Philippines Cold Storage Warehouse Market Size and Share Analysis 2025-2033

Philippines Cold Storage Warehouse Market Overview

The Philippines Cold Storage Warehouse Market is witnessing robust expansion, driven by the growing demand for temperature-controlled logistics, the rise in e-commerce grocery delivery, and the increasing consumption of frozen and processed food products. As the Philippines strengthens its food security and export capacity, the need for efficient cold chain infrastructure — from farm to retail — has become more vital than ever.

Cold storage warehouses are essential components in the agriculture, fisheries, pharmaceutical, and food service industries, ensuring product freshness, quality, and safety. With climate variability, urban population growth, and heightened consumer expectations for ready-to-eat meals, cold storage capacity expansion has become a national logistics priority.

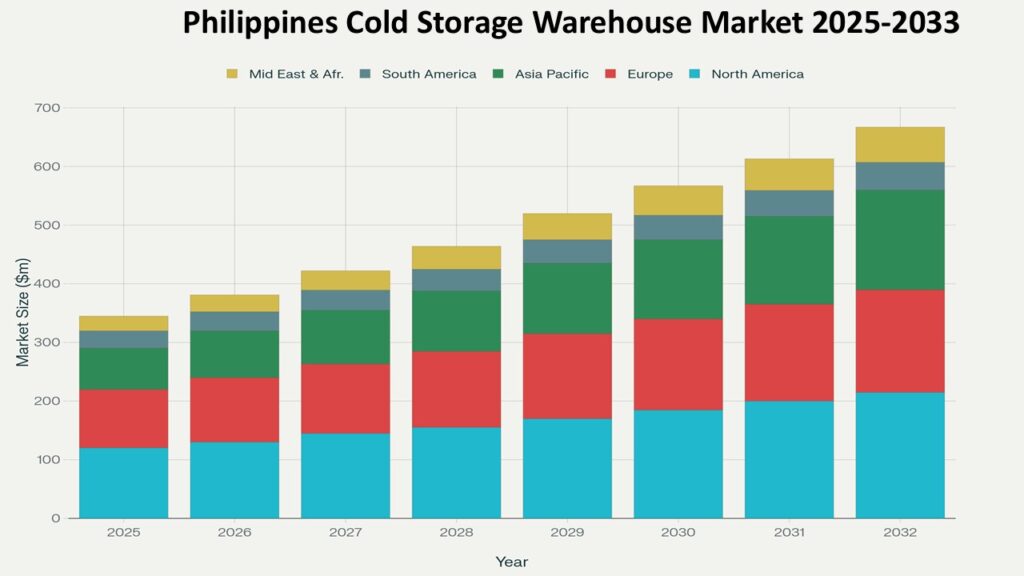

According to Phoenix’s Demand Forecast Engine, the Philippines Cold Storage Warehouse Market Size is estimated at USD 874.6 million in 2025 and is projected to reach approximately USD 1.65 billion by 2033, expanding at a CAGR of 8.4% (2025–2033).Metro Manila, Calabarzon, and Central Luzon currently dominate the market due to their industrial density, export zones, and logistics connectivity, while Visayas and Mindanao are emerging hotspots for cold chain investments in agriculture and aquaculture exports.

The Philippines Cold Storage Warehouse Market is evolving rapidly with automation, energy-efficient refrigeration systems, and smart warehouse management solutions, transforming the cold chain ecosystem into a sustainable and technology-enabled logistics backbone for the Philippines.

Key Drivers of Philippines Cold Storage Warehouse Market Growth

1. Rising Demand for Frozen and Processed Food Products

The surge in frozen meat, seafood, and ready-to-cook meal consumption is propelling investments in advanced cold chain facilities to preserve quality and meet the needs of the modern Filipino consumer.

2. Expanding E-commerce and Quick Commerce Grocery Delivery

The boom in online food and grocery platforms such as GrabMart, Lazada Fresh, and MetroMart is fueling demand for last-mile cold storage and micro-warehousing solutions to ensure real-time order fulfillment and freshness.

3. Growth of the Pharmaceutical and Healthcare Cold Chain

The rising demand for vaccines, biologics, and temperature-sensitive drugs has underscored the critical role of pharma-grade cold storage infrastructure across hospitals and distribution centers.

4. Government Initiatives and Public-Private Partnerships (PPPs)

The Department of Agriculture (DA) and Board of Investments (BOI) are offering incentives for cold chain developers to enhance food security, minimize post-harvest losses, and support export competitiveness.

5. Advancements in Refrigeration and Energy-Efficient Technologies

Manufacturers and logistics providers are integrating IoT-enabled monitoring systems, solar-powered refrigeration units, and ammonia/CO₂-based cooling solutions to optimize performance and sustainability.

6. Expansion of the Fisheries and Aquaculture Export Sector

The Philippines’ strong seafood export base — particularly tuna, shrimp, and crab — requires modern cold storage facilities near ports like General Santos and Cebu, ensuring compliance with international food safety standards.

Philippines Cold Storage Warehouse Market Segmentation

By Warehouse Type

-

Private Cold Storage

-

Public Cold Storage

-

Contract/Third-Party Logistics (3PL) Cold Storage

By Temperature Range

-

Frozen Storage (< –18°C)

-

Chilled Storage (0°C to 10°C)

-

Deep Frozen Storage (< –30°C)

By Construction Type

-

Bulk Storage Warehouses

-

Portable/Modular Cold Rooms

-

Blast Freezers and Chillers

By Application

-

Food & Beverage (Meat, Dairy, Seafood, Fruits & Vegetables, Processed Food)

-

Pharmaceuticals & Healthcare

-

Agriculture & Horticulture

-

E-commerce Grocery and Retail

-

Others

By Region

-

Luzon (Metro Manila, Central Luzon, Calabarzon)

-

Visayas (Cebu, Iloilo, Leyte)

-

Mindanao (Davao, General Santos, Cagayan de Oro)

Regional Insights of the Philippines Cold Storage Warehouse Market

Luzon – Core Hub for Industrial and Retail Cold Chain

Luzon, led by Metro Manila and Calabarzon, dominates the market with high food import volumes, retail concentration, and pharmaceutical distribution centers. Infrastructure expansion in Clark and Batangas supports the seamless integration of cold chain logistics with ports and highways.

Visayas – Emerging Distribution Zone

Visayas, anchored by Cebu, is developing regional cold storage clusters serving food processors, exporters, and fisheries. Government-backed logistics corridors are improving cold storage connectivity between ports and retail networks.

Mindanao – High Growth Potential

Mindanao’s cold chain demand is surging due to fisheries and banana exports, with Davao and General Santos emerging as strategic cold storage hubs for both domestic distribution and international trade.

Leading Companies in the Philippines Cold Storage Warehouse Market

-

Big Chill Inc.

-

Jentec Storage Inc.

-

Frabelle Cold Storage Corporation

-

Arctic Cold Storage

-

Glacier Megafridge Inc.

-

Polar Bear Freezing and Storage Corporation

-

Frozone Cold Storage Solutions

These companies are investing in automation, energy-efficient refrigeration systems, and AI-powered warehouse management software (WMS) to enhance storage efficiency and reduce energy consumption.

ORCA Cold Chain Solutions currently leads the market with smart warehousing systems and high-capacity automated facilities in Luzon and Visayas.

Strategic Intelligence and Technology Trends

-

Automation & Robotics Integration: AI-based automated storage and retrieval systems (ASRS) are optimizing cold chain logistics.

-

Renewable and Green Cooling Systems: Companies are adopting solar-powered cold rooms and natural refrigerants for sustainability compliance.

-

Digital Twin & IoT Adoption: Real-time temperature tracking, predictive maintenance, and energy monitoring enhance operational reliability.

-

Public-Private Investments: Ongoing PPP initiatives are driving infrastructure upgrades in underserved regions.

-

Cold Chain as a Service (CCaaS): A new model enabling small enterprises to access cold storage on a pay-per-use basis is emerging.

Philippines Cold Storage Warehouse Market Forecast Snapshot: 2025–2033

| Metric | Value |

|---|---|

| 2025 Market Size | USD 874.6 Million |

| 2033 Market Size | ~USD 1.65 Billion |

| CAGR (2025–2033) | 8.4% |

| Largest Market | Luzon (Metro Manila, Calabarzon) |

| Fastest-Growing Region | Mindanao |

| Top Trend | Automation & Smart Cold Chain Warehousing |

| Key Driver | Rising Frozen Food and Pharma Storage Demand |

| Future Outlook | Energy-Efficient, Tech-Driven, and Regionally Integrated Cold Chain Networks |

Why the Philippines Cold Storage Warehouse Market Remains Critical

-

Boosted by e-commerce grocery and food delivery growth

-

Supported by government cold chain development programs

-

Driven by pharma-grade logistics expansion post-pandemic

-

Strengthened by renewable energy and digital transformation initiatives

-

Reinforced by investments in modern storage and export-oriented infrastructure

Final Takeaway of the Philippines Cold Storage Warehouse Market

The Philippines Cold Storage Warehouse Market is rapidly evolving into a strategic logistics pillar for national food security, healthcare resilience, and export competitiveness. As businesses embrace energy-efficient refrigeration, AI-enabled monitoring, and automation, the sector is set to deliver both economic and environmental sustainability.

With strong government backing, foreign direct investment, and rising consumer demand for quality and convenience, the market is on a path toward becoming a digitally connected, sustainable, and future-ready cold chain ecosystem.

At Phoenix Research, our AI-powered forecast engine and logistics intelligence models help businesses identify growth zones, optimize cold chain operations, and build resilient, data-driven infrastructure strategies across the Philippines.

1. Philippines Cold Storage Warehouse Market Overview

2. Key Drivers of Philippines Cold Storage Warehouse Market Growth

-

Rising Demand for Frozen and Processed Food Products

-

Expanding E-commerce and Quick Commerce Grocery Delivery

-

Growth of the Pharmaceutical and Healthcare Cold Chain

-

Government Initiatives and Public-Private Partnerships (PPPs)

-

Advancements in Refrigeration and Energy-Efficient Technologies

-

Expansion of the Fisheries and Aquaculture Export Sector

3. Philippines Cold Storage Warehouse Market Segmentation

By Warehouse Type

-

Private Cold Storage

-

Public Cold Storage

-

Contract/Third-Party Logistics (3PL) Cold Storage

By Temperature Range

-

Frozen Storage (< –18°C)

-

Chilled Storage (0°C to 10°C)

-

Deep Frozen Storage (< –30°C)

By Construction Type

-

Bulk Storage Warehouses

-

Portable/Modular Cold Rooms

-

Blast Freezers and Chillers

By Application

-

Food & Beverage (Meat, Dairy, Seafood, Fruits & Vegetables, Processed Food)

-

Pharmaceuticals & Healthcare

-

Agriculture & Horticulture

-

E-commerce Grocery and Retail

-

Others

By Region

-

Luzon (Metro Manila, Central Luzon, Calabarzon)

-

Visayas (Cebu, Iloilo, Leyte)

-

Mindanao (Davao, General Santos, Cagayan de Oro)

4. Regional Insights of the Philippines Cold Storage Warehouse Market

-

Luzon – Core Hub for Industrial and Retail Cold Chain

-

Visayas – Emerging Distribution Zone

-

Mindanao – High Growth Potential

5. Leading Companies in the Philippines Cold Storage Warehouse Market

-

ORCA Cold Chain Solutions

-

Royal Cargo Inc.

-

Koldstor Centre Philippines Inc.

-

Big Chill Inc.

-

Jentec Storage Inc.

-

Frabelle Cold Storage Corporation

-

Arctic Cold Storage

-

Glacier Megafridge Inc.

-

Polar Bear Freezing and Storage Corporation

-

Frozone Cold Storage Solutions

6. Strategic Intelligence and Technology Trends

-

Phoenix Demand Forecast Engine

-

Automation & Robotics Integration

-

Renewable and Green Cooling Systems

-

Digital Twin & IoT Adoption

-

Public-Private Investments

-

Cold Chain as a Service (CCaaS)

-

Porter’s Five Forces Analysis

7. Philippines Cold Storage Warehouse Market Forecast Snapshot: 2025–2033

-

2025 Market Size

-

2033 Market Size

-

CAGR (2025–2033)

-

Largest Market

-

Fastest Growing Region

-

Top Trend

-

Key Driver

-

Future Growth Focus

8. Why the Philippines Cold Storage Warehouse Market Remains Critical

-

Boosted by E-commerce Grocery and Food Delivery Growth

-

Supported by Government Cold Chain Development Programs

-

Driven by Pharma-Grade Logistics Expansion Post-Pandemic

-

Strengthened by Renewable Energy and Digital Transformation Initiatives

-

Reinforced by Investments in Modern Storage and Export Infrastructure