Global Craft Soda Market Report 2026-2033

Global Craft Soda Market Forecast Snapshot: 2026–2033

| Metric | Value |

|---|---|

| 2025 Market Size | USD 5.8 Billion |

| 2033 Market Size | ~USD 10.3 Billion |

| CAGR (2026–2033) | ~7.8% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Top Segment | Flavored & Functional Craft Sodas |

| Key Trend | Low-Sugar, Functional Fortification & Premiumization |

| Future Focus | Probiotic Innovation, Sustainable Packaging & DTC Expansion |

Global Craft Soda Market Overview

The Global Craft Soda Market is experiencing rapid transformation, driven by rising consumer demand for healthier, flavorful, and ethically produced beverages, coupled with innovation, premiumization, and sustainability trends. Craft soda formats—including flavored, functional, low-sugar, and fortified variants—are evolving into innovation-led, digitally enabled beverage ecosystems that cater to health-conscious and taste-driven consumers.

According to Phoenix Research, the Global Craft Soda Market is valued at USD 5.8 billion in 2025 and is projected to reach approximately USD 10.3 billion by 2033, registering a CAGR of ~7.8% (2026–2033). This revenue forecast reflects consistent growth fueled by premiumization, functional fortification, DTC and e-commerce expansion, and sustainable packaging adoption across both mature and emerging markets.

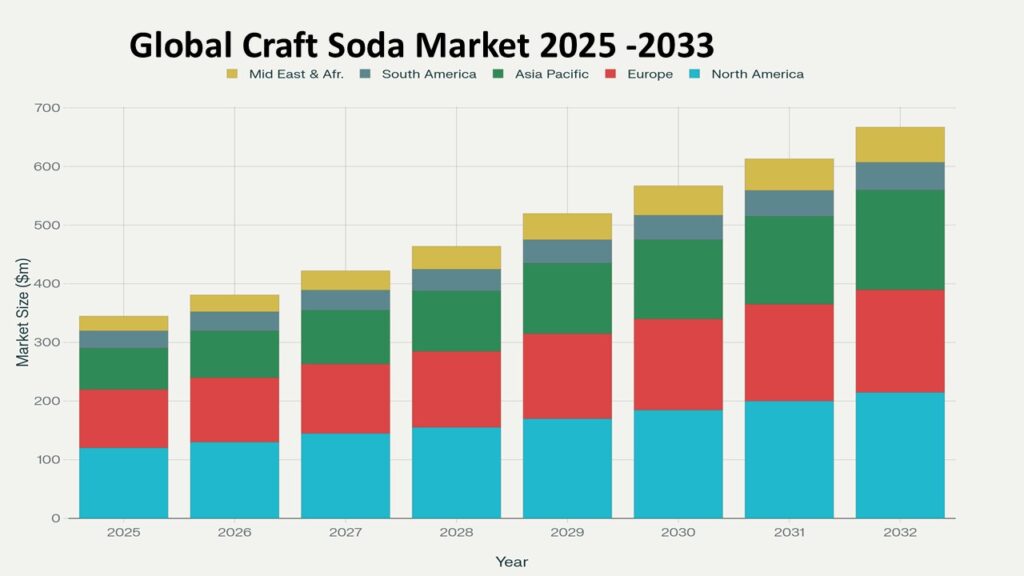

North America holds the largest market share, supported by high consumer awareness of probiotics and functional beverages, established craft soda brands, and widespread online and retail availability. Asia-Pacific is emerging as the fastest-growing region, driven by urbanization, rising disposable income, and increasing preference for natural, low-sugar, and functional beverages among younger consumers.

The Post-2025 outlook for the Craft Soda Market highlights continued innovation in flavor and functional ingredients, adoption of AI-driven consumer analytics, expansion of DTC subscription models, and sustainability initiatives, enabling brands to enhance market penetration, optimize operations, and respond effectively to evolving consumer preferences.

1. Executive Summary

1.1 Market Snapshot (2026–2033)

1.2 Key Growth Highlights

1.3 Largest & Fastest Growing Regions

1.4 Dominant & Emerging Segments

1.5 Strategic Opportunity Areas

2. Global Craft Soda Market Overview

2.1 Definition & Product Scope

2.2 Evolution of Craft Soda Industry

2.3 Value Chain Analysis

2.4 Business Models (Artisanal, DTC, E-Commerce, Private Label)

2.5 Pricing Analysis

2.6 Regulatory Landscape

3. Market Forecast Snapshot (2026–2033)

3.1 2025 Market Size: USD 5.8 Billion

3.2 2033 Market Size: ~USD 10.3 Billion

3.3 CAGR (2026–2033): ~7.8%

3.4 Largest Region: North America

3.5 Fastest Growing Region: Asia-Pacific

3.6 Top Segment: Flavored & Functional Craft Sodas

3.7 Key Trend: Low-Sugar, Functional Fortification & Premiumization

3.8 Future Focus: Probiotic Innovation, Sustainable Packaging & DTC Expansion

4. Market Dynamics

4.1 Key Growth Drivers

4.2 Market Restraints

4.3 Emerging Opportunities

4.4 Industry Challenges

4.5 Impact of Macroeconomic Factors

5. Market Segmentation by Product Type (USD Billion), 2026–2033

5.1 Natural / Organic Craft Soda

5.1.1 Sugar-Free / Low-Sugar Natural Sodas

5.1.1.1 Stevia-Sweetened Sodas

5.1.1.2 Monk Fruit-Sweetened Sodas

5.1.1.3 Erythritol / Other Low-Calorie Sweeteners

5.1.2 Organic Fruit-Based Sodas

5.1.2.1 Citrus Organic Sodas (Lemon, Lime, Orange)

5.1.2.2 Berry Organic Sodas (Strawberry, Blueberry, Raspberry)

5.1.2.3 Tropical Organic Sodas (Mango, Pineapple, Passion Fruit)

5.1.3 Organic Botanical & Herbal Sodas

5.1.3.1 Herbal Infusions (Mint, Ginger, Lemongrass)

5.1.3.2 Floral Infusions (Hibiscus, Lavender, Rose)

5.1.3.3 Spiced / Exotic Botanical Blends

5.2 Conventional Craft Soda

5.2.1 Classic Cola Variants

5.2.1.1 Original Cola

5.2.1.2 Spiced / Flavored Cola

5.2.1.3 Regional Cola Blends

5.2.2 Traditional Root Beer & Ginger Ale

5.2.2.1 Root Beer Classic

5.2.2.2 Premium / Small-Batch Root Beer

5.2.2.3 Ginger Ale Variants (Spiced, Premium)

5.2.3 Standard Citrus & Fruit Blends

5.2.3.1 Lemon-Lime Sodas

5.2.3.2 Orange-Based Blends

5.2.3.3 Mixed Fruit Sodas

5.3 Functional & Botanical Infused Craft Soda

5.3.1 Vitamin & Mineral Fortified Sodas

5.3.1.1 Vitamin C Enriched Sodas

5.3.1.2 Multivitamin Craft Sodas

5.3.1.3 Mineral-Enriched Sodas

5.3.2 Adaptogen-Infused Sodas

5.3.2.1 Ashwagandha-Based Sodas

5.3.2.2 Ginseng-Infused Sodas

5.3.2.3 Herbal Adaptogen Blends

5.3.3 Herbal & Botanical Infusions

5.3.3.1 Hibiscus Craft Sodas

5.3.3.2 Lavender-Infused Sodas

5.3.3.3 Mint & Herbal Blends

6. Market Segmentation by Flavor (USD Billion), 2026–2033

6.1 Fruit-Based

6.1.1 Citrus (Lemon, Lime, Orange)

6.1.1.1 Lemon Craft Soda

6.1.1.2 Lime Craft Soda

6.1.1.3 Orange Craft Soda

6.1.2 Berry (Strawberry, Blueberry, Raspberry)

6.1.2.1 Strawberry

6.1.2.2 Blueberry

6.1.2.3 Raspberry

6.1.3 Tropical (Mango, Pineapple, Passion Fruit)

6.1.3.1 Mango

6.1.3.2 Pineapple

6.1.3.3 Passion Fruit

6.2 Spice & Herb-Based

6.2.1 Ginger Variants

6.2.1.1 Classic Ginger Ale

6.2.1.2 Spiced Ginger

6.2.1.3 Premium Small-Batch Ginger

6.2.2 Mint Infused

6.2.2.1 Mint-Citrus Blend

6.2.2.2 Herbal Mint Blend

6.2.2.3 Seasonal Mint Varieties

6.2.3 Cinnamon & Spice Blends

6.2.3.1 Cinnamon Citrus Sodas

6.2.3.2 Spiced Fruit Blends

6.2.3.3 Limited-Edition Seasonal Blends

6.3 Floral & Botanical

6.3.1 Hibiscus

6.3.2 Lavender

6.3.3 Rose & Other Floral Blends

6.4 Cola & Traditional Blends

6.4.1 Classic Cola

6.4.2 Blended Cola with Citrus / Spice

6.4.3 Root Beer & Traditional Craft Soda Mixes

7. Market Segmentation by Distribution Channel (USD Billion), 2026–2033

7.1 Supermarkets & Hypermarkets

7.1.1 Premium Craft Soda Shelves

7.1.1.1 Organic / Natural Craft Sodas

7.1.1.2 Functional & Botanical Sodas

7.1.2 Limited-Edition Packs

7.1.2.1 Seasonal Collections

7.1.2.2 Holiday / Festive Packs

7.1.3 Promotional Bundles

7.1.3.1 Multi-Pack Combos

7.1.3.2 Retailer Exclusive Bundles

7.2 Convenience Stores

7.2.1 Single-Serve Bottles

7.2.2 Ready-to-Drink Multipacks

7.2.3 Seasonal or Regional Variants

7.3 Online Retail / E-Commerce

7.3.1 Third-Party Marketplaces

7.3.2 Brand-Owned Online Stores

7.3.3 Subscription Boxes / Curated Collections

7.4 Cafés & Specialty Beverage Stores

7.4.1 Barista-Style Craft Soda Mixes

7.4.2 Specialty Bottled Beverages

7.4.3 Seasonal & Experimental Flavors

8. Market Segmentation by End User (USD Billion), 2026–2033

8.1 Household Consumption

8.1.1 Daily Refreshment & Family Packs

8.1.2 Health-Conscious Home Consumption

8.1.3 Limited-Edition / Seasonal Packs

8.2 HoReCa (Hotels, Restaurants, Cafés)

8.2.1 Fine Dining Beverage Menus

8.2.2 Café & Specialty Drink Pairings

8.2.3 Event & Banquet Services

8.3 Specialty Retailers

8.3.1 Gourmet Stores

8.3.2 Organic / Health-Focused Retailers

8.3.3 Curated Beverage Shops

9. Market Segmentation by Region (USD Billion), 2026–2033

9.1 North America

9.2 Europe

9.3 Asia-Pacific

9.4 Latin America

9.5 Middle East & Africa

10. Regional Insights

10.1 North America – Market Leadership

10.2 Europe – Premiumization & Specialty Adoption

10.3 Asia-Pacific – Rapid Urbanization & Young Consumer Base

10.4 Latin America – Gradual Adoption & Urban Growth

10.5 Middle East & Africa – Urban & Premium Segment Expansion

11. Competitive Landscape

11.1 Market Share Analysis

11.2 Competitive Positioning Matrix

11.3 Mergers & Acquisitions

11.4 Product Launch & Innovation Trends

12. Company Profiles

12.1 Reed’s Inc.

12.2 Boylan Bottling Co.

12.3 Fentimans Ltd.

12.4 Virgil’s Soda Company

12.5 Brooklyn Bottling Co.

12.6 Q Drinks

12.7 Maine Root Soda

12.8 Polar Beverages

12.9 Sanpellegrino

12.10 SodaStream (Artisan & Botanical Lines)

13. Strategic Intelligence & AI-Driven Insights

13.1 Phoenix Demand Forecast Engine

13.2 Sentiment Analyzer Tool

13.3 Innovation Tracker

13.4 Porter’s Five Forces Analysis

13.5 Investment & Expansion Strategy Outlook

14. Why the Global Craft Soda Market Remains Critical

14.1 Health & Wellness Alignment

14.2 Sustainable Sourcing & Eco-Packaging

14.3 AI-Enabled Consumer Insights

14.4 Premiumization & Innovation Growth

14.5 Artisanal & Local Entrepreneurship

15. Appendix

16. About Us

17. Disclaimer