Orphan Drug Commercialization Market 2025-2033

Overview

The Orphan Drug Commercialization Market is experiencing robust growth, with global revenues projected to rise from approximately USD 190 billion in 2024 to over USD 528 billion by 2033, reflecting a CAGR of 12%. This market is primarily driven by a surge in rare disease diagnoses, substantial R&D investments, and supportive government incentives such as market exclusivity, tax credits, and expedited FDA approvals.

North America, especially the United States, currently dominates the sector, propelled by a favorable regulatory landscape and rising patient needs. Oncology remains the largest therapeutic segment, fueled by ongoing introductions of cancer-focused orphan therapies. Despite over 500 orphan drugs approved, significant unmet medical needs persist for rare diseases globally. Ongoing advancements in gene therapies and precision medicine, alongside premium pricing models and increasing awareness, are expected to further accelerate market expansion in the coming years.

Key Drivers of Market Growth

- Supportive regulatory frameworks such as the U.S. Orphan Drug Act and various global incentives provide market exclusivity, tax credits, and expedited approvals, encouraging investment and early entry by pharmaceutical companies.

- Rising prevalence and diagnosis of rare diseases—nearly 10,000 identified in the U.S. alone—is expanding the target patient population for orphan drug commercialization.

- Technological advancements in genomics, gene therapy, and personalized medicine have enabled identification and treatment of previously unaddressed rare diseases, creating new opportunities for drug development.

- Increased pharmaceutical and biotechnology investments in rare disease research and development are driving pipeline growth and faster commercialization, especially for biologics and targeted therapies.

- Growing patient advocacy and awareness initiatives are boosting demand for novel treatments and supporting improved market access and reimbursement for orphan drugs.

- Attractive financial incentives and premium pricing models, supported by high unmet clinical needs and limited therapeutic alternatives, contribute to strong revenue potential and sustained market entry.

Market Segmentation

The Orphan Drug Commercialization Market is segmented by:

- Product Type: Biological drugs and non-biological drugs

- Disease Type: Oncology, hematology, neurology, cardiovascular, and others

- Therapy Area: Neuromuscular, respiratory, metabolic, and others

- Distribution Channel: Hospital pharmacies, retail pharmacies, and online pharmacies

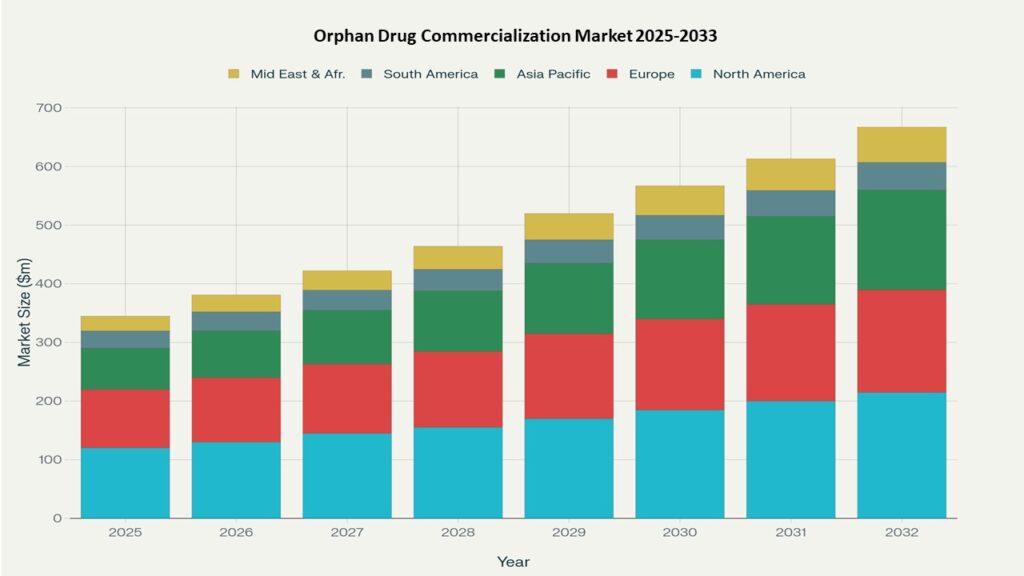

North America currently dominates the market due to substantial expenditure and a strong presence of major players, while Asia Pacific is expected to be the fastest-growing region. Oncology-related orphan drugs form the largest therapeutic segment, driven by ongoing innovation and high unmet clinical needs.

Region-Level Insights

- North America: Largest market, supported by favorable regulatory incentives (market exclusivity, tax credits) and robust R&D pipelines.

- Europe: Second-largest market, benefiting from harmonized regulations and national orphan drug frameworks, with key markets in the UK, Germany, and France.

- Asia Pacific: Fastest-growing region, driven by increased healthcare investment, rising awareness, and growing pharmaceutical infrastructure, particularly in China, Japan, and India.

- Latin America & Middle East & Africa: Smaller but emerging markets, supported by improving diagnostics and healthcare access.

Leading Companies in the Market

The market is dominated by major pharmaceutical and biotech companies, including:

- Johnson & Johnson

- AstraZeneca

- Roche

- Novartis

- Vertex Pharmaceuticals

- Sanofi

- Amgen

- Merck & Co.

- Bristol-Myers Squibb

- Pfizer

Bristol-Myers Squibb and Roche have leading oncology-focused orphan drug portfolios. U.S.-based firms like Pfizer, Regeneron, and AbbVie continue to leverage strong pipelines for both cancer and rare diseases.

Strategic Intelligence and AI-Backed Insights

The orphan drug commercialization market is projected to exceed USD 610 billion by 2034, underpinned by regulatory incentives, rising rare disease prevalence, and sustained R&D investments.

AI-powered intelligence is transforming the sector by:

- Identifying rare disease clusters

- Accelerating target discovery and clinical trial optimization

- Forecasting regulatory approvals and regional demand shifts

These data-driven insights enable companies to maximize ROI, improve patient identification, and launch therapies faster. Expansion of gene and cell therapies, supported by premium pricing and favorable reimbursement, is expected to intensify competition and enhance growth opportunities.

Forecast Snapshot: 2025–2033

| Metric | Value |

| 2025 Market Size | USD 215 billion |

| 2033 Market Size | USD 528 billion |

| CAGR (2025–2033) | 12% |

| Largest Region (2025) | North America (41% share) |

| Fastest Growing Region | Asia Pacific (CAGR 14%) |

| Leading Therapeutic Area | Oncology (approx. 35% share) |

| Approved Orphan Drugs (2025) | 550+ |

Why the Global Market Remains Critical

The global orphan drug commercialization market addresses over 7,000 rare diseases affecting millions of patients worldwide. Favorable policies (tax credits, exclusivity, accelerated approvals) enable sustained investment despite small patient populations.

Global growth ensures:

- Broader access to treatments for underserved patients

- Development of advanced modalities (gene & cell therapies)

- Harmonized reimbursement and regulatory practices

This market remains a cornerstone of precision medicine, shaping healthcare delivery and driving biotech innovation worldwide.

Final Takeaway

The orphan drug commercialization market is expected to maintain a 12% CAGR through 2033, surpassing USD 528 billion in value. While North America and Europe continue to lead, Asia Pacific will drive incremental growth.

Opportunities are expanding through gene therapy breakthroughs, targeted biologics, and AI-driven commercialization strategies. Stakeholders that invest in innovative R&D, strengthen patient advocacy collaborations, and optimize regional pricing strategies will capture the greatest share in this rapidly evolving sector.

Table of Contents

Overview

1.1 Market Context: Orphan Drug Commercialization Market Landscape

1.2 Why Orphan Drugs, Why Now: Addressing Unmet Rare Disease Needs Globally

1.3 Market Snapshot: USD 215B (2025) to USD 528B (2033) | CAGR 12%

1.4 Role of Orphan Drugs in Precision Medicine and Biotech Innovation

1.5 Phoenix Methodology: Regulatory Analysis, R&D Pipeline Forecasting, and AI-Enabled Market Intelligence

Key Drivers of Market Growth

2.1 Supportive Regulatory Frameworks (U.S. Orphan Drug Act and Global Incentives)

2.2 Rising Prevalence and Diagnosis Rates of Rare Diseases

2.3 Technological Advancements: Genomics, Gene Therapy, and Personalized Medicine

2.4 Increasing Pharmaceutical and Biotech Investments in Rare Disease R&D

2.5 Growing Patient Advocacy and Awareness Improving Market Access

2.6 Premium Pricing Models and High Revenue Potential Sustaining Market Entry

Market Segmentation

3.1 By Product Type

• 3.1.1 Biological Drugs

• 3.1.2 Non-Biological Drugs

3.2 By Disease Type

• 3.2.1 Oncology (Largest Segment)

• 3.2.2 Hematology

• 3.2.3 Neurology

• 3.2.4 Cardiovascular

• 3.2.5 Others

3.3 By Therapy Area

• 3.3.1 Neuromuscular

• 3.3.2 Respiratory

• 3.3.3 Metabolic

• 3.3.4 Others

3.4 By Distribution Channel

• 3.4.1 Hospital Pharmacies

• 3.4.2 Retail Pharmacies

• 3.4.3 Online Pharmacies

3.5 By Geography

• 3.5.1 North America

• 3.5.2 Europe

• 3.5.3 Asia Pacific

• 3.5.4 Latin America

• 3.5.5 Middle East & Africa

Region-Level Insights

4.1 North America – Market Leader (41% Share in 2025)

• 4.1.1 Favorable Regulatory Incentives: Market Exclusivity, Tax Credits, and Fast-Track Approvals

• 4.1.2 Strong R&D Pipelines and Premium Pricing Models

4.2 Europe – Second Largest Market

• 4.2.1 Harmonized EU Regulations and National Orphan Drug Frameworks

• 4.2.2 Key Markets: UK, Germany, France

4.3 Asia Pacific – Fastest Growing Region (CAGR 14%)

• 4.3.1 Expanding Pharmaceutical Infrastructure in China, Japan, India

• 4.3.2 Increasing Awareness and Healthcare Investment Driving Rare Disease Diagnosis

4.4 LATAM & MENA – Emerging Markets

• 4.4.1 Gradual Improvement in Diagnostics and Patient Access

• 4.4.2 Regional Policy Initiatives Supporting Market Adoption

Leading Companies in the Market

5.1 Market Leaders: Therapeutic Portfolios and Differentiators

• Johnson & Johnson

• AstraZeneca

• Roche

• Novartis

• Vertex Pharmaceuticals

• Sanofi

• Amgen

• Merck & Co.

• Bristol-Myers Squibb

• Pfizer

5.2 Oncology-Focused Orphan Drug Leaders: Bristol-Myers Squibb, Roche

5.3 U.S.-Based Leaders with Broad Pipelines: Pfizer, Regeneron, AbbVie

5.4 Strategic Partnerships, Patient Advocacy Collaborations, and Global Expansion

Strategic Intelligence and AI-Backed Insights

6.1 AI-Powered Market Intelligence Driving R&D and Commercialization

• 6.1.1 Identifying Rare Disease Clusters and Target Populations

• 6.1.2 Accelerating Clinical Trial Optimization and Regulatory Approvals

• 6.1.3 Forecasting Regional Demand Shifts and ROI

6.2 Expansion of Gene and Cell Therapies Supported by Premium Pricing and Favorable Reimbursement

6.3 Phoenix Predictive Dashboard: Global Pipeline Tracking and Market Entry Analysis

6.4 Competitive Intelligence: Pipeline Density vs. Therapeutic Area Unmet Needs

Forecast Snapshot: 2025–2033

7.1 Total Market Size: USD 215B → USD 528B

7.2 Largest Region (2025): North America (41% Share)

7.3 Fastest Growing Region: Asia Pacific (CAGR 14%)

7.4 Leading Therapeutic Area: Oncology (~35% Share)

7.5 Approved Orphan Drugs in 2025: 550+

Why the Global Market Remains Critical

8.1 Over 7,000 Rare Diseases Affecting Millions of Patients Worldwide

8.2 Policies Enabling Sustained Investment Despite Small Patient Populations

8.3 Broadening Access to Advanced Modalities: Gene & Cell Therapies

8.4 Harmonized Reimbursement and Regulatory Practices Strengthening Global Reach

8.5 Orphan Drugs as a Cornerstone of Precision Medicine and Healthcare Delivery

Phoenix Analyst Insights and Final Takeaway

9.1 Final Outlook: Market Expected to Surpass USD 528B by 2033 at 12% CAGR

9.2 Key Recommendations:

• Invest in Innovative R&D and Strengthen Rare Disease Pipelines

• Enhance Patient Advocacy Collaborations for Improved Access

• Optimize Regional Pricing Strategies and Reimbursement Alignment

9.3 Watchlist:

• AI-Driven Commercialization and Patient Identification

• Gene Therapy and Cell Therapy Approvals

• Rare Disease Diagnosis Expansion in Emerging Markets

9.4 Investment Horizon: Focus on Oncology, Gene Therapy Platforms, and Patient Access Technologies

9.5 Vision 2033: Orphan Drugs as Drivers of Biotech Innovation and Rare Disease Care

Appendices

10.1 Phoenix Research Methodology

10.2 Data Sources and Definitions

10.3 Orphan Drug Regulatory Glossary (e.g., Exclusivity, Priority Review Vouchers)

10.4 Market Map: By Therapy Area and Geographic Region

10.5 Contact Phoenix for Custom Market Briefings and Strategic Advisory