Global Ethanol Processing Market 2025-2033

Phoenix Research Forecasts Global Ethanol Processing Market to Reach USD 145.8 Billion by 2031, Driven by Biofuel Mandates, Beverage Industry Demand, and Advanced Processing Technologies

– August 12, 2025 – Phoenix Research, a global leader in AI-enabled energy and bioeconomy analytics, has released its latest industry report: “Global Ethanol Processing Market: Scaling Renewable Fuels, Green Chemicals, and Low-Carbon Innovations (2024–2031).” According to the report, the market is projected to expand from USD 90.4 billion in 2023 to approximately USD 145.8 billion by 2031, growing at a 6.1% CAGR.

The report underscores how government biofuel blending mandates, surging alcoholic beverage consumption, and expanding industrial uses are accelerating ethanol market growth. Advanced processing technologies—particularly second-generation cellulosic ethanol—are improving yield efficiency and reducing environmental impact.

“Ethanol is no longer just a fuel additive—it’s a cornerstone of the global bioeconomy,” said Dr. Elena Vasquez, Senior Bioenergy Analyst at Phoenix Research. “From renewable transportation fuels to bio-based plastics, ethanol’s role is expanding rapidly, with AI and carbon reduction tools reshaping the competitive landscape.”

Key Insights from the Report

Policy-Driven Fuel Demand

Global renewable fuel mandates, such as the U.S. Renewable Fuel Standard (RFS) and Brazil’s RenovaBio program, are driving large-scale ethanol blending.

Diversification into High-Value Applications

Beyond fuel, ethanol is gaining traction in pharmaceuticals, cosmetics, solvents, and beverage-grade markets, creating multi-channel revenue streams.

Feedstock and Technology Shifts

Cellulosic biomass and carbon capture integration are enabling higher yields and lower lifecycle GHG emissions compared to conventional feedstocks.

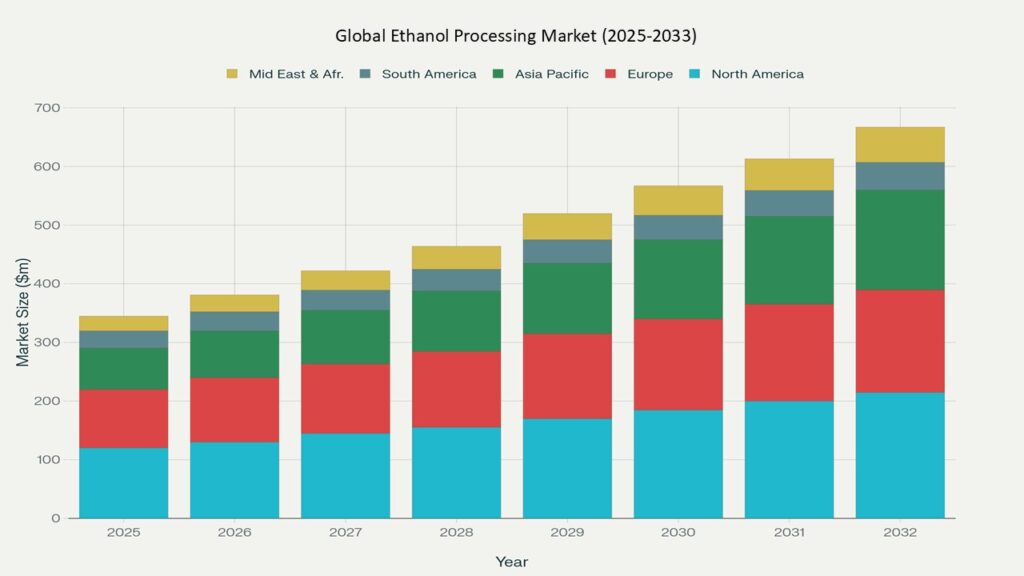

Regional Dynamics

- North America – Largest market (2024 share leader) with strong policy support and advanced corn-to-ethanol innovation. CAGR (2024–2031): 5.8%

- Asia Pacific – Fastest-growing region (8.2% CAGR), led by India, Thailand, and China’s ethanol blending initiatives.

- Europe – Expanding cellulosic ethanol capacity under RED II mandates for carbon intensity reduction.

- Latin America – Brazil’s sugarcane ethanol remains the benchmark for low-carbon fuel economics.

- Middle East & Africa – Early-stage projects with growth potential in fuel blending and beverage production.

Segment Trends

- By Feedstock: Corn remains dominant, but cellulosic biomass is the fastest-growing category.

- By Technology: Dry mill processes lead, while cellulosic processing shows highest growth potential.

- By Application: Fuel ethanol remains the largest share, but industrial ethanol demand is rising rapidly.

- By End User: Oil & gas companies dominate, with beverage producers and chemical manufacturers expanding their share.

Competitive Intelligence

Phoenix’s Competitive Mapping identifies top innovators:

- Archer Daniels Midland Company (ADM) – Expanding into carbon capture and green chemical derivatives.

- POET, LLC – Leading in cellulosic ethanol commercialization.

- Valero Energy Corporation – Scaling vertically integrated ethanol assets.

- Raízen S.A. – Pioneering sugarcane ethanol with low-carbon credentials.

- Green Plains Inc., Tereos S.A., Cargill Inc. – Innovating in feedstock efficiency and by-product monetization.

Phoenix AI Toolkit in Action

- Demand Forecast Engine processed global ethanol production and blending mandates to model regional growth trajectories.

- AI-Based Fermentation Optimization predicts yield improvements and minimizes downtime.

- Policy Tracking Algorithms monitor 50+ ethanol blending programs in real time.

- Carbon Intensity Modeling provides lifecycle GHG benchmarking for compliance and ESG reporting.

Forecast Snapshot (2024–2031)

| Metric | Value |

| 2023 Market Size | USD 90.4 Billion |

| 2031 Market Size | USD 145.8 Billion (est.) |

| CAGR (2024–2031) | 6.1% |

| Largest Region (2024) | North America |

| Fastest Growing Region | Asia Pacific |

| Top Segment | Fuel Ethanol |

| Key Trend | Second-generation cellulosic ethanol |

| Future Growth Focus | Integration with green hydrogen and bio-based chemicals |

Why the Global Ethanol Processing Market Matters

- Supports decarbonization of the transportation sector and chemical manufacturing

- Enables feedstock diversification for energy security and price stability

- Powers growth in renewable fuels, green chemicals, and bio-based materials

- Leverages AI to make production more efficient, sustainable, and scalable

Final Takeaway

The global ethanol processing market is shifting from a commodity fuel sector to a diversified bioeconomy platform. With AI-enabled optimization, feedstock diversification, and cross-sector applications, ethanol stands to play a central role in the world’s renewable energy and sustainable manufacturing future.