Global Wine Market Report 2026-2033

Global Wine Market Forecast Snapshot: 2026–2033

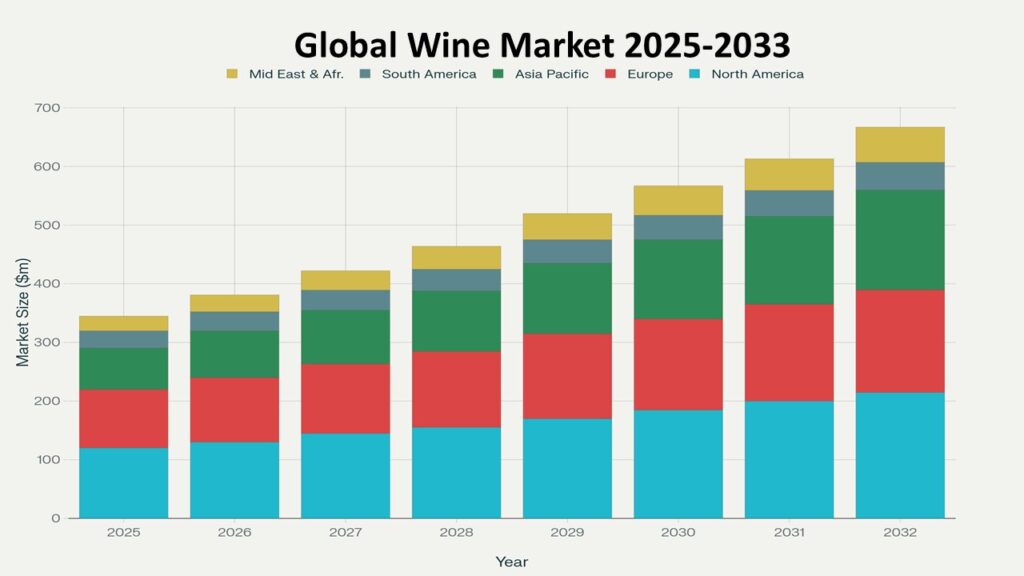

| Metric | Value |

|---|---|

| 2025 Market Size | USD 528.4 Billion |

| 2033 Market Size | ~USD 712.6 Billion |

| CAGR (2026–2033) | ~3.8% |

| Largest Region | Europe |

| Fastest Growing Region | Asia-Pacific |

| Top Segment | Still Wine (Red & White) |

| Key Trend | Premiumization, Sustainable Viticulture & DTC Expansion |

| Future Focus | Organic & Biodynamic Wines, AI-Driven Retail Analytics & Wine Tourism |

Global Wine Market Overview

The Global Wine Market is undergoing steady structural evolution, supported by changing consumer lifestyles, premiumization trends, expanding wine culture in emerging economies, and the growing integration of digital retail channels. Wine categories—including red, white, rosé, sparkling, and fortified wines—continue to evolve into premium-driven, experience-oriented beverage ecosystems aligned with modern consumption preferences.

According to Phoenix Research, the Global Wine Market is valued at USD 528.4 billion in 2025 and is projected to reach approximately USD 712.6 billion by 2033, registering a CAGR of ~3.8% (2026–2033). This revenue forecast reflects stable global demand, premium product innovation, expansion of direct-to-consumer channels, and sustained wine tourism growth across mature and developing markets.

Europe holds the largest market share, supported by historic wine-producing nations such as France, Italy, and Spain, strong export networks, and established consumption patterns. Asia-Pacific is emerging as the fastest-growing region, driven by urbanization, rising disposable income, growing wine education, and increasing adoption among younger consumers.

The Post-2025 outlook for the Wine Market highlights continued premiumization, organic and biodynamic production practices, AI-powered supply chain optimization, digital retail growth, and experiential wine tourism as key long-term growth drivers.

Key Drivers of Global Wine Market Growth

1. Premiumization & Evolving Consumer Preferences

Consumers are increasingly shifting toward premium, aged, and limited-edition wines, prioritizing quality, authenticity, and origin over volume consumption.

2. Expansion of Direct-to-Consumer & Online Channels

Winery memberships, subscription wine boxes, and online wine marketplaces are improving accessibility, personalization, and higher-margin sales models.

3. Sustainable & Organic Viticulture

Growing environmental awareness is accelerating adoption of organic, biodynamic, and low-intervention wine production methods.

4. Wine Tourism & Experiential Consumption

Vineyard tours, curated tastings, and immersive wine experiences are strengthening brand loyalty and premium positioning.

5. Growth in Emerging Markets

Asia-Pacific and Latin America are witnessing rising wine adoption due to increasing disposable incomes and Western lifestyle influence.

Global Wine Market Segmentation

1. By Wine Type

1.1 Red Wine

1.1.1 Cabernet Sauvignon

1.1.1.1 Premium Reserve Cabernet

1.1.1.2 Single-Vineyard Cabernet

1.1.1.3 Oak-Aged Cabernet

1.1.1.4 Organic & Biodynamic Cabernet

1.1.2 Merlot

1.1.2.1 Estate Bottled Merlot

1.1.2.2 Blended Merlot

1.1.2.3 Barrel-Aged Merlot

1.1.2.4 Limited-Edition Merlot

1.1.3 Pinot Noir

1.1.3.1 Cool-Climate Pinot Noir

1.1.3.2 Single-Origin Pinot Noir

1.1.3.3 Organic Pinot Noir

1.1.3.4 Luxury Vintage Pinot Noir

1.1.4 Syrah / Shiraz

1.1.4.1 Old-World Syrah

1.1.4.2 New-World Shiraz

1.1.4.3 Reserve Shiraz

1.1.4.4 Small-Batch Syrah

1.1.5 Regional & Premium Blends

1.1.5.1 Bordeaux Blends

1.1.5.2 Rhône Blends

1.1.5.3 Super Tuscans

1.1.5.4 Proprietary Premium Blends

1.2 White Wine

1.2.1 Chardonnay

1.2.1.1 Unoaked Chardonnay

1.2.1.2 Oak-Aged Chardonnay

1.2.1.3 Single-Vineyard Chardonnay

1.2.1.4 Organic & Sustainable Chardonnay

1.2.2 Sauvignon Blanc

1.2.2.1 Marlborough Style

1.2.2.2 Old-World Sauvignon Blanc

1.2.2.3 Reserve Sauvignon Blanc

1.2.2.4 Limited-Release Sauvignon Blanc

1.2.3 Riesling

1.2.3.1 Dry Riesling

1.2.3.2 Off-Dry Riesling

1.2.3.3 Sweet Riesling

1.2.3.4 Late Harvest Riesling

1.2.4 Pinot Grigio

1.2.4.1 Italian Pinot Grigio

1.2.4.2 Premium Estate Pinot Grigio

1.2.4.3 Organic Pinot Grigio

1.2.4.4 Aromatic Reserve Pinot Grigio

1.2.5 Premium White Blends

1.2.5.1 Rhône-Style White Blends

1.2.5.2 Aromatic White Blends

1.2.5.3 Barrel-Fermented Blends

1.2.5.4 Boutique White Blends

1.3 Rosé Wine

1.3.1 Dry Rosé

1.3.1.1 Provence Style

1.3.1.2 Estate Dry Rosé

1.3.1.3 Organic Rosé

1.3.1.4 Limited-Edition Seasonal Rosé

1.3.2 Premium Rosé

1.3.2.1 Barrel-Aged Rosé

1.3.2.2 Single-Vineyard Rosé

1.3.2.3 Luxury Rosé

1.3.2.4 Collector’s Rosé

1.3.3 Sparkling Rosé

1.3.3.1 Champagne Rosé

1.3.3.2 Prosecco Rosé

1.3.3.3 Cava Rosé

1.3.3.4 Premium Vintage Sparkling Rosé

1.4 Sparkling & Champagne

1.4.1 Champagne

1.4.1.1 Non-Vintage Champagne

1.4.1.2 Vintage Champagne

1.4.1.3 Prestige Cuvée

1.4.1.4 Blanc de Blancs / Blanc de Noirs

1.4.2 Prosecco

1.4.2.1 Prosecco DOC

1.4.2.2 Prosecco DOCG

1.4.2.3 Extra Dry / Brut Variants

1.4.2.4 Premium Millesimato

1.4.3 Cava

1.4.3.1 Traditional Cava

1.4.3.2 Reserva & Gran Reserva

1.4.3.3 Organic Cava

1.4.3.4 Boutique Cava

1.4.4 Luxury Vintage Sparkling

1.4.4.1 Estate Vintage Sparkling

1.4.4.2 Limited Production Sparkling

1.4.4.3 Organic Vintage Sparkling

1.4.4.4 Collector’s Edition Sparkling

1.5 Fortified & Dessert Wines

1.5.1 Port

1.5.1.1 Ruby Port

1.5.1.2 Tawny Port

1.5.1.3 Vintage Port

1.5.1.4 Late Bottled Vintage (LBV)

1.5.2 Sherry

1.5.2.1 Fino

1.5.2.2 Amontillado

1.5.2.3 Oloroso

1.5.2.4 Pedro Ximénez

1.5.3 Late Harvest Wines

1.5.3.1 Botrytized Wines

1.5.3.2 Noble Rot Wines

1.5.3.3 Sweet Reserve Wines

1.5.3.4 Premium Dessert Selections

1.5.4 Ice Wine

1.5.4.1 Canadian Ice Wine

1.5.4.2 German Eiswein

1.5.4.3 Estate Ice Wine

1.5.4.4 Limited Vintage Ice Wine

2. By Distribution Channel

2.1 On-Trade / Hospitality

2.1.1 Fine Dining Restaurants

2.1.1.1 Michelin-Starred Establishments

2.1.1.2 Premium Independent Restaurants

2.1.1.3 Chef-Led Boutique Dining

2.1.1.4 Wine-Pairing Tasting Menu Programs

2.1.2 Hotels & Resorts

2.1.2.1 Luxury 5-Star Hotels

2.1.2.2 Boutique & Lifestyle Hotels

2.1.2.3 Resort & Destination Properties

2.1.2.4 All-Inclusive & Event Venues

2.1.3 Wine Bars & Tasting Rooms

2.1.3.1 Urban Wine Bars

2.1.3.2 Vineyard Tasting Rooms

2.1.3.3 Themed & Experiential Wine Lounges

2.1.3.4 Pop-Up & Seasonal Wine Events

2.2 Off-Trade / Retail

2.2.1 Supermarkets & Hypermarkets

2.2.1.1 Premium Imported Wine Shelves

2.2.1.2 Private Label & Store Brands

2.2.1.3 Promotional & Discounted Packs

2.2.1.4 Seasonal & Festive Collections

2.2.2 Specialty Wine Stores

2.2.2.1 Independent Boutique Retailers

2.2.2.2 Organic & Biodynamic Wine Shops

2.2.2.3 Collector & Fine Wine Merchants

2.2.2.4 Regional / Artisanal Focused Stores

2.2.3 Duty-Free & Travel Retail

2.2.3.1 Airport Duty-Free Stores

2.2.3.2 Cruise & Ferry Retail

2.2.3.3 Cross-Border Retail Outlets

2.2.3.4 Limited-Edition Travel Exclusives

2.3 Direct-to-Consumer (DTC)

2.3.1 Winery Membership Programs

2.3.1.1 Tiered Membership Clubs

2.3.1.2 Quarterly / Annual Shipment Plans

2.3.1.3 Exclusive Member-Only Releases

2.3.1.4 VIP Event & Vineyard Access

2.3.2 Subscription Wine Clubs

2.3.2.1 Curated Regional Selections

2.3.2.2 Sommelier-Curated Premium Boxes

2.3.2.3 Themed & Seasonal Collections

2.3.2.4 Personalized AI-Driven Selections

2.3.3 Estate Limited Releases

2.3.3.1 Small-Batch Micro-Lots

2.3.3.2 Single-Vineyard Allocations

2.3.3.3 Pre-Release & En Primeur Offers

2.3.3.4 Collector Allocation Programs

2.4 E-Commerce

2.4.1 Online Retail Platforms

2.4.1.1 National Online Liquor Retailers

2.4.1.2 Cross-Border Wine Platforms

2.4.1.3 Flash Sale & Discount Platforms

2.4.1.4 Premium Digital Marketplaces

2.4.2 Brand-Owned E-Stores

2.4.2.1 Winery Official Websites

2.4.2.2 Mobile Commerce Applications

2.4.2.3 Virtual Tasting & Purchase Platforms

2.4.2.4 Limited Digital-Only Releases

2.4.3 Global Wine Marketplaces

2.4.3.1 Auction-Based Platforms

2.4.3.2 Collector & Rare Wine Exchanges

2.4.3.3 B2B Wholesale Marketplaces

2.4.3.4 Investment-Grade Wine Platforms

3. By End-User

3.1 Individual Consumers

3.1.1 Millennials & Gen Z

3.1.1.1 Social & Experiential Consumers

3.1.1.2 Organic & Sustainable Wine Seekers

3.1.1.3 Digital-First Buyers

3.1.1.4 Trend-Driven & Limited-Edition Buyers

3.1.2 Affluent Urban Professionals

3.1.2.1 Premium Everyday Consumers

3.1.2.2 Corporate Entertainers

3.1.2.3 Luxury & Fine Wine Buyers

3.1.2.4 International & Imported Wine Buyers

3.1.3 Wine Collectors & Connoisseurs

3.1.3.1 Investment-Grade Collectors

3.1.3.2 Vintage & Rare Wine Enthusiasts

3.1.3.3 Auction Participants

3.1.3.4 Cellar Portfolio Builders

4. By Region

4.1 Europe

4.2 Asia-Pacific

4.3 North America

4.4 Latin America

4.5 Middle East & Africa

Regional Insights of the Global Wine Market

Europe – Largest Global Wine Market

Europe continues to dominate both global wine production and consumption, supported by historic vineyards, established appellation systems, strong export networks, and deeply rooted cultural integration of wine. Countries such as France, Italy, and Spain lead in premium and luxury segments, while Western and Northern Europe maintain strong on-trade and retail demand. Sustainability initiatives and organic certifications are further strengthening the region’s premium positioning.

Asia-Pacific – Fastest Growing Market

Asia-Pacific is the fastest-growing regional market, fueled by rapid urbanization, expanding middle-class populations, and increasing exposure to Western dining and lifestyle trends. Rising disposable incomes and growing wine education are accelerating demand across China, Japan, India, South Korea, and Southeast Asia. E-commerce platforms and digital wine clubs are playing a critical role in driving accessibility and premium adoption.

North America

North America remains a significant revenue contributor, led by the United States and Canada. Growth is driven by premium Napa and Sonoma wines, expanding direct-to-consumer (DTC) subscription services, wine tourism, and increasing demand for organic and sustainable wine varieties. Digital retail integration continues to enhance consumer engagement and margin optimization.

Latin America

Latin America is experiencing steady expansion, particularly in Brazil, Mexico, Argentina, and Chile. Growth is supported by rising urban affluence, expanding tourism, and increasing interest in premium imported and locally produced wines. The region also benefits from strong export potential and growing wine culture awareness.

Middle East & Africa

Market growth in the Middle East & Africa is concentrated in luxury hospitality hubs and high-income metropolitan centers such as Dubai and Johannesburg. Premium wine demand is largely driven by tourism, expatriate populations, and upscale dining establishments, with expansion opportunities emerging through luxury retail and hospitality infrastructure development.

Leading Companies in the Global Wine Market

-

Treasury Wine Estates

-

Pernod Ricard

-

Moët Hennessy

-

Torres

-

Penfolds

-

Champagne Louis Roederer

-

Domaine de la Romanée-Conti

E. & J. Gallo Winery remains one of the largest global wine producers in terms of scale and distribution reach.It operates across multiple price segments and has a strong international presence, supplying wines to markets around the world.

Strategic Intelligence & AI-Driven Insights

Phoenix Demand Forecast Engine – Projects stable long-term growth supported by sustained premiumization, geographic expansion in emerging markets, and rising global demand for higher-margin wine categories. The model identifies strong revenue resilience in premium and DTC segments despite macroeconomic fluctuations.

Consumer Behavior Analyzer – Detects accelerating consumer preference for organic, biodynamic, low-intervention, and limited-edition wines. Data signals growing demand for authenticity, origin transparency, sustainability credentials, and experiential consumption among Millennials and Gen Z.

Innovation Tracker – Highlights increasing investments in AI-powered vineyard monitoring, precision viticulture, climate-adaptive grape cultivation, smart inventory systems, and automated logistics optimization to enhance yield quality and operational efficiency.

Porter’s Five Forces Analysis – Reflects high competitive rivalry due to fragmented global producers, moderate supplier power in premium grape sourcing, strong brand-based differentiation, and evolving competitive advantage through sustainability practices, digital engagement, and heritage positioning.

Why the Global Wine Market Remains Critical

-

Strong global cultural integration and lifestyle association

-

Growing premium and collectible wine segment

-

Sustainable production enhances brand value

-

AI-powered analytics improve supply chain efficiency

-

Multi-channel distribution supports scalability

Final Takeaway of the Global Wine Market

The Global Wine Market is evolving into a premium-centric, sustainability-led, and digitally integrated ecosystem. The projected CAGR of ~3.8% (2026–2033) underscores stable and resilient growth, driven by premiumization, expanding direct-to-consumer (DTC) models, rising demand for organic and biodynamic wines, and shifting global consumption patterns.

Future market leadership will be defined by companies that successfully leverage AI-powered vineyard analytics, optimize supply chain efficiency, expand omnichannel distribution (retail, on-trade, DTC, and e-commerce), and elevate experiential wine tourism and brand storytelling.

At Phoenix Research, our advanced forecasting frameworks deliver comprehensive Wine Market revenue projections, competitive intelligence, and AI-backed strategic insights — empowering stakeholders to navigate the Post-2025 landscape with data-driven precision, operational agility, and sustainable long-term value creation.

📢 Social Mentions & Publication Channels

Explore deeper insights and follow our cross-platform updates on LinkedIn, and X for continuous intelligence and market coverage.

LinkedIn : https://www.linkedin.com/feed/update/urn:li:activity:7430551872865808384

X : https://x.com/Pheonix_Insight/status/2024793508293611567?s=20

1. Executive Summary

1.1 Market Snapshot (2025–2033)

1.2 Key Growth Highlights

1.3 Largest & Fastest Growing Regions

1.4 Dominant Segments

1.5 Strategic Opportunity Areas

1.6 Analyst Recommendations

2. Global Wine Market Overview

2.1 Market Definition & Scope

2.2 Industry Evolution & Historical Trends

2.3 Value Chain Analysis

2.4 Pricing Structure Analysis

2.5 Regulatory & Compliance Landscape

2.6 Taxation & Trade Policies

2.7 Supply Chain & Distribution Ecosystem

3. Market Forecast Snapshot (2026–2033)

3.1 2025 Market Size: USD 528.4 Billion

3.2 2033 Market Size: ~USD 712.6 Billion

3.3 CAGR (2026–2033): ~3.8%

3.4 Largest Region: Europe

3.5 Fastest Growing Region: Asia-Pacific

3.6 Top Segment: Still Wine (Red & White)

3.7 Key Trend: Premiumization, Sustainable Viticulture & DTC Expansion

3.8 Future Focus: Organic Wines, AI-Driven Retail Analytics & Wine Tourism

4. Market Dynamics

4.1 Market Drivers

4.2 Market Restraints

4.3 Emerging Opportunities

4.4 Industry Challenges

4.5 Impact of Macroeconomic Factors

4.6 Technological Advancements in Viticulture

5. Market Segmentation by Wine Type (USD Billion), 2026–2033

5.1 Red Wine

5.1.1 Cabernet Sauvignon

5.1.1.1 Premium Reserve Cabernet

5.1.1.2 Single-Vineyard Cabernet

5.1.1.3 Oak-Aged Cabernet

5.1.1.4 Organic & Biodynamic Cabernet

5.1.2 Merlot

5.1.2.1 Estate Bottled Merlot

5.1.2.2 Blended Merlot

5.1.2.3 Barrel-Aged Merlot

5.1.2.4 Limited-Edition Merlot

5.1.3 Pinot Noir

5.1.3.1 Cool-Climate Pinot Noir

5.1.3.2 Single-Origin Pinot Noir

5.1.3.3 Organic Pinot Noir

5.1.3.4 Luxury Vintage Pinot Noir

5.1.4 Syrah / Shiraz

5.1.4.1 Old-World Syrah

5.1.4.2 New-World Shiraz

5.1.4.3 Reserve Shiraz

5.1.4.4 Small-Batch Syrah

5.1.5 Regional & Premium Blends

5.1.5.1 Bordeaux Blends

5.1.5.2 Rhône Blends

5.1.5.3 Super Tuscans

5.1.5.4 Proprietary Premium Blends

5.2 White Wine

5.2.1 Chardonnay

5.2.1.1 Unoaked Chardonnay

5.2.1.2 Oak-Aged Chardonnay

5.2.1.3 Single-Vineyard Chardonnay

5.2.1.4 Organic & Sustainable Chardonnay

5.2.2 Sauvignon Blanc

5.2.2.1 Marlborough Style

5.2.2.2 Old-World Sauvignon Blanc

5.2.2.3 Reserve Sauvignon Blanc

5.2.2.4 Limited-Release Sauvignon Blanc

5.2.3 Riesling

5.2.3.1 Dry Riesling

5.2.3.2 Off-Dry Riesling

5.2.3.3 Sweet Riesling

5.2.3.4 Late Harvest Riesling

5.2.4 Pinot Grigio

5.2.4.1 Italian Pinot Grigio

5.2.4.2 Premium Estate Pinot Grigio

5.2.4.3 Organic Pinot Grigio

5.2.4.4 Aromatic Reserve Pinot Grigio

5.2.5 Premium White Blends

5.2.5.1 Rhône-Style White Blends

5.2.5.2 Aromatic White Blends

5.2.5.3 Barrel-Fermented Blends

5.2.5.4 Boutique White Blends

5.3 Rosé Wine

5.3.1 Dry Rosé

5.3.1.1 Provence Style

5.3.1.2 Estate Dry Rosé

5.3.1.3 Organic Rosé

5.3.1.4 Limited-Edition Seasonal Rosé

5.3.2 Premium Rosé

5.3.2.1 Barrel-Aged Rosé

5.3.2.2 Single-Vineyard Rosé

5.3.2.3 Luxury Rosé

5.3.2.4 Collector’s Rosé

5.3.3 Sparkling Rosé

5.3.3.1 Champagne Rosé

5.3.3.2 Prosecco Rosé

5.3.3.3 Cava Rosé

5.3.3.4 Premium Vintage Sparkling Rosé

5.4 Sparkling & Champagne

5.4.1 Champagne

5.4.1.1 Non-Vintage

5.4.1.2 Vintage

5.4.1.3 Prestige Cuvée

5.4.1.4 Blanc de Blancs / Blanc de Noirs

5.4.2 Prosecco

5.4.2.1 DOC

5.4.2.2 DOCG

5.4.2.3 Extra Dry / Brut

5.4.2.4 Millesimato

5.4.3 Cava

5.4.3.1 Traditional

5.4.3.2 Reserva & Gran Reserva

5.4.3.3 Organic

5.4.3.4 Boutique

5.4.4 Luxury Vintage Sparkling

5.4.4.1 Estate Vintage

5.4.4.2 Limited Production

5.4.4.3 Organic Vintage

5.4.4.4 Collector’s Edition

5.5 Fortified & Dessert Wines

5.5.1 Port

5.5.1.1 Ruby

5.5.1.2 Tawny

5.5.1.3 Vintage

5.5.1.4 LBV

5.5.2 Sherry

5.5.2.1 Fino

5.5.2.2 Amontillado

5.5.2.3 Oloroso

5.5.2.4 Pedro Ximénez

5.5.3 Late Harvest Wines

5.5.3.1 Botrytized

5.5.3.2 Noble Rot

5.5.3.3 Sweet Reserve

5.5.3.4 Premium Dessert Selection

5.5.4 Ice Wine

5.5.4.1 Canadian Ice Wine

5.5.4.2 German Eiswein

5.5.4.3 Estate Ice Wine

5.5.4.4 Limited Vintage Ice Wine

6. Market Segmentation by Distribution Channel (USD Billion), 2026–2033

6.1 On-Trade / Hospitality

6.1.1 Fine Dining Restaurants

6.1.1.1 Michelin-Starred Establishments

6.1.1.2 Premium Independent Restaurants

6.1.1.3 Chef-Led Boutique Dining

6.1.1.4 Wine-Pairing Tasting Menu Programs

6.1.2 Hotels & Resorts

6.1.2.1 Luxury 5-Star Hotels

6.1.2.2 Boutique & Lifestyle Hotels

6.1.2.3 Resort & Destination Properties

6.1.2.4 All-Inclusive & Event Venues

6.1.3 Wine Bars & Tasting Rooms

6.1.3.1 Urban Wine Bars

6.1.3.2 Vineyard Tasting Rooms

6.1.3.3 Themed & Experiential Wine Lounges

6.1.3.4 Pop-Up & Seasonal Wine Events

6.1.4 Cruise Lines & Premium Travel Catering

6.1.4.1 Luxury Cruise Operators

6.1.4.2 Private Yacht Catering

6.1.4.3 Airline First & Business Class Service

6.1.4.4 International Travel Hospitality Programs

6.2 Off-Trade / Retail

6.2.1 Supermarkets & Hypermarkets

6.2.1.1 Premium Imported Wine Shelves

6.2.1.2 Private Label & Store Brands

6.2.1.3 Promotional & Discounted Packs

6.2.1.4 Seasonal & Festive Collections

6.2.2 Specialty Wine Stores

6.2.2.1 Independent Boutique Retailers

6.2.2.2 Organic & Biodynamic Wine Shops

6.2.2.3 Collector & Fine Wine Merchants

6.2.2.4 Regional / Artisanal Focused Stores

6.2.3 Duty-Free & Travel Retail

6.2.3.1 Airport Duty-Free Stores

6.2.3.2 Cruise & Ferry Retail

6.2.3.3 Cross-Border Retail Outlets

6.2.3.4 Limited-Edition Travel Exclusives

6.2.4 Warehouse Clubs & Bulk Retailers

6.2.4.1 Membership-Based Wholesale Clubs

6.2.4.2 Discount Bulk Wine Retailers

6.2.4.3 Private Label Bulk Programs

6.2.4.4 Value-Oriented Premium Multipacks

6.3 Direct-to-Consumer (DTC)

6.3.1 Winery Membership Programs

6.3.1.1 Tiered Membership Clubs

6.3.1.2 Quarterly / Annual Shipment Plans

6.3.1.3 Exclusive Member-Only Releases

6.3.1.4 VIP Event & Vineyard Access

6.3.2 Subscription Wine Clubs

6.3.2.1 Curated Regional Selections

6.3.2.2 Sommelier-Curated Premium Boxes

6.3.2.3 Themed & Seasonal Collections

6.3.2.4 Personalized AI-Driven Selections

6.3.3 Estate Limited Releases

6.3.3.1 Small-Batch Micro-Lots

6.3.3.2 Single-Vineyard Allocations

6.3.3.3 Pre-Release & En Primeur Offers

6.3.3.4 Collector Allocation Programs

6.3.4 Digital Engagement & Virtual Commerce

6.3.4.1 Virtual Tasting Events

6.3.4.2 Live Commerce Wine Launches

6.3.4.3 Influencer & Sommelier Collaborations

6.3.4.4 NFT / Digital Ownership Wine Programs

6.4 E-Commerce

6.4.1 Online Retail Platforms

6.4.1.1 National Online Liquor Retailers

6.4.1.2 Cross-Border Wine Platforms

6.4.1.3 Flash Sale & Discount Platforms

6.4.1.4 Premium Digital Marketplaces

6.4.2 Brand-Owned E-Stores

6.4.2.1 Winery Official Websites

6.4.2.2 Mobile Commerce Applications

6.4.2.3 Virtual Tasting & Purchase Platforms

6.4.2.4 Limited Digital-Only Releases

6.4.3 Global Wine Marketplaces

6.4.3.1 Auction-Based Platforms

6.4.3.2 Collector & Rare Wine Exchanges

6.4.3.3 B2B Wholesale Marketplaces

6.4.3.4 Investment-Grade Wine Platforms

6.4.4 Quick Commerce & App-Based Delivery

6.4.4.1 30–60 Minute Delivery Platforms

6.4.4.2 Urban On-Demand Alcohol Apps

6.4.4.3 Premium Concierge Delivery

6.4.4.4 Subscription-Based Instant Delivery

7. Market Segmentation by End User (USD Billion), 2026–2033

7.1 Individual Consumers

7.1.1 Millennials & Gen Z

7.1.1.1 Social & Experiential Consumers

7.1.1.2 Organic & Sustainable Wine Seekers

7.1.1.3 Digital-First Buyers

7.1.1.4 Trend-Driven & Limited-Edition Buyers

7.1.2 Affluent Urban Professionals

7.1.2.1 Premium Everyday Consumers

7.1.2.2 Corporate Entertainers

7.1.2.3 Luxury & Fine Wine Buyers

7.1.2.4 International & Imported Wine Buyers

7.1.3 Wine Collectors & Connoisseurs

7.1.3.1 Investment-Grade Collectors

7.1.3.2 Vintage & Rare Wine Enthusiasts

7.1.3.3 Auction Participants

7.1.3.4 Cellar Portfolio Builders

7.2 Corporate & Institutional Buyers

7.2.1 Hospitality Groups

7.2.1.1 International Hotel Chains

7.2.1.2 Premium Restaurant Groups

7.2.1.3 Luxury Resort Operators

7.2.1.4 Cruise & Travel Hospitality Groups

7.2.2 Corporate Gifting

7.2.2.1 Festive & Seasonal Corporate Hampers

7.2.2.2 Premium Client Appreciation Gifts

7.2.2.3 Executive & Board-Level Gifting

7.2.2.4 Custom-Branded Wine Labels

7.2.3 Event & Banquet Procurement

7.2.3.1 Weddings & Private Celebrations

7.2.3.2 Corporate Conferences & Summits

7.2.3.3 Luxury Gala Events

7.2.3.4 Government & Diplomatic Events

8. Market Segmentation by Region (USD Billion), 2026–2033

8.1 Europe

8.2 Asia-Pacific

8.3 North America

8.4 Latin America

8.5 Middle East & Africa

9. Regional Insights

9.1 Europe – Largest Market

9.2 Asia-Pacific – Fastest Growing

9.3 North America – Premium & DTC Expansion

9.4 Latin America – Emerging Growth

9.5 Middle East & Africa – Luxury Hospitality Driven

10. Competitive Landscape

10.1 Market Share Analysis

10.2 Competitive Benchmarking

10.3 M&A & Strategic Alliances

10.4 Innovation & Product Launch Analysis

11. Company Profiles

11.1 E. & J. Gallo Winery

11.2 Concha y Toro

11.3 Treasury Wine Estates

11.4 Pernod Ricard

11.5 Moët Hennessy

11.6 Torres

11.7 Penfolds

11.8 Champagne Louis Roederer

11.9 Domaine de la Romanée-Conti

12. Strategic Intelligence & AI-Driven Insights

12.1 Phoenix Demand Forecast Engine

12.2 Consumer Behavior Analyzer

12.3 Innovation Tracker

12.4 Porter’s Five Forces Analysis

12.5 Investment & Expansion Outlook

13. Why the Global Wine Market Remains Critical

13.1 Cultural & Lifestyle Integration

13.2 Premium & Collectible Growth

13.3 Sustainability & Organic Expansion

13.4 AI-Driven Operational Optimization

13.5 Omnichannel Distribution Scalability

14. Appendix

15. About Us

16. Disclaimer