Global Premium Wine Market Report 2026-2033

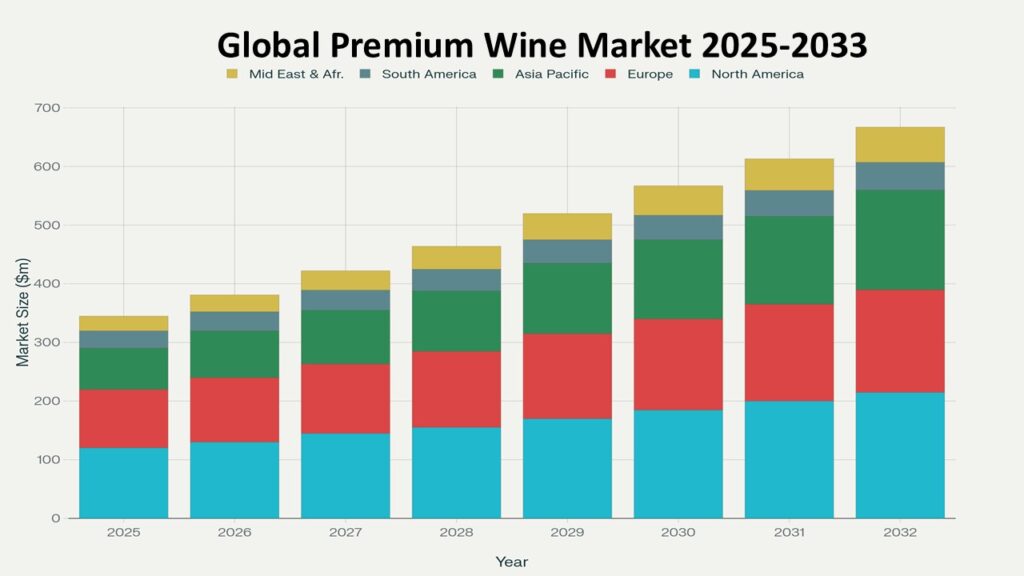

Global Premium Wine Market Forecast Snapshot: 2026–2033

| Metric | Value |

|---|---|

| 2025 Market Size | USD 74.22 Billion |

| 2033 Market Size | ~USD 112.35 Billion |

| CAGR (2026–2033) | ~5.34% |

| Largest Region | Europe |

| Fastest Growing Region | Asia-Pacific |

| Top Segment | Red & Sparkling Wines |

| Key Trend | Premiumization, Sustainable Production & Direct-to-Consumer Channels |

| Future Focus | Organic & Biodynamic Wines, AI-Driven Customer Insights, Multi-Channel Retail Expansion |

Global Premium Wine Market Overview

The Global Premium Wine Market includes high-quality red, white, rosé, and sparkling wines, sold across retail, e-commerce, direct-to-consumer channels, fine-dining restaurants, wine clubs, and exclusive tasting experiences.

Premium wine consumption is driven by rising disposable income, growing wine culture in emerging markets, increased interest in wine pairing with gourmet cuisine, and the convenience of online and subscription-based wine platforms.

According to Phoenix Research, the Global Premium Wine Market was valued at USD 74.22 billion in 2025 and is projected to reach approximately USD 112.35 billion by 2033, registering a CAGR of ~5.34% during 2026–2033.

Europe dominates the market, supported by established wine-producing countries like France, Italy, and Spain. Asia-Pacific is the fastest-growing region due to rising wine consumption in China, India, and Southeast Asia, fueled by urbanization, premium lifestyle trends, and tourism.

The Post-2025 outlook emphasizes premiumization, sustainable viticulture practices, AI-powered marketing and inventory management, expansion of direct-to-consumer channels, and experiential wine tourism as key growth drivers.

Key Drivers of Global Premium Wine Market Growth

1. Premiumization and Evolving Consumer Preferences

Global consumers are increasingly gravitating toward fine, aged, and limited-edition wines. The growing interest in wine pairing with gourmet cuisine and immersive tasting experiences is fueling demand for premium offerings worldwide.

2. Growth of Direct-to-Consumer and Online Channels

E-commerce platforms, subscription-based services, and winery-direct sales are expanding accessibility to premium wines. These channels enable higher margins, personalized experiences, and seamless delivery, driving adoption across diverse markets.

3. Rise of Sustainable and Organic Wine Production

Heightened health consciousness and environmental awareness are boosting demand for organic, biodynamic, and low-sulfite wines. Sustainable production practices enhance brand reputation, foster consumer trust, and strengthen long-term loyalty.

4. Expansion in Emerging Markets and Tourism-Driven Growth

Rapidly developing wine cultures in Asia-Pacific, Latin America, and the Middle East are accelerating consumption. Urbanization, rising disposable incomes, and tourism-driven demand are key factors driving market expansion in these regions.

5. Influence of Celebrity and Sommelier Endorsements

Collaborations with renowned chefs, sommeliers, and celebrities elevate the perception of exclusivity and quality. Such endorsements increase brand visibility, enhance prestige, and attract high-end consumer segments globally.

Global Premium Wine Market Segmentation

1. By Wine Type

1.1 Red Wine

1.1.1 Cabernet Sauvignon

1.1.1.1 Single Vineyard Cabernet

1.1.1.2 Blended Cabernet

1.1.1.3 Aged Barrel Cabernet

1.1.2 Merlot

1.1.2.1 Classic Merlot

1.1.2.2 Reserve / Estate Merlot

1.1.2.3 Blended Merlot Wines

1.1.3 Pinot Noir

1.1.3.1 Old World Pinot Noir

1.1.3.2 New World Pinot Noir

1.1.3.3 Premium Pinot Noir Blends

1.1.4 Syrah / Shiraz

1.1.4.1 Syrah Single Vineyard

1.1.4.2 Shiraz Reserve

1.1.4.3 Syrah Blends

1.1.5 Blends & Other Premium Reds

1.1.5.1 Bordeaux Blends

1.1.5.2 Rhône Blends

1.1.5.3 Other Regional Blends

1.2 White Wine

1.2.1 Chardonnay

1.2.1.1 Oaked Chardonnay

1.2.1.2 Unoaked Chardonnay

1.2.1.3 Reserve / Estate Chardonnay

1.2.2 Sauvignon Blanc

1.2.2.1 Classic Sauvignon Blanc

1.2.2.2 Premium Single Vineyard

1.2.2.3 Blended Sauvignon Blanc

1.2.3 Riesling

1.2.3.1 Dry Riesling

1.2.3.2 Semi-Sweet Riesling

1.2.3.3 Ice Wine Riesling

1.2.4 Pinot Grigio

1.2.4.1 Italian Pinot Grigio

1.2.4.2 New World Pinot Grigio

1.2.4.3 Premium Pinot Grigio Blends

1.2.5 Premium White Blends

1.2.5.1 Chardonnay + Sauvignon Blanc Blends

1.2.5.2 Other White Regional Blends

1.2.5.3 Estate / Reserve White Blends

1.3 Rosé Wine

1.3.1 Light Rosé

1.3.1.1 Provence Style

1.3.1.2 Dry Rosé

1.3.1.3 Summer Blend Rosé

1.3.2 Premium Blush Rosé

1.3.2.1 Reserve Rosé

1.3.2.2 Barrel-Aged Blush Rosé

1.3.2.3 Limited Edition Rosé

1.3.3 Sparkling Rosé

1.3.3.1 Classic Sparkling Rosé

1.3.3.2 Brut Rosé

1.3.3.3 Vintage Sparkling Rosé

1.4 Sparkling & Champagne

1.4.1 Classic Champagne

1.4.1.1 Non-Vintage Champagne

1.4.1.2 Vintage Champagne

1.4.1.3 Prestige Cuvée

1.4.2 Prosecco

1.4.2.1 DOCG Prosecco

1.4.2.2 Spumante Prosecco

1.4.2.3 Rosé Prosecco

1.4.3 Cava

1.4.3.1 Traditional Cava

1.4.3.2 Reserve Cava

1.4.3.3 Limited Edition Cava

1.4.4 Premium Sparkling Varietals

1.4.4.1 Blanc de Blancs

1.4.4.2 Blanc de Noirs

1.4.4.3 Luxury Vintage Sparkling

1.5 Fortified & Dessert Wines

1.5.1 Port & Sherry

1.5.1.1 Tawny Port

1.5.1.2 Ruby Port

1.5.1.3 Sherry Fino / Oloroso

1.5.2 Late Harvest Wines

1.5.2.1 Single Vineyard Late Harvest

1.5.2.2 Blended Late Harvest Wines

1.5.2.3 Ice Wine Varieties

1.5.3 Ice Wine

1.5.3.1 Riesling Ice Wine

1.5.3.2 Vidal Ice Wine

1.5.3.3 Limited Edition Ice Wines

1.5.4 Vermouth & Specialty Dessert Wines

1.5.4.1 Sweet Vermouth

1.5.4.2 Dry Vermouth

1.5.4.3 Dessert Wine Blends

2. By Distribution Channel

2.1 On-Trade / Hospitality

2.1.1 Fine Dining Restaurants

2.1.1.1 Michelin-Star Wine Lists

2.1.1.2 Sommelier-Selected Wines

2.1.1.3 Wine Pairing Experiences

2.1.2 Hotel & Resort Wine Bars

2.1.2.1 Resort Exclusive Labels

2.1.2.2 Signature Wine Menus

2.1.2.3 Wine Tastings & Events

2.1.3 Wine Tasting Rooms & Vineyards

2.1.3.1 Estate Tasting Rooms

2.1.3.2 Vineyard Tours

2.1.3.3 VIP Wine Clubs

2.2 Off-Trade / Retail

2.2.1 Supermarkets & Hypermarkets

2.2.1.1 Premium Shelf Wines

2.2.1.2 Limited Edition Packs

2.2.1.3 Promotional Wines

2.2.2 Specialty Wine Stores

2.2.2.1 Boutique Wine Shops

2.2.2.2 Sommelier Curated Wines

2.2.2.3 Rare & Collectible Wines

2.2.3 Duty-Free & Travel Retail

2.2.3.1 Airport Exclusive Wines

2.2.3.2 Travel Retail Limited Editions

2.2.3.3 Gift & Collector Packs

2.3 Direct-to-Consumer (DTC)

2.3.1 Winery Membership Programs

2.3.1.1 Subscription-Based Wine Clubs

2.3.1.2 VIP Tasting Memberships

2.3.1.3 Estate Limited Releases

2.3.2 Online Wine Clubs & Subscriptions

2.3.2.1 Personalized Wine Boxes

2.3.2.2 Curated Tasting Selections

2.3.2.3 Seasonal Wine Collections

2.3.3 App-Based Wine Retail & Delivery

2.3.3.1 Direct Winery-to-Consumer Apps

2.3.3.2 Third-Party Wine Delivery Apps

2.3.3.3 Subscription-Based App Delivery

2.4 E-Commerce

2.4.1 Third-Party Platforms

2.4.1.1 Online Retailers & Marketplaces

2.4.1.2 Subscription Platforms

2.4.1.3 Premium Wine Aggregators

2.4.2 Brand-Owned E-Stores

2.4.2.1 Direct Wine Sales Portals

2.4.2.2 Limited Edition Online Releases

2.4.2.3 Loyalty Member Exclusive Sales

2.4.3 Marketplace & Aggregator Channels

2.4.3.1 Wine Auction Platforms

2.4.3.2 Global Wine Marketplaces

2.4.3.3 Influencer-Endorsed Wine Drops

3. By End-User

3.1 Individual Consumers

3.1.1 Millennials & Gen Z Wine Enthusiasts

3.1.1.1 Urban Professionals

3.1.1.2 Social Media-Focused Consumers

3.1.1.3 Experience-Oriented Wine Drinkers

3.1.2 Urban Professionals & Affluent Consumers

3.1.2.1 Corporate Entertaining

3.1.2.2 Home Wine Cellars

3.1.2.3 Fine Dining Occasions

3.1.3 Wine Collectors & Connoisseurs

3.1.3.1 Investment-Grade Wines

3.1.3.2 Rare & Vintage Collections

3.1.3.3 Auction Participation

3.2 Corporate & Institutional

3.2.1 Corporate Gifting & Hospitality

3.2.1.1 Executive Gift Packages

3.2.1.2 Corporate Wine Tastings

3.2.1.3 Event Hosting & Sponsorship

3.2.2 Event & Conference Wine Services

3.2.2.1 Banquet & Catering Wines

3.2.2.2 Wine Pairing Experiences

3.2.2.3 Premium Wine Rentals & Bars

3.2.3 Hotel & Restaurant Procurement

3.2.3.1 Fine Dining Restaurants

3.2.3.2 Luxury Resorts & Hotels

3.2.3.3 Specialty Wine Bars

4.by Region

1. Europe – Largest Market

2. Asia-Pacific – Fastest Growing Region

3. North America

4. Latin America

5. Middle East & Africa

Regional Insights of Global Premium Wine Market

Europe – Largest Market

Europe continues to dominate premium wine consumption, driven by historical vineyards, strong export networks, and consumer appreciation for aged, high-quality wines. France, Italy, and Spain lead production, while urban centers across Germany, the UK, and Scandinavia drive on-trade demand.

Asia-Pacific – Fastest Growing Region

China, Japan, South Korea, and India are experiencing surging demand for premium wines, fueled by rising disposable incomes, expanding wine culture, and online wine retail. Urban professional segments and wine clubs are key growth drivers.

North America

The U.S. and Canada represent significant growth markets, with increased adoption of Napa and Sonoma wines, sparkling varieties, and subscription-based wine services. Premiumization, wine tourism, and food pairing culture support revenue expansion.

Latin America

Brazil, Mexico, and Chile show rising adoption of imported wines, wine tourism, and premium lifestyle products. Growth is concentrated in major cities and affluent consumer segments.

Middle East & Africa

Premium wine growth is concentrated in urban hubs such as Dubai, Johannesburg, and Riyadh, driven by luxury hospitality, tourism, and high-net-worth consumer spending.

Leading Companies in the Global Premium Wine Market

-

Pernod Ricard (Jacob’s Creek, Mumm)

-

Domaine de la Romanée-Conti

-

Moët & Chandon

-

Champagne Louis Roederer

-

Vega Sicilia

-

Penfolds

-

Torres

The market is highly fragmented, with both global conglomerates and boutique vineyard operators competing for premium positioning.E. & J. Gallo Winery is the largest company among the listed wine producers.

Why the Global Premium Wine Market Remains Critical

-

Rising global interest in fine wines and wine culture ensures steady demand.

-

AI-based customer segmentation, demand forecasting, and inventory management enhance operational efficiency.

-

Direct-to-consumer channels and subscription models improve margin and customer loyalty.

-

Sustainable viticulture and organic certification strengthen brand positioning.

-

Multi-channel presence (retail, hospitality, online) enables market scalability.

Strategic Intelligence and AI-Backed Insights – Global Premium Wine Market

- Phoenix Demand Forecast Engine: Steady growth supported by premiumization, emerging markets adoption, and online wine retail expansion.

- Consumer Behavior Analyzer: Rising preference for organic, biodynamic, and exclusive aged wines; emphasis on wine education, tasting experiences, and authenticity.

- Innovation Tracker: Automation in wine production, AI-powered vineyard monitoring, smart logistics, personalized recommendations, and loyalty-based engagement are key differentiators.

- Porter’s Five Forces Analysis: High rivalry due to fragmented boutique and global brands; moderate supplier power for premium grapes; differentiation through authenticity, origin, and sustainable practices.

Final Takeaway of Global Premium Wine Market

The Global Premium Wine Market is steadily evolving into a premium-driven, experience-oriented, and technology-enabled beverage ecosystem. The projected CAGR of ~5.34% during 2026–2033 reflects stable growth supported by rising global demand for aged and limited-edition wines, sparkling and Champagne offerings, and health-conscious, sustainably produced varietals.

Growth will be defined by a dual-engine model:

- High-margin experiential segments, including aged reds, Champagne, limited editions, wine tourism, curated tastings, and exclusive cellar offerings.

- Scalable retail and direct-to-consumer (DTC) formats, including e-commerce delivery, online wine subscriptions, and winery membership programs.

This balanced structure enables both premium positioning and broad market accessibility. Operators that successfully integrate AI-driven customer insights, enhance sustainable vineyard practices, expand international direct-to-consumer rollouts, and strengthen omnichannel distribution (retail, on-trade, DTC, and online) will be best positioned for sustainable long-term value creation.

At Phoenix Research, our advanced forecasting models provide in-depth Global Premium Wine Market revenue forecasts, competitive benchmarking, and strategic intelligence — enabling stakeholders to capitalize on the post-2025 market outlook with data-backed precision and actionable growth strategies.

📢 Social Mentions & Publication Channels

Explore deeper insights and follow our cross-platform updates on LinkedIn, and X for continuous intelligence and market coverage.

LinkedIn : https://www.linkedin.com/feed/update/urn:li:activity:7430468268567736320

X : https://x.com/Pheonix_Insight/status/2024707980361699547?s=20

1. Executive Summary

1.1 Global Market Snapshot (2025–2033)

1.2 Key Growth Highlights & Strategic Insights

1.3 Largest and Fastest-Growing Regions

1.4 Dominant and Emerging Market Segments

1.5 High-Potential Opportunity Areas

2. Global Premium Wine Market Overview

2.1 Market Definition and Scope

2.2 Evolution of the Global Premium Wine Industry

2.3 Value Chain & Supply Ecosystem

2.4 Business Models (Retail, DTC, Hospitality, Wine Clubs)

2.5 Pricing Analysis and Premium Tier Strategies

2.6 Regulatory Landscape and Quality Certifications

3. Market Forecast Snapshot (2026–2033)

3.1 Market Size 2025: USD 74.22 Billion

3.2 Market Size 2033: ~USD 112.35 Billion

3.3 CAGR (2026–2033): ~5.34%

3.4 Largest Region: Europe

3.5 Fastest-Growing Region: Asia-Pacific

3.6 Top Segments: Red Wine & Sparkling Wine

3.7 Key Trend: Premiumization, Sustainable Production & DTC Channels

3.8 Future Focus: Organic & Biodynamic Wines, AI-Driven Insights, Multi-Channel Retail Expansion

4. Market Dynamics

4.1 Key Growth Drivers

4.2 Market Restraints and Barriers

4.3 Emerging Opportunities

4.4 Industry Challenges

4.5 Macroeconomic and Trade Impact

5. Market Segmentation by Wine Type (USD Billion), 2026–2033

5.1 Red Wine

5.1.1 Cabernet Sauvignon

5.1.1.1 Single Vineyard Cabernet

5.1.1.2 Blended Cabernet

5.1.1.3 Aged Barrel Cabernet

5.1.2 Merlot

5.1.2.1 Classic Merlot

5.1.2.2 Reserve / Estate Merlot

5.1.2.3 Blended Merlot

5.1.3 Pinot Noir

5.1.3.1 Old World Pinot Noir

5.1.3.2 New World Pinot Noir

5.1.3.3 Premium Pinot Noir Blends

5.1.4 Syrah / Shiraz

5.1.4.1 Syrah Single Vineyard

5.1.4.2 Shiraz Reserve

5.1.4.3 Syrah Blends

5.1.5 Blends & Other Premium Reds

5.1.5.1 Bordeaux Blends

5.1.5.2 Rhône Blends

5.1.5.3 Other Regional Blends

5.2 White Wine

5.2.1 Chardonnay

5.2.1.1 Oaked Chardonnay

5.2.1.2 Unoaked Chardonnay

5.2.1.3 Reserve / Estate Chardonnay

5.2.2 Sauvignon Blanc

5.2.2.1 Classic Sauvignon Blanc

5.2.2.2 Premium Single Vineyard

5.2.2.3 Blended Sauvignon Blanc

5.2.3 Riesling

5.2.3.1 Dry Riesling

5.2.3.2 Semi-Sweet Riesling

5.2.3.3 Ice Wine Riesling

5.2.4 Pinot Grigio

5.2.4.1 Italian Pinot Grigio

5.2.4.2 New World Pinot Grigio

5.2.4.3 Premium Pinot Grigio Blends

5.2.5 Premium White Blends

5.2.5.1 Chardonnay + Sauvignon Blanc Blends

5.2.5.2 Other Regional White Blends

5.2.5.3 Estate / Reserve Blends

5.3 Rosé Wine

5.3.1 Light Rosé

5.3.1.1 Provence Style

5.3.1.2 Dry Rosé

5.3.1.3 Summer Blend

5.3.2 Premium Blush Rosé

5.3.2.1 Reserve Rosé

5.3.2.2 Barrel-Aged Blush Rosé

5.3.2.3 Limited Edition

5.3.3 Sparkling Rosé

5.3.3.1 Classic Sparkling Rosé

5.3.3.2 Brut Rosé

5.3.3.3 Vintage Sparkling

5.4 Sparkling & Champagne

5.4.1 Classic Champagne

5.4.1.1 Non-Vintage Champagne

5.4.1.2 Vintage Champagne

5.4.1.3 Prestige Cuvée

5.4.2 Prosecco

5.4.2.1 DOCG Prosecco

5.4.2.2 Spumante Prosecco

5.4.2.3 Rosé Prosecco

5.4.3 Cava

5.4.3.1 Traditional Cava

5.4.3.2 Reserve Cava

5.4.3.3 Limited Edition

5.4.4 Premium Sparkling Varietals

5.4.4.1 Blanc de Blancs

5.4.4.2 Blanc de Noirs

5.4.4.3 Luxury Vintage

5.5 Fortified & Dessert Wines

5.5.1 Port & Sherry

5.5.1.1 Tawny Port

5.5.1.2 Ruby Port

5.5.1.3 Sherry Fino / Oloroso

5.5.2 Late Harvest Wines

5.5.2.1 Single Vineyard

5.5.2.2 Blended Late Harvest

5.5.2.3 Ice Wine Varieties

5.5.3 Ice Wine

5.5.3.1 Riesling Ice Wine

5.5.3.2 Vidal Ice Wine

5.5.3.3 Limited Edition Ice Wines

5.5.4 Vermouth & Specialty Dessert Wines

5.5.4.1 Sweet Vermouth

5.5.4.2 Dry Vermouth

5.5.4.3 Dessert Wine Blends

6. Market Segmentation by Distribution Channel (USD Billion), 2026–2033

6.1 On-Trade / Hospitality

6.1.1 Fine Dining Restaurants (Michelin, Sommelier, Wine Pairings)

6.1.2 Hotels & Resort Wine Bars

6.1.3 Wine Tasting Rooms & Vineyards

6.2 Off-Trade / Retail

6.2.1 Supermarkets & Hypermarkets

6.2.2 Specialty Wine Stores

6.2.3 Duty-Free & Travel Retail

6.3 Direct-to-Consumer (DTC)

6.3.1 Winery Membership Programs

6.3.2 Online Wine Clubs & Subscriptions

6.3.3 App-Based Wine Retail & Delivery

6.4 E-Commerce

6.4.1 Third-Party Platforms

6.4.2 Brand-Owned E-Stores

6.4.3 Marketplace & Aggregator Channels

7. Market Segmentation by End User (USD Billion), 2026–2033

7.1 Individual Consumers

7.1.1 Millennials & Gen Z Wine Enthusiasts

7.1.1.1 Urban Professionals

7.1.1.2 Social Media-Focused Consumers

7.1.1.3 Experience-Oriented Wine Drinkers

7.1.2 Urban Professionals & Affluent Consumers

7.1.2.1 Corporate Entertaining

7.1.2.2 Home Wine Cellars

7.1.2.3 Fine Dining Occasions

7.1.3 Wine Collectors & Connoisseurs

7.1.3.1 Investment-Grade Wines

7.1.3.2 Rare & Vintage Collections

7.1.3.3 Auction Participation

7.2 Corporate & Institutional

7.2.1 Corporate Gifting & Hospitality

7.2.1.1 Executive Gift Packages

7.2.1.2 Corporate Wine Tastings

7.2.1.3 Event Sponsorship & Brand Collaborations

7.2.2 Event & Conference Wine Services

7.2.2.1 Banquet & Catering Wines

7.2.2.2 Wine Pairing Experiences

7.2.2.3 Premium Wine Rentals & Bars

7.2.3 Hotel & Restaurant Procurement

7.2.3.1 Fine Dining Restaurants

7.2.3.2 Luxury Resorts & Hotels

7.2.3.3 Specialty Wine Bars & Lounges

8. Market Segmentation by Region (USD Billion), 2026–2033

8.1 Europe – Largest Market

8.2 Asia-Pacific – Fastest Growing Region

8.3 North America

8.4 Latin America

8.5 Middle East & Africa

9. Regional Insights

9.1 Europe – Heritage Vineyards & Export Leadership

9.2 Asia-Pacific – Rapid Adoption & Urban Growth

9.3 North America – Napa, Sonoma & Subscription Trends

9.4 Latin America – Emerging Consumption & Wine Tourism

9.5 Middle East & Africa – Premium Lifestyle & Hospitality

10. Competitive Landscape

10.1 Market Share Analysis

10.2 Competitive Positioning Matrix

10.3 Mergers, Acquisitions & Strategic Alliances

10.4 Product Launches & Innovation Trends

11. Leading Company Profiles

11.1 Concha y Toro

11.2 Treasury Wine Estates

11.3 Pernod Ricard (Jacob’s Creek, Mumm)

11.4 E. & J. Gallo Winery

11.5 Domaine de la Romanée-Conti

11.6 Moët & Chandon

11.7 Champagne Louis Roederer

11.8 Vega Sicilia

11.9 Penfolds

11.10 Torres

12. Strategic Intelligence & AI-Backed Insights

12.1 AI-Driven Customer Segmentation & Insights

12.2 Demand Forecasting & Market Modeling

12.3 Innovation Tracker: Smart Vineyards & Logistics

12.4 Sustainability & Organic Certification Trends

12.5 Porter’s Five Forces Analysis

12.6 Investment & Expansion Strategy Outlook

13. Why the Global Premium Wine Market Remains Critical

13.1 Rising Global Wine Culture

13.2 Direct-to-Consumer & Subscription Scalability

13.3 Sustainable Viticulture & Brand Differentiation

13.4 Multi-Channel Retail Expansion

14. Appendix

15. About Us

16. Disclaimer