Global Semiconductor Used Equipment Market Size and share analysis 2025 -2033

Global Semiconductor Used Equipment Market Overview

The Global Semiconductor Used Equipment Market is witnessing a vibrant transformation, driven by the increasing demand for affordable semiconductor manufacturing solutions, growing chip production, and the urgent need to overcome global supply shortages. As the semiconductor industry continues to expand, manufacturers are discovering worthwhile opportunities in used and refurbished semiconductor equipment, enabling cost-effective scaling, reliable performance, and sustainability across the global supply chain.

This Global Semiconductor Used Equipment Market is being energized by rising adoption of AI, IoT, and automotive electronics, boosting demand for mature node manufacturing tools. Companies are learning to convert challenges such as capital constraints and long lead times into opportunities by leveraging pre-owned equipment that ensures proven reliability, quick availability, and responsible reuse. Moreover, the focus on circular economy practices and sustainability has further boosted the market’s transformation into a vital pillar of semiconductor manufacturing efficiency.

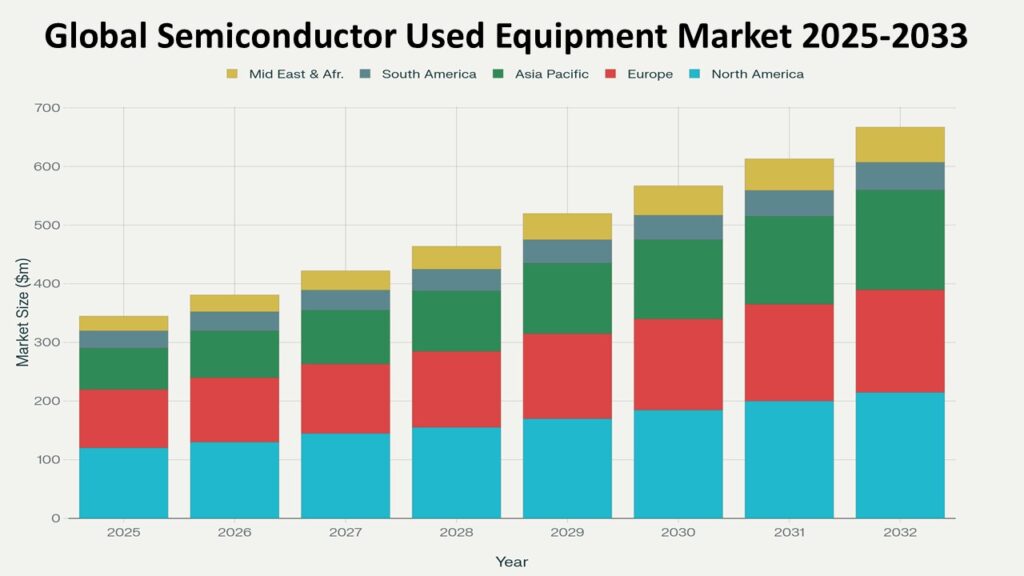

According to Phoenix’s Demand Forecast Engine, the Global Semiconductor Used Equipment Market size is estimated at USD 13.6 billion in 2025 and is projected to reach approximately USD 23.1 billion by 2033, reflecting a proven CAGR of 6.8% during the forecast period. Asia-Pacific dominates both production and demand, driven by extensive foundry capacity and rapid industrial growth, while North America and Europe remain key hubs for refurbishment, resale, and technological upgrades.

The Global Semiconductor Used Equipment market’s expansion is further energized by global chip fabrication initiatives, increasing adoption of 200mm and 300mm wafer production, and an accelerating shift toward automotive-grade and IoT device chips. Companies that innovate responsibly, maintain quality assurance, and ensure immediate equipment availability are set to succeed confidently in the evolving Global Semiconductor Used Equipment Market.

Key Drivers of Global Semiconductor Used Equipment Market Growth

Cost-Efficiency and Rapid Deployment

Used and refurbished equipment allows manufacturers to boost production capacity quickly and cost-effectively, ensuring faster return on investment and reduced downtime.

Sustainability and Circular Economy Focus

Environmental responsibility and proven sustainability goals are driving demand for reliable, reusable semiconductor equipment that reduces e-waste and supports green manufacturing practices.

Expanding Demand from Foundries and IDMs

Rising demand for chips in automotive, consumer electronics, and industrial automation is instantly increasing equipment utilization across global fabrication facilities.

Technological Advancements in Refurbishment

AI-driven testing, precision recalibration, and predictive maintenance ensure the refurbished equipment performs with near-new efficiency, building trust and reliability.

Global Supply Chain Challenges

Semiconductor shortages have encouraged manufacturers to discover and secure pre-owned tools immediately, helping them overcome procurement delays and maintain production continuity.

Global Semiconductor Used Equipment Market Segmentation

By Equipment Type

-

Wafer Fabrication Equipment (Etching, Deposition, Lithography, CMP)

-

Assembly and Packaging Equipment

-

Test and Inspection Equipment

-

Cleaning and Doping Equipment

-

Others (Metrology, Implantation, etc.)

By Application

-

Foundries

-

Integrated Device Manufacturers (IDMs)

-

Memory & Logic Chip Fabrication

-

Power & Analog Semiconductors

-

Research & Development Facilities

By Sales Channel

-

Direct Sales (OEM Resale & Refurbished Programs)

-

Independent Dealers / Brokers

-

Online Marketplace Platforms

-

Auctions & Secondary Market Sales

By End-User Industry

-

Consumer Electronics

-

Automotive & Transportation

-

Industrial Automation

-

Telecommunications

-

Healthcare Devices

Global Semiconductor Used Equipment Market Region-Level Insights

Asia-Pacific – Largest & Fastest-Growing Region (CAGR 2025–2033: 7.2%)

APAC dominates due to the presence of major semiconductor foundries in China, Taiwan, South Korea, and Japan. The region’s rapid expansion in chip fabrication and the adoption of cost-effective equipment boost sustainable production.

North America

The U.S. leads in equipment refurbishment and resale, supported by strong R&D facilities and the presence of major OEMs. Companies are learning to repurpose older tools to support fab expansions and pilot lines.

Europe

Focus on energy-efficient semiconductor manufacturing and sustainability programs is increasing demand for certified, refurbished equipment from established OEMs and independent suppliers.

Latin America & Middle East/Africa

Emerging semiconductor manufacturing and electronics assembly operations are discovering worthwhile opportunities in affordable, reliable, and quick-to-deploy used tools.

Leading Companies in the Global Semiconductor Used Equipment Market

-

Tokyo Electron Limited

-

Hitachi High-Tech Corporation

-

KLA Corporation

-

SurplusGLOBAL, Inc.

-

Semiconductor Equipment Corporation (SEC)

-

Canon Machinery Inc.

-

Nikon Corporation

These players are investing in AI-powered refurbishment, testing automation, and data-driven performance validation to ensure reliability, boost efficiency, and deliver guaranteed satisfaction to global buyers.

Strategic Intelligence and AI-Backed Insights of the Global Semiconductor Used Equipment Market

-

Phoenix Demand Forecast Engine models growth based on chip fabrication trends, equipment life cycle analysis, and production expansion projects worldwide.

-

Sentiment Analyzer Tool highlights increasing confidence in certified refurbished tools as OEMs and fabs seek quick deployment solutions.

-

Construction Activity Mapping System identifies fab expansion and modernization projects across APAC and North America through 2030.

-

Automated Porter’s Five Forces Analysis shows moderate supplier power, high buyer demand, and excellent potential for innovation in refurbishment and testing services.

Global Semiconductor Used Equipment Market Forecast Snapshot: 2025–2033

| Metric | Value |

|---|---|

| 2025 Market Size | USD 13.6 Billion |

| 2033 Market Size | ~USD 23.1 Billion |

| CAGR (2025–2033) | 6.8% |

| Largest Region (2024) | Asia-Pacific (~58%) |

| Fastest Growing Region | Asia-Pacific (7.2% CAGR) |

| Top Segment | Wafer Fabrication Equipment |

| Key Trend | Circular economy & refurbished semiconductor tools |

| Future Growth Focus | Refurbishment, automation, and sustainability |

Why the Global Semiconductor Used Equipment Market Remains Critical

-

Supports sustainable manufacturing and reduces global electronic waste.

-

Enables cost-effective production scaling for new fabs and startups.

-

Provides quick equipment access, overcoming supply chain bottlenecks.

-

Encourages technological recycling and process innovation.

-

Strengthens global chip supply security through responsible reuse and refurbishment.

Final Takeaway of the Global Semiconductor Used Equipment Market

The Global Semiconductor Used Equipment Market is vibrantly transforming, driven by sustainability, affordability, and technological innovation. As chip demand continues to surge, companies that discover efficient refurbishment models, boost operational reliability, and ensure quick equipment delivery are instantly positioned to succeed.

At Phoenix Research, our AI-powered forecasting tools and strategic intelligence systems empower stakeholders to learn quickly, convert insights into immediate action, and succeed confidently in this dynamic and rapidly evolving Global Semiconductor Used Equipment Market, ensuring long-term growth, proven reliability, and sustainable success.

Table of Contents

-

Market Overview

-

Key Drivers of Global Semiconductor Used Equipment Market Growth

2.1 Cost-Efficiency and Rapid Deployment

• Enables faster scaling of production capacity at reduced cost, ensuring quick ROI and minimized downtime.2.2 Sustainability and Circular Economy Focus

• Supports green manufacturing and e-waste reduction through responsible reuse of semiconductor tools.2.3 Expanding Demand from Foundries and IDMs

• Increasing chip needs for automotive, consumer electronics, and industrial sectors boost equipment utilization.2.4 Technological Advancements in Refurbishment

• AI-based testing and predictive maintenance improve refurbished equipment performance and reliability.2.5 Global Supply Chain Challenges

• Semiconductor shortages accelerate the adoption of pre-owned tools to overcome lead times and ensure continuity. -

Global Semiconductor Used Equipment Market Segmentation

3.1 By Equipment Type

• Wafer Fabrication Equipment (Etching, Deposition, Lithography, CMP)

• Assembly and Packaging Equipment

• Test and Inspection Equipment

• Cleaning and Doping Equipment

• Others (Metrology, Implantation, etc.)3.2 By Application

• Foundries

• Integrated Device Manufacturers (IDMs)

• Memory & Logic Chip Fabrication

• Power & Analog Semiconductors

• Research & Development Facilities3.3 By Sales Channel

• Direct Sales (OEM Resale & Refurbished Programs)

• Independent Dealers / Brokers

• Online Marketplace Platforms

• Auctions & Secondary Market Sales3.4 By End-User Industry

• Consumer Electronics

• Automotive & Transportation

• Industrial Automation

• Telecommunications

• Healthcare Devices -

Region-Level Insights

4.1 Asia-Pacific – Largest & Fastest-Growing Region (CAGR: 7.2%)

• Home to leading foundries and rapid expansion in fabrication facilities across China, Taiwan, South Korea, and Japan.4.2 North America

• Strong refurbishment ecosystem supported by OEMs, R&D centers, and fab expansion projects.4.3 Europe

• Sustainability-focused production drives demand for certified refurbished tools and energy-efficient systems.4.4 Latin America & Middle East/Africa

• Emerging markets adopting affordable, quick-deploy used tools for semiconductor and electronics assembly. -

Leading Companies in the Global Semiconductor Used Equipment Market

• Applied Materials, Inc.

• Lam Research Corporation

• ASML Holding N.V.

• Tokyo Electron Limited

• Hitachi High-Tech Corporation

• KLA Corporation

• SurplusGLOBAL, Inc.

• Semiconductor Equipment Corporation (SEC)

• Canon Machinery Inc.

• Nikon Corporation -

Strategic Intelligence and AI-Backed Insights

• Phoenix Demand Forecast Engine – Models growth using fab expansion data and equipment life cycle analytics.

• Sentiment Analyzer Tool – Highlights rising confidence in certified refurbished tools and quick deployment solutions.

• Construction Activity Mapping System – Tracks fab modernization projects across APAC and North America.

• Automated Porter’s Five Forces Analysis – Indicates moderate supplier power, high buyer demand, and innovation potential in testing and refurbishment. -

Forecast Snapshot (2025–2033)

• 2025 Market Size: USD 13.6 Billion

• 2033 Market Size: ~USD 23.1 Billion

• CAGR (2025–2033): 6.8%

• Largest Region (2024): Asia-Pacific (~58%)

• Fastest-Growing Region: Asia-Pacific (7.2% CAGR)

• Top Segment: Wafer Fabrication Equipment

• Key Trend: Circular economy & refurbished semiconductor tools

• Future Focus: Refurbishment, automation, and sustainability -

Why the Global Semiconductor Used Equipment Market Remains Critical

• Enables cost-effective and sustainable semiconductor manufacturing.

• Reduces electronic waste through responsible reuse of tools.

• Offers quick access to essential production equipment.

• Strengthens chip supply security through technological recycling.

• Supports innovation and green production globally. -

Final Takeaway