Global Frozen Drinks Market Report 2026-2033

Market Forecast Snapshot (2026–2033)

| Metric | Value |

|---|---|

| 2025 Market Size | USD 12.9 Billion |

| 2033 Market Size | ~USD 21.8 Billion |

| CAGR (2026–2033) | 6.8% |

| Largest Market | North America |

| Fastest Growing Region | Asia-Pacific |

| Dominant Segment | Non-Alcoholic Frozen Drinks |

| Key Trend | Premium & Alcohol-Infused Frozen Beverages |

| Future Focus | Low-Sugar, Plant-Based, Smart Dispensing Systems |

Global Frozen Drinks Market Overview

The Global Frozen Drinks Market includes non-alcoholic and alcoholic beverages served in frozen or semi-frozen formats, such as slushies, smoothies, frozen carbonated beverages, frappes, frozen coffee drinks, and frozen cocktails. These products are widely distributed across quick-service restaurants (QSRs), cafés, bars, cinemas, theme parks, convenience stores, and entertainment venues, forming an important high-margin beverage category within the global foodservice industry.

Frozen drinks have evolved from seasonal refreshment products into a mainstream experiential beverage segment. Their popularity is driven by expanding QSR chains, rising urbanization, growing youth demographics, demand for visually appealing and customizable beverages, and increasing adoption of premium and alcohol-infused frozen formats. In addition, low-sugar recipes, fruit-based blends, plant-based smoothie innovations, and limited-edition seasonal flavors are supporting broader consumer appeal beyond summer months.

According to Phoenix Demand Forecast Engine, the Global Frozen Drinks Market is valued at USD 12.9 billion in 2025 and is projected to reach approximately USD 21.8 billion by 2033, reflecting a CAGR of ~6.8% during 2026–2033.

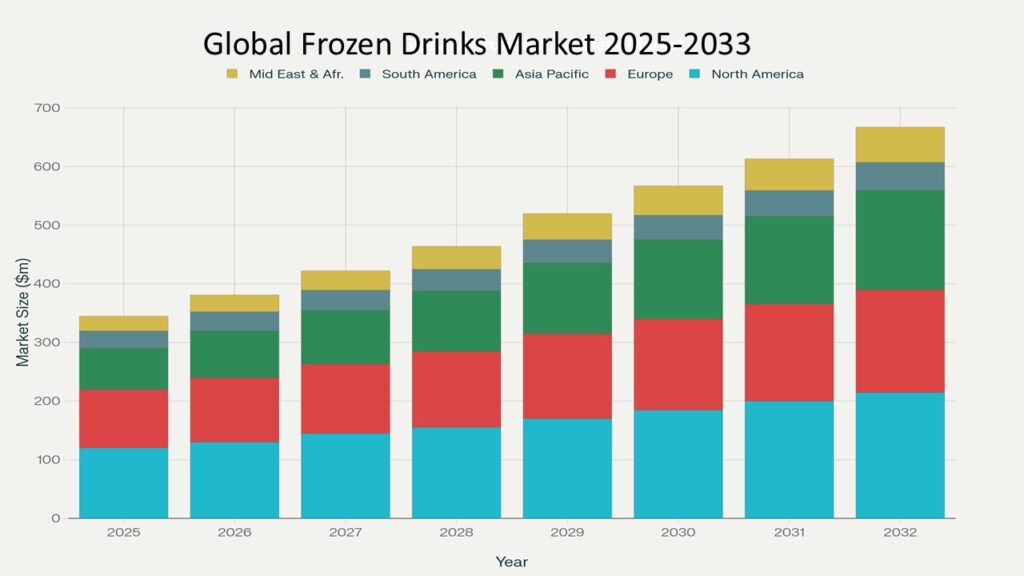

North America holds the largest market share, supported by strong QSR penetration, established frozen beverage brands, cinema and theme park consumption, and a growing frozen cocktail culture. Asia-Pacific represents the fastest-growing region, driven by rapid franchise expansion, rising disposable incomes, urban youth populations, and increasing adoption of Western-style café and QSR formats.

The post-2025 outlook indicates rising premiumization, alcohol-infused frozen beverage expansion, smart dispensing technology integration, sustainable packaging initiatives, and innovation in low-calorie, fruit-forward, and plant-based frozen drink formulations.

Key Drivers of Market Growth

-

Expansion of global QSR and franchise networks

-

Increasing youth population and social consumption culture

-

Growth in frozen cocktails and alcoholic slush beverages

-

Rising demand for low-calorie and fruit-based drinks

-

Technological advancements in frozen beverage machines

-

Strong climate-driven demand in hot-weather regions

Global Frozen Drinks Market Segmentation

1. By Product Type

1.1 Non-Alcoholic Frozen Drinks

1.1.1 Slushies / Ice Slush

1.1.1.1 Carbonated Slush

1.1.1.2 Fruit-Based Slush

1.1.1.3 Functional / Vitamin-Infused Slush

1.1.2 Smoothies

1.1.2.1 Fruit Smoothies

1.1.2.2 Dairy-Based Smoothies

1.1.2.3 Plant-Based Smoothies

1.1.3 Frozen Carbonated Beverages

1.1.3.1 Cola-Based Frozen Drinks

1.1.3.2 Flavored Soda Frozen Drinks

1.1.3.3 Energy-Infused Frozen Drinks

1.1.4 Frozen Coffee & Frappes

1.1.4.1 Coffee-Based Frappes

1.1.4.2 Chocolate / Mocha Variants

1.1.4.3 Specialty / Premium Frappes

1.2 Alcoholic Frozen Drinks

1.2.1 Frozen Cocktails

1.2.1.1 Frozen Margaritas

1.2.1.2 Frozen Daiquiris

1.2.1.3 Frozen Piña Coladas

1.2.2 Frozen Beer & Malt-Based Drinks

1.2.2.1 Frozen Draft Beer

1.2.2.2 Malt-Based Frozen Slush

1.2.3 Frozen Wine-Based Beverages

1.2.3.1 Frozen Rosé (Frosé)

1.2.3.2 Sparkling Frozen Wine Blends

2. By Ingredient Type

2.1 Fruit-Based

2.1.1 Citrus-Based

2.1.1.1 Lemon & Lime Slush

2.1.1.2 Orange-Based Frozen Drinks

2.1.1.3 Grapefruit Variants

2.1.2 Berry-Based

2.1.2.1 Strawberry Blends

2.1.2.2 Blueberry & Raspberry Mixes

2.1.2.3 Mixed Berry Fusion

2.1.3 Tropical Fruit Blends

2.1.3.1 Mango-Based Frozen Drinks

2.1.3.2 Pineapple & Passionfruit

2.1.3.3 Exotic Multi-Fruit Combinations

2.2 Dairy-Based

2.2.1 Milk-Based

2.2.1.1 Classic Milkshakes

2.2.1.2 Flavored Frozen Milk Beverages

2.2.1.3 Chocolate-Based Variants

2.2.2 Yogurt-Based

2.2.2.1 Frozen Yogurt Smoothies

2.2.2.2 Probiotic-Enriched Blends

2.2.2.3 Greek Yogurt Frozen Drinks

2.2.3 Cream-Based

2.2.3.1 Ice Cream-Based Shakes

2.2.3.2 Premium Dessert Frozen Drinks

2.2.3.3 Whipped Cream-Topped Variants

2.3 Plant-Based

2.3.1 Almond / Soy / Oat-Based

2.3.1.1 Almond Milk Smoothies

2.3.1.2 Soy-Based Frozen Beverages

2.3.1.3 Oat Milk Frappes

2.3.2 Coconut-Based

2.3.2.1 Coconut Milk Smoothies

2.3.2.2 Coconut Cream Frozen Blends

2.3.2.3 Tropical Coconut Slush Variants

2.4 Alcohol-Infused

2.4.1 Spirit-Based

2.4.1.1 Vodka-Based Frozen Cocktails

2.4.1.2 Rum-Based Daiquiris

2.4.1.3 Tequila-Based Margaritas

2.4.2 Wine-Based

2.4.2.1 Frozen Sangria

2.4.2.2 Wine Slushies

2.4.2.3 Sparkling Wine Frozen Blends

2.4.3 Beer-Based

2.4.3.1 Frozen Beer Cocktails

2.4.3.2 Craft Beer Slush Variants

2.4.3.3 Beer-Mixed Frozen Blends

3. By Distribution Channel

3.1 Quick-Service Restaurants (QSRs)

3.1.1 Global QSR Chains

3.1.1.1 International Burger Chains

3.1.1.2 Fried Chicken Chains

3.1.1.3 Pizza & Combo Chains

3.1.2 Regional Franchise Chains

3.1.2.1 National QSR Brands

3.1.2.2 Mall-Based Franchises

3.1.2.3 Highway & Transit QSR Units

3.1.3 Independent Outlets

3.1.3.1 Standalone Frozen Drink Kiosks

3.1.3.2 Street-Level Beverage Shops

3.1.3.3 Seasonal Pop-Up Stalls

3.2 Cafés & Coffee Chains

3.2.1 International Coffee Brands

3.2.1.1 Frappes & Frozen Coffee

3.2.1.2 Signature Seasonal Beverages

3.2.1.3 Premium Blended Drinks

3.2.2 Local Café Chains

3.2.2.1 Artisan Beverage Cafés

3.2.2.2 Dessert & Beverage Boutiques

3.2.2.3 Youth-Centric Café Formats

3.3 Bars & Nightclubs

3.3.1 Premium Cocktail Bars

3.3.1.1 Signature Frozen Cocktails

3.3.1.2 Mixologist-Led Concepts

3.3.1.3 Luxury Rooftop Bars

3.3.2 Casual Bars & Lounges

3.3.2.1 Frozen Margarita Stations

3.3.2.2 Happy Hour Slush Cocktails

3.3.2.3 Music & Entertainment Bars

3.4 Entertainment & Leisure Venues

3.4.1 Cinemas

3.4.1.1 Multiplex Chains

3.4.1.2 Premium Cinema Lounges

3.4.1.3 Family Entertainment Centers

3.4.2 Theme Parks

3.4.2.1 International Theme Parks

3.4.2.2 Regional Amusement Parks

3.4.2.3 Water Parks

3.4.3 Sports Arenas

3.4.3.1 Stadium Concession Stands

3.4.3.2 VIP Lounge Beverage Services

3.4.3.3 Seasonal Tournament Events

3.5 Retail & Convenience

3.5.1 Convenience Stores

3.5.1.1 Self-Serve Slush Machines

3.5.1.2 Grab-and-Go Frozen Packs

3.5.1.3 Fuel Station Beverage Counters

3.5.2 Supermarkets (Ready-to-Freeze Packs)

3.5.2.1 DIY Frozen Cocktail Kits

3.5.2.2 Smoothie Freezer Packs

3.5.2.3 Family-Size Frozen Mixes

4. By End User

4.1 Individual Consumers

4.1.1 Youth / Teen Consumers

4.1.1.1 Social Media-Driven Buyers

4.1.1.2 Trend-Focused Flavor Seekers

4.1.1.3 After-School Consumption

4.1.2 Working Professionals

4.1.2.1 Office Break Purchases

4.1.2.2 Evening Social Drinkers

4.1.2.3 Weekend Leisure Buyers

4.1.3 Health-Conscious Consumers

4.1.3.1 Low-Sugar Seekers

4.1.3.2 Plant-Based Buyers

4.1.3.3 Functional Smoothie Consumers

4.2 Commercial & Hospitality

4.2.1 Hotels & Resorts

4.2.1.1 Poolside Beverage Services

4.2.1.2 All-Inclusive Resort Packages

4.2.1.3 Luxury Hospitality Chains

4.2.2 Catering & Event Services

4.2.2.1 Wedding & Private Events

4.2.2.2 Corporate Catering

4.2.2.3 Festival & Outdoor Events

4.2.3 Cruise & Tourism Operators

4.2.3.1 Cruise Line Beverage Programs

4.2.3.2 Tourist Destination Kiosks

4.2.3.3 Seasonal Vacation Hubs

5. By Region

5.1 North America

5.2 Europe

5.3 Asia-Pacific

5.4 Latin America

5.5 Middle East & Africa

Regional Insights of the Global Frozen Drinks Market

North America

Dominates due to strong QSR presence, frozen cocktail culture, and high summer consumption. The U.S. drives innovation in premium frozen beverages.

Europe

Growth supported by café culture, frozen wine-based drinks, and high tourism activity in Southern Europe.

Asia-Pacific

Rapid urbanization, franchise expansion, and strong youth demographics in China, India, and Southeast Asia fuel demand.

Latin America

Warm climate and social beverage culture drive high adoption of fruit-based frozen drinks.

Middle East & Africa

High temperatures and mall-based QSR expansion increase consumption.

Leading Companies in the Global Frozen Drinks Market

-

The Coca-Cola Company (Frozen Fanta, Frozen Coke)

-

PepsiCo Inc. (Frozen Mountain Dew, Slurpee partnerships)

-

McDonald’s Corporation (Frozen beverages & frappes)

-

Starbucks Corporation (Frappuccino range)

-

Jamba (GoTo Foods)

-

Sonic Drive-In

-

Taco Bell (Frozen Baja Blast)

-

Keurig Dr Pepper

-

Nestlé S.A.

Large beverage conglomerates dominate syrup supply chains, while QSR brands control end-consumer distribution channels. The coca-cola company is the largest company in the

Global Frozen Drinks Market

Strategic Intelligence & AI-Backed Insights

Market modeling: Phoenix Demand Forecast Engine analyzed seasonal demand patterns, QSR growth rates, climate data, and alcohol adoption trends.

Production mapping: Increasing investments in frozen beverage dispensing equipment, syrup production, and centralized beverage hubs.

Consumer sentiment: Strong shift toward fruit-based, Instagram-friendly, low-sugar, and premium frozen drinks.

Porter’s Five Forces Analysis: Moderate supplier power (flavor concentrates & equipment providers); high buyer power in QSR channel due to competitive pricing and brand substitution.

Why the Global Frozen Drinks Market Remains Critical

-

Strong alignment with youth and social consumption culture.

-

High-margin category for QSR and entertainment operators.

-

Seasonal revenue booster in hot-weather markets.

-

Growing crossover with alcoholic beverage innovation.

-

Technology-driven efficiency via automated dispensing systems.

1. Executive Summary

1.1 Market Forecast Snapshot (2026–2033)

1.2 Global Market Size & CAGR Analysis

1.3 Largest & Fastest-Growing Segments

1.4 Region-Level Leadership & Growth Trends

1.5 Key Market Drivers

1.6 Competitive Landscape Overview

1.7 Strategic Outlook Through 2033

2. Introduction & Market Overview

2.1 Definition of the Global Frozen Drinks Market

2.2 Scope of the Study

2.3 Evolution from Seasonal Slush to Premium Frozen Beverage Culture

2.4 Role of QSRs, Cafés, Bars & Entertainment Venues

2.5 Alcohol-Infused Frozen Beverage Expansion

2.6 Smart Dispensing Systems & Automation Integration

2.7 Sustainability, Low-Sugar & Plant-Based Innovations

3. Research Methodology

3.1 Primary Research

3.2 Secondary Research

3.3 Market Size Estimation Model

3.4 Forecast Assumptions (2026–2033)

3.5 Data Validation & Triangulation

4. Market Dynamics

4.1 Drivers

4.1.1 Expansion of Global QSR & Franchise Networks

4.1.2 Rising Youth & Social Consumption Culture

4.1.3 Growth in Frozen Cocktails & Alcoholic Slush

4.1.4 Demand for Low-Calorie & Fruit-Based Drinks

4.1.5 Climate-Driven Seasonal Demand

4.1.6 Technological Advancements in Frozen Beverage Machines

4.2 Restraints

4.2.1 Raw Material & Flavor Concentrate Price Volatility

4.2.2 Equipment Installation & Maintenance Costs

4.2.3 Regulatory Restrictions on Alcoholic Variants

4.2.4 Health & Sugar Tax Regulations

4.3 Opportunities

4.3.1 Premium & Craft Frozen Cocktail Concepts

4.3.2 Plant-Based & Functional Smoothie Expansion

4.3.3 Smart Self-Serve Dispensing Systems

4.3.4 Emerging Market Franchise Expansion

4.4 Challenges

4.4.1 Seasonal Revenue Volatility

4.4.2 Competitive QSR Pricing Pressure

4.4.3 Aggregator Commission Margin Impact

4.4.4 Supply Chain Sensitivity

5. Global Frozen Drinks Market Analysis (USD Billion), 2026–2033

5.1 Market Size Overview

5.2 CAGR Analysis

5.3 Region-Wise Revenue Distribution

5.4 Product-Wise Revenue Split

5.5 Margin & Pricing Trend Analysis

6. Market Segmentation by Product Type (USD Billion), 2026–2033

6.1 Non-Alcoholic Frozen Drinks

6.1.1 Slushies / Ice Slush

6.1.1.1 Carbonated Slush

6.1.1.2 Fruit-Based Slush

6.1.1.3 Functional / Vitamin-Infused Slush

6.1.2 Smoothies

6.1.2.1 Fruit Smoothies

6.1.2.2 Dairy-Based Smoothies

6.1.2.3 Plant-Based Smoothies

6.1.3 Frozen Carbonated Beverages

6.1.3.1 Cola-Based Frozen Drinks

6.1.3.2 Flavored Soda Frozen Drinks

6.1.3.3 Energy-Infused Frozen Drinks

6.1.4 Frozen Coffee & Frappes

6.1.4.1 Coffee-Based Frappes

6.1.4.2 Chocolate / Mocha Variants

6.1.4.3 Specialty / Premium Frappes

6.2 Alcoholic Frozen Drinks

6.2.1 Frozen Cocktails

6.2.1.1 Frozen Margaritas

6.2.1.2 Frozen Daiquiris

6.2.1.3 Frozen Piña Coladas

6.2.2 Frozen Beer & Malt-Based Drinks

6.2.2.1 Frozen Draft Beer

6.2.2.2 Malt-Based Frozen Slush

6.2.3 Frozen Wine-Based Beverages

6.2.3.1 Frozen Rosé (Frosé)

6.2.3.2 Sparkling Frozen Wine Blends

7. Market Segmentation by Ingredient Type (USD Billion), 2026–2033

7.1 Fruit-Based

7.1.1 Citrus-Based

7.1.1.1 Lemon & Lime Slush

7.1.1.2 Orange-Based Frozen Drinks

7.1.1.3 Grapefruit Variants

7.1.2 Berry-Based

7.1.2.1 Strawberry Blends

7.1.2.2 Blueberry & Raspberry Mixes

7.1.2.3 Mixed Berry Fusion

7.1.3 Tropical Fruit Blends

7.1.3.1 Mango-Based Frozen Drinks

7.1.3.2 Pineapple & Passionfruit

7.1.3.3 Exotic Multi-Fruit Combinations

7.2 Dairy-Based

7.2.1 Milk-Based

7.2.1.1 Classic Milkshakes

7.2.1.2 Flavored Frozen Milk Beverages

7.2.1.3 Chocolate-Based Variants

7.2.2 Yogurt-Based

7.2.2.1 Frozen Yogurt Smoothies

7.2.2.2 Probiotic-Enriched Blends

7.2.2.3 Greek Yogurt Frozen Drinks

7.2.3 Cream-Based

7.2.3.1 Ice Cream-Based Shakes

7.2.3.2 Premium Dessert Frozen Drinks

7.2.3.3 Whipped Cream-Topped Variants

7.3 Plant-Based

7.3.1 Almond / Soy / Oat-Based

7.3.1.1 Almond Milk Smoothies

7.3.1.2 Soy-Based Frozen Beverages

7.3.1.3 Oat Milk Frappes

7.3.2 Coconut-Based

7.3.2.1 Coconut Milk Smoothies

7.3.2.2 Coconut Cream Frozen Blends

7.3.2.3 Tropical Coconut Slush Variants

7.4 Alcohol-Infused

7.4.1 Spirit-Based

7.4.1.1 Vodka-Based Frozen Cocktails

7.4.1.2 Rum-Based Daiquiris

7.4.1.3 Tequila-Based Margaritas

7.4.2 Wine-Based

7.4.2.1 Frozen Sangria

7.4.2.2 Wine Slushies

7.4.2.3 Sparkling Wine Frozen Blends

7.4.3 Beer-Based

7.4.3.1 Frozen Beer Cocktails

7.4.3.2 Craft Beer Slush Variants

7.4.3.3 Beer-Mixed Frozen Blends

8. Market Segmentation by Distribution Channel (USD Billion), 2026–2033

8.1 Quick-Service Restaurants (QSRs)

8.1.1 Global QSR Chains

8.1.2 Regional Franchise Chains

8.1.3 Independent Outlets

8.2 Cafés & Coffee Chains

8.2.1 International Coffee Brands

8.2.2 Local Café Chains

8.3 Bars & Nightclubs

8.3.1 Premium Cocktail Bars

8.3.2 Casual Bars & Lounges

8.4 Entertainment & Leisure Venues

8.4.1 Cinemas

8.4.2 Theme Parks

8.4.3 Sports Arenas

8.5 Retail & Convenience

8.5.1 Convenience Stores

8.5.2 Supermarkets (Ready-to-Freeze Packs)

9. Market Segmentation by End-User (USD Billion), 2026–2033

9.1 Individual Consumers

9.1.1 Youth / Teen Consumers

9.1.2 Working Professionals

9.1.3 Health-Conscious Consumers

9.2 Commercial & Hospitality

9.2.1 Hotels & Resorts

9.2.2 Catering & Event Services

9.2.3 Cruise & Tourism Operators

10. Market Segmentation by Geography

10.1 North America

10.2 Europe

10.3 Asia-Pacific

10.4 Latin America

10.5 Middle East & Africa

11. Competitive Landscape – Global

11.1 Market Share Analysis

11.2 Brand Positioning Matrix

11.3 QSR Partnership & Syrup Supply Chain Analysis

11.4 Competitive Intensity Mapping

11.5 Strategic Expansion Trends

12. Company Profiles

12.1 The Coca-Cola Company

12.2 PepsiCo Inc.

12.3 McDonald’s Corporation

12.4 Starbucks Corporation

12.5 Jamba (GoTo Foods)

12.6 Sonic Drive-In

12.7 Taco Bell

12.8 Keurig Dr Pepper

12.9 Nestlé S.A.

13. Regional Insights

13.1 North America – Largest Market

13.2 Europe – Tourism & Wine-Based Frozen Growth

13.3 Asia-Pacific – Fastest Growing Region

13.4 Latin America – Climate & Fruit Culture

13.5 Middle East & Africa – High-Temperature Demand

14. Strategic Intelligence & Phoenix AI-Backed Insights

14.1 Phoenix Demand Forecast Engine

14.2 Climate-Based Demand Modeling

14.3 Alcohol Adoption Trend Mapping

14.4 Smart Dispensing & Automation Analytics

14.5 Automated Porter’s Five Forces Analysis

15. Future Outlook & Strategic Recommendations

15.1 Premiumization & Craft Frozen Cocktail Growth

15.2 Low-Sugar & Functional Beverage Expansion

15.3 Plant-Based Product Innovation

15.4 Smart Dispensing System Investments

15.5 Long-Term Market Outlook (2033+)