India Business Process Outsourcing Market size and Share Analysis 2025-2033

India Business Process Outsourcing Market Overview

The India Business Process Outsourcing Market is rapidly evolving as one of the most dynamic, technology-driven, and globally trusted service ecosystems, empowering digital transformation, operational efficiency, and enterprise agility across industries. India remains the global hub for BPO and IT-enabled services (ITeS), thanks to its skilled talent pool, competitive pricing, and expanding adoption of AI, automation, and cloud-based outsourcing models.

Driven by the country’s strong digital infrastructure, supportive government policies, and fast-growing demand from BFSI, healthcare, e-commerce, and telecom sectors, the India BPO industry is transitioning from traditional voice-based services to AI-powered, multi-channel customer experience solutions.

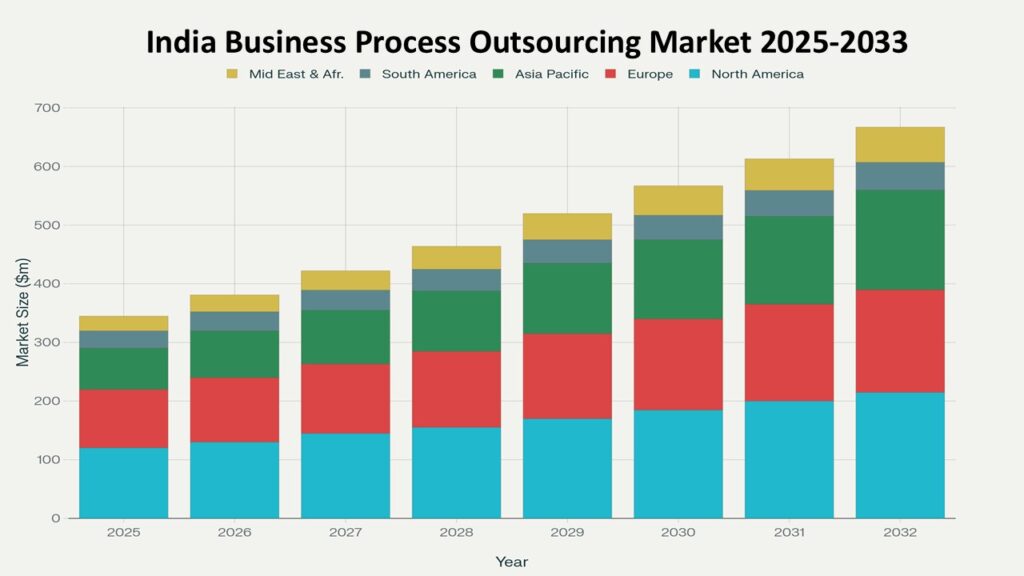

According to Phoenix Research’s Forecast Engine, the India Business Process Outsourcing Market size is valued at USD 55.6 billion in 2025 and is projected to reach approximately USD 108.9 billion by 2033, growing at a CAGR of 8.7% (2025–2033). The India Business Process Outsourcing (BPO) Market size growth reflects India’s strong position as a global outsourcing hub, driven by digital transformation, cost efficiency, and skilled workforce availability.

The surge in digital outsourcing, data analytics, and automation-driven workflows is further strengthening the India Business Process Outsourcing Market, positioning the country as the most reliable and resilient BPO destination, trusted by Fortune 500 companies and startups alike..

Key Drivers of India Business Process Outsourcing Market Growth

1. Expanding Digital Transformation Across Industries

Enterprises are embracing cloud-enabled BPO, robotic process automation (RPA), and AI-driven analytics to improve efficiency, reduce costs, and enhance customer experience. The rise of digital-first outsourcing models is fueling strong demand for Indian BPO firms.

2. Skilled Workforce and Cost-Effective Operations

India’s massive pool of English-speaking, tech-savvy professionals continues to offer unmatched value. Cost-effectiveness and service quality make India a preferred global outsourcing hub for customer support, finance, and IT services.

3. Growth of AI, Automation, and RPA Integration

AI chatbots, machine learning algorithms, and intelligent process automation are reshaping service delivery. Indian BPO providers are integrating smart automation to drive higher productivity and quicker turnaround times.

4. Rising Global Demand for 24/7 Customer Engagement

The boom in e-commerce, fintech, and OTT platforms has created high demand for round-the-clock multilingual support, positioning Indian BPOs as strategic partners for global enterprises.

5. Government Support and Policy Reforms

The Digital India Initiative, IT/ITeS-friendly SEZ policies, and simplified compliance frameworks are promoting steady growth and global investor confidence in India’s outsourcing industry.

6. Expansion of Knowledge Process Outsourcing (KPO)

The market is shifting toward high-value outsourcing segments such as data analytics, legal process outsourcing (LPO), and financial research, allowing Indian firms to move up the value chain.

India Business Process Outsourcing Market Segmentation

By Service Type

-

Customer Support Services (Voice/Non-Voice)

-

Finance & Accounting Outsourcing

-

Human Resource Outsourcing (HRO)

-

IT Helpdesk & Technical Support

-

Procurement & Supply Chain Management

-

Knowledge Process Outsourcing (KPO)

-

Legal Process Outsourcing (LPO)

By Deployment Mode

-

On-premise

-

Cloud-Based

By End User Industry

-

Banking, Financial Services & Insurance (BFSI)

-

Healthcare & Life Sciences

-

Retail & E-commerce

-

Telecom & IT

-

Manufacturing

-

Travel & Hospitality

-

Government & Public Sector

By Enterprise Size

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

By Region (India)

-

North India – Delhi NCR, Chandigarh

-

South India – Bengaluru, Hyderabad, Chennai

-

West India – Pune, Mumbai, Ahmedabad

-

East India – Kolkata, Bhubaneswar

Regional Insights of the India Business Process Outsourcing Market

South India – The Outsourcing Powerhouse

Bengaluru, Chennai, and Hyderabad remain India’s BPO and IT innovation hubs, hosting global players and start-ups. The presence of skilled talent, advanced IT parks, and government-backed digital ecosystems drives large-scale adoption of intelligent outsourcing solutions.

North India – Rapid Expansion of Service Centers

Delhi NCR leads in customer service operations and shared service centers, catering to global BFSI and telecom clients with high-end business process management capabilities.

West India – Hub for Fintech and Automation Services

Mumbai and Pune dominate in financial process outsourcing, analytics, and AI-enabled customer experience management, supported by a strong IT infrastructure and global connectivity.

East India – Emerging BPO Destination

Kolkata and Bhubaneswar are witnessing growing investments in back-office and multilingual process outsourcing, driven by regional skill development initiatives and government incentives.

Leading Companies in the India Business Process Outsourcing Market

-

Tata Consultancy Services (TCS)

-

Infosys BPM Ltd.

-

Wipro Ltd.

-

Tech Mahindra Ltd.

-

Genpact Ltd.

-

HCLTech Ltd.

-

Cognizant Technology Solutions

-

EXL Service Holdings Inc.

-

WNS Global Services Pvt. Ltd.

-

Firstsource Solutions Ltd.

These leading companies are investing in AI, RPA, cloud computing, and analytics-driven outsourcing models to deliver efficient, scalable, and secure BPO solutions to global clients.

Genpact and TCS currently hold the largest market share, driven by strong client portfolios, innovative digital transformation frameworks, and robust global delivery networks.

Strategic and Technological Insights

-

AI-Powered Automation: Drives faster, data-backed decisions and optimized workflows.

-

Cloud-Based BPO Platforms: Ensure scalability, security, and flexibility in service delivery.

-

Robotic Process Automation (RPA): Reduces repetitive manual tasks and operational costs.

-

Omnichannel Customer Experience: Integrates voice, chat, and social media engagement.

-

Data Analytics & Insights: Strengthens business intelligence and customer retention.

-

Cybersecurity in BPO: Growing focus on data protection and compliance with GDPR and ISO standards.

India Business Process Outsourcing Market Forecast Snapshot: 2025–2033

| Metric | Value |

|---|---|

| 2025 Market Size | USD 55.6 Billion |

| 2033 Market Size | ~USD 108.9 Billion |

| CAGR (2025–2033) | 8.7% |

| Largest BPO Hub | South India (Bengaluru, Hyderabad, Chennai) |

| Fastest-Growing Region | East India |

| Top Service Segment | Customer Support & KPO |

| Key Technology Trend | AI, Automation & Cloud Outsourcing |

| Future Focus | Digital Transformation & Value-Based Outsourcing |

Why the India Business Process Outsourcing Market Remains Critical

-

Rising adoption of digital outsourcing and AI automation.

-

Strong presence of skilled English-speaking workforce.

-

Increasing demand for 24x7 customer support and omnichannel services.

-

Government-led Digital India and IT infrastructure programs.

-

Expansion of knowledge-driven and high-value outsourcing segments.

Final Takeaway of the India Business Process Outsourcing Market

The India Business Process Outsourcing Market stands as a pillar of the global digital services economy, driving innovation, efficiency, and cost optimization across industries. With the integration of AI, cloud computing, and analytics, India continues to redefine the future of outsourcing through smart, scalable, and data-driven business process solutions.

As global enterprises look to transform operations and enhance customer experiences, India’s BPO ecosystem remains the most reliable, trusted, and future-ready partner in achieving long-term business excellence.

At Phoenix Research, our AI-powered market forecasting and strategic insights help businesses, investors, and policymakers unlock growth potential in India’s ever-evolving outsourcing and digital services landscape.

Table of Contents

-

1. India Business Process Outsourcing Market Overview

-

2. Key Drivers of India Business Process Outsourcing Market Growth

-

Expanding Digital Transformation Across Industries

-

Skilled Workforce and Cost-Effective Operations

-

Growth of AI, Automation, and RPA Integration

-

Rising Global Demand for 24/7 Customer Engagement

-

Government Support and Policy Reforms

-

Expansion of Knowledge Process Outsourcing (KPO)

-

-

3. India Business Process Outsourcing Market Segmentation

-

By Service Type

-

Customer Support Services (Voice/Non-Voice)

-

Finance & Accounting Outsourcing

-

Human Resource Outsourcing (HRO)

-

IT Helpdesk & Technical Support

-

Procurement & Supply Chain Management

-

Knowledge Process Outsourcing (KPO)

-

Legal Process Outsourcing (LPO)

-

-

By Deployment Mode

-

On-premise

-

Cloud-Based

-

-

By End User Industry

-

Banking, Financial Services & Insurance (BFSI)

-

Healthcare & Life Sciences

-

Retail & E-commerce

-

Telecom & IT

-

Manufacturing

-

Travel & Hospitality

-

Government & Public Sector

-

-

By Enterprise Size

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

-

-

By Region (India)

-

North India – Delhi NCR, Chandigarh

-

South India – Bengaluru, Hyderabad, Chennai

-

West India – Pune, Mumbai, Ahmedabad

-

East India – Kolkata, Bhubaneswar

-

-

-

4. Regional Insights of the India Business Process Outsourcing Market

-

South India – The Outsourcing Powerhouse

-

North India – Rapid Expansion of Service Centers

-

West India – Hub for Fintech and Automation Services

-

East India – Emerging BPO Destination

-

-

5. Leading Companies in the India Business Process Outsourcing Market

-

Tata Consultancy Services (TCS)

-

Infosys BPM Ltd.

-

Wipro Ltd.

-

Tech Mahindra Ltd.

-

Genpact Ltd.

-

HCLTech Ltd.

-

Cognizant Technology Solutions

-

EXL Service Holdings Inc.

-

WNS Global Services Pvt. Ltd.

-

Firstsource Solutions Ltd.

-

-

6. Strategic and Technological Insights

-

AI-Powered Automation

-

Cloud-Based BPO Platforms

-

Robotic Process Automation (RPA)

-

Omnichannel Customer Experience

-

Data Analytics & Insights

-

Cybersecurity in BPO

-

-

7. India Business Process Outsourcing Market Forecast Snapshot (2025–2033)

-

2025 Market Size

-

2033 Market Size

-

CAGR (2025–2033)

-

Largest BPO Hub

-

Fastest-Growing Region

-

Top Service Segment

-

Key Technology Trend

-

Future Focus

-

-

8. Why the India Business Process Outsourcing Market Remains Critical

-

Rising adoption of digital outsourcing and AI automation

-

Strong presence of skilled English-speaking workforce

-

Growing 24×7 customer support and omnichannel service demand

-

Government-led Digital India and IT infrastructure growth

-

Expansion of knowledge-driven and high-value outsourcing

-

-

9. Final Takeaway of the India Business Process Outsourcing Market