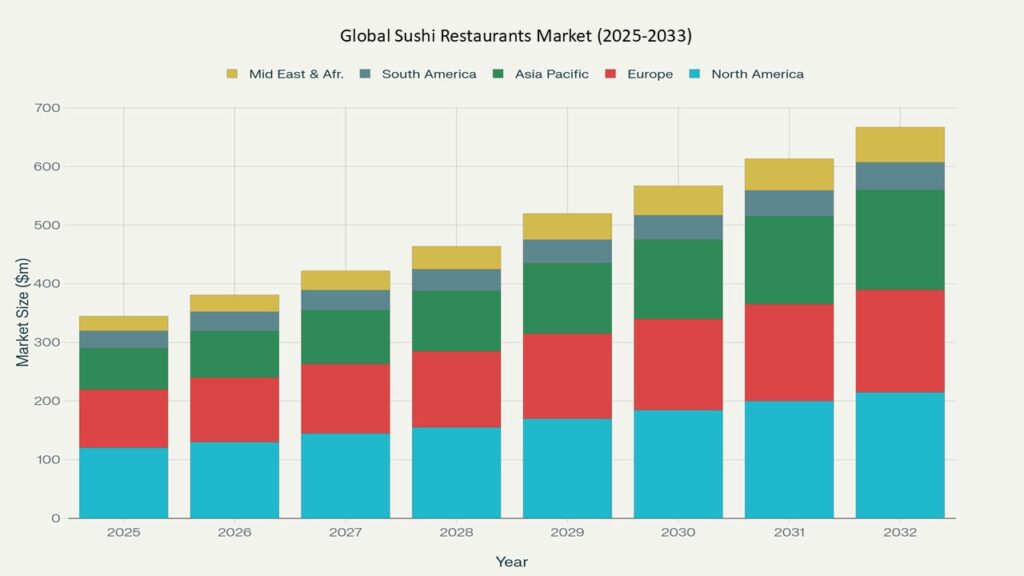

According to Phoenix’s Demand Forecast Engine, the global sushi restaurants market is projected to grow from USD 31.7 billion in 2025 to nearly USD 49.3 billion by 2033, registering a CAGR of 5.7%. North America accounted for the largest share (36.2%) in 2024, while Asia Pacific is expected to be the fastest-growing region at a CAGR of 6.8%, driven by both domestic consumption in Japan and international expansion across China, South Korea, and Southeast Asia.

Key Drivers of Market Growth

- Globalization of Japanese Cuisine

Cultural exports and increased international travel have popularized sushi, supported by food media, influencers, and Japanese tourism promotion. - Health & Wellness Trends

Sushi is perceived as a low-calorie, high-protein, and nutrient-rich meal, aligning with global health-conscious dining preferences. - Fusion & Premiumization

Creative menus (vegan sushi, spicy rolls, regional adaptations) and luxury Omakase experiences expand customer base across demographics. - Digital Ordering & Delivery Platforms

Online food delivery and aggregator platforms (Uber Eats, DoorDash, Deliveroo, Foodpanda) boost accessibility and frequency of sushi consumption. - Franchising & Global Expansion

International chains are scaling through franchising models and mall-based dining formats, driving growth in emerging urban centers.

Market Segmentation

By Restaurant Type

- Fine Dining / Omakase

- Casual Dining Sushi Restaurants

- Fast-Casual / Conveyor Belt (Kaiten-zushi)

- Quick-Service / Takeaway & Delivery

By Cuisine Style

- Traditional Japanese Sushi

- Fusion & Contemporary Sushi

- Plant-Based & Alternative Protein Sushi

By Service Model

- Dine-In

- Takeaway

- Online Delivery

By End User

- Household Consumers

- Corporate & Business Dining

- Tourists / International Visitors

Region-Level Insights

North America – Largest Market (36.2% share in 2024)

Home to leading sushi chains and strong adoption of fusion menus. Expansion of fast-casual conveyor-belt sushi and delivery models drives steady growth.

Europe

High adoption in UK, Germany, France, and Nordic countries; growth fueled by premium Omakase experiences and plant-based sushi innovations.

Asia Pacific – Fastest Growing (6.8% CAGR, 2025–2033)

Strong domestic base in Japan, with rapid expansion in China, South Korea, Thailand, and Singapore. Rising middle-class incomes and cultural affinity with Japanese cuisine support growth.

Latin America

Brazil, Mexico, and Chile are hotspots where sushi has been integrated into local fusion cuisine (e.g., cream cheese rolls in Brazil). Growth led by casual dining chains.

Middle East & Africa

Premium sushi restaurants expanding in UAE, Saudi Arabia, and South Africa, catering to expatriates, tourists, and affluent urban consumers.

Leading Companies in the Market

- Sushiro Global Holdings Ltd.

- Genki Sushi Co., Ltd.

- Kura Sushi, Inc.

- Sushi Zanmai Co., Ltd.

- Wasabi Co., Ltd. (UK)

- YO! Sushi

- Sushi Tei Pte Ltd.

- Nobu Hospitality Group

- Sakae Holdings Ltd.

- Blue Ribbon Sushi

These players are focusing on international franchising, menu innovation (vegan/plant-based sushi), and premium Omakase positioning while integrating digital ordering platforms to capture delivery-driven growth.

Strategic Intelligence and AI-Backed Insights

- Phoenix Demand Forecast Engine modeled sushi consumption trajectories by restaurant type, showing fast-casual/conveyor belt formats gaining 27% share by 2030.

- Consumer Sentiment Analyzer indicates sustained demand for healthy, portable dining options and willingness to pay premium for authentic Japanese Omakase.

- Global Expansion Mapping Tool flags strong growth opportunities in Tier 2 urban markets in APAC, MEA, and Latin America.

- Automated Porter’s Five Forces shows moderate supplier power (seafood imports) and high buyer preference for fusion and convenience formats.

Forecast Snapshot: 2025–2033

| Metric | Value |

| 2025 Market Size | USD 31.7 Billion |

| 2033 Market Size | ~USD 49.3 Billion |

| CAGR (2025–2033) | 5.7% |

| Largest Region (2024) | North America (36.2% share) |

| Fastest Growing Region | Asia Pacific (6.8% CAGR) |

| Top Segment | Casual Dining & Fast-Casual Conveyor Belt Sushi |

| Key Trend | Fusion, plant-based sushi, digital delivery platforms |

| Future Growth Focus | Omakase premiumization + franchising in emerging markets |

Why the Global Market Remains Critical

- Sushi is a globalized food category aligning with health and cultural dining trends.

- Fusion formats and plant-based innovation enhance accessibility across consumer groups.

- Premium Omakase restaurants reinforce sushi’s luxury positioning.

- Franchising and delivery models ensure scalable growth in both developed and emerging markets.

Final Takeaway

The Global Sushi Restaurants Market is evolving into a mainstream yet premiumized global dining category, blending traditional authenticity with modern fusion and digital-first accessibility. Companies leveraging franchising models, premium Omakase experiences, and plant-based menu innovation will be best positioned to capture consumer loyalty and multi-regional growth.

- Executive Summary & Market Overview

- 1.1 Introduction to the Global Sushi Restaurants Market

- 1.2 Market Definition, Scope, and Study Objectives

- 1.3 Market Snapshot: Size, Share, and Growth Outlook (2023–2032)

- 1.4 Evolution of Sushi Consumption Trends Across Regions

- 1.5 Impact of COVID-19, Lifestyle Shifts, and Dining Preferences

- 1.6 Phoenix Research Methodology & Forecasting Model

- Key Drivers of Market Growth

- 2.1 Rising Global Popularity of Japanese Cuisine

- 2.2 Growing Health & Wellness Awareness (Sushi as a Low-Calorie, High-Protein Food)

- 2.3 Expansion of Asian Cuisine in Western Markets

- 2.4 Influence of Travel, Tourism & Cultural Exchange on Sushi Adoption

- 2.5 Digitalization & Online Food Delivery Platforms Fueling Sushi Demand

- 2.6 Emergence of Fusion Sushi & Premium Dining Experiences

- Market Segmentation

- 3.1 By Type of Restaurant

- 3.1.1 Full-Service Sushi Restaurants

- 3.1.2 Quick-Service Sushi Outlets

- 3.1.3 Sushi-on-the-Go / Grab-and-Go Counters

- 3.1.4 Online Sushi Delivery Platforms

- 3.2 By Cuisine Style

- 3.2.1 Traditional Sushi (Nigiri, Sashimi, Maki)

- 3.2.2 Contemporary / Fusion Sushi

- 3.2.3 Vegan & Plant-Based Sushi

- 3.3 By Price Range

- 3.3.1 Premium / Fine Dining Sushi Restaurants

- 3.3.2 Mid-Range Sushi Restaurants

- 3.3.3 Budget & Quick-Service Sushi Outlets

- 3.4 By Distribution Channel

- 3.4.1 Dine-In

- 3.4.2 Takeaway / Grab-and-Go

- 3.4.3 Online Delivery (Third-Party Apps & Direct Platforms)

- Regional Insights – Global Sushi Restaurants Market

- 4.1 North America

- U.S., Canada – High penetration of premium sushi dining & fusion sushi

- 4.2 Europe

- U.K., Germany, France, Italy – Rising sushi adoption, health-oriented dining

- 4.3 Asia Pacific

- Japan – Core market & traditional sushi leader

- China, South Korea, India, Australia – Fast-growing sushi restaurant markets

- 4.4 Latin America

- Brazil, Mexico, Argentina – Rising sushi dining culture among urban millennials

- 4.5 Middle East & Africa

- UAE, Saudi Arabia, South Africa – Premium & luxury sushi dining growth

- Leading Companies in the Market

- 5.1 Competitive Landscape Overview

- 5.2 Profiles of Key Sushi Restaurant Chains & Brands

- 5.2.1 Sushiro Global Holdings

- 5.2.2 Genki Sushi Co. Ltd.

- 5.2.3 Kura Sushi USA, Inc.

- 5.2.4 Sushi Express

- 5.2.5 Yo! Sushi

- 5.2.6 Sushi Shop (AmRest Group)

- 5.2.7 Nobu Restaurants

- 5.2.8 Other Emerging & Local Sushi Brands

- 5.3 Competitive Benchmarking – Menu Innovation, Pricing, Market Expansion

- 5.4 Mergers, Acquisitions & Strategic Partnerships

- Strategic Intelligence and Phoenix-Backed Insights

- 6.1 Phoenix Opportunity Index – Global Sushi Dining Potential

- 6.2 Role of Menu Innovation: Vegan Sushi, Fusion Rolls, Premium Ingredients

- 6.3 Changing Consumer Behavior: On-the-Go Sushi & Online Ordering

- 6.4 Porter’s Five Forces Analysis

- 6.4.1 Industry Rivalry – Global & Regional Sushi Chains

- 6.4.2 Supplier Power – Seafood & Raw Material Dependency

- 6.4.3 Buyer Power – Price Sensitivity & Dining Experience Preferences

- 6.4.4 Threat of New Entrants – Rising Local Sushi Outlets

- 6.4.5 Threat of Substitutes – Alternative Asian & Healthy Fast Foods

- Forecast Snapshot: 2023–2032

- 7.1 Global Sushi Restaurants Market Size & Growth Outlook

- 7.2 CAGR by Type of Restaurant

- 7.3 Growth in Premium vs. Quick-Service Sushi Segments

- 7.4 Online Sushi Delivery Market Forecast

- 7.5 Regional Growth Hotspots

- Why the Sushi Restaurants Market Remains Critical

- 8.1 Growing Global Affinity for Japanese Cuisine

- 8.2 Sushi as a Health-Oriented Dining Choice

- 8.3 Increasing Role of Online Delivery in Expanding Sushi Access

- 8.4 Sushi as a Premium Lifestyle & Cultural Experience

- Phoenix Researcher Insights & Final Takeaways

- 9.1 Strategic Recommendations for Sushi Chains, Investors & Restaurateurs

- 9.2 Opportunities in Emerging Markets & Vegan/Fusion Sushi Segments

- 9.3 Role of Technology in Enhancing Sushi Dining & Delivery Experience

- 9.4 Future of Sushi Restaurants – Premiumization, Sustainability & Expansion

- 9.5 Phoenix Positioning – Unlocking Growth in the Global Sushi Dining Market

- Appendices

- 10.1 Research Methodology

- 10.2 Data Sources & Assumptions

- 10.3 Glossary of Food & Restaurant Industry Terms

- 10.4 Phoenix Market Intelligence Suite Overview

- 10.5 Contact & Custom Research Support