Global Ethanol Fuel Blending Market 2025-2033

Phoenix Research Forecasts Global Ethanol Fuel Blending Market to Reach USD 145.6 Billion by 2031, Driven by Government Mandates, Vehicle Compatibility Expansion, and High-Blend Adoption

– August 14, 2025 – Phoenix Research, a global leader in AI-enabled energy and transportation fuel analytics, has released its latest industry report: “Global Ethanol Fuel Blending Market: Policy-Driven Growth, Technological Advancements, and Emerging High-Blend Opportunities (2024–2031).” According to the report, the market is set to grow from USD 89.4 billion in 2023 to approximately USD 145.6 billion by 2031, reflecting a 6.3% CAGR.

The report details how renewable fuel mandates, emission reduction targets, and advancements in both ethanol production and vehicle compatibility are accelerating the adoption of ethanol-gasoline blends globally. With blend levels ranging from E5 to E100, ethanol fuel blending is becoming a cornerstone of the low-carbon mobility transition.

“Ethanol blending not only reduces greenhouse gas emissions but also improves octane quality and supports domestic energy independence,” said Dr. Elena Vasquez, Senior Transportation Fuels Analyst at Phoenix Research. “As governments push toward higher blend mandates and the automotive sector adapts, ethanol will be central to sustainable fuel strategies worldwide.”

Key Insights from the Report

Government Blending Mandates Driving Demand:

Policies such as the U.S. Renewable Fuel Standard (RFS), Brazil’s RenovaBio, and India’s Ethanol Blending Program (20% target by 2025) are spurring large-scale ethanol adoption in both existing and new markets.

Emission Reduction & Energy Security Benefits:

Ethanol blends play a critical role in meeting Paris Agreement climate goals, while reducing reliance on imported crude oil by substituting with domestically produced renewable fuel.

Vehicle Compatibility Expansion:

The rise of flexible-fuel vehicles (FFVs), improved mid-blend compatibility in standard engines, and hybrid powertrain integration are enabling higher ethanol blend penetration without performance compromises.

Market Dynamics

- Drivers: Strong policy frameworks, energy diversification goals, FFV market growth, and sustainable fuel adoption.

- Challenges: Feedstock price volatility, cold weather performance issues, and limited blending/storage infrastructure in emerging regions.

- Opportunities: High-blend fuel expansion (E85–E100), cellulosic ethanol scale-up, biorefinery co-products, and rapid adoption in Africa, Southeast Asia, and the Middle East.

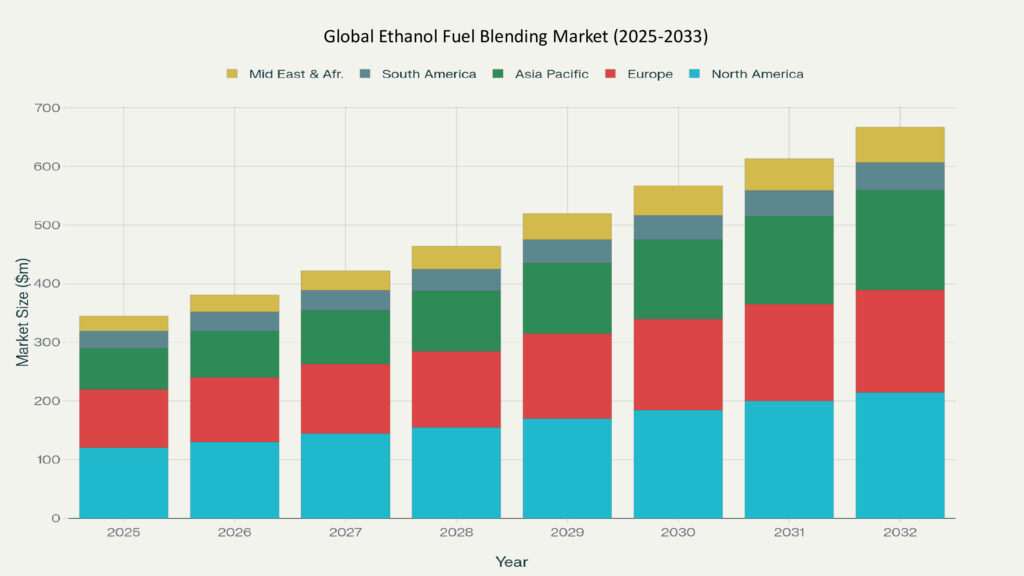

Regional Dynamics

- North America – Largest market, with the U.S. standardizing E10 and expanding E15/E85 in the Midwest; Canada implementing Clean Fuel Regulations. CAGR (2024–2031): 5.9%

- Europe – RED II driving E10 adoption; France and Germany leading regional demand.

- Asia Pacific – Fastest growth at 8.0% CAGR, led by India’s E20 target and China’s ethanol rollout.

- Latin America – Brazil’s flex-fuel vehicle dominance sustaining large-scale E27/E100 use.

- Middle East & Africa – Early-stage ethanol blending programs in South Africa and Gulf nations, with import-driven growth.

Segment Trends

- By Blend Level: Low-level blends (E5–E10) dominate; high-level blends (E85–E100) showing fastest CAGR.

- By Feedstock: Corn and sugarcane remain key; cellulosic ethanol expanding as a sustainable alternative.

- By End Use: Passenger vehicles lead; aviation and marine emerging as growth frontiers.

- By Distribution Channel: Fuel stations primary; fleet operator contracts growing for high-volume blends.

Competitive Intelligence

Phoenix’s Competitive Mapping identifies the following leaders:

- POET LLC – Scaling high-blend ethanol capacity.

- Green Plains Inc. – Investing in cellulosic ethanol technology.

- Raízen Energia S.A. – Advancing sugarcane ethanol infrastructure.

- ADM – Expanding integrated feedstock-to-fuel models.

- Valero Energy Corporation, Petrobras, BP p.l.c., Indian Oil Corporation Ltd., PetroChina – Building long-term supply networks and infrastructure for higher blend adoption.

Phoenix AI Toolkit in Action

- Blending Optimization Models to balance cost, emissions, and performance.

- Supply Chain Predictive Analytics forecasting demand from vehicle registration and policy trends.

- Quality Assurance Systems for real-time blend consistency and ethanol purity monitoring.

- Policy Impact Simulations to project market outcomes under evolving regulations.

Forecast Snapshot (2024–2031)

| Metric | Value |

| 2023 Market Size | USD 89.4 Billion |

| 2031 Market Size | USD 145.6 Billion (est.) |

| CAGR (2024–2031) | 6.3% |

| Largest Region (2024) | North America |

| Fastest-Growing Region | Asia Pacific |

| Top Segment | High-Level Blends (E85–E100) |

| Key Trend | Government Mandates & High-Blend Expansion |

| Future Growth Focus | Second-Generation Ethanol & Sustainable Aviation Fuels |

Why the Global Ethanol Fuel Blending Market Matters

- Enables nations to meet climate commitments cost-effectively.

- Improves fuel quality and reduces tailpipe emissions.

- Enhances energy independence by using domestic feedstocks.

- Supports the transition to low-carbon mobility in both developed and emerging markets.

Final Takeaway

The ethanol fuel blending market is evolving from low-percentage blends toward high-integration fuel strategies backed by strong policy mandates and automotive industry readiness. By combining sustainable production pathways, expanded vehicle compatibility, and AI-optimized supply chains, ethanol blends are set to play a vital role in the future global energy mix.