Global Ethanol Production Market 2025-2033

Phoenix Research Forecasts Global Ethanol Production Market to Reach USD 145.8 Billion by 2031, Fueled by Multi-Sector Demand and Low-Carbon Innovation

– August 14, 2025 – Phoenix Research, a global leader in AI-enabled renewable energy and bioeconomy intelligence, has released its latest market intelligence report: “Global Ethanol Production Market: Feedstock Diversification, Policy Momentum, and Technology Breakthroughs (2024–2031).” The report forecasts the global ethanol production market will grow from USD 90.4 billion in 2023 to USD 145.8 billion by 2031, registering a 6.1% CAGR.

The research highlights how ethanol’s role as a renewable transportation fuel, industrial chemical, and beverage ingredient is driving production expansion worldwide. With government blending mandates, advances in cellulosic ethanol technology, and ethanol’s versatility across multiple sectors, the market is entering a new era of diversified feedstocks and integrated bio-refinery operations.

“Ethanol is no longer just a transportation fuel—it’s becoming a platform for decarbonization, circular bioeconomy solutions, and value-added co-products,” said Dr. Marcus LeClair, Lead Biofuels Analyst at Phoenix Research. “From grain to cellulosic waste, producers are scaling capacity and technology to meet both climate goals and industrial market demand.”

Key Insights from the Report

Government Mandates Driving Scale:

Policies such as the U.S. Renewable Fuel Standard (RFS), Brazil’s RenovaBio, and India’s Ethanol Blending Program (EBP) continue to accelerate production growth, while RED II in Europe pushes advanced and cellulosic ethanol adoption.

Multi-Sector Demand Support:

Beyond transportation fuels, ethanol is seeing sustained demand growth in pharmaceuticals, personal care, disinfectants, and as a key chemical building block for bio-based products.

Technological Advancements Unlocking Efficiency:

Second-generation production, AI-optimized fermentation, and carbon capture integration are enabling higher yields with lower greenhouse gas intensity.

Market Dynamics

- Drivers: Policy-backed production targets, industrial ethanol demand, ESG and low-carbon fuel compliance, and feedstock innovation.

- Challenges: Feedstock price volatility, electric vehicle adoption, and high infrastructure costs.

- Opportunities: Waste-to-ethanol pathways, ethanol co-products such as DDGS and CO₂, and emerging trade hubs in Africa, the Middle East, and Southeast Asia.

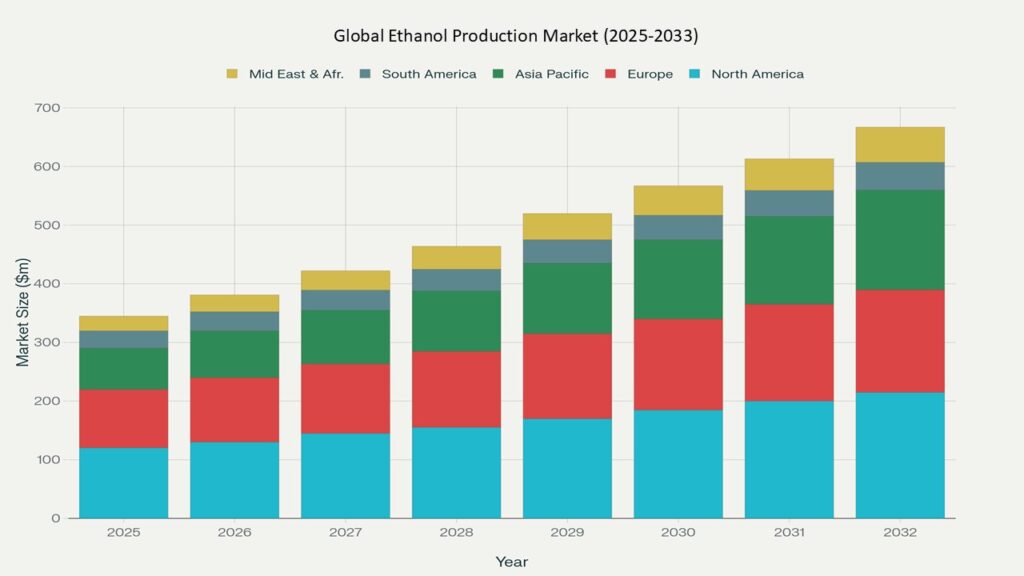

Regional Highlights

- North America – Largest producer globally, led by U.S. corn ethanol; strong policy frameworks under RFS and Low Carbon Fuel Standards.

- Europe – Growing cellulosic ethanol capacity under RED II; focus on advanced biofuels with low carbon intensity.

- Asia Pacific – Rapid capacity expansion in India and China; Thailand emerging as a key exporter.

- Latin America – Brazil’s low-GHG sugarcane ethanol integrated with flex-fuel vehicle market.

- Middle East & Africa – Early-stage ethanol production with potential for beverage, fuel, and industrial sectors.

Segment Trends

- By Feedstock: Corn remains dominant, sugarcane strong in Latin America, cellulosic ethanol posting highest CAGR.

- By Production Technology: Dry milling prevalent, cellulosic production gaining share through new investments.

- By Application: Fuel ethanol leads, with industrial and beverage-grade ethanol providing diversification.

- By End User: Oil & gas companies are primary buyers; chemical and pharmaceutical sectors expanding uptake.

Competitive Intelligence

Phoenix’s Competitive Radar identifies leading players:

- Archer Daniels Midland Company (ADM) – Expanding advanced ethanol facilities.

- POET, LLC – Scaling cellulosic ethanol operations.

- Green Plains Inc. – Integrating carbon capture into ethanol plants.

- Raízen S.A., Valero Energy Corporation, Tereos S.A., GranBio, The Andersons Inc., Cargill, Pacific Ethanol – Pursuing feedstock diversification, vertical integration, and strategic global partnerships.

Global Ethanol Production Market

Phoenix AI Toolkit in Action

- AI-Optimized Fermentation for real-time yield improvements.

- Predictive Maintenance using IoT analytics to minimize downtime.

- Global Policy Monitoring for blending targets and trade shifts.

- Carbon Intensity Analytics to align production with ESG goals and low-carbon standards.

Forecast Snapshot (2024–2031)

Metric Value 2023 Market Size USD 90.4 Billion 2031 Market Size USD 145.8 Billion (est.) CAGR (2024–2031) 6.1% Largest Region North America Fastest-Growing Segment Cellulosic Ethanol Key Trend Waste-to-Ethanol & Bio-Refinery Integration Future Growth Focus Industrial & Chemical Applications Why the Global Ethanol Production Market Matters

- Reduces greenhouse gas emissions and supports climate targets.

- Enhances energy security by reducing oil import dependence.

- Serves as a platform chemical for a wide range of bio-based industries.

- Enables a diversified, circular bioeconomy across multiple sectors.

Final Takeaway

The ethanol production industry is moving beyond traditional grain and sugarcane pathways toward a multi-feedstock, multi-application future. Policy alignment, technological innovation, and expanding industrial uses will define competitive advantage as global demand grows through 2031.

Global Ethanol Production Market